ECONOMIC DATA WATCH AND MARKET OUTLOOK

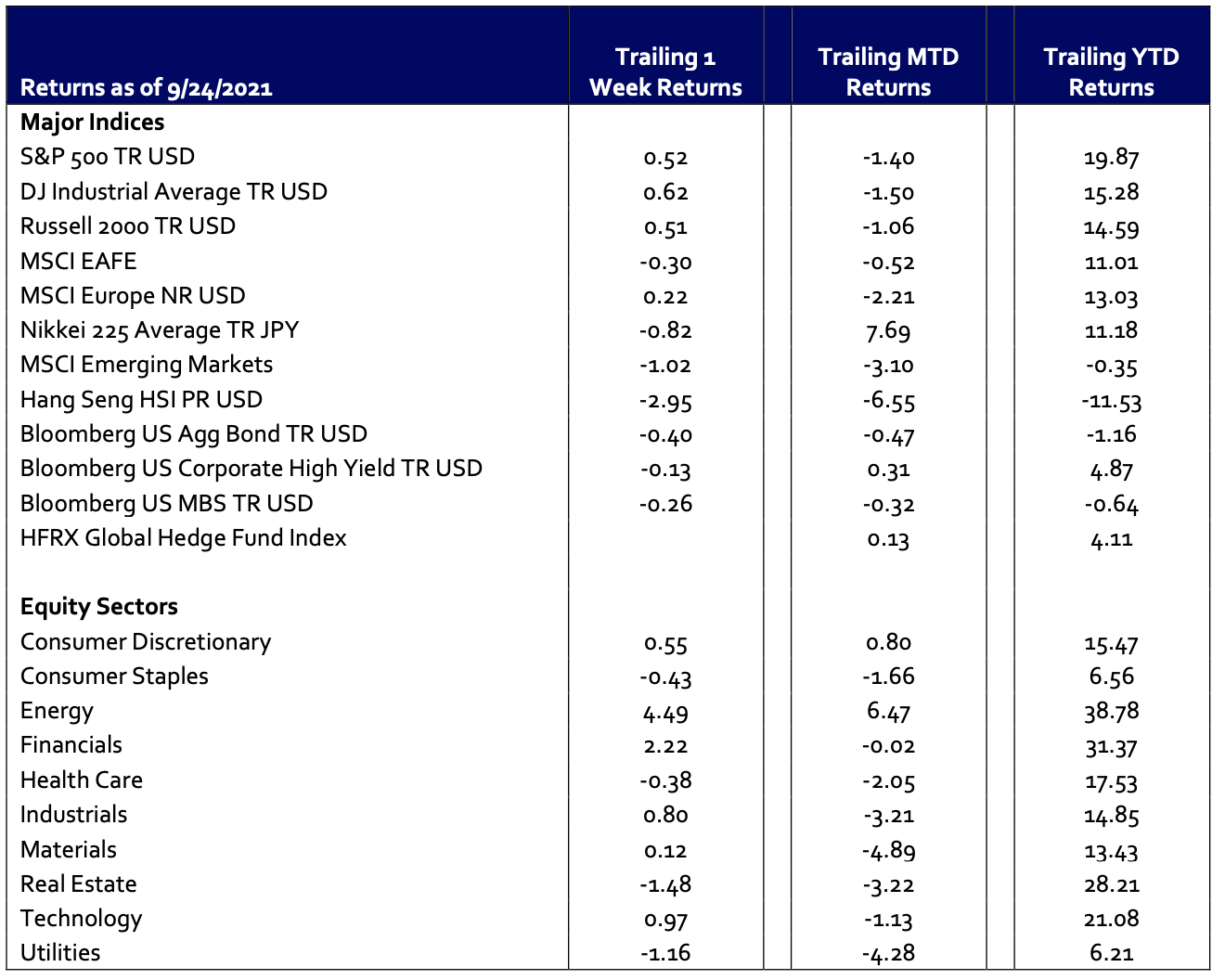

Equity markets finished up slightly with the S&P rising 52 basis points but the path was not linear. Anxiety over the US Federal Reserve’s path toward easing took a bit of the back seat to China’s largest developer pending interest payments due later in the week.

The real question surrounding Evergrande was not its fate. That seemed to be a foregone conclusion. It was about China, its role to prevent a crisis of confidence in the global economy, and, most importantly, its ability to maintain economic growth. Would China’s command economy orchestrate a bailout of the failing entity or let it fail? At Wednesday’s close the S&P 500 had fallen 1.7% but made up ground and then some after the Fed offered a more structured plan for easing and China appeared to take steps to prevent a significant financial impact.

