Economic Data and Market Highlights

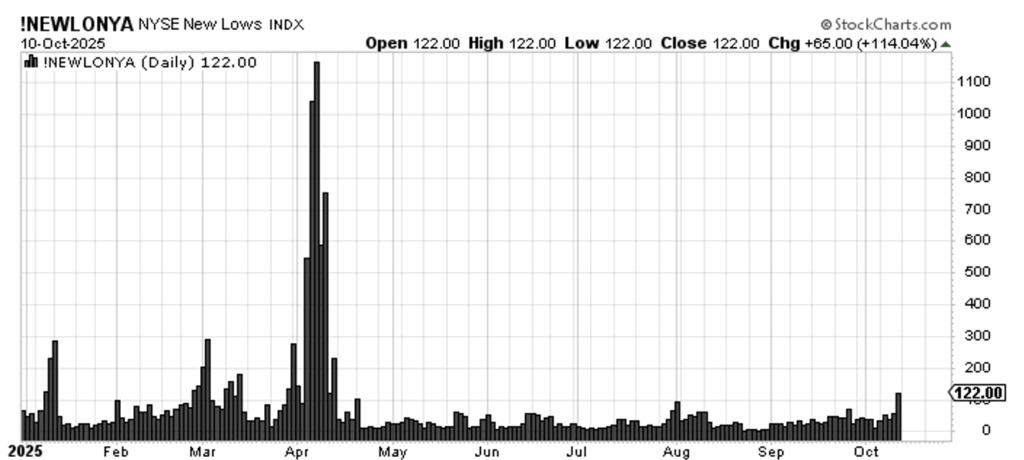

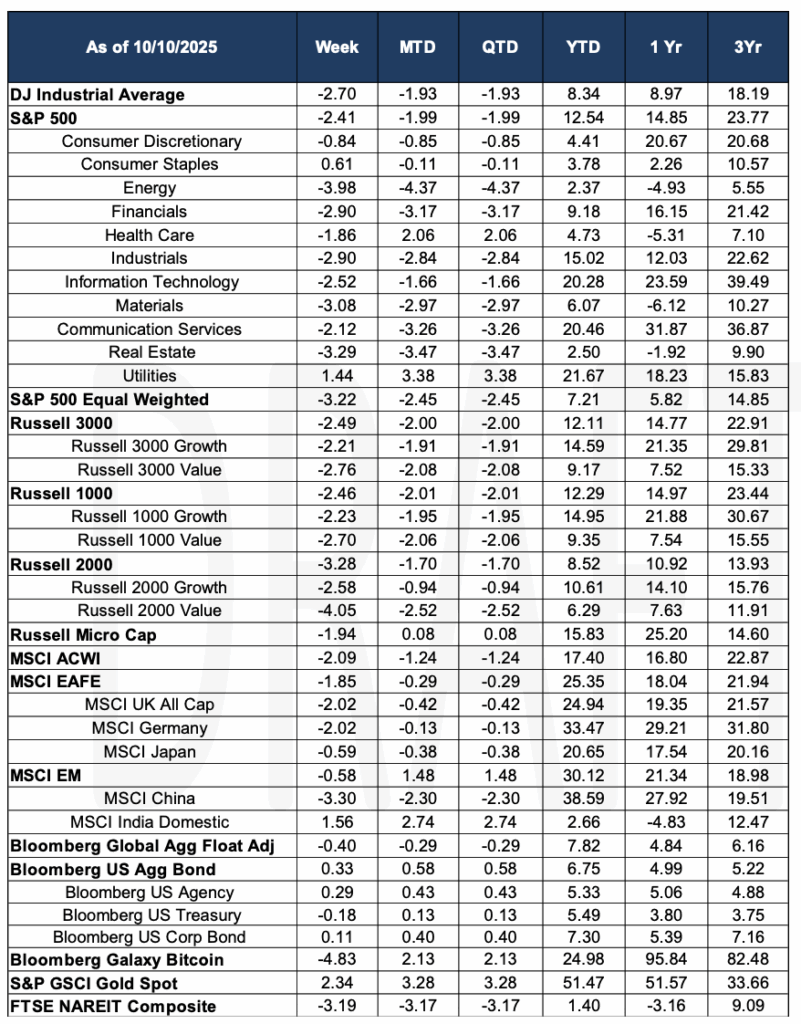

U.S. and global equities ended the week lower after fresh tariff threats on China sparked a sharp Friday selloff, which saw 424 declines in the S&P 500 and the most new lows since April. The Food, Beverage, and Tobacco sector was the only industry within the S&P 500 to finish higher for the day. For the week ending October 10, 2025, the S&P 500 fell 2.41%, its worst performance since May; volatility jumped as mega-cap tech stocks led declines. Global stocks softened as well, with MSCI ACWI down -2.09%. Core bonds provided ballast: the Bloomberg U.S. Aggregate was +0.33% week-over-week.

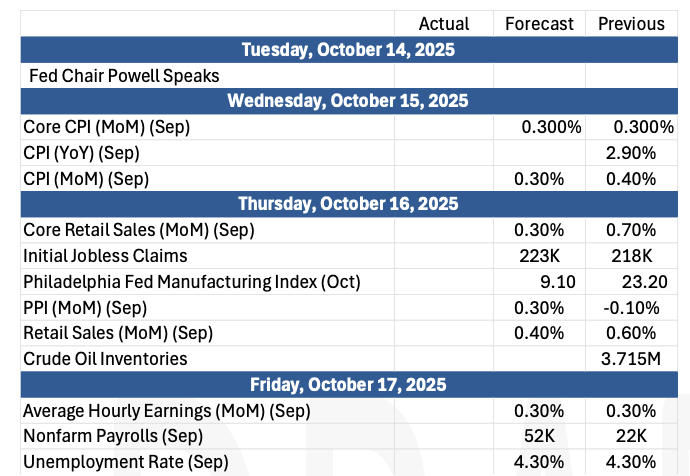

The Federal government is calling some BLS employees back despite the shutdown to prepare a CPI release on October 24th.

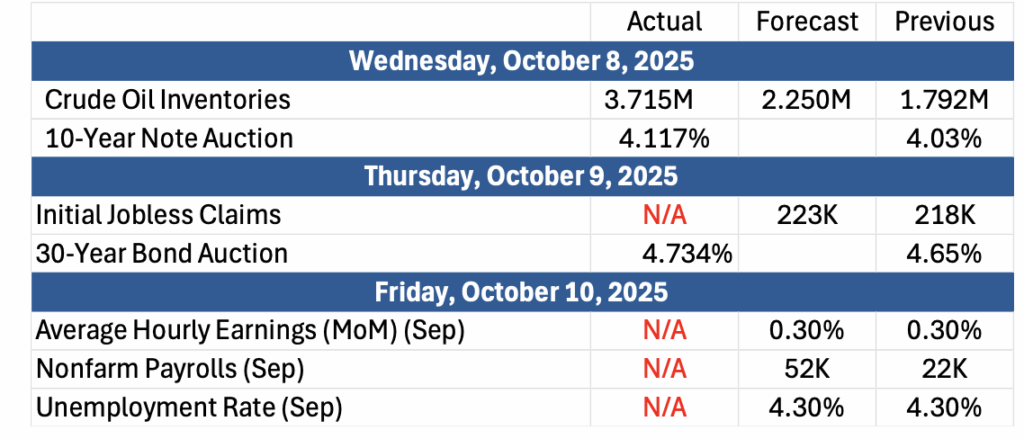

The Past Week’s Notable US data points (with revisions)

The Upcoming Week’s notable US data points

Some data may not be released due to the U.S. government shutdown

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara