Economic Data Watch and Market Outlook

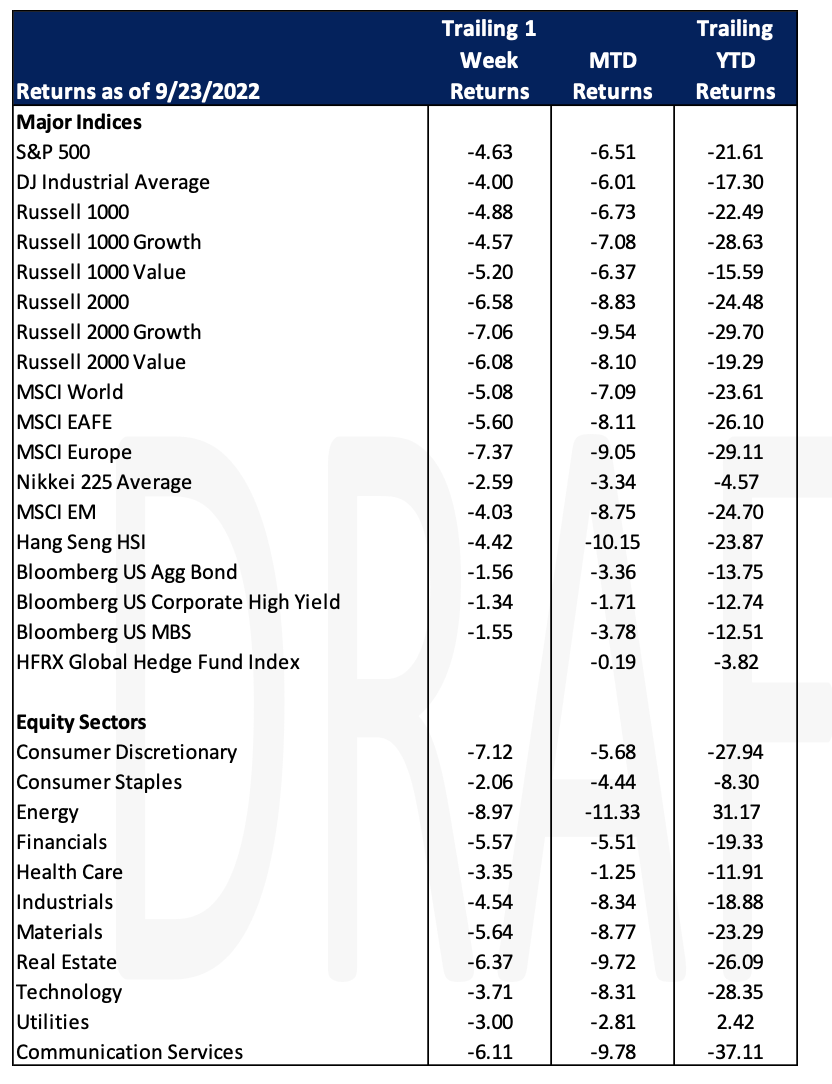

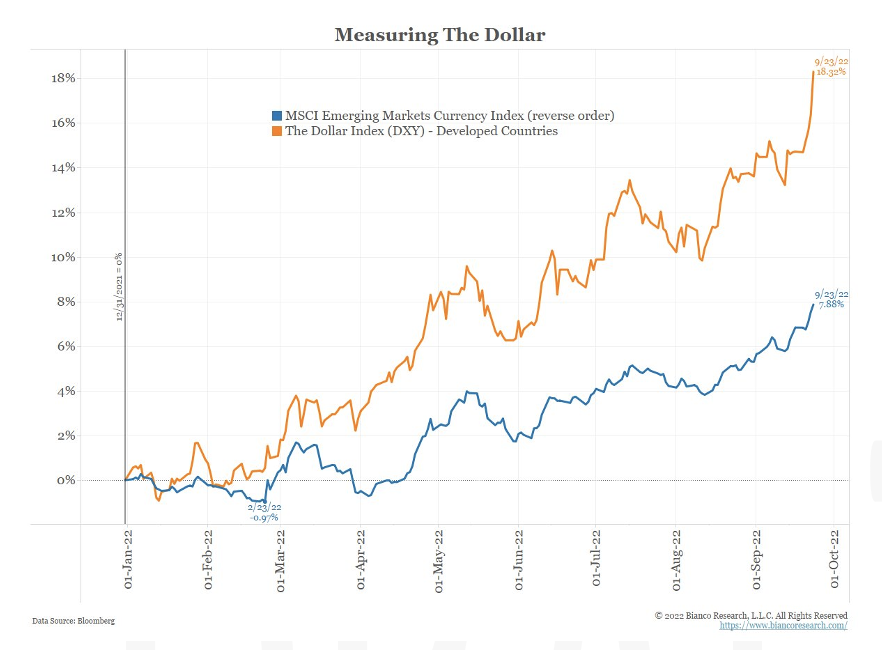

Global Stocks dropped for the week with the MSCI World Index falling 5.08% in USD. The S&P 500 fell 4.63% and the MSCI EAFE fell 5.60%. The Bloomberg Aggregate Bond Index fell 1.56% having their worst year-to-date performance since 1949. Negative sentiment has increased in the market as there are fears the Fed may be too aggressive. The chart below speaks to the negative sentiment in equities as the demand for hedges has grown significantly.

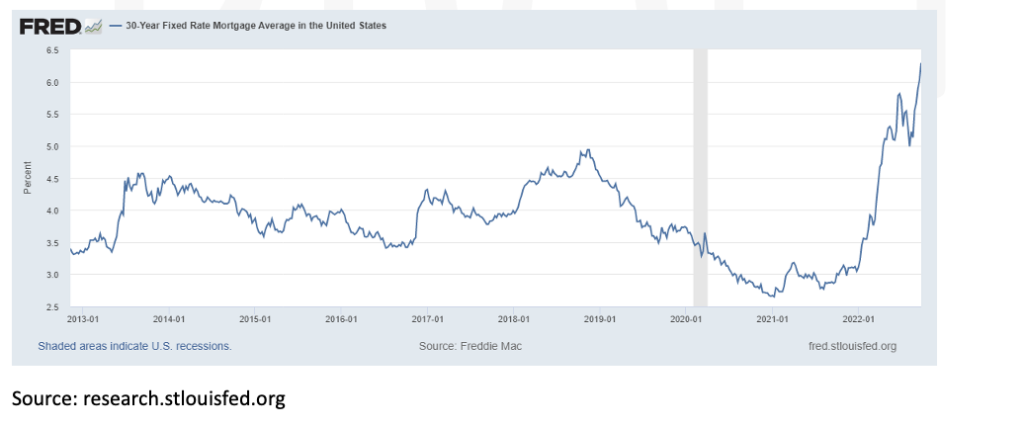

30-year fixed mortgage rates reached 6.7% on Friday. The housing market has gone through a reality check in the past six months, and while prices have eased, they are still up 13.10% YoY, with the median home