Economic Data and Market Highlights

Global equities rallied for the week ending October 24, 2025. The S&P 500 rose 1.93% for the week, buoyed by a muted inflation print and strong corporate earnings. The MSCI ACWI (+1.78%) likewise showed gains, as global risk assets responded to improved trade and policy sentiment. Meanwhile, the Bloomberg U.S. Aggregate Bond Index continues to reflect resilience in fixed income: year‑to‑date returns are around +7.3% in the “Agg” benchmark. The combination of equity gains, still‑solid bond returns, and a calming inflation backdrop helped risk assets extend their run.

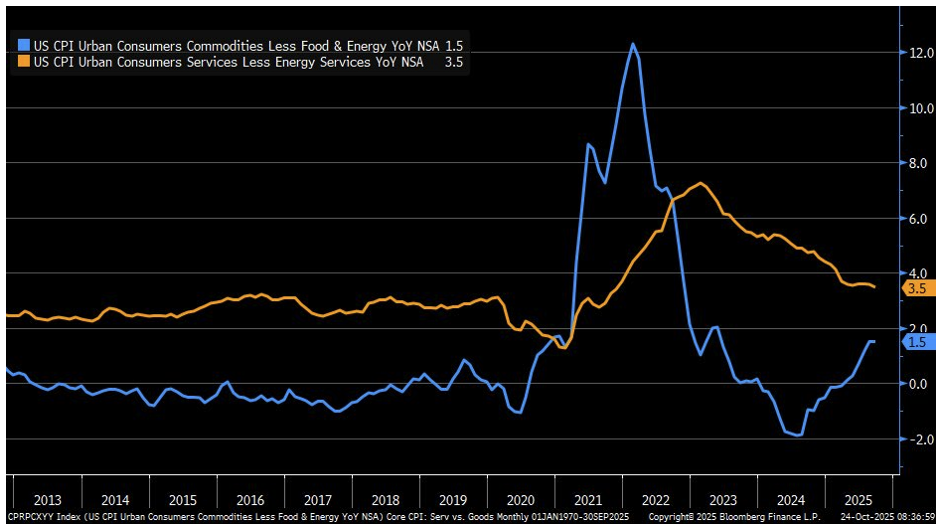

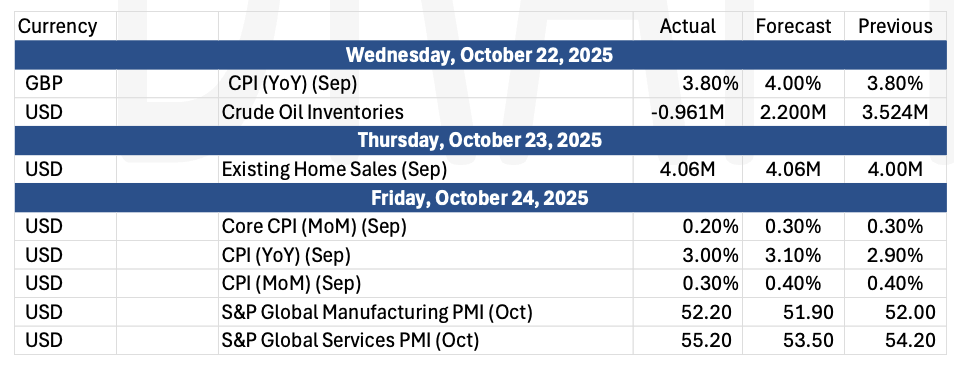

Key U.S. data this week includes the headline CPI Inflation (YoY) for September: Actual 3.0 % vs Forecast 3.1 % and Previous 2.9 % (released Oct 24) as the BLS assembled the data in advance of the US Fed meeting this week. The core CPI (ex‑food & energy) also printed 3.0 % (Forecast 3.1 %, Previous 3.1 %). The US Government noted that the result will likely not be processed next month as the government shutdown continues.

Building permits for August came in at –2.3 % MoM (Forecast –3.7 %, Previous –2.2 %).

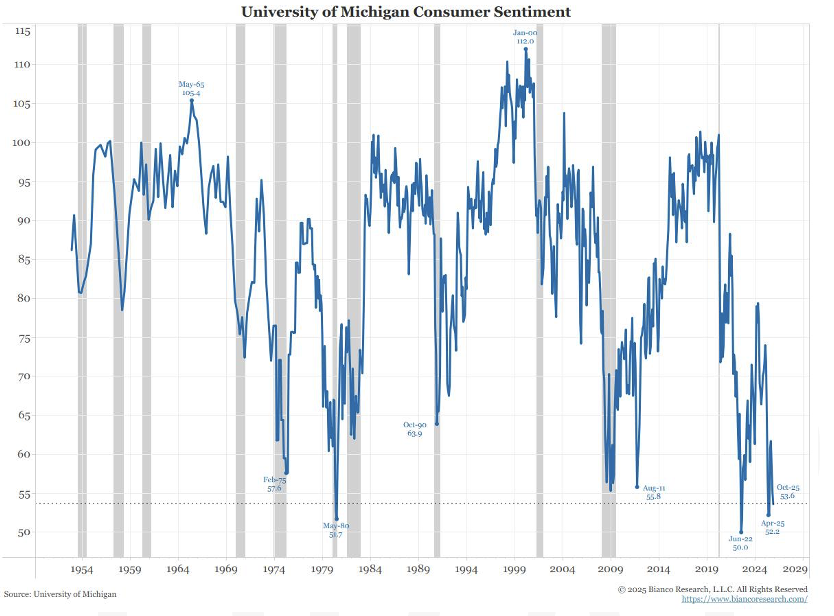

The University of Michigan released its Consumer Sentiment Survey last week. The reading was one of the lowest in its history.

