Economic Data Watch and Market Outlook

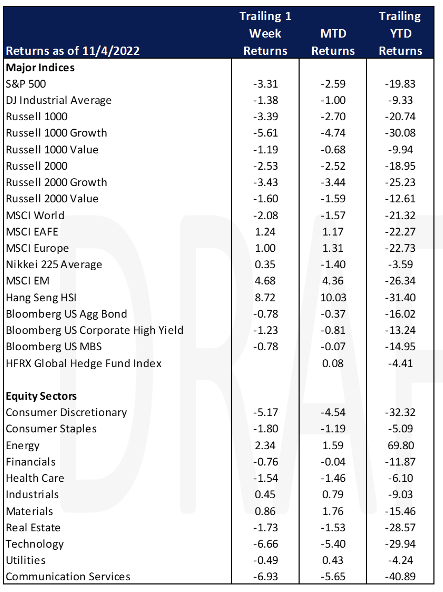

Global equity prices declined for the week as the MSCI World index fell 2.08%. US Stocks fell 3.31% as indicated by the S&P 500 after the US Fed raised interest rates another 75 bps and provided clarity around future rate decisions.

At Powell’s press conference after the rate decision was announced, he again threw cold water on the notion that the Fed would pause or lower the size of future rate hikes. Fed officials have repeatedly emphasized that in order to meet their inflation goal, they need to bring labor supply and demand more into balance, but investors and pundits have continued to speculate, incorrectly thus far, that a pause would take place. This has exacerbated market volatility in recent months. The following day, it was announced that nonfarm payrolls increased 261,000 last month following an upwardly revised 315,000 gain in September. Jobs gains were relatively broad – healthcare, professional and business services and manufacturing posted solid increases. The report from the Department of Labor suggests demand for workers remains robust despite rapid interest rate increases.

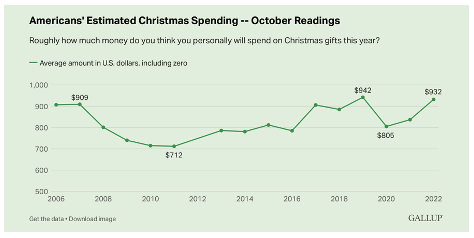

As we mentioned last week, personal income continued to rise. US businesses reported strong hiring and wage increases in October although the unemployment rate climbed. A recent poll also suggested that the consumer will spend more this year during the holidays than before COVID.

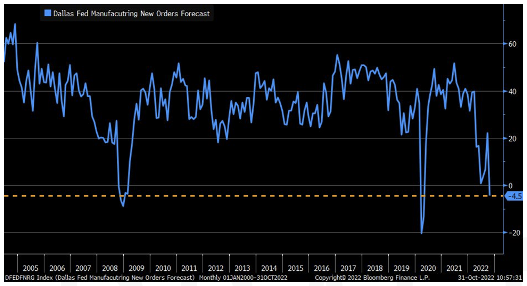

While spending continues, manufacturing continues to decline according to recent data circulated by the Dallas Fed.

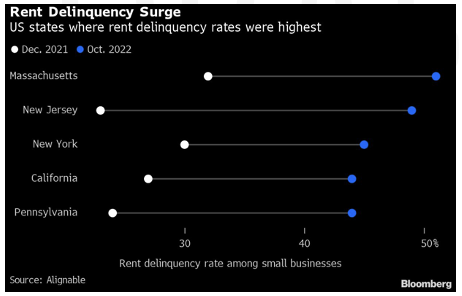

Also, this week an alarming stat was circulated by Alignable and Bloomberg suggesting that rent delinquencies are starting to rise with small businesses. The chart below shows the top four largest delinquency rates by state.

While exposure is limited among most managers that Clearbrook recommends, Twitter made significant headlines during the week. After Elon Musk took over the company, he wasted time no laying off thousands of workers. Musk also floated a $20 per month charge for users that want to be verified but that rate was met with significant resistance and was later lowered to $8 per month. The change, however, hardly addresses the cash needed to service the debt Musk borrowed to purchase the company. Further, major advertisers are beginning to leave following pressure from the public. IPG, one of the largest advertising companies in the world issued a recommendation to clients for a temporary pause in spending at Twitter. Look for volatility around this name, and Tesla, which is pledged as collateral related to the Twitter debt Musk incurred.

Equities

For the week the Dow fell 1.39% to snap a four-week winning streak while the S&P dropped 3.34% and the NASDAQ declined 5.65% in volatile markets since the Fed announced the expectations for continued interest rate increases and mixed jobs report.

Twitter, the now private company, is being sued by employees regarding layoff tactics as Elon Musk is slashing jobs due to projected loses of $700M in 2023 due to interest expenses of $1.3 billion on its nearly $13 billion in new loans.

On Friday Starbucks (SBUX: +8.48%) posted record fourth quarter revenue that beat expectations and CEO Howard Schultz said that Starbucks represented an “affordable luxury” to customers. Meanwhile other food company names such as Kellogg Co. (K: +0.50%), Mondelez (MDLZ: +1.97%) and Hershey’s (HSY: -1.32%) all believe they still have “pricing power” where they believe they have the ability to raise prices further or keep them elevated as they have not seen a decrease in demand.

European indices (FTSE 100: +4.42%; Euro STOXX 600: +1.51%) are up for the week even as central banks of the EU and UK all poised to raise interest rates as inflation continues to rise. Ocado Group PLC (OCDO: +35.69%) inked a new deal with South Korea’s Lotte Shopping to develop six (6) customer fulfillment centers by 2028, with the first one to go live in 2025. The estimated revenue increase of this deal is approximately $100 million (~4% of sales in the last financial year) of annual revenue.