price settling at $435,000 according to realtor.com. A price correction seems imminent as home buyers who were able to finance purchases at abnormally low rates will now be priced out of the market after the more than doubling of rates in 2022.

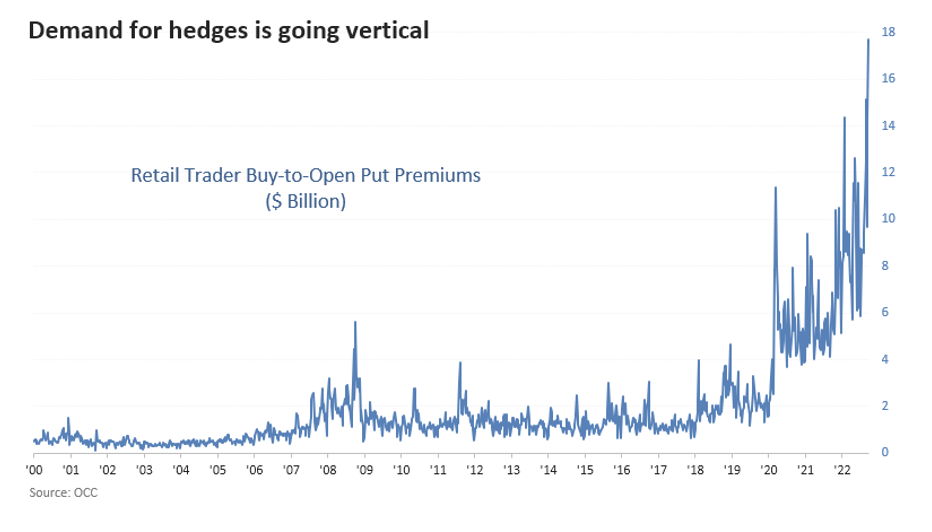

The dollar hit a 22-year high after the Fed signaled rates would remain higher for longer. The relative strength of the dollar creates issues for countries around the world whose currencies have fallen dramatically to multi-decade lows. On Thursday, Japan intervened to buy Yen for the first time since 1998. For context, approximately 85 % of global trade is in dollars according to Jim Bianco Research. This is putting significant stress on countries (and companies) that must convert their currencies to USD to facilitate global trade.

