Economic Data Watch and Market Outlook

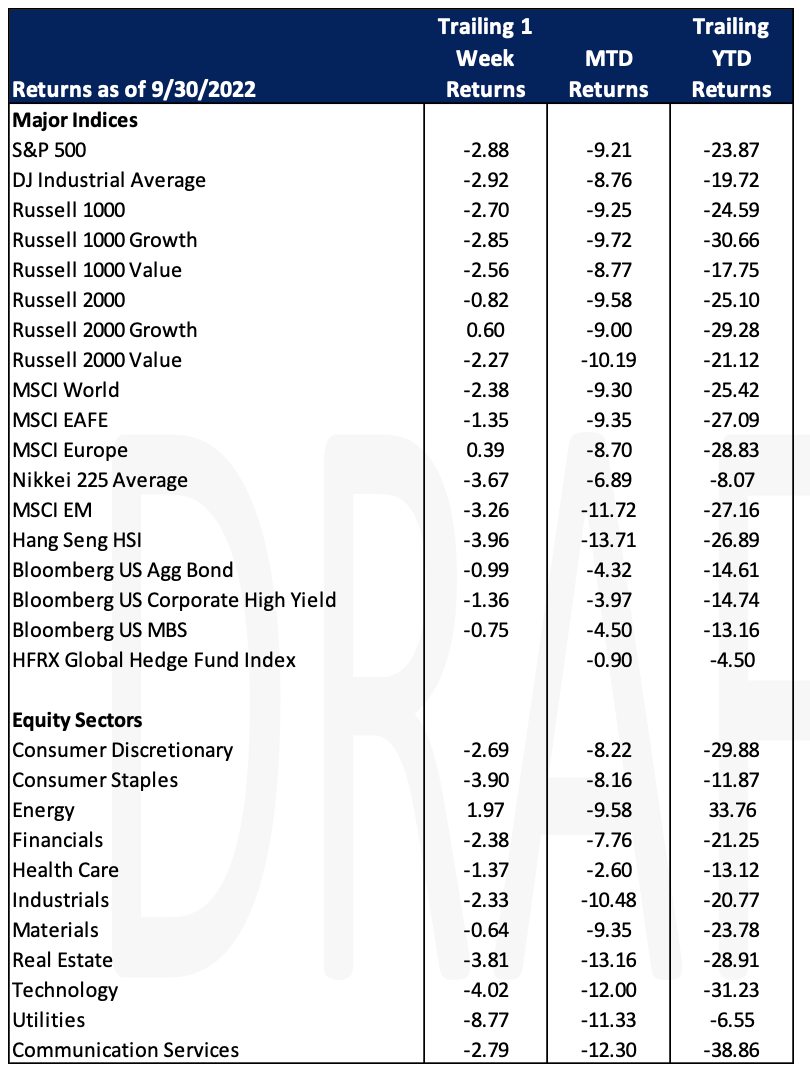

Global Stocks dropped for the week with the MSCI World Index falling 2.38% and for the month is down 9.21%. The S&P 500 has ended the second quarter of 2022 at its lowest in two years – ending Friday down 1.5% and down 9.3% for the month. The index posted its third straight quarter of losses for the first time since 2009. The S&P 500 swung between gains and losses, moves that came after a hotter-than-expected inflation measure was released. The stock slide ends a week of volatile trading, with a new crisis for investors coming out of the UK – the whipsaw also highlights the challenges facing central banks around the world as they try to contain inflation.

