Economic Data Watch and Market Outlook

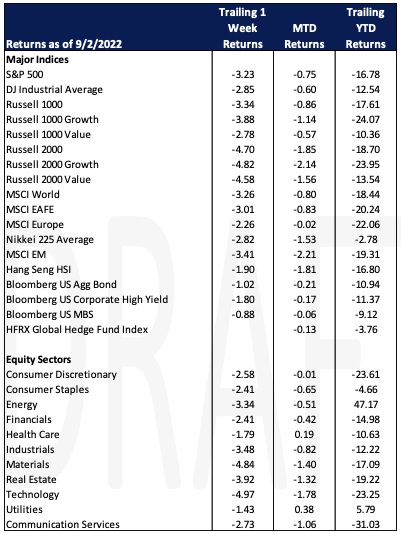

Asset prices declined during the week as the MSCI World index declined 3.26% and the US Aggregate Bond index fell 1.02%

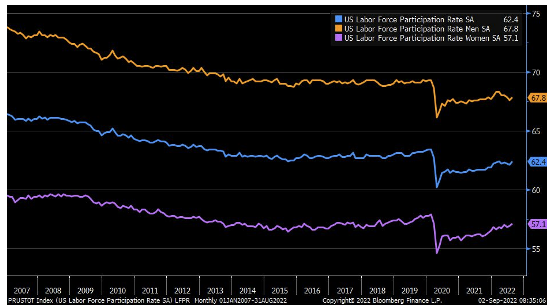

Friday’s job report was a bit stronger than expected and numbers were solid in many categories including the participation rate, rising to 62.40% up from 62.1% the previous month.

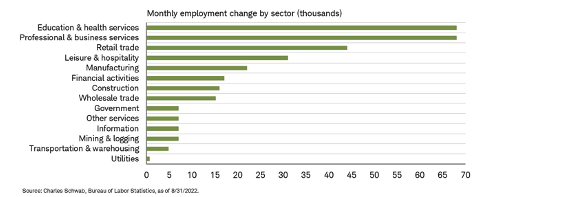

Below are the sectors that experienced the most significant increases:

The G7 have unveiled a plan to put price caps on Russian energy in global markets to limit revenues during war time. The cap will be imposed by prohibiting insurance and shipping companies from helping Russia sell oil above the limit set. Meanwhile, Gazprom has shut down the Nord Stream pipeline indefinitely. Initially set to reopen Saturday, the company has sited important maintenance requirements as the reason for delay.

In the upcoming abbreviated trading week, we’ll get data on manufacturing as ISM results are released on Tuesday, Mortgage data on Wednesday and energy production data later in the week.

Equities

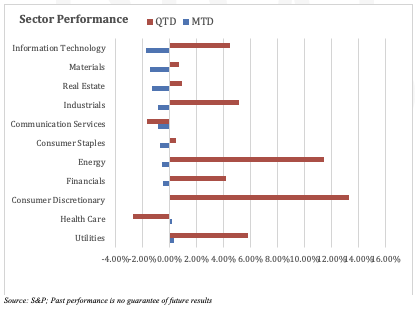

Equities market indices finished down for another week (Dow: -2.85%; S&P 500: -3.23%); as the anticipated employment numbers were in line with what was expected and worries about Gazprom halting the delivery of natural gas via Nord Stream 1 indefinitely while heading into the three day weekend. All sectors except energy (+1.81%) finished down for the day. Though from a month to date perspective, the utilities (+0.33%), healthcare (+0.19%) and consumer discretionary (+0.02%) sectors are still up slightly.

The technology – semiconductor sector was also hit this week when the US government ordered Nvidia (NVDA: – 16.06%) and Advanced Micro Devices (AMD: -11.99%) to halt exports of their high-performance chips to China. Meanwhile the industry is also seeing softer PC demand.

Pindoudou a mobile only marketplace that connects millions of agricultural producers with consumers across China built to operate on the WeChat platform, rose (PDD: + 25.48%) for the week on revenue and sales reported that surpassed the street’s expectation, citing a recovery in consumer spending in China.