In other news, the US housing market slowed in August with COVID-19 demand dying down as kids go back to school and workers return to offices. August existing-home sales posted a 2% decline from July, the biggest monthly decline since April of this year. Sales slid 1.5% from a year earlier, marking the first year-over-year decrease since June 2020. Although the housing market has slowed down, prices have stayed high enough to keep some potential buyers from the fast-paced market. The typical home sold in August was on the market for 17 days, unchanged from July. Home sales on a seasonally adjusted annual basis have hovered between 5.8-6 million, an extremely high figure on a historic basis. We’ll gain more insights into housing in the coming week with additional home price data due on Tuesday and pending home sales on Wednesday.

The US Congress debated the debt ceiling and whether to raise it to keep government open. The US Federal Government is expected to run out of money by this Friday. We’ve been here before and the markets has thus far viewed it as theater, but we’ll be watching closely for developments later this week.

In looking ahead to the economic calendar, it’s expected to be a very busy week. In addition to the housing data mentioned above, in the US we’ll see Durable Good orders, Consumer Confidence, Jobless Claims, and GDP Growth. Outside the US we’ll see, Industrial Production numbers out of China, inflation in Brazil, and unemployment, CPI and other inflation results in the EU.

We’re closely watching the above durable goods number, China Industrial profit and the Dallas and Richmond Fed’s Manufacturing results for further clues around supply chain. Last week we saw significant month over month improvement in New York’s Empire Manufacturing Index but also significant increase in the wait times for the delivery of goods.

Supply chain issues have caused US prices to run hot. Much of the rise earlier this year in CPI data was due to autos and used autos but supply chain issues persist due to Covid-related uncertainty. Global shipping rates have risen significantly eating into margins of companies dependent on offshore production. One such example is Nike who reduced 2022 guidance because not only have they been impacted by increased shipping rates but transit times increased from a pre-COVID level of 40 days to the current 80. Further pressure could be put on the supply chains as people begin to consider holiday shopping.

We’re expecting that as unemployment payments are ending across the US and Pfizer’s vaccine for children being submitted to the FDA for approval may help improved employment data and alleviate some supply chain issues. We’re not expecting this to occur overnight and the US continues to remain dependent on offshore production for many items, but we do expect some leveling of prices in early 2022.

U.S. EQUITIES

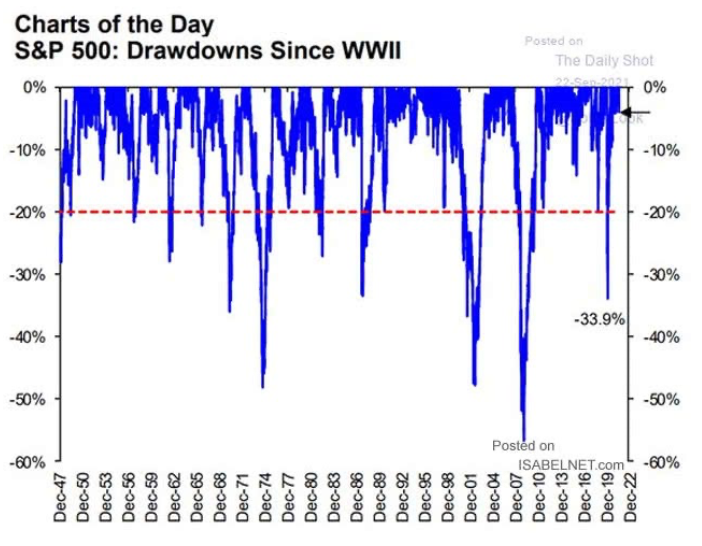

As we noted earlier, US Equity investors were very anxious over a two-day period with the highest reading of Cboe Volatility Index, the “VIX”, since May 12th. Markets ultimately recovered but there is still the acknowledge that we have had over 1000 days since the last correction of 10% or more. The figure below shows the severity of corrections historically for context.

While there may continue to be some volatility in the months ahead, cheap money is plentiful, significant money still sits on the sidelines, and the Fed still encourages us to invest in risk assets by way of continued low interest rates. Perhaps as rates do creep up, we may see a pull back in certain sectors. Tech stocks have traditionally suffered when rates increase.