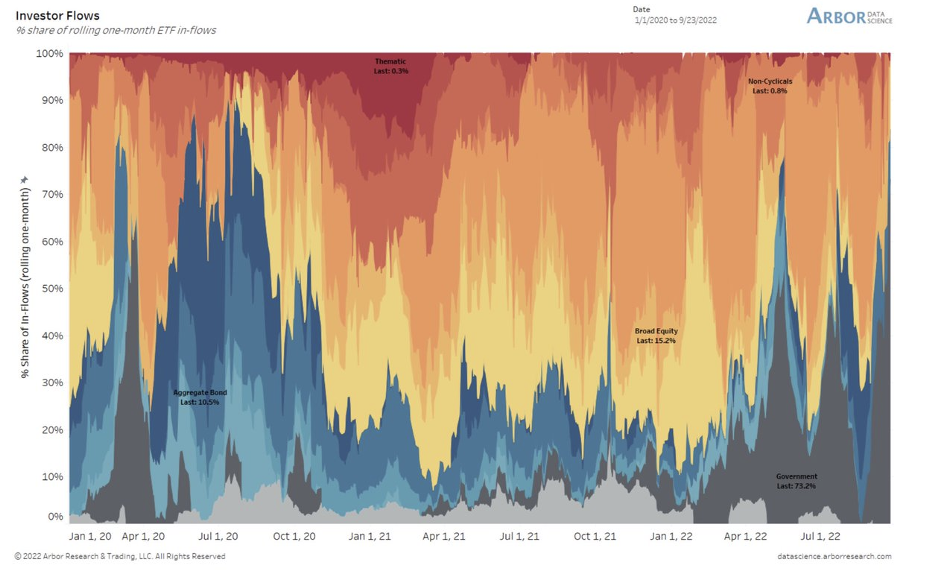

Over the past month, government bond fund ETFs accounted for 73% of the inflows while large-cap ETFs experienced the biggest outflows.

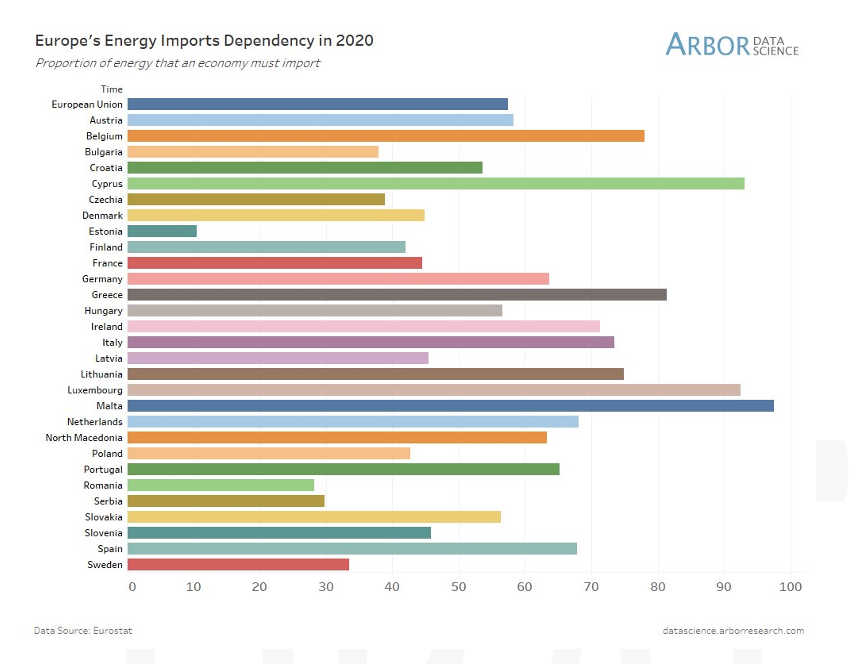

The Nord Stream 2 Pipeline was reportedly sabotaged this week. Gazprom a Russian state-controlled energy company is the primary owner of the pipelines. The pipeline, when active, can supply about 10% of Europe’s daily consumption. Fingers have been pointed at Russia as the perpetrator of the suspected sabotage. Russia responded to the allegations by blaming the US for the attack. To gain context, the graphic below shows which countries rely most heavily on imports.