Fixed Income

Treasury yields rose throughout the final week of August in anticipation of jobs reports for the month. Following Jerome Powell’s Jackson Hole speech on the 26th, many investors were looking at this report for indication of the Fed’s next move in mid-September. The months unemployment rate rose from 3.5% in July, to 3.7% in August, adding 315,000 new positions down from 526,000 in the previous month. The Fed’s mission will likely remain unchanged as inflation is nowhere near the level they would like to see. The 2-year Treasury yield fell 15 bps below its pre jobs report level of 3.55% with the 10-year Treasury yield following suit, dropping 10 bps from a level 3.28% to a daily low of 3.18%.

Eurozone Bond yields fell on Friday in line with the US on its jobs report. Germany’s 10-year bond yield fell to 1.51%, down from 1.63% Thursday which was its highest level since the end of June. Italy’s 10-year yield fell to 3.84% down from more than 4% on Thursday. According to a senior economist at Allianz, the ECB will have to cut its policy rates in the beginning of 2023, stating that the hawkish ambitions of the ECB will have to scale back in Q1 2023 due to the impending recession in Q4 that many investors are planning for.

Mortgage rates rose above 6% to close out the week as the US housing market has begun to cool. Existing home sales fell in July by -5.90% from June and -20.20% from the previous year. According to Redfin the average home sold for less than its listing price for the first time in over 17 months. Generally, all indicators of real estate buyer sentiment have decreased over the summer. Buyers that were previously able to enter the market at low rates have been locked out of the housing market will continue to feel the pain until rates begin to decrease.

Hedge Funds

Hedge funds earned their keep in the month of August. Despite steep index losses in most regions globally, hedge funds were able to mitigate those losses. In August, the MSCI World declined 3.6% and the average global fund fell just 20 bps, the S&P 500 fell 4.1% while the average Americas-based long/short equity fund declined slightly over 40 bps and the Euro STOXX 600 declined over 5% while the average European fund lost only 30 bps. Asia told a little bit of a different story. The MSCI Asia was down ~ 90 bps and the average Asia fund was UP 1.2%.

In NA, it was a challenging week for crowded longs as they declined over 4% compared to the S&P 500 dropping 2.2% leading to a negative spread for the month while the spread was positive in other regions. Across regions, funds added back to gross exposure, both on the long and short sides with the largest occurring in North America. Long adds slightly outpaced short adds leading to a slight net buy skew. The long additions were concentrated in TMT and healthcare while the short additions came mainly from index level products. Hedge funds were sellers of some defensive sectors such as consumer staples and utilities after being net buyers for the first 3 weeks of August. Outside of NA, the largest gross additions were in Europe and Japan, but funds were net sellers as short additions outpaced long additions. AxJ saw similar activity as Europe and Japan but in smaller scale.

Private Equity

Private equity’s reach into the cybersecurity industry is quickly expanding as investors seek to take advantage of the sector’s declining valuations and established business model which offers high margins as well as low client churn rates. Through August 2022, private equity deal makers and their portfolio companies have completed 162 cybersecurity deals across the globe this year valued at $34.9 billion. If the current pace continues, 2022 could surpass last year’s total of $36.4 billion and 306 total deals.

Analysts suspect a few factors are driving up deal value and quantity in this sector. First, investors are able to secure private deals of mature companies at discounted prices due to the falling valuations in the tech industry. Second, consolidation opportunities are driving an increase in activity within the sector as end users of cybersecurity products increasingly prefer a full suite of integrated cybersecurity services from one provider rather than fragmented solutions. Lastly, as hacker attacks are on the rise in both public and private sectors, advancement in cybersecurity has become increasingly urgent.

Analysts suspect deal making in this sector to continue to gain momentum throughout the rest of the year. Given the increased threat of cyber hacks the United States government has included grants within its $1 trillion infrastructure legislation to fund local and state government cybersecurity projects. Similarly, the Australian government has budgeted roughly $6.7 billion to cyber intelligence.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M

| This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes. |