Economic Data Watch and Market Outlook

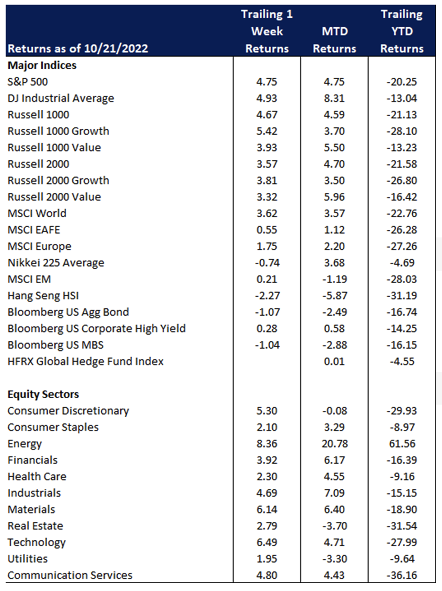

Global equity asset prices were up for the week as the MSCI World Index rose 3.62% while the US Aggregate Bond index fell another 107 basis points. Corporate earnings were a bit better than expected and investors believed that the economy may be in better shape than anticipated.

The US budget deficit was cut in half for fiscal 2022, the biggest drop in history following two years of tremendous Covid-related spending. The deficit declined to $1.375 trillion, compared to the 2021 deficit of $2.776 trillion. The deficit decline would have been steeper had it not been for the Biden administration’s student loan forgiveness program. Education spending totaled $639.4 billion for the fiscal year – $408 billion higher than estimated. Treasury Secretary Janet Yellen said the deficit cut provided proof that the historical economic recovery was driven by the American Rescue plan.

Foreign capital inflows into the US amounted to $275.6 billion in August, the largest recorded since March 2020.

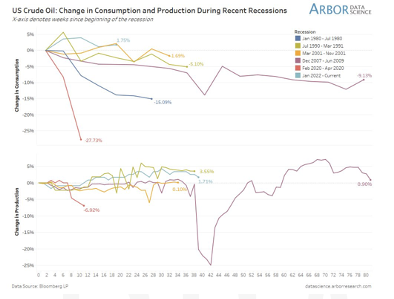

US Oil producers are recording record margins as diesel fuel leapt to $86 per barrel.

During slowdowns, oil consumption and production typically slow. That is not the case this far as data from Ann Arbor seems to indicate it is higher relative to past recessions. The above and below have driven energy equity names up roughly 18%. We’ll learn more about gasoline production and heating oil inventories on Wednesday.

The UK’s Prime Minister Liz Truss resigned as moves in her administration caused significant volatility in UK bonds marking the shortest PM tenure in history.

This week we’ll learn more about inflation data as PCE (Personal Consumption Expenditure) results are released. Powell has noted that he is following this number closely as a guide for future decisions. Markets have assumed that there will be at least a 75-basis point increase but speculation continues as to when the Fed will ease or pause. The ECB will also announce their decision later this week.

Equities

All three major US equities indices posted weekly gains (Dow: +4.93%; S&P 500: +4.75% and NASDAQ: +5.78%) leaving them all in the black MTD. Stocks logged their best week since June after rising sharply to close higher Friday. Investors weighed the possibility of a slower pace of interest rate increases and the latest batch of corporate results. This week showed several signs that US economy is stronger than many initially feared – several corporate giants such as JPMorgan Chase and Delta Airlines have both expressed confidence that the US consumer remains strong. JPMorgan closed Friday up more than 5%. Earnings season reporting has been better than expected as 20% of companies in the S&P 500 had reported 3rd quarter earnings, of which 72% reported EPS above estimates but below their 5- or 10-year averages. On the other hand, Dow components American Express and Verizon fell about 1.6% and 4.5% after their quarterly reports release.

One of the largest deals in the history of the US grocery industry was executed last week. Kroger plans to acquire its rival Albertsons for $24.6B. The acquisition will help Kroger/Albertsons make up 13% of US grocery sales. Walmart, the largest company in the grocery industry makes up 22%.

Twitter (TWTR – 4.75%) shares fell as the Biden administration officials are discussing whether the US should subject some of Elon Musk’s ventures to national security reviews as reported by Bloomberg News.

Mobileye Global Inc, the self-driving car unit of Intel, is expected to begin trading October 26th. Originally Mobileye was expected to have a $50 billion valuation but is now set to sell a smaller number of shares and expected to target its valuation at around $20 billion.

This week another 165 S&P companies are scheduled to report earnings including the tech sector, which accounts for ~20% of the index’s earnings.