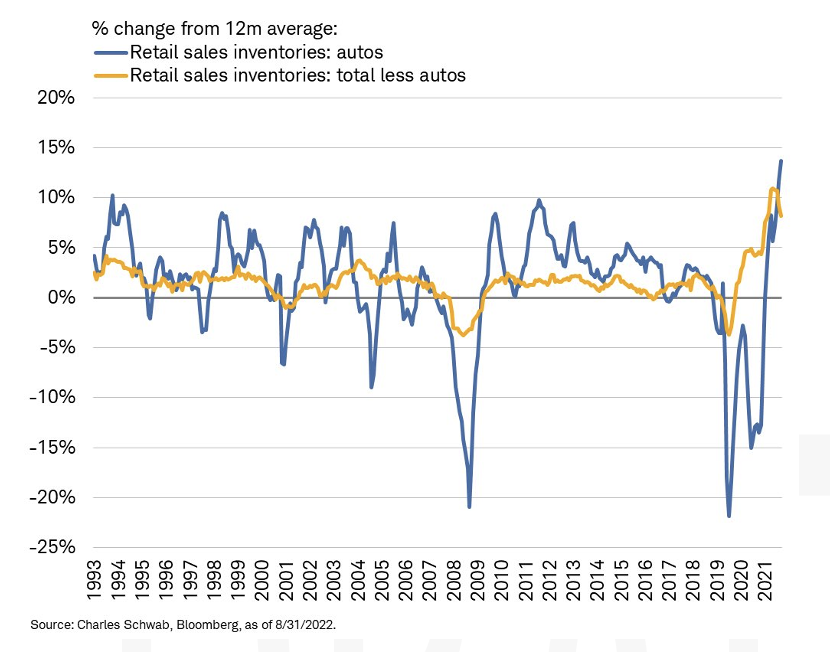

The Consumer Confidence Index rose to 108 in September from 103.6 – economists expected a rise to 104.5. Americans are feeling better on the back of falling gasoline prices. The strong labor market and rising wages also gave Americans a boost of confidence, according to the survey. The unemployment rate is close to a 54-year low and wages are rising at the fastest pace in decades. Inflation and interest-rate hikes remain strong headwinds for consumers as borrowing costs increase for houses, new cars, and other big-ticket items. We have already seen auto inventories rise slightly and the decline in home sales has been well publicized.

Equities

It has been the worst September and nine months of a calendar year for the stock market since 2002, as markets closed down for the week (Dow: -1.71%; S&P500: -1.51%; Nasdaq: -1.51%). A big reason for this is due to PCE data that indicates the Fed will continue to increase interest rates. Year-to-date, all 3 major US indices have suffered significant losses with the Dow -20.95%; S&P – 24.77% and the Nasdaq – 32.40%. Nike was down -12.82% Friday; -14.34% for the week after they announced results that beat revenue / earnings per share but missed margins and predicted being down for fiscal 2023 citing excess inventory. Biogen (+1.03% Friday; +35.00% for the week) announced the success of an experimental drug that slowed cognitive decline in early stage Alzheimer patients (their partner is Eisai Co.) Meanwhile, Intel’s self-driving car unit Mobileye, has filed for its IPO with the SEC. Intel acquired Mobileye in 2017 for $15.3B.

Dune Analytics reported the NFT market has dried up drastically as trading volumes have tumbled 97% from a record high in January this year, sliding to just $466 million in September from $17 billion at the start of 2022.

European markets (FTSE: +0.18%; Euro STOXX 600: +1.30%) ended positive on Friday but still down for the week as the UK continued to buy government bonds to stabilize the debt market after announcements of tax cuts on Tuesday. Porsche IPO (P911) became the largest IPO in Germany in more than 25 years with 911 million shares outstanding with a market cap of ~$72 billion.

Asian markets were down for the week (Hang Seng: -3.96%; Shanghai Composite: -2.07%; Nikkei: -3.67%). Shanghai composite index declined 0.55% Friday after surveys of manufacturers showed production and new orders declined in September.

Fixed Income

Treasury yields fell slightly in the final week of September with the 2-year Treasury yield falling 5 bps, the 10-year Treasury yield falling 5 bps, and the 30-year Treasury yield ending the week up 7 bps. Although bonds are typically seen as less risky investments many indices that track debt markets are showing double digit losses this year. The iShares 20+ Year Treasury Bond ETF (TLT) is down 29.85% YTD, with the PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ) down 38.47% YTD, and the iShares Core US Aggregate Bond ETF (AGG) down 14.50%.

The Bank of England stepped in to buy bonds to moderate the market after tax cuts spurred a large selloff. The BoE announced that they would buy long dated UK government bonds to relax markets and prevent economic damage. After the announcement bond prices rallied and yields dropped. The UK Gilt 30-year yield fell from over 5.0% to 3.93% after the announcement. Post intervention, spreads decreased slightly, with the average bid-ask spread being 6.23 bps, down from 6.40 bps prior to the announcement. The tax cut will lower payroll taxes, freeze corporate taxes, remove a banker-bonus cap, and spend billions in energy bill subsidies. This is the largest tax cut for the British government since the early 1970’s, which hopes to bolster growth during a troubling economic landscape.

