Economic Data Watch and Market Outlook

The first full trading week of October did not disappoint in terms of news and suspense. Early in the week, China and the US traded verbal barbs about the trade agreement put in place under the previous administration. China has not lived up to the purchases promised under Phase One of that agreement but is pressing the current administration to remove the tariffs put on its goods. China further dominated the news offshore as it continues to mount military exercises around Taiwan and has suggested reunification.

In the US, Congress continued the theater around the debt ceiling only to kick the can down the road a bit more as the Senate agreed on Thursday to pay the US Government’s expenses through early-December as 11 Republicans joined the Democrats to get the to 60 vote threshold. The news caused US equity markets to advance with the S&P 500 up 0.85% and the Russell 2000 to jump 1.59%. The strength in equities and volatility in bond prices illustrate that the potential of a government shutdown was a very important aspect to investors’ level of comfort. It also illustrated that although there are bears in the market, they do not have the depth or breadth to move prices significantly. The “buy the dip” philosophy as well as the market still has more tailwinds than headwinds continues to prevail.

Finally, last week we discussed an unexpected but very modest increase in jobless claims (11,000) and labor force participation rate. Consensus estimates for the jobs report was roughly 500,000 new jobs but only 194,000 were added. Despite the weakness, traders perceived the longer term as positive as it somewhat solidified the Fed’s posture around tightening. Any potential variable that will extend the economic recovery seems to soothe the bulls and discourage the bears. Potential rising rates, the Delta variant and confusion about what will increase hiring are still providing a decent backdrop.

The week ahead, we’ll see a variety of employment reports (the US, Great Britain, South Korea and Australia) and inflation results out of the US, Germany, South Korea, and China. We’ll pay close attention to any clues related to adjustments to previously discussed supply chain issues. As prices have surged at the pump and the weather turns colder, we’ll also be watching multiple energy related numbers coming out on Thursday.