Equities

All equity market indices, domestic and global, ended the week lower. The Dow closed Friday -1.62% to 29,590.41, the lowest level since November 2020. The S&P declined-1.72% and the Nasdaq -1.80% as investors continued to worry about the Federal Reserve interest rate increases to tamper inflation.

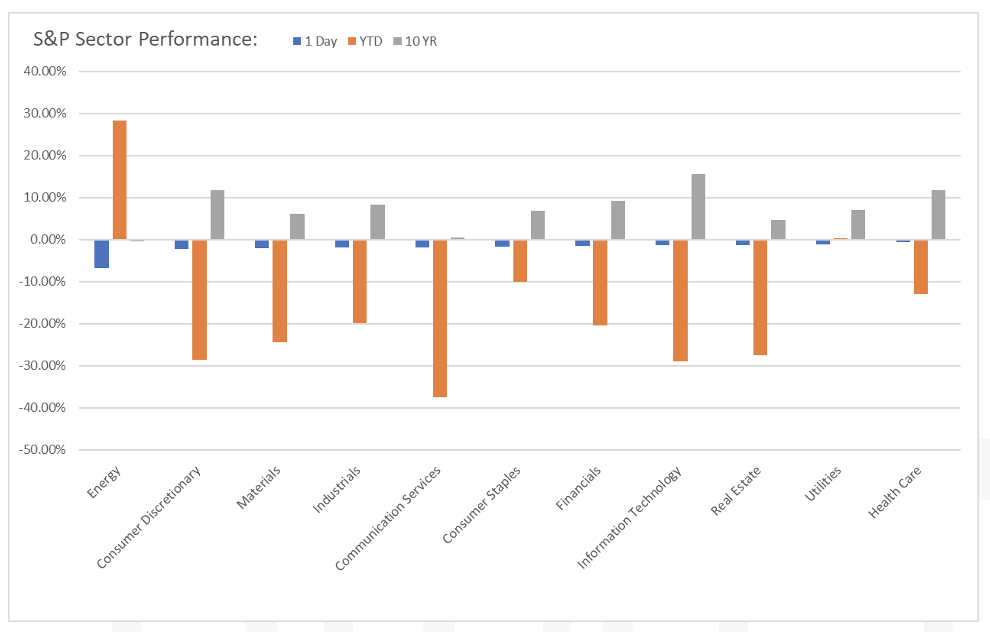

Energy declined the most on Friday (-6.75%), but has still gained +28.36% year to date. Utilities is still (+0.26%), but declined Friday -1.18%. From a 10-year annualized view, while all other sectors gained, Energy still declined -0.31%.

UK unveiled its largest tax cut since 1972, which is supposed to kick start growth, but seemed to create the opposite effect. Preliminary data for the Eurozone saw business activity contracting for a third consecutive month with manufacturing leading the downturn along with concerns over soaring energy prices and inflation. The Euro STOXX 600 closed Friday down -2.34%, the lowest level since December 2020.

China’s internet lending companies Lufax Holding Ltd (LU, -1.88%), 360 DigiTech Inc (QFIN, -5,85%), FinVolution Group (FINV, -4.46%) and Lexin Fintech Holdings Ltd (LX, +55%), are all currently profitable but reported a rise in bad loans and believes that it will be a tougher environment for new loans due to the slowing economy. Asia indices declined with Hong Kong Hang Seng -1.2% and Shanghai composite -0.66%. Japanese markets were closed for the Autumnal Equinox holiday.