The Public Company Accounting Oversight Board (PCAOB) completed their seven-week onsite audit work of New York listed Chinese companies, which started in Hong Kong in September. The Hang Seng and Shanghai indices closed Friday +5.36% and +2.43%, respectively, with the news that the company audits have been completed ahead of schedule and hopes that US officials were satisfied. China dispelled the rumor that they would ease tough COVID restrictions and make substantial changes to the “dynamic-zero” COVID 19 policy in the coming months as China was postponing the Guangzhou auto show due to rising infections.

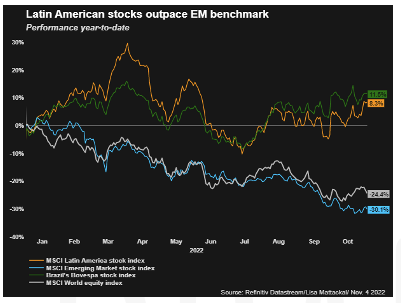

The Brazilian real gained 3% after the results of President Lula da Silva’s win as investors cheered easing political uncertainties. Overall Latin American stocks have risen over 8% this year, outperforming the broader emerging markets indices.

Fixed Income

The Fed did not capitulate to the rumors of a possible pivot during their Wednesday meeting as they hiked rates once again with their 4th consecutive 75bps hike. Jerome Powell’s speech focused on being sufficiently restrictive and avoiding a situation where easing is premature. Powell noted that while growth in consumer spending has slowed from 2021, the labor market remains tight with unemployment at a 50-year low, job vacancies are still high, and wage growth is elevated. Although the effects of rate hikes are being noticed in interest-rate-sensitive sectors such as housing, it will take time for the effects of monetary policy tightening to move throughout the economy. In response to the 75bps hike, markets turned downwards. On Wednesday and Thursday, the S&P 500 fell 2.5% and 1.1% respectively. Yields rose throughout the week, with the 2-year Treasury yield finishing at 4.66%, while the 10-year Treasury yield finished at 4.17% and the 30-year yield finished at 4.27%. The message by the Fed helped solidify investors views on what was to come in 2023, and that rate hikes are here to stay.

Mirroring the US Federal Reserve, The Bank of England raised rates by the largest amount in over 30 years on Thursday. The Monetary Policy Committee increased the UK benchmark by 75bps, the benchmark rate now sits at 3%. The BOE’s quarterly forecasts show that the UK is already in a recession and predict that the economy will remain in contraction through 2024. UK inflation is coming in above 10%, with a goal of reaching 2% in the next few years.

Investors are fleeing to the safety of cash funds once again as the Fed remains firmly hawkish. Money market funds saw $194 billion inflows so far in Q4. The asset class had inflows of $62.1 billion in the week through November 2, according to EPFR Global Data. Global equity funds also saw $13.76 billion of inflows during the week, the second consecutive week of inflows and the biggest weekly net buying since March 23, according to Refinitiv Lipper data. US, European, and Asian equity funds all received inflows worth $10.19 billion, $2.42 billion, and $830 million, respectively.

Hedge Funds

Hedge funds protected capital the first few trading days of the month, outperforming their respective indices in all regions. Global funds were down approximately 40 bps compared to -270 bps for the MSCI World. Americas-based long/short equity funds were down more than 150 bps but that compares to -390 bps for the S&P 500. European funds were flat compared to the Euro STOXX 600 down 60 bps. Asia-based funds were the only region to post gains as Asia funds were +150 bps and China-based funds +240 bps compared to the MSCI Asia Pacific Index +120 bps. It was a tough week for crowded names in North America as longs were down 660 bps lagging the S&P -2%. This was offset by crowded shorts generating alpha as they were down 7.7% for the week. Crowded names in Asia worked well which could explain the region’s outperformance. The top 50 longs were +5% compared to +2.60% for shorts leading to a positive spread. Looking at flows, NA hedge funds were net buyers for the week with the buying split between ETFs (long buying), healthcare (equipment & supplies and biotech-short covering) and energy (integrated oil & gas and E&Ps-long buying). HF were long sellers of technology (IT services, hardware, software) with the tech the most sold industry on the long side by a fairly wide margin. HF were also net sellers of financials (capital markets, banks) and utilities. Outside NA, flows were fairly muted in Europe and Japan (both slightly net bought) and AxJ slightly net sold, mostly China A-shares.

Private Equity

As private equity exits overall slowed globally in Q3, exits in the energy industry remained strong amidst other industries such as healthcare and IT services that slowed dramatically between Q2 and Q3. Crude oil prices rose gradually throughout 2021, and then spiked following Russia’s invasion of Ukraine in late February. Similarly, natural gas followed a comparable trajectory and spiked again in the third quarter. As crude oil and natural gas prices reached their highest since 2008, the value of oil and gas assets created an attractive environment for energy PE exits.

Although energy exits are down from historic highs seen in 2021, 2022 is on pace to finish roughly in line with earlier years even finishing notably higher than 2020’s numbers. 2022 has seen 50 exits to date totaling $29.3 billion as compared to 95 exits valued at $43.4 billion in 2021. PE firms continue to look to capitalize on high energy prices and although investments are down across the board, firms have continued to burn through dry powder. According to Pitchbook data, across the PE ecosystem, the ratio of exits to investments fell to a ten-year low of 0.41x.

Analysts suspect the energy industry to remain strong and even continue to gain momentum as geopolitical factors and unrest continue to play a part in rising energy prices.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanely, Goldman Sachs and the Wall Street Journal.