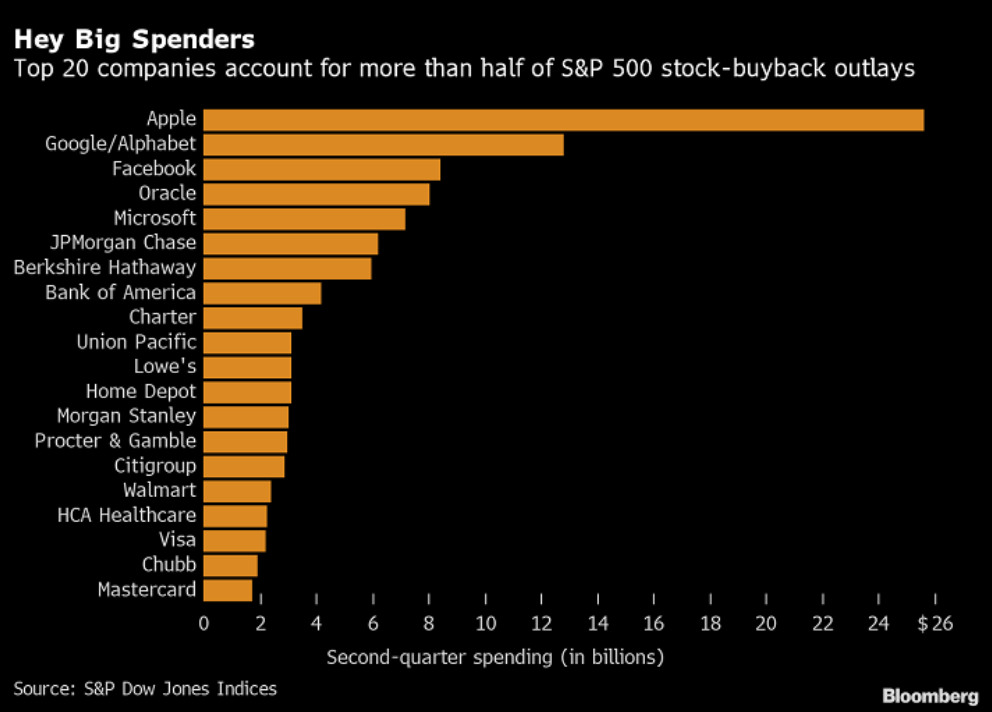

Despite that, large cap companies especially big tech companies have continued to buy back shares at a record pace. Using excess cash from record earnings, many large cap tech names have purchased their own stock at a record pace. Below is a chart form Bloomberg showing the pace in the Second Quarter of 2021. Companies bought back almost $198.8 billion worth of stock slightly more that the first quarter of 2020’s $198.7 billion. According to Bloomberg, the top 20 (shown below) accounted for roughly 56% of those purchases. Record earnings, lack of yield on cash, and uncertainty around tax policy for investors make buybacks an attractive option.

For the week, equities proved resilient again as investors prepare for earnings. Overall they should be strong but it remains to be seen if strong enough to push stock prices much higher. Interest sensitive sectors like Utilities and Real Estate dropped 1.16% and 1.48% respectively. The potential for rising rates helped financial stocks(up 2.22%) as hopes improved for increased margins. Energy stocks also surged 4.49% for the week despite one of their worst days in several months last Monday. Recent supply disruptions, the opening of economies around the globe, and attractive relative yields have caused investors to look toward those names. On a year-to-date basis, the S&P’s Energy sector has surged 38.78%.

INTERNATIONAL EQUITIES

China dominated the news cycle this past week. As noted above Evergrande, a large property developer, was subject to an $83.5 million dollar interest payment and all eyes were on China to see how their command economy handled the situation. According to reports, the company borrowed heavily and presold apartments to acquire land and pay out dividends. When Covid struck, it virtually halted the sale of new units and scrambled for ways to pay suppliers, paying some with vacant apartment buildings. The company missed its payment on Thursday but has a 30 day grace period before a default becomes official.

In other news, China issued a statement that crypto currency transactions were illegal. This caused the price of Bitcoin among others to fall almost 9% on the news. There is some debate about how fresh the news was as the release was dated 9/15/21 and we’ve heard similar consistent declarations over the last 12 months.

The Bank of England met on the 23rd and provided more guidance on easing taking a somewhat hawkish tone. However, acknowledged uncertainty around labor markets and subsequently revised global growth down by 1%.

FIXED INCOME

Treasury yields spike on Thursday after the FOMC meeting detailed a plan for tapering but left open the possibility of rate increases toward the end of 2022. The spike, 13 basis points on the 10 year, was the largest one day increase since February. We also saw Norges Bank, increase rates representing the first developed economy to do so.

Hedge funds weathered Monday’s storm and are having a strong month of relative returns. All regions outperformed their respective benchmarks with Asia funds reporting the strongest outperformance. That said, China was net sold through a combination of long selling and short additions (mostly A and H shares, ADRs were flat).

Data Source: Bloomberg, HFR (returns have a two-day lag), International Monetary Fund, Isabelnet, Morningstar, Morgan Stanley, Standard & Poor’s , and the Wall Street Journal