US trade with Canada stumbled this week as the US canceled negotiations based on an advertisement run on American television, paid for by the Ontario government, criticizing US tariffs.

The Past Week’s Notable US data points (with revisions)

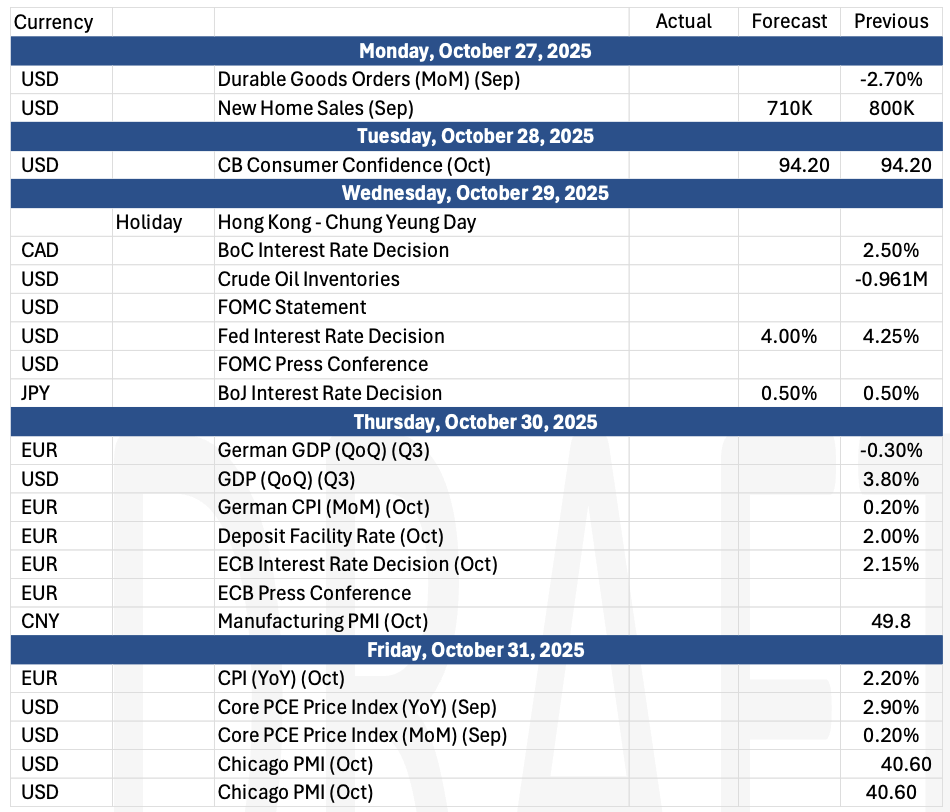

The Upcoming Week’s notable US data points

Some data may not be released due to the U.S. government shutdown

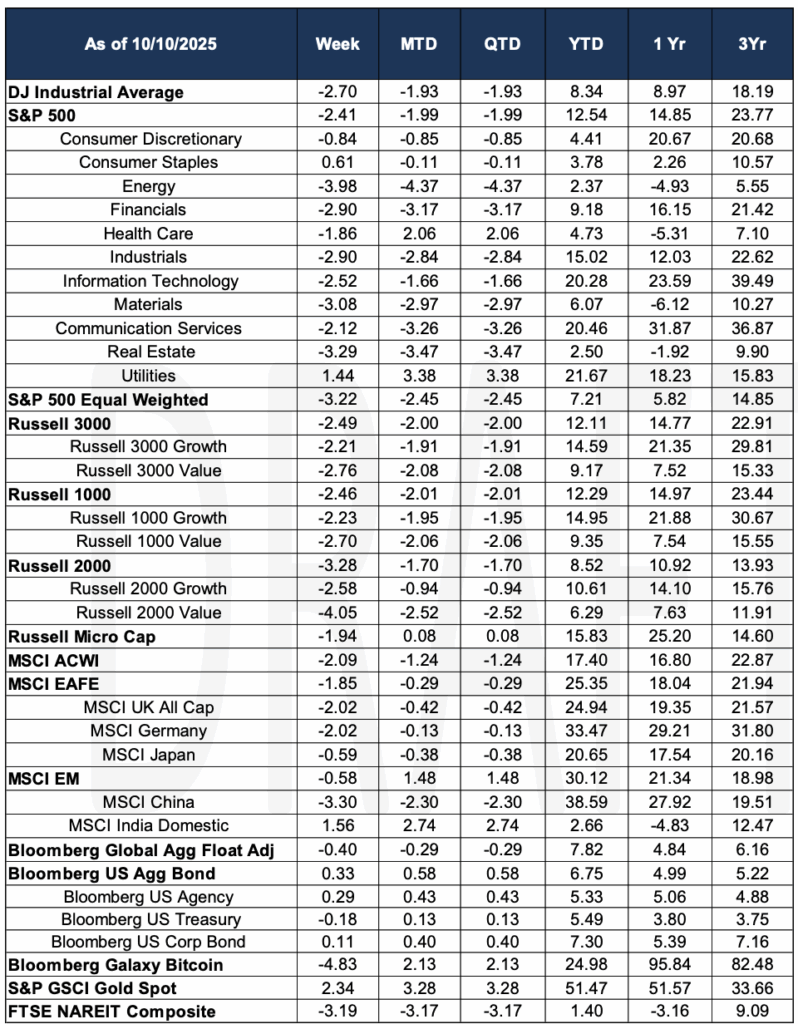

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co., Financial News London, Financial Times, Kobelessi Letter, Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara