Economic Data and Market Highlights

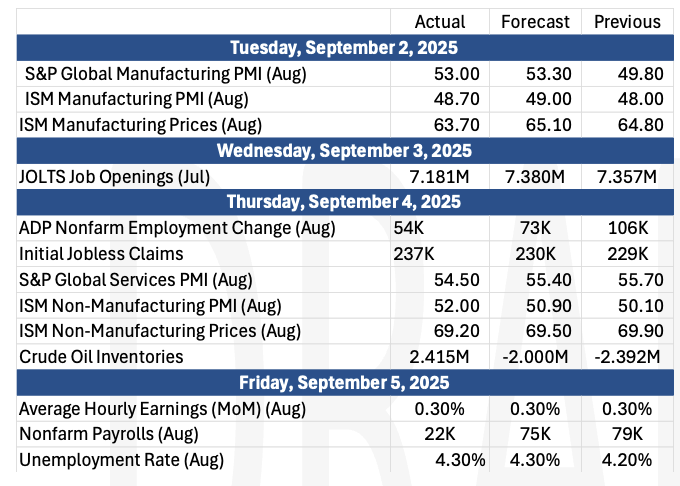

The S&P 500 rose 37 basis points. All eyes were on US jobs data. Initial jobless claims posted a higher than estimate, 7,000 more claims than expected. Friday’s non-farm payrolls were much weaker than expected, 22k versus a 75k estimate. One of the segments hardest hit is the 16- to 24-year-olds sector, with unemployment rising to 10.5%.

While weaker-than-expected data significantly tilts the probability of a rate cut this month, speculation turned to how much the cut would be, with some expecting a cut as much as 50 basis points, and how many more there will be this year.

Global bond markets were volatile this week, with yields in the U.S., U.K., Japan, and France climbing as fiscal deficits widen and central bank support fades. The U.K. gilt market is under particular stress, with 30-year yields hitting a 27-year high and the pound weakening. Analysts caution that this shift reflects evolving fiscal dynamics rather than structural cracks, though risks are evident in places like Bolivia, where depleted sovereign reserves raise default fears that could spill into emerging market spreads. In response, some investors are tactically rotating into mortgage-backed securities, commercial mortgage-backed securities, and preferreds to capture relative yield opportunities.

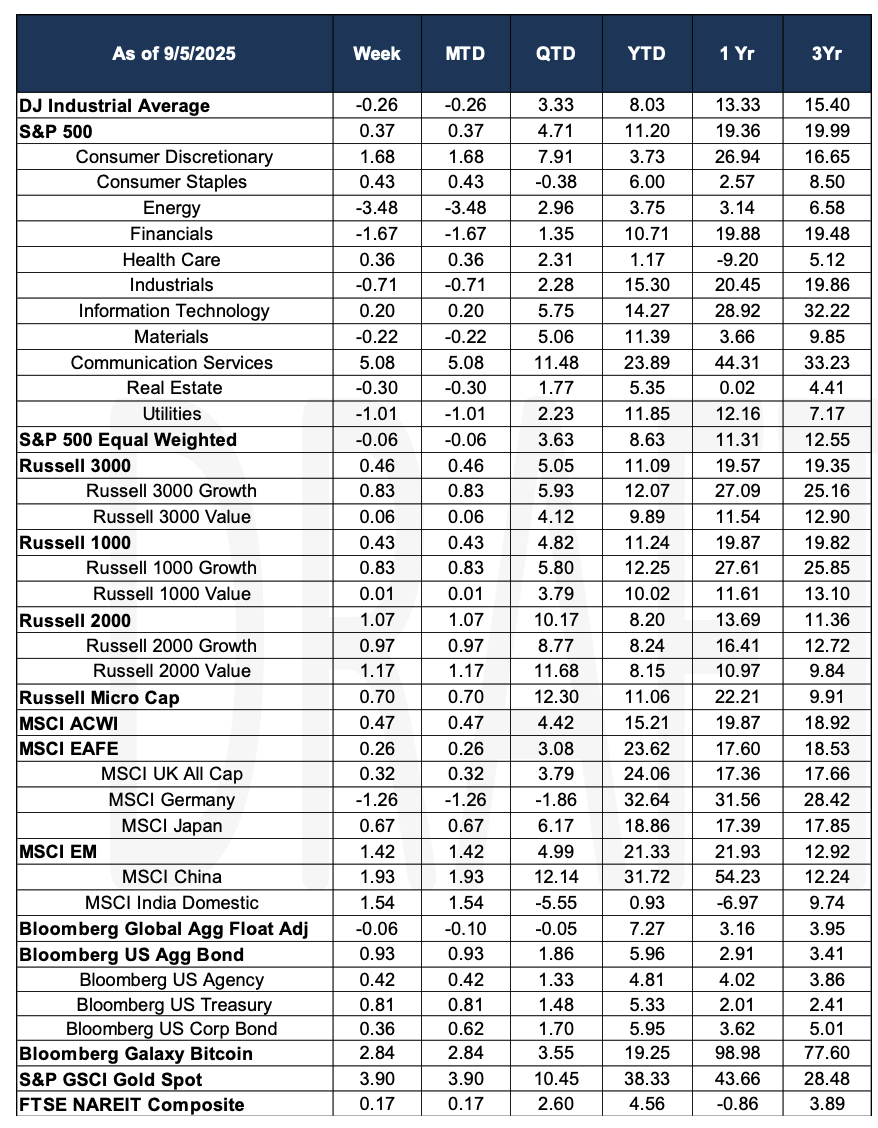

Equity markets have been buoyed by a rebound in global technology shares, led by Alphabet’s ~9% surge after a favorable antitrust ruling avoided a breakup. The rally spread across Asia, with Japan, India, and Taiwan gaining on the back of a weaker U.S. dollar and U.S. tech strength. However, concerns linger that elevated valuations could cap further upside, with analysts stressing that sustained momentum will require broader participation beyond mega-caps. Encouragingly, small-caps showed strength, with the Russell 2000 jumping about 7% in August, significantly outpacing the S&P 500 and Nasdaq.

Cross-market dynamics reflect heightened caution. Gold prices are reaching record highs as investors position for potential instability in Fed leadership and fiscal independence, with projections suggesting the metal could climb toward $4,000 per ounce by mid-2026 and even $5,000 in more extreme scenarios. Seasonal patterns also add risk: September has historically been a weak month for equities, amplifying the backdrop of tariff disputes and political uncertainty.

The Past Week’s Notable US data points (with revisions)

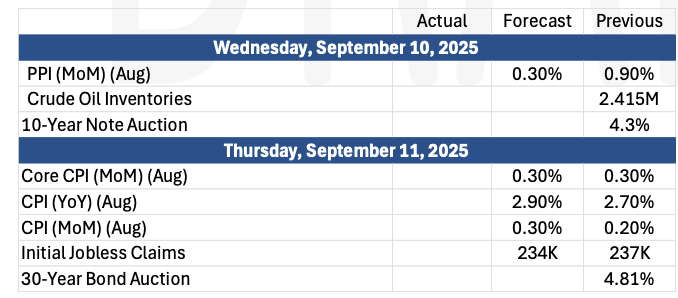

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara