Economic Data Watch and Market Outlook

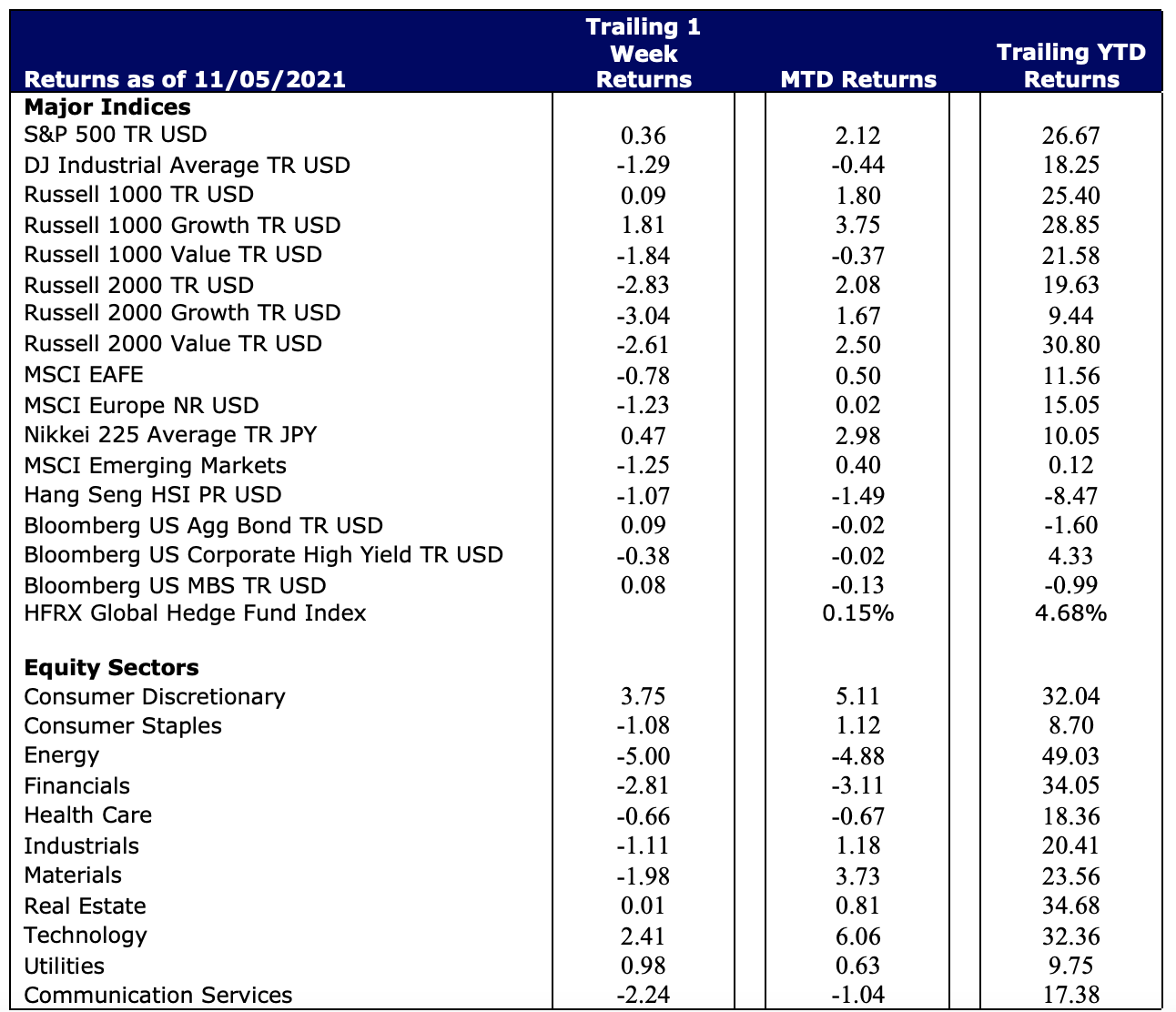

Equity markets continue to roll forward as indicated by the S&P 500 rising approximately 0.36% on the week and 2.12% month-to-date. As Americans get ready to spend the week travelling or welcoming family to celebrate Thanksgiving, expect trading volume to be relatively light. For those travelling by car, inflation may be top of mind as they pass each service area along the highway. Gas prices remain elevated with the national average just slightly above $3.40 a gallon. However, as AAA current survey shows in Figure One below, prices can vary state by state, so if you can make it over state lines perhaps it could be a little bit cheaper to fill your tank.

