Economic Data Watch and Market Outlook

US inflation forecasts were trimmed through the end of next year as we have seen reductions in energy prices especially at the pump, with the national average for a gallon of gas at $3.72. Used car prices have also come down considerably. Mortgage rates rose slightly during the week with a 30-year rate at 5.94%.

Projections for the year-over-year personal consumption expenditures price index, the Fed’s preferred inflation gauge, were lowered 1 to 2 bps for each quarter. By Q1 2024, it is expected to average 2.4% – close to the Central Bank’s 2% target. The forecast could be an encouraging sign for the Fed as it tries to keep price expectations steady. However, the survey also showed that economists now see a 50% chance of recession over the next 12 months, a slight increase from August. The labor market is seen broadly holding up while with unemployment rate is expected to peak at 4.3% in the second half of next year, compared to a current reading of 3.7%.

India is set to impose a 20% duty on rice exports following a lackluster rainfall during the planting season. Exports are expected to fall 25% in the coming months if the duty is passed. India accounts for more than 40% of global rice shipments and provides rice to over 150 countries and exported 21.5M tons of rice in 2021. India competes with Thailand, Pakistan, Vietnam, and Myanmar but exports more than all those countries combined.

In addition to the above comments around food production in emerging nations, the rising US dollar has put pressure on those same economies. The chart below shows the JP Morgan Asian Currency Index, a basket of the most actively traded currencies relative to USD. Stress in EM countries may not directly affect the US economies, but it could put pressure on imports from theses countries and could necessitate a bailout from developed countries.

Ukrainian forces recaptured Izium, a strategically valuable town in northeastern Ukraine. The town had been under Russian occupation since the beginning of the invasion. Ukrainian forces have pushed into the region over the past few weeks and reports say that Russian moral is dwindling, with the General Staff of Ukrainian Armed forces referencing 15 Russian desertions taking place.

Meanwhile, Russia maintains a chokehold on European energy. After European governments began floating a price cap on Russian oil, Russia froze oil exports to the EU. Putin stated that he will not import oil to the EU if there is a price cap in place leading Eurozone countries to scramble.

US Equity funds recorded outflows of $11.5 billion in the week to Wednesday – their largest outflow in 11 weeks according to Bank of America Merrill. Investors are rushing out of equities on the back of several risks increasing the likelihood of an economic downturn. The biggest exodus was in technology stocks, which saw withdrawals of $1.8 billion. Global equity funds had outflows of $14.5 billion, while $6.1 billion was poured into government and Treasury bonds.

Equities

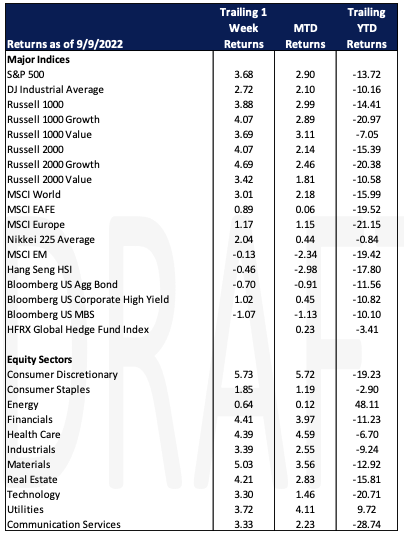

Equities sharply increased Friday (Dow: 1.19%; S&P: 1.53%) and for the week (Dow: 2.72%; S&P: 3.68%) snapping a three-week losing streak with communication services (S&P Communication Services Sector: 2.33%), energy (S&P Energy Sector: 0.64%) and technology leading gains (S&P Information Technology Sector: 3.30%). Communication services gained as investors rotated into high-risk sectors, while technology rallied due to the slide of the dollar.

Equity market volatility at the beginning of the week, right after the Labor Day weekend, was driven primarily by signs that the Fed will increase interest rates by 75 bps in September. As the week continued sentiments were tempered by the Fed’s Beige Book that suggested moderation in inflation which helped the equities market rally for the week.

