Economic Data Watch and Market Outlook

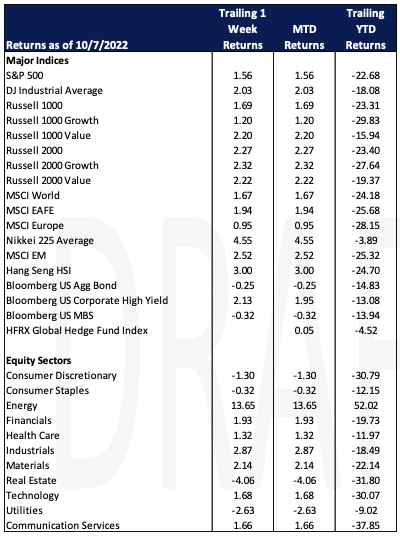

Global asset prices were up for the week as the MSCI World Index rose 1.67% but the return masked the week’s volatility. The S&P 500 rose 1.56% but traded between 3604.83 and 3806.91. The US Aggregate Bond index fell 25 basis points. Traders had speculated earlier in the week that the Federal Reserve may ease their stance on curtailing inflation, but Fed Governors communicated that was unlikely.

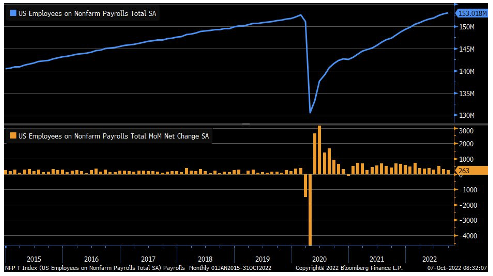

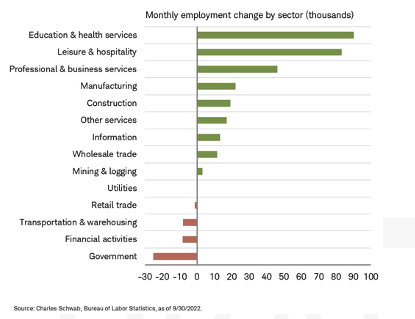

The U.S unemployment rate fell to 3.5% in September, lower than expectations of 3.7%. The economy continues to be resilient in the wake of stringent monetary policy by the Fed. Nonfarm payrolls rose by 263,000 jobs, more than the 255,000 economists expected. As a result, traders followed a ‘good news is bad news’ mentality and equities declined over 2% on Friday. Despite the strength in employment hiring and continued wage growth, the Fed will likely see these indicators as catalysts for keeping inflation high.

The week’s manufacturing and services data, leading economic indicators, also showed the economy is resilient, but slowing. The ISM Manufacturing Index fell to 52.2, brought down by large declines in new orders and employment – an indication that high interest rates are becoming a burden to rate-sensitive business investment. The ISM Services PMI also fell slightly to 56.7 driven by declines in business activity and new orders.

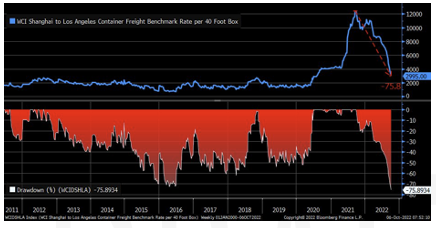

Supply chain issues have continued to recede as indicated by data tracked by the NY Fed.

Shipping container costs from China to LA have dropped precipitously.

This week’s Consumer Price Index will provide more color of the current state of inflation in the US.

Equities

As noted above equity prices were volatile during the week. Large cap stocks rose 1.69% as indicated by the Russell 1000 index but were outpaced by small-caps as the Russell 2000 advanced 2.27%.Growth and value small cap stocks advanced almost equally for the week at 2.32% and 2.22% respectively, but significant differences were evident in the large cap growth and value indices. The Russell 1000 Growth rose 1.20% while the Russell 1000 Value rose 2.20%. The difference occurred because of the increase in energy stocks, up 13.65% as OPEC made headlines announcing it decided to cut production.

While Technology stocks were up 1.68%, the Philadelphia SE Semiconductor index fell after a revenue warning from Advanced Micro Devices (AMD) signaled a chip slump could be worse than expected. The index slumped 5.14%. On Friday, the US has also restricted Chinese access to semiconductors amid a tech rivalry between the two – the U.S says it wants to keep its “sensitive technologies” away from China’s military and security services, but China said the move would hurt businesses on both sides. The export rules imposed by the US vastly expand the reach to slow Beijing’s technological and military advances, some of which are effectively immediately. The restrictions bar US companies from selling chips used for super computing and AI to Chinese companies, as well as limiting foreign firms that use US tech in their products from doing business with China. US allies are feeling the pain. Taiwan and South Korea are being forced to choose between China (one of their largest markets) and the US. AMD shares fell 12.3%, the largest decliner on the Nasdaq 100, as its third-quarter revenue estimates were about $1 billion less than previously forecasted.