Figure One.

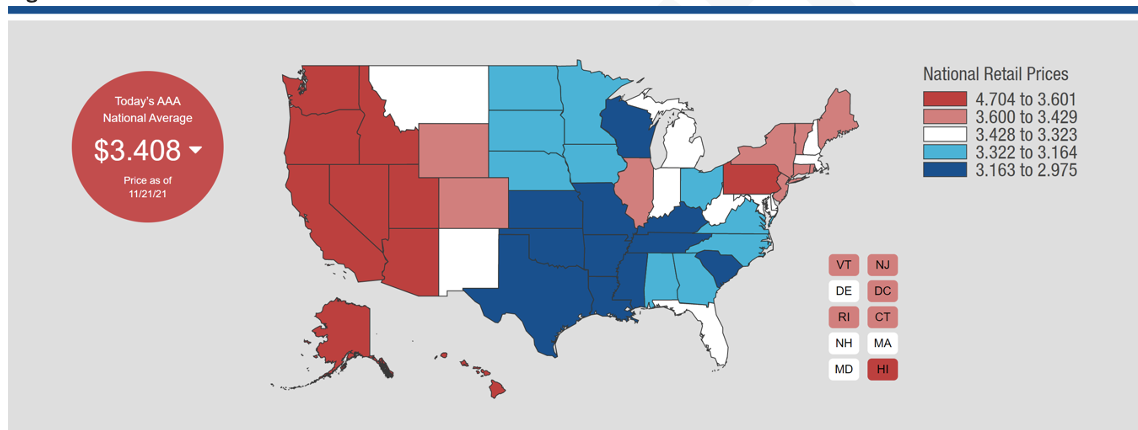

Inflation is likely weighing on the consumer’s mind exemplified by a decline in The University of Michigan Sentiment index (the index measures optimism on the economy). We also saw an increase in consumer spending, noted by big box retailers in their recent earnings reports. Most households in developed markets however have improved their balance sheets significantly. As figure two shows below those households have retained a significant amount of cash, much more than expected. It remains to be seen if this cash will be spent during the holidays or invested, but one thing is certain, rates in savings and checking accounts continue to remain negative in real terms.

Figure Two

As most Americans will gather with family, COVID remains top of people’s minds. Recent headlines from Europe show each country handling increased infections differently from lockdowns to mandating vaccinations. We have also seen increased infections in the US as the seven-day rolling average has crept higher. However, as booster shots become more available, along with different advances (a potential COVID pill), hospitalizations and deaths are largely affecting those that are not vaccinated. Medical care has continued to evolve in the US, as we have learned more about mass testing and mass vaccinations. One such example is CVS. The chain recently announced that they will close 300 stores over 2022 but increase in-house medical care at a cost of over $1 billion.

Despite the short trading week in the US, interesting numbers will be released from housing starts to durable goods orders and GDP mid-week. We can also expect an announcement in the coming days regarding the current administration’s pick to lead the Fed. We’ll also start to hear significant debate about raising the debt ceiling. Abroad we expect to learn more about European retail sales and Japan’s CPI.

Happy Thanksgiving from your team at Clearbrook.