Fixed Income

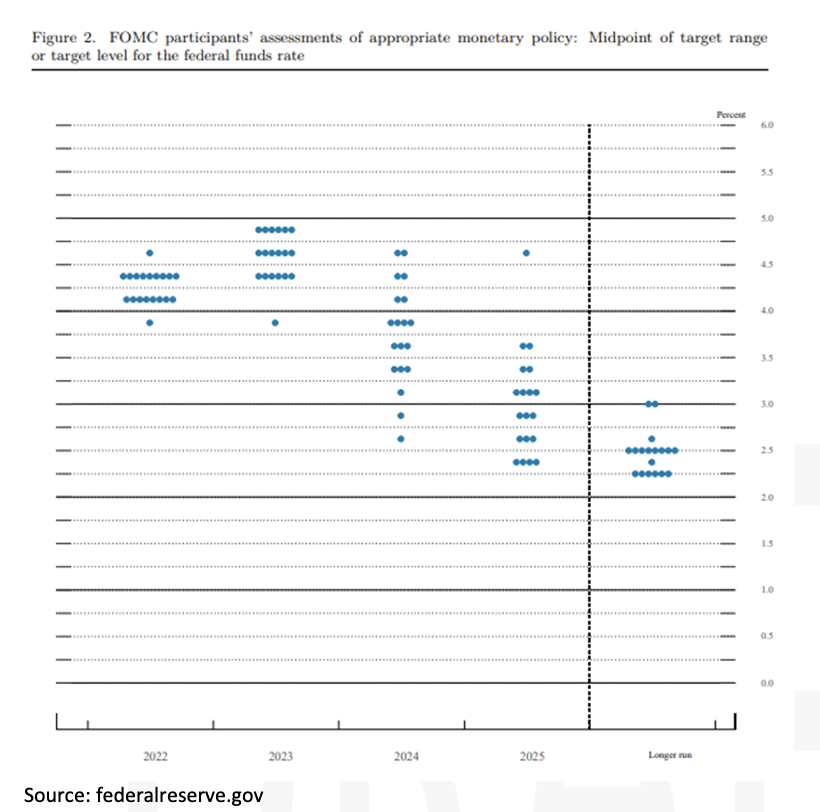

Bond Yields continued their meteoric rise this week after the Fed raised interest rates 75 bps for the third consecutive time. On Friday the 30-year Treasury yield reached 3.71%, the 10-year Treasury yield reached 3.82%, and the 2-year Treasury yield reached 4.26%. The 10-year yield closed at its highest point since 2011 at 3.70% on Wednesday. Following the Fed’s hike, numerous central banks followed suit. The UK, Norway, Indonesia, and the Philippines all raised rates by 50 bps, while Switzerland went further with a 75 bp increase, making it one of the last central banks to leave negative territory. The Fed’s dot plot, which depicts expected monetary policy, showed an increase of this years’ Fed Funds rate from what was previously projected to 4.4%, from 3.4% and next year’s rate increasing to 4.6%, previously 3.8%. The dot plot shows that Fed members expect the Federal Funds rate to come down in 2024 and 2025 and settle between 2.0% and 3.0%.

Mortgage-backed securities have seen a dramatic fall over the past year as well, with the UMBS 30-year down from a 52-week high of 110.12, to 98.09 on Friday.

Hedge Funds

Even with global equity indices declining, there was little turnover among hedge funds. That said, funds did add to their short exposure reducing net leverage to 38%, close to the June 2022 decade low of 35%. Interestingly, in North America, 7 of 11 sectors were net bought through Thursday and even the ones that were net sold, the magnitude was small. Hedge funds did add to downside protection increasing ETF shorts, mostly from broad-based indices. At the factor level, flows tended to be towards more defensive sectors as well as size and quality. Outside NA, hedge funds were net sellers of Europe by a mix of short adds and long selling. Funds were also net sellers of Asia ex-Japan with most of the selling in China (split among A-shares, H-shares and ADRs). Unlike weeks past where hedge funds protected against the downside, this week they captured a large portion of the downside. In North America, crowded shorts were down more than crowded longs, but crowded longs underperformed the S&P by ~ 200 bps. Funds underperformed mainly for 2 reasons.1) Funds are still running with net long exposure and 2) crowded longs make up a larger percentage of the long book than crowded shorts do of the short book. For the week, Europe was the best performer in both absolute and relative terms. MTD, funds are still outperforming their relative indices buy a comfortable margin.

Private Equity

Given environmental regulations and social pressure, carbon capture technologies continue to experience an extreme amount of interest as well as investment. In Q2 of 2022 carbon capture tech saw its highest-ever venture capital investment with $882.2 million invested across eleven deals reflecting a significant increase over the previous four quarters which totaled just $432 million invested. Analysts suspect that VC deals in this space will continue to grow driven by the improvement to tax credits for carbon capture in the United States and the tightening of carbon allowances in Europe.

Although carbon removal technology is not new, the landscape for modern technology in this space is extremely broad and encompasses three main approaches with a focus on decreasing energy requirements. The first approach, pre-combustion capture, seeks to convert high-carbon fuels to low-carbon fuels plus carbon, the second is oxy-fuel combustion capture in which fuels are burned in pure oxygen producing essentially clean carbon and lastly, post-combustion capture which uses carbon-scrubbing technology to remove carbon released after fuel is burned. Of the three technologies, post-combustion carbon capture likely has the strongest benefits because it can integrate with existing infrastructure. Analysts suspect this technology to receive the highest degree of attention and funding from the venture community in the coming quarters.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.