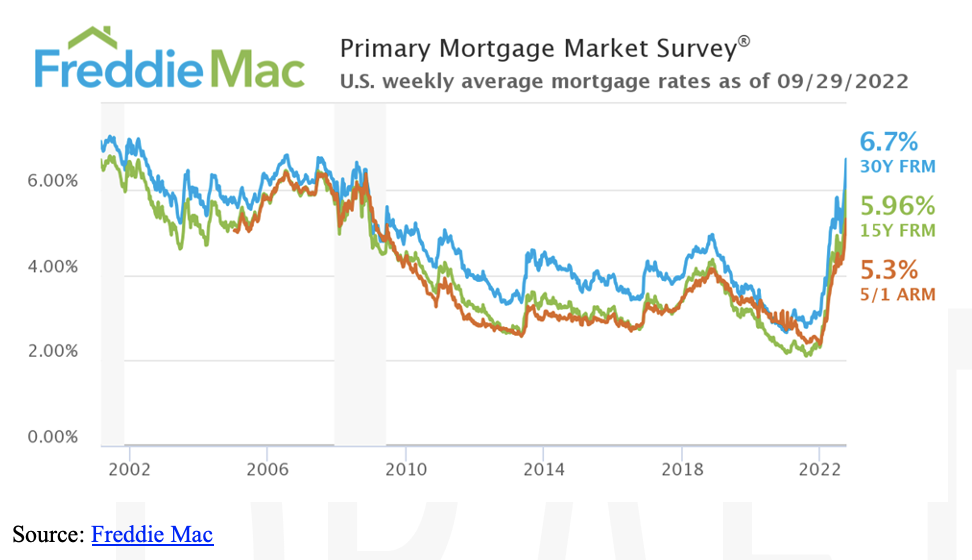

On Tuesday, the 30-year fixed mortgage rate broke 7% then fell back into sub 7% territory to end the week. Mortgage backed securities ended the week slightly lower than the previous Friday. Premiums have been almost nonexistent in 2022 due to the increased risk of borrowers refinancing at a lower rate in the future. Home prices are sitting at a national median level of $427,000, up 13% from last year. In June, the median home price hit a record high of $450,000.

Hedge Funds (as of Thursday, September 29th)

After being net sellers of global equities for the past 2 weeks, hedge funds became buyers of equities in large amounts but the only region to be net bought was North America (NA). Funds added to longs in all regions but Asia ex-Japan. In NA, the buying was relatively concentrated at the sector level, focusing on utilities (4th week in a row), materials and communications services. The buying activity was also in index-level ETFs where the short activity was muted. Net leverage fell to YTD lows of 35% on Monday in US-based long/short equity funds but recovered to 38% when funds flipped to buying. Outside of NA, hedge funds were net sellers with the largest amounts in Europe and Japan, mostly from adding to shorts. AxJ flows were more muted with small selling on a net basis in China and Australia. HF relative performance was much better this week. Through last Thursday, the average Global fund was down only ~10 bps for the week which compares to the MSCI AC World Index falling ~1.7%. Americas-based L/S funds, which had posted the largest losses last week, were the top performers over the past four days as they were the only strategy to post gains on average – for the week, the average fund was up ~30 bps vs. the S&P down 1.4%. MTD, the average Global fund now sits down 2.8% vs. the MSCI -8.8%, and the average Americas-based L/S fund is down 4.7% vs. the S&P -7.8%.

The spread between the crowded names was positive in all regions, with most of the alpha in NA and Asia coming from the long side, whereas the positive alpha in Europe came as shorts lagged the Euro STOXX 600.

Private Equity

The venture capital market has seen relatively steady growth since the recession years of 2007 and 2008 with valuations continuously growing and a relatively low level of down rounds. Furthermore, valuations over the past three years have skyrocketed as growth was the highest priority for companies seeking the first-mover advantage. However, the recent shift in both public markets and in the venture capital mindset from grow at all costs to conserve cash is leaving many venture-stage companies with inflated valuations and near impossible revenue metrics. At the same time, public market exits are now few and far between leaving many of these companies in need of another financing round in a less than desirable market.

As a result, analysts suspect to see a significant increase in down rounds for venture-backed companies. Down rounds, or financing rounds in which a company sells shares at a price per share that is less than the price per share offered in an earlier financing round, often lag into a down market as companies find creative ways to lengthen runway or avoid equity financing. As of Q2 2022, it is estimated that fewer than 6% of completed financings have been down rounds with the majority of these financings happening at the late-stage.

Down rounds can be detrimental to the equity stakes of founders and investors and can create barriers for future company growth, including the stigma that the business is struggling. However, for some companies down rounds are unavoidable and are at times even thought of as an enticing opportunity for investors to take a sizable stake of a still promising company. Looking at 1,421 companies that raised a down round between 2008 and 2014, only 188 of these companies were unable to complete further financing or complete an exit after taking the down round, suggesting that down rounds are not an instant company killer. The data also shows that 88% of known exit valuations for companies taking a down round were in fact higher than the company’s down round valuation.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.