The MSCI EAFE, rose 1.94% and the MSCI Emerging Markets index rose 4.55%.

Fixed Income

Government Bond yields rose on Friday in response to the September jobs report which showed no sign of an economic slowdown. Employers added 263,000 jobs in September, bringing the unemployment rate down to 3.5% from August’s level of 3.7%. The 10-year Treasury yield hit 3.90% up from 3.83% on Thursday, while the 2-year Treasury yield climbed to 4.33%, up from 4.23% the previous day. The Fed has shown no sign of pivoting and it seems doubtful that they will reverse any time soon with inflation still near record highs.

Credit Suisse offered to buy back $3B worth of bonds on Friday in a show of strength. Over the last few weeks investors have become increasingly nervous about Credit Suisse’s financial situation. The bank stated that buybacks allow repurchasing of debt at attractive prices, while also providing reassurance to investors that the health of the bank’s financial situation is not in question. Credit Suisse’s stock rose throughout the week after hitting a low of $3.80 per share on October 3rd.

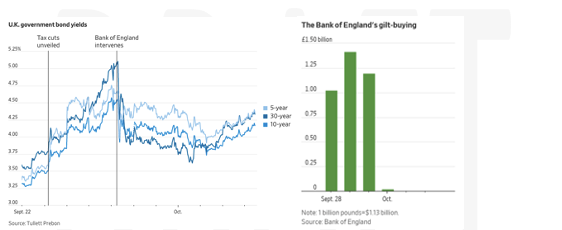

Last week, the UK announced that it would purchase bonds to stabilize markets after Liz Truss announced a new tax cut. The BoE stated that they could purchase up to £65B on long dated gilts. After the central banks purchasing slowed, yields began to rise again, the 30-year gilt hit 4.33%, the 10-year hit 4.22%, and the 2-year hit 4.12%.

Foreign money continues to flow out of Chinese debt markets. Overseas holdings of Chinese binds fell by $83B in August, leading to the 7th straight month of outflows for the country’s debt market. The selloff of bonds is being influenced by several factors. A primary reason for investor worries is the possibility of sanctions on Chinese markets if they decide to formally support Moscow in their war effort against the Ukraine. Support for Russia is not the only reason sanctions could be implemented, the ongoing conflict between mainland China and Taiwan is another reason for investors to think twice about their involvement with the world’s second largest economy.

Hedge Funds (Through Thursday, october 7th)

Following a difficult end to September, hedge funds were able to capture a large portion of the past week’s gains. Americas-based long/short equity funds were the top performers returning 3% compared to the S&P’s 4.5%. Unlike September where crowded longs were down more than the indices, those names recovered in the first week of September outpacing both the S&P 500 and crowded shorts by a wide margin. The same return profile for crowded names occurred in both Europe and Asia. As the markets rallied, hedge funds leaned towards covering shorts resulting in net leverage inching higher (Japan was the most net bought followed by North America while Europe and AxJ were more muted). In NA, almost all the covering was at the index level – ETFs, and interestingly, stripping out the ETF covering, NA tilted towards short additions. On a sector level, hedge funds were buyers of consumer (both staples and discretionary), utilities and financials – all long additions. On the flip side, funds were long sellers of energy and materials after both sectors outperformed for the week. TMT flows were more muted with buying in internet, direct marketing retail and semiconductors and selling in software.

Private Equity

2022 has proven to be another strong year for the venture capital ecosystem in the Middle East and North Africa with raised capital on track to match or even outpace 2021’s figures. Since the start of this year, a total of $12.6 billion was raised and invested in the region across 874 total deals. At this pace, the region could see a record year in terms of total deal value, although the number of deals may fall short of last year’s record-breaking number of 1,461 deals. Similar to 2021, roughly 40% of venture capital deals in the region have been angel/seed rounds while 30% have been early-stage VC and the final 30% later VC stage deals.

Due in part to its mature ecosystem, strong ties with the US and highly skilled workforce, Israel continues to be the region’s largest venture capital destination. According to analysts at Pitchbook, the country is ranked second in the world in terms of VC investment per capita. In 2021, Israel closed 746 venture capital deals, the highest of any country in the Middle East region.

A key driver behind the Middle East and North Africa regions’ strengthening VC market has been strong government support. Sovereign wealth funds such as the Saudi Arabia’s Public Investment Fund and the Abu Dhabi Investment Authority have offered the region an abundance of capital and support.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.