U.S. Equities

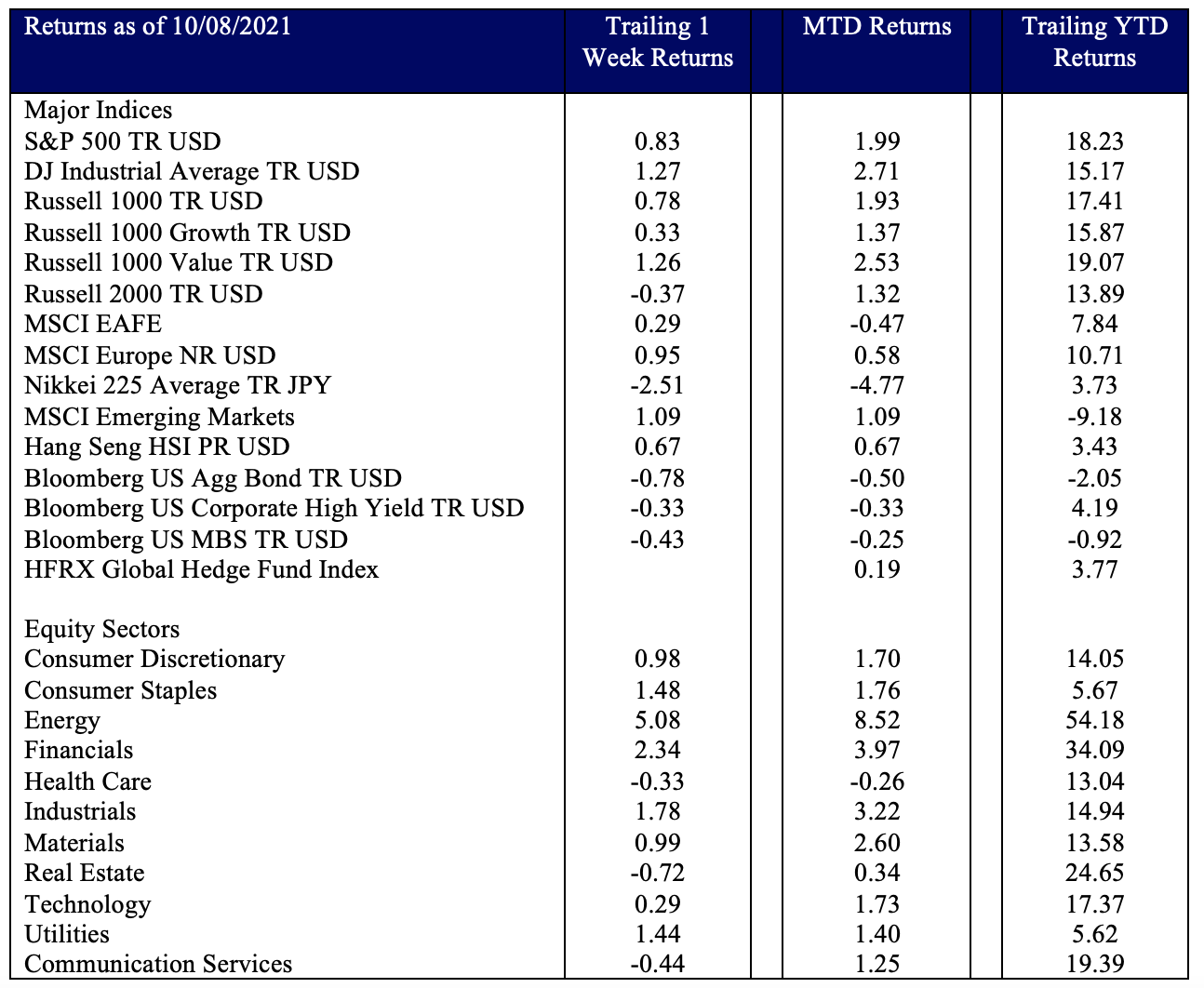

Large cap US equities rose for the week with the S&P 500 up 0.83% and the Russell 1000 up 0.78% , but small caps stumbled a bit, declining (-0.37%). Energy stocks continue on a tear, advancing 5.08% for the week, up 54.18% on a year-to-date basis. As the US economy has evolved, it should be noted that Energy as the sector amounts to less than 3% of the S&P 500, shrinking since its peak 16% level in June of 2008.

The Financials sector advanced 2.34% for the week and was the second-best performing sector on a year-to-date basis, up 34.09%. All sectors of the S&P were up for the week except for Healthcare, Real Estate, and Communication Services.

Another important component is that earnings will begin this week and at this point in time expectations are not overly optimistic. Going into the last quarter, focus has shifted to early shopping for the holidays as supply shortages and bottlenecks will support earlier shopping, another optimistic positive for investors as they approach November and December

International Equities

Developed Market equities rose 0.29% in US Dollar terms for the week as did Emerging Market Equities up 1.09% USD terms.

As German elections are in the rear view mirror, we continue to watch how the coalition government will be formed and organized and whether the country will continue its dominance in the EU.

We continue to see significant money invested in private equity deals across Europe, especially in the UK as $78 billion of deals were announced in the first three months according to Pitchbook Research. What’s especially interesting is the deals to take public companies private. These deals have surpassed 2020’s rate and is on track to surpass 2019’s record.

In Japan, Liberal Democratic Party (LDP)’s Fumio Kishida sped up plans to form his government. The Nikkei continued its fall this week, declining another 2.51%.

Fixed Income

Interest rates as measured by the benchmark US Treasury yield curve have risen slightly during the past week with the two-year Treasury note yielding .32% and the ten-year bond at 1.61%. These represent somewhat elevated inflation fears, albeit muted, given the Fed’s insistence that price pressures are transitory. As if to emphasize the point, fossil fuel costs- which still provide the vast majority of energy around the world – have risen to levels not seen in several years and appear to be the result of structural changes in energy infrastructure investment post the collapse in oil prices just 16 months ago when energy actually traded below zero!

We are witnessing history. The Fed’s favorite gauge of core inflation sits at a 30-year high while the Fed Funds Rate simultaneously stands at zero. Even so, the monetary authorities continue to focus on employment (194,000) expecting subsequent numbers to drive decisions around tapering and short-term policy rate targeting. It would appear we are close to the Fed scaling back long-term bond purchases in the coming months which any change to short term policy rates remains further in the distance – perhaps in early 2023.

Hedge Funds

Over the past week hedge funds flipped back to buying as net leverage is near its lows since January in North America, 11-month in EU and lowest since May in Asia. Gross leverage had declined but that was more related to mark-to-market moves than selling. Much of the buying in North America comes from adding to growth and Technology, Media, and Telecom (TMT)-related sectors with rotation to cyclicals slowing. There was some tilt to buying Asia ex-Japan, which was mostly China and small selling of Japan. Hedge funds did not capture this week’s market upside, but this follows being positioned well for September’s volatility, outperforming in all regions. Year-to-date, event-driven funds, as a strategy, are leading the pack. We like this strategy because many funds have the capability to invest in idiosyncratic ideas globally where the broader markets are more temporary mark-to-market headwinds/tailwinds. Crowded trades continue to be problematic in the US. According to Morgan Stanley’s top 50 crowded longs and shorts from their prime brokerage book, crowded long are up less than the S&P YTD while crowded shorts are up significantly more than the S&P. EU and Asia both have positive spreads (longs outperforming shorts).