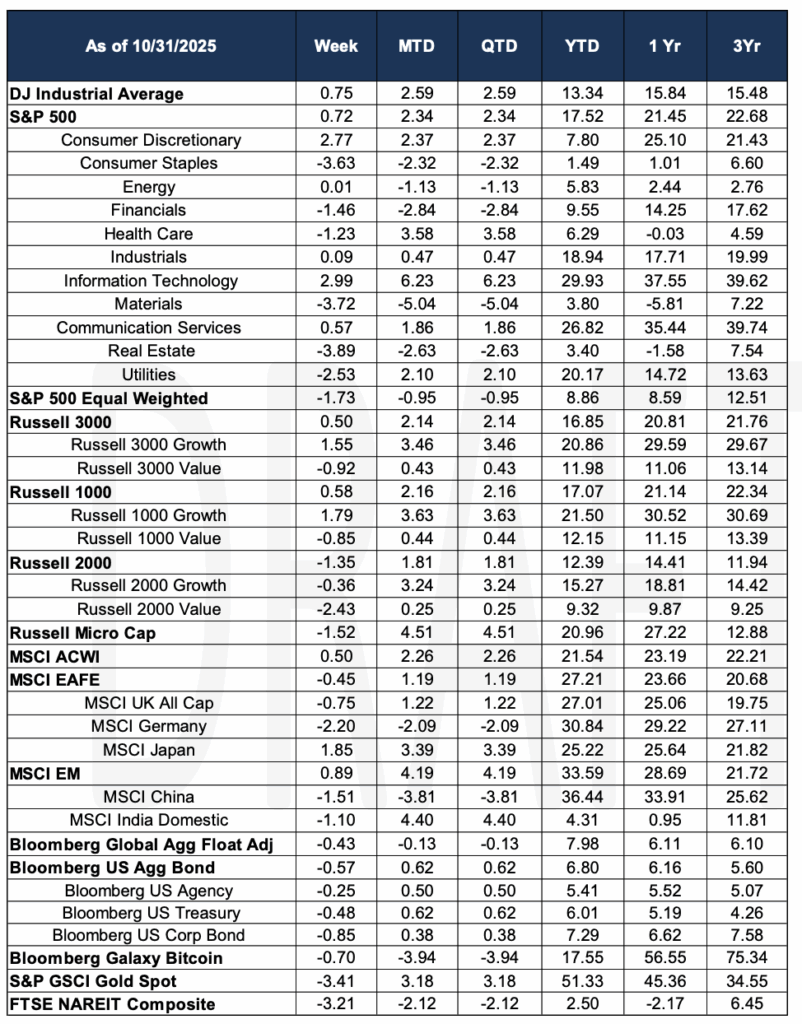

Global equities advanced for the week (MSCI ACWI, + 50 basis points) while the S&P 500 rose 0.75%. The AI boom continued to drive stocks, as NVIDIA, the largest name in the S&P 500, became the first company to reach a $5 trillion market capitalization. Despite the limited economic data, the Federal Reserve lowered the Fed Funds rate by 25 basis points. The Fed is juggling its dual mandate of lower prices and steady employment, and the cuts come as Amazon, Target, Microsoft, and others have announced layoffs. Powell noted that future rate cuts, while expected by the market, are not a foregone conclusion.

The Fed also noted that it would stop shrinking its Treasury holdings on December 1st. This has caused some concern related to liquidity, causing repo rates to surge. The Fed’s Standing Repo Facility was tapped for $20.4 billion by counterparties. Repo rates also surged in the UK with $23 billion tapped by counterparties.

The US Government continues to be closed for business as both sides of the aisle remain entrenched in their positions. Trump spent the week in Asia ironing out trade agreements and there is some hope negotiations will begin upon his return. While in Asia, the most notable progress occurred between China and the US as China agreed to buy soybeans, loosen rare earth curbs while the US would halve fentanyl tariffs and discuss opening access to US AI tech.

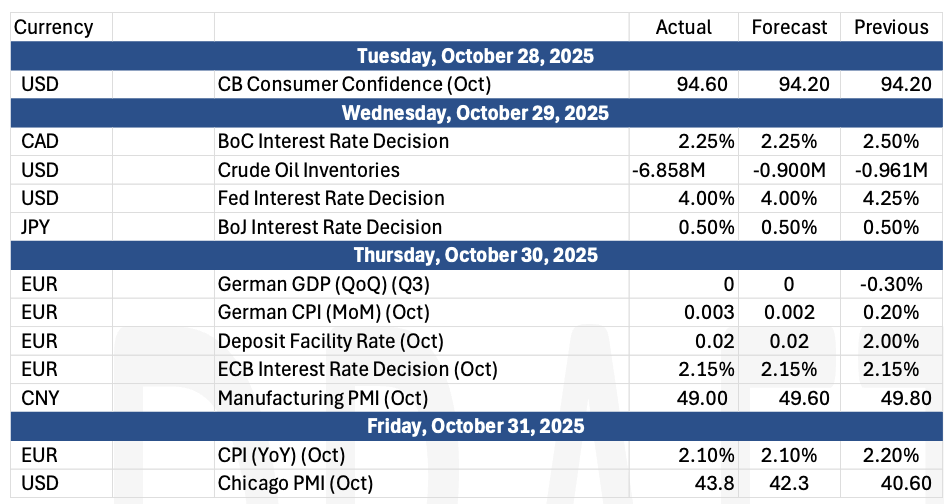

The Past Week’s Notable US data points (with revisions)

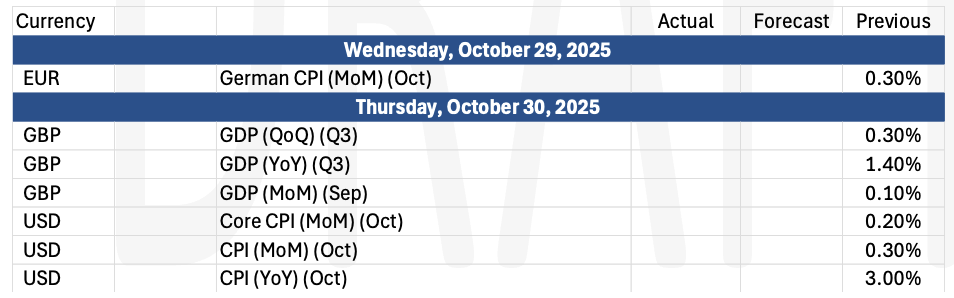

The Upcoming Week’s notable US data points

Some data may not be released due to the U.S. government shutdown

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara