The weekly has been and always will be a collection of the Investment Committee and research team’s thoughts occurring from debate and discussion throughout the week. Going forward we plan to incorporate more content about ideas and trends. We’ll also incorporate more direct write-ups from team members expanding on those ideas and trends. Of course, we’ll continue to talk markets and what drove them, but we hope you will find the changes positive and more helpful in your various roles, responsibilities to constituents and investment interests. Clearbrook also prides itself on being a part of your team and listening to what you want from us. Any and all suggestions are welcome!

ECONOMIC DATA WATCH AND MARKET OUTLOOK

September did not deviate from historical expectations as a month of weaker equity performance, as the S&P declined 4.65% in September. October got off to a nice start rising 1.15% keeping in mind it represents just one trading day. There was an unexpected but very modest increase in jobless claims (11,000) on Friday largely caused by some adjustment changes in California’s unemployment programs and a rise in Michigan claims with some automakers adjusting production due to semiconductor shortages. Economists are now turning to the labor force participation rate. Currently it sits 61.7%, below its 63.4% rate pre-COVID January 2020, equating to roughly 3 million workers. We’ll hear more about the unemployment rate later this week.

Financial markets tend to move in phases – early in the month focuses on economic data, followed by earnings on a quarterly basis and then lastly by geopolitical events. This past week was all about politics. Treasury Secretary Yellen was very pointed about the bi-partisan posturing on a potential government shut-down. Debates raged about the Delta variant for children, elderly and professional athletes now that school districts, healthcare facilities, and various workplaces have mandated vaccines. Further, booster shots and the newest treatment, a pill from Merck which could minimize the effects of those who have COVID 19, seek approval from various US federal agencies. The execution of the Afghan withdrawal is starting to look worse and worse. Although there was a decent amount of market volatility, the impression is that there is still money on the sidelines that act opportunistically.

The modest rise in interest rates is welcomed as it begins to test sentiment to the inevitable fact of rising rates. The FOMC would be ecstatic if the market would push rates higher and allow them to essentially validate the move. As Secretary of Treasury Robert Rubin stated, the FOMC and Treasury cannot move markets to where they want but can only support once they have moved.

The most important component of the upcoming earnings announcements will be the evaluation of free cash flow for major companies. At this point in time, it is expected to show that although multiples may be high, they are supported by underlying cash generation. We also believe that the supply chain disruptions and delays will simply elongate the underlying demand into 2022, another tailwind for the equity markets as we approach the historically favorable fourth quarter.

In addition to the ADP employment on Wednesday and nonfarm payrolls on Friday companies start to report earnings, including PepsiCo, Constellation Brands, and Conagra. Reports will be especially interesting as companies provide guidance likely incorporating their views of about supply chain issues and input prices.

