Economic Data and Market Highlights

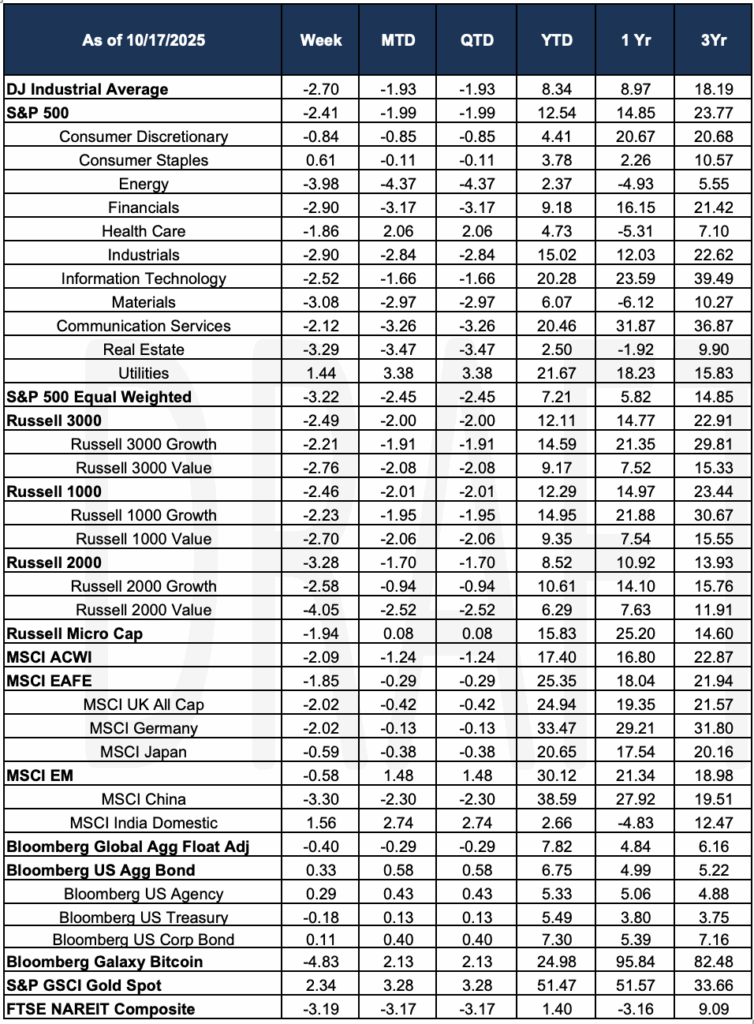

U.S. and global stocks finished higher for the week as worries over regional banks eased and trade rhetoric softened into Friday. The S&P 500 gained +1.71% week‑over‑week, the MSCI ACWI rose +1.21%, and the Bloomberg U.S. Aggregate, advanced +0.45%. Headlines credited Friday strength to President Trump saying 100% tariffs on China would be “not sustainable,” alongside steadier bank earnings, helping all three major U.S. indexes notch weekly gains.

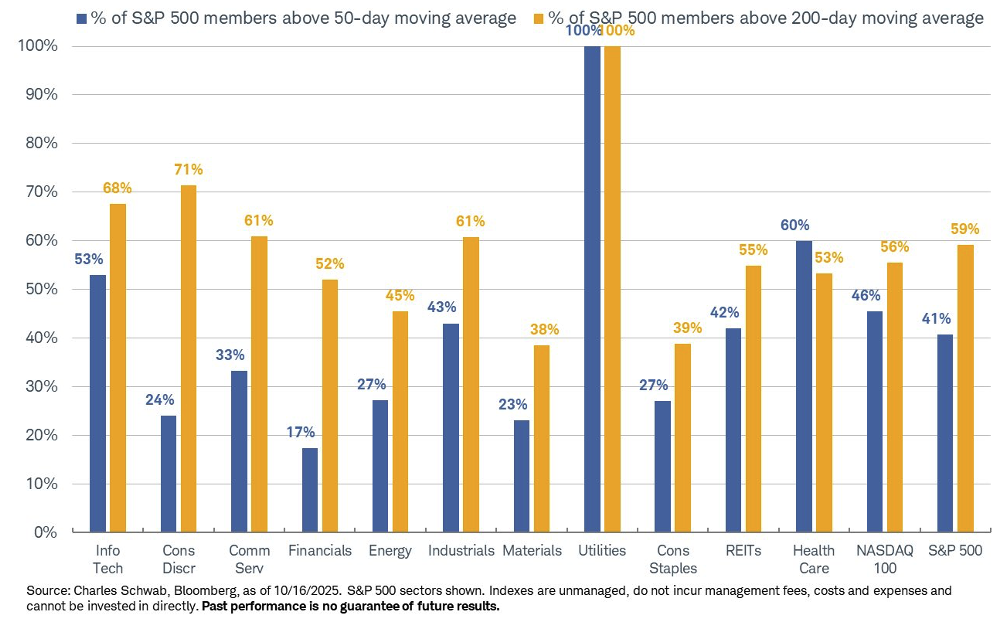

As the S&P continues to advance forward, AI names continue to advance but so have sectors that support AI, most notably, Utilities, with 100% of stocks in that sector above their 50 and 200 day moving averages. They are the second-best performing sector in the S&P 500, advancing 23.53% YTD ending Friday, behind Communication Services, up 24.84%. Names that have nuclear energy exposure are up over 25% year to date.

Economic data was thinner than usual amid the ongoing federal shutdown, but a few notable readings still landed. Homebuilder sentiment (NAHB HMI) surprised to the upside at 37 (forecast 33, previous 32) on Oct 16.

Michigan Consumer Sentiment (Oct, prelim.) printed 55.0 (forecast 54.1, previous 55.1) on Oct 10. Initial Jobless Claims for the week ending Oct 11 had no official print; Investing.com reported economists’ estimate of 217K vs 235K prior given suspended government reporting. The September CPI release was delayed to Oct 24 because of the shutdown.

Cross‑asset moves reflected cautious optimism: stocks rallied into the close as trade fears ebbed, Treasury yields firmed, and the dollar edged up, while gold cooled after setting fresh records earlier in the week. With several government prints postponed, markets will take cues next week from corporate earnings, delayed CPI/housing data, and any further U.S.–China developments out of Washington and the IMF meetings circuit.

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara