Economic Data and Market Highlights