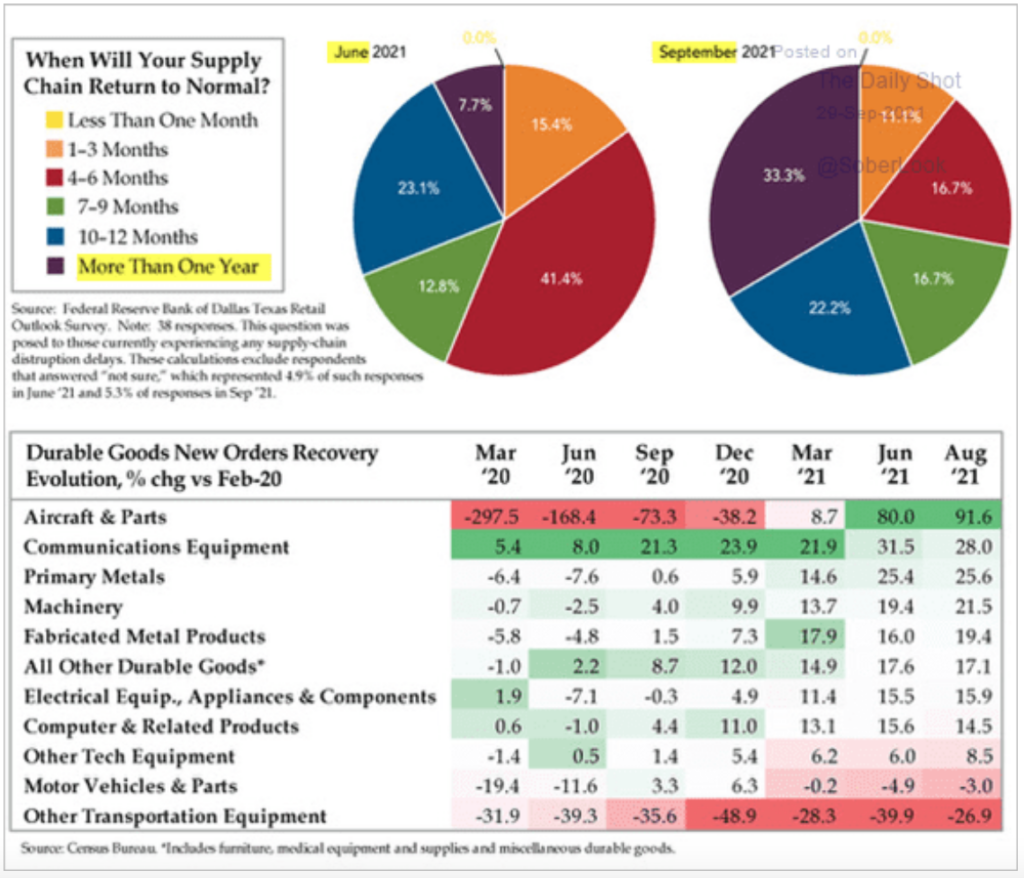

Supply chain issues continue to be a significant concern. As noted earlier, it has slightly impacted jobless claims, but those trends have consistently been considered as transitory. Durable goods orders surged last week, up 1.8%, but companies are still grappling with supply chain slowdowns. We mentioned in a previous note that the term ‘transitory’ seems to have a fluid meaning as it relates to inflation and the recovery in the supply chain. Note the figure below from the Dallas Fed and the Census Bureau data and compiled by Quill Intelligence Research. The Dallas Fed polled companies for their opinion of the supply chain recovery and the expectations for a recovery taking one year or more grew by more than 400% since June while durable goods orders have grown consistently.

While most active managers employed by Clearbrook on behalf of client portfolios do not trade based on weekly data, they will undoubtedly be considering earnings and earnings outlooks that will be discussed as it relates to their strategies and underlying holdings.

U.S. EQUITIES

As noted above, US equities had a rocky week as Tech and HealthCare sectors fell -3.34% and -3.51% respectively. Energy surged (+5.72%), however, concerns rose around global supplies, especially in Europe. Some of the rise is due to demand issues but there is also concern that significant funding to maintain fossil fuel infrastructure is being diverted to renewable projects that have yet to come online and the existing infrastructure may not be sufficient. While the rise in the energy sector was significant for the week, it was not enough to generate a positive return for the Value benchmark, but it did help. Both the Russell 1000 Growth and Value indices did fall but there was significant divergence as growth stocks fell more significantly ( -3.48% versus -0.83%). Despite the weekly gyrations, the S&P 500 is up 17.26% year-to-date and the Russell 1000 Growth and Value benchmarks are up 17.59% and 15.48%. Small cap names have taken a similar path but have not tracked as high year to date (up 14.31%), but lost a little less this week and in the month of September (-0.24% and -2.95%).

While no performance is linear, we do believe that US stocks present more opportunity in the short and medium term and continue to recommend a bias to large cap US stocks.

INTERNATIONAL EQUITIES

Developed Market equities fell 2.90% in US Dollar terms for the month of September while Emerging Market Equities fell 5.1% in USD terms.

German elections took center stage for the week and the election marked the end of Angela Merkel’s 16-year tenure as Chancellor and with it there was not an overwhelming victor. The Social Democratic Party gained won(?) by gaining only 25.7% of the votes. Merkel’s, Christian Democratic Union Party of Germany closely followed with 24.1 % but underwhelmed expectations. The election could potentially chart a new path for Germany as they work toward forming a coalition government in the coming days.