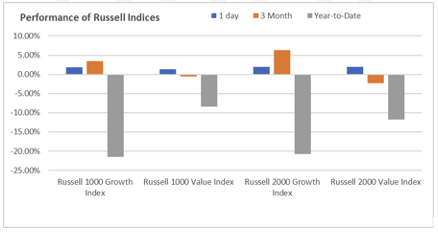

The Russell Growth and Value indices were also up for the day. Over the last 3 months the Russell Growth performed better but year to date Russell Value has performed better than Growth.

The MSCI EAFE rose 89 basis points in US dollar terms while the MSCI Emerging Markets index declined slightly, falling 13 basis points. While energy prices have declined oil priced in USD has created headwinds. Developed nations will likely be able to weather these price spikes but some emerging economies may could be under pressure in the coming months.

Fixed Income

Treasury yields rose this week as inflation worries continued to permeate the markets.Yields across the curve moved higher on Tuesday with the 2-Year Treasury yield reaching upwards of 3.51% and the 10-year yield hitting 3.32%. Yields dipped mid-week and surged on Friday with the 2-year rate hitting 3.56% and the 10-year rate climbing back to 3.31%. On Friday, Fed Governor Christopher Waller indicated that he would back a concurrent 75 bps hike at the September 20-21 fed meeting. He went on to state that he could not predict what would happen post the September meeting, and that policy makers should move away from projections and stick to the data.

With the energy crisis in Europe causing fear of further economic struggles, the reality of inflation is here to stay for the time being. Thursday the ECB hiked rates by 75 bps which is the largest rate increase since 1999. As the energy crisis continues, the threat of recession in Europe has become more apparent and policy makers are turning to rate hikes as a solution. 2023 Eurozone inflation was forecasted to show an average of 5.5% and growth expectations were downgraded from 3.10% in 2022 to 0.90% in 2023.

Mortgage applications fell for the fifth week in a row as housing purchases have begun to slow down. The Mortgage Bankers Associations seasonally adjusted index showed that application volume for new loans reached its lowest point since the beginning of the Covid-19 pandemic. Mortgage rates continued to rise as the 30-year rate reached a new high of 5.89%, exceeding earlier highs in mid-June. After the exceptionally low rates during the pandemic, the housing frenzy is slowing down. Rates have doubled since the beginning of 2022 and could continue to trend higher with further rate hikes by the Fed.

Hedge Funds

The strong end to the week helped hedge funds recover from losses earlier in the month, bringing MTD returns to roughly flat. Crowded stocks in North America performed well with longs outperforming the S&P 500 by ~ 50 bps and shorts underperforming by ~ 20 bps. Europe saw similar performance to NA while Asia lagged for the week as those markets continued their sell-offs. Hedge funds were buyers of global equities for the week with the activity spread across North America, Europe and Japan. Asia ex-Japan was the only region net sold. In NA, the buying was both long buying and short covering with communications services the most net bought sector. Funds bought across TMT with most of the buying in semis, software and IT services (mix of long adds + covers) as well as the more defensive sectors healthcare and utilities. Outside of NA, hedge funds added longs in Europe and Japan. HF also added to gross exposure on the short side in Europe and interestingly, the US-based long/short equity funds accounted for most of the recent increase in exposure in the region. Buying at the sector level mirrored NA.

Private Equity

Despite an increased pressure on deal making, European venture deal sizes are continuing to grow larger. In the first half of 2022, deal sizes across all stages rose as compared to the same time frame last year. Median stage deal size increased by 32% to roughly $2.5M USD while the median late-stage deal size grew by 38% despite this stage being the most affected by public market volatility. Seed stage deals saw a modest increase in deal size, rising from $1.2M in 2021 to $1.9M in the first half of 2022. Angel stage deals saw the smallest increase from the average of $500k in 2021 to $600k in the first half of 2022.

Although there is a well-known lag in private market data, analysts suspect there are additional factors that are keeping European deal sizes elevated. Venture capitalists have a considerable amount of capital that needs to be deployed and analysts estimate that venture investors have $562.4 billion in dry powder to deploy. Given the high amount of dry powder, it is likely that VCs are deploying more into the most promising companies therefore increasing the company’s round sizes. Additionally, founders are also bracing for an economic downturn, forcing them to raise larger rounds now to avoid having to raise again at the end of the year.

Although deal sizes are currently outpacing 2021 levels, analysts suspect venture deal making is likely in for a downturn and the asset class will see smaller rounds and fewer deals going forward.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M