NASDAQ halted the IPO of at least four small-cap Chinese companies while it investigates IPO price swings of companies that debuted earlier this year. NASDAQ has been privately informing lawyers that new listings of small-cap companies are being subjected to additional reviews and approvals were suspended until further notice.Though all companies will face this scrutiny, the exchange is paying particular attention to companies in China and the rest of Asia due to IPO price swings in recent months.

On the flip side, Hong Kong Exchanges & Clearing is planning new rules that would lower the bar for listings of pre-revenue and early-stage technology companies that haven’t generated revenue to go public. Early-stage technology and semiconductor companies are among those specifically targeted by the proposed changes in the US.

Major European indices were mostly down on Friday, except for FTSE 100, but up for the week. Asian indices were down for the week as well.

Fixed Income

This week yields climbed steadily until Friday, spiking at market open and then finishing the week slightly higher than they began. The 2-year Treasury yield ended the week at 4.50% while the 10-year Treasury yield finished the week at 4.23%, and the 30-year Treasury yield ended the week at 4.34%. There has been a change in how investors are looking ahead at bond markets. The conversation has shifted from determining the next rate hike, to when the Fed will pivot. Many believe the Fed will raise rates into the range of 5% in mid-2023. Last week’s CPI print cemented the fact that we should expect to see two more 75 bps hikes in November and December, and Federal Funds futures markets are pricing in the benchmark policy rate hitting 5% in May of 2023, up from 4.6% prior to the latest CPI print. On Wednesday, Neel Kashkari, the president of the Minneapolis Fed was quoted saying that if they did not see progress in inflation or core inflation, he saw no reason to stop hiking rates at 4.50% or 4.75%. Stating that “We need to see actual progress in core inflation and services inflation, and we are not seeing that yet.”

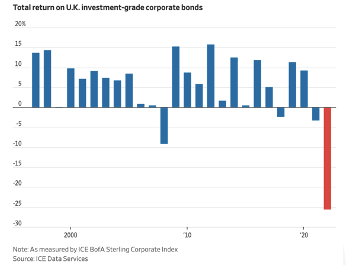

It’s been a bad year for global bonds, but the UK is seeing the worst of it. A wild political landscape, high inflation, and soaring interest rates are making the market particularly challenging. Corporate bonds issued in the British pound are posting returns of -25%, which is the largest average loss in over 25 years. Currently, the UK 10-Year bond yield is coming in at 4.05%. The selloff in bonds has hit UK pensions especially hard. In recent weeks there has been a selloff due to an effort to make margin calls, and some of the products being sold are corporate bonds. Further, the Bank of England is making efforts to sell its own holdings of corporate and government bonds, which will only further strain UK debt markets.

Hedge Funds

All regions but Asia saw positive performance this past week which is not surprising as indices in their respective geographies were up (MSCI Asia Pacific was down). Americas-based L/S equity was the best relative performer at +130 bps compared to +230 bps for the S&P. Contributing to this was the positive spread between crowded longs and shorts. Regarding flows, it was a relatively quiet week in all geographies. Hedge funds leaned towards trimming gross exposure by covering shorts with long activity fairly muted.The short covering was the largest in Europe where funds covered indices as well as single-name (cyclicals). Long activity was more subdued with the only significant long buying in the tech sector.In Asia ex-Japan, hedge funds trimmed longs (real estate, healthcare and consumer discretionary) and flows to Japan were net flat. In the US, the short covering was less pronounced than Europe and was led by index products (funds actually added to single-name shorts). Financials were the most net bought sector (led by capital markets) as companies in that sector kicked off earnings season. Tech was the 2nd most net bought sector as hedge funds added to longs after reducing longs earlier in the month. At the factor level, funds favored large-cap over small with the size factor bought in some of the largest amounts seen in months.

Private Equity

Private equity deal activity slowed in the US in Q3 2022 as investors took a more cautious approach given rising interest rates, high inflation and other economic and political uncertainties. PE managers closed a total of $280.64 billion worth of deals during Q3, which is a 20.4% year over year decline. However, given increasing challenges to finance new deals, PE investors gravitated toward smaller deals as well as add-ons which equated to a year over year increase in deal count of 3.7%.

With an estimated $293 billion in exits through the end of Q3, deal volume and value dropped substantially from 2021’s record level. The decline in exit activity is due in part to a frozen IPO market that has been harshly affected by increased market volatility and drop in public stock markets. Over the last two years public listings accounted for approximately one-third of PE-backed exit value in the US. In stark contrast, 2022 public listings represented only 1.6% of the total exit value so far this year.

Amidst market volatility PE managers continued to have a strong fundraising performance through the first three quarters of the year. US PE firms raised an estimated $258.8 billion which is in line with 2021’s numbers. However, analysts suspect that PE fundraising will slow in Q4 as many managers will delay closings until 2023 as the fundraising market is overcrowded and limited partners are struggling to maintain re-ups.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.