Progress was also made in Japan as the ruling Liberal Democratic Party (LDP) picked former foreign minister Fumio Kishida who it is largely expected to become its next Prime Minister in the coming days based on discussions in Japan’s Upper and Lower House. Cabinet members are then picked in late October /November. The pick of Kishida by the LDP was somewhat of a surprise and most believed Kono Taro, minister in charge of administrative and regulatory reform would be the choice. The Nikkei advanced over 5.5% in Yen but fell 4.3% this week.

China and the Evergrande situation continued to drive the emerging markets news cycle but markets rebounded 1.55% for the week in US Dollar terms. We remain mindful of the recent rise in the US Dollar and its impact on emerging markets and their ability to pay back loans set in Dollar terms. Clearbrook continues to recommend maintaining a position in EM equities but manager selection is important in this space. We are also mindful that many of the EM positions found in portfolios are not the traditional material plays. Many positions held by managers are meant to capitalize on the rise of the middle class so managers have significant weights to Information Technology and Consumer Discretionary names.

FIXED INCOME

Now that we have the FOMC meeting in the rear-view mirror, markets are adapting albeit with a strong sense of anxiety. On Tuesday, the 10-year yield rose slightly (five basis points) and the 30-year rose just above 2.00%, but these slight moves helped send the S&P 500 into a 2% decline.

Knowing that real yields are negative in shorter term instruments, we continue to look for opportunities in the fixed income space. There is no free lunch in fixed income and those seeking higher yields either need to take on more risk or accept lower liquidity. We recommend options when appropriate in areas such as private credit to complement a broader and diverse fixed income portfolio but understand the nuances of each manager is significant. We consistently hear from managers in the fixed space that there are a variety of tourists (new entrants) in this space that are unproven and may not have the expertise or the connections to originate loans, therefore not able to maintain solid performance over the long term. Covenants remain on the lighter side with terms more favorable to the borrower and loans. Additionally, high yield issuance for the purposes of paying dividends is on pace to surpass 2017’s record of $503 billion according to a recent WSJ article. Easier terms and heavier issuance mandates that managers have the expertise. Historical default rates relative to markets and the teams a manager employs to help workout terms with a potential issuer who will default are clues to future performance.

We continue to look at opportunities and processes that have expertise in the short end of the curve or have a solid portfolio of floating rate issues.

HEDGE FUNDS

Hedge funds limited the downside in September, significantly outperforming the broader indices for the month falling 0.38% and represented by the HFRX Global Hedge Fund Index. On a year-to-date basis, the index rose 3.58%. This is important point as Clearbrook has reviewed and recommended funds that were/are for most clients a bond proxy. The US Aggregate bond index fell 87 basis points in September and fell 1.28% on a year-to-date basis. Funds continued their rotation into Europe while North America and developed Asia were net sold. We witnessed a large sell-off in Nasdaq, and well-known big tech names due to a reaction to a rise in rates, but not all technology suffered the same fate as software was net bought during the month. Investors also flocked back into healthcare and consumer staples, both defensive sectors.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG)

Momentum continues in the ESG space but wide differentiation is evident as more managers create, adjust, and/or re-brand strategies in the liquid space. With that there is tremendous opportunity to tailor a client’s portfolio to more closely meet their mission but greater attention is required too. What is also becoming more apparent is that managers, without the ESG brand in the fund’s materials, are using ESG criteria as a risk analysis tool which we find promising.

Further, with the rise in equities, there is mounting prospecting from investment firms for alternative investments with longer lock-ups in private equity, infrastructure initiatives and alternative energy growth supporting ESG initiatives. The pitchbooks are piled high at Clearbrook looking for capital. We will be reviewing them over the coming weeks for those clients that might have appropriate availability and interest.

We plan to continue to report developments in this section going forward as it has become an important topic in client meetings as they explore this space for the first time or continue to build on a developed strategy. We would really appreciate comments or topic suggestions in this space.

Data Source: Bloomberg, The Daily Shot, Dallas Federal Reserve, HFR (returns have a two-day lag), Morningstar, Politico, Quill Intelligence, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.