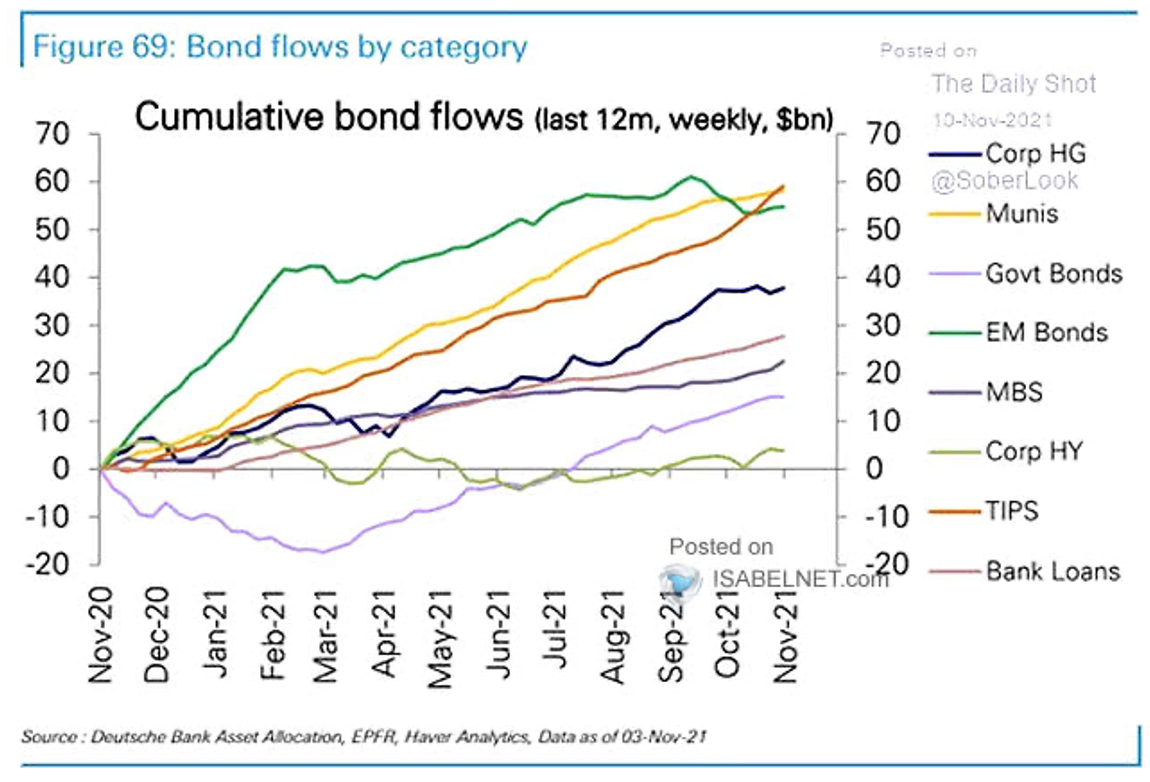

U.S. Equities

Equity markets continue to trend higher in the period as noted, the S&P 500 rose 36 basis points for the week. Growth stocks lead the way as the Russell 1000 Growth surged 1.81%. Value stocks, as indicated by the Russell 1000 value index, fell roughly the same amount (-1.84%). Energy stocks, while a smaller part of the aggregate indices, have a larger weight in the value indices. Those stocks fell roughly 5% during the week. Technology stocks and consumer discretionary stocks were significant positive contributors to both the broad markets with the growth indices rising 2.41% and 3.75% respectively.

Small cap stocks fell roughly 2.8% during the week. The same disparity did not hold true between growth and value. Small growth stocks fell 3.04% while small value stocks fell 2.61%

International Equities

In U.S. dollar terms European stocks fell 73 basis points while Japanese stocks rose 47 basis points. Emerging market stocks fell roughly 125 basis points for the week and are now flat for the year.

Fixed Income

After grinding higher over the last several weeks, interest rates across the yield curve began falling sharply toward the end of the week that ended 11/19. It became apparent that another COVID spike in Europe might be a precursor to a similar pattern in different parts of the world stalling the much-heralded re-opening. Given the proximity to the Holidays, this became particularly worrisome from an economic growth perspective, however, it also may be suggestive of moderating inflationary pressures.

The result has been a decline in the benchmark ten-year Treasury bond from a previous yield of 1.65% to 1.52% as of this writing. Similarly, the closely watched two-year Treasury yield fell from 0.55% earlier in the week to 0.42% as we approach the Thanksgiving Holiday. The duration of the viral reemergence may well determine the trajectory of interest rates in the coming months.

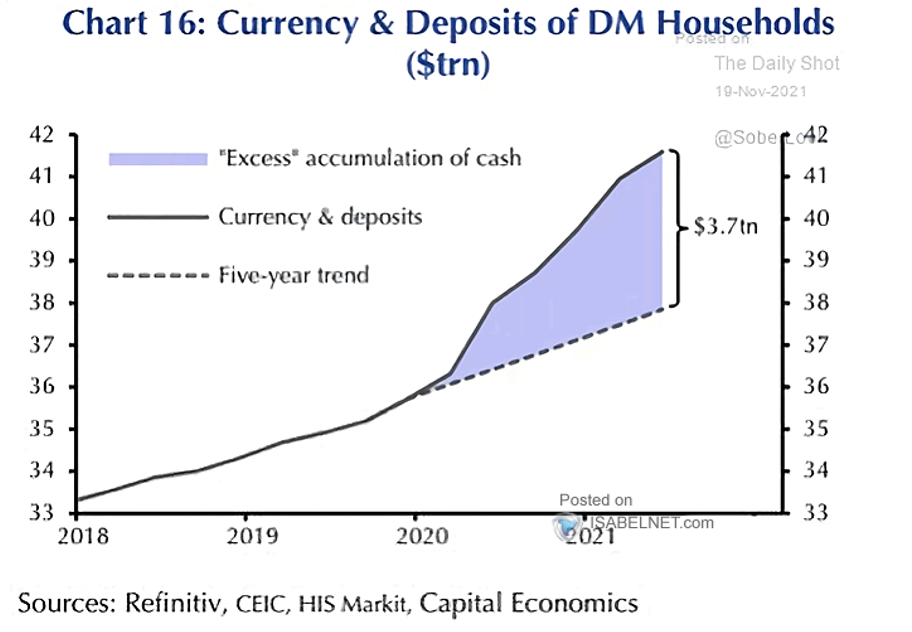

An interesting byproduct of low interest rate central bank policy around the globe has been increased money flows into fixed income funds as Figure Three shows. We speculate that despite the low return opportunities in fixed income, institutional investors are forced to adhere to allocation ranges in their investment policy statements. As equity prices have increased it has caused them to rebalance their portfolios back into fixed income.

Figure Three

Hedge Funds

It was a challenging week for hedge fund performance as most strategies were flat to slightly down with North American funds the worst performers. Funds were net buyers across regions. Looking at sectors, hedge funds bought healthcare stocks at the fastest pace in more than four months (long buying outpacing short selling). Also seeing their largest buying since the summer were the real estate and materials sectors. Hedge funds were net sellers of financials both selling longs and adding to shorts. Stat arb/quant, event driven, multi-strategy and macro funds all added to gross this past week with stat arb/quant and event driven adding to longs and multi-strategy and macro adding to shorts. Hedge funds were net buyers of Asia ex-Japan but interestingly the buying came from North American funds. Gross exposure was reduced in Europe, but it came more from short covering than long selling leading to higher net exposures. The de-grossing was mainly in EU ETFs and financials by multi-strategy and macro funds.

Private Equity

Outperforming both investor and industry expectations, AI technologies including deep learning, machine learning and natural language processing have continued their substantial year-over-year growth with $25.9B invested globally across a record of 1,395 venture capital deals in Q3 of 2021. Additionally, AI venture capital exits have also accelerated for the third consecutive quarterly record of 127 exits including 9 IPOs.

Although global AI venture capital funding was relatively flat for a two-year period between 2018-2020, beginning in 2019 AI produced exit value that exceeded total VC investment, outperforming in its category relative to other software technology including DevOps and SaaS. In 2021 alone, AI companies produced $166.2B in VC exits through Q3, tripling 2020’s disclosed deal value.

Analysts expect the AI vertical to reach $80.2B in 2021 growing at a 25.4% CAGR to $158.1B in 2024. Already in Q4, Meta has acquired the computer vision startup AI. Reverie, signaling that AI acquisitions remain strategic to tech giants.

Data Source: Bloomberg, Bureau of Labor Statistics, CDC, CNBC, The Daily Shot, Deutsche Bank, Haver Economics, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook, Redfin, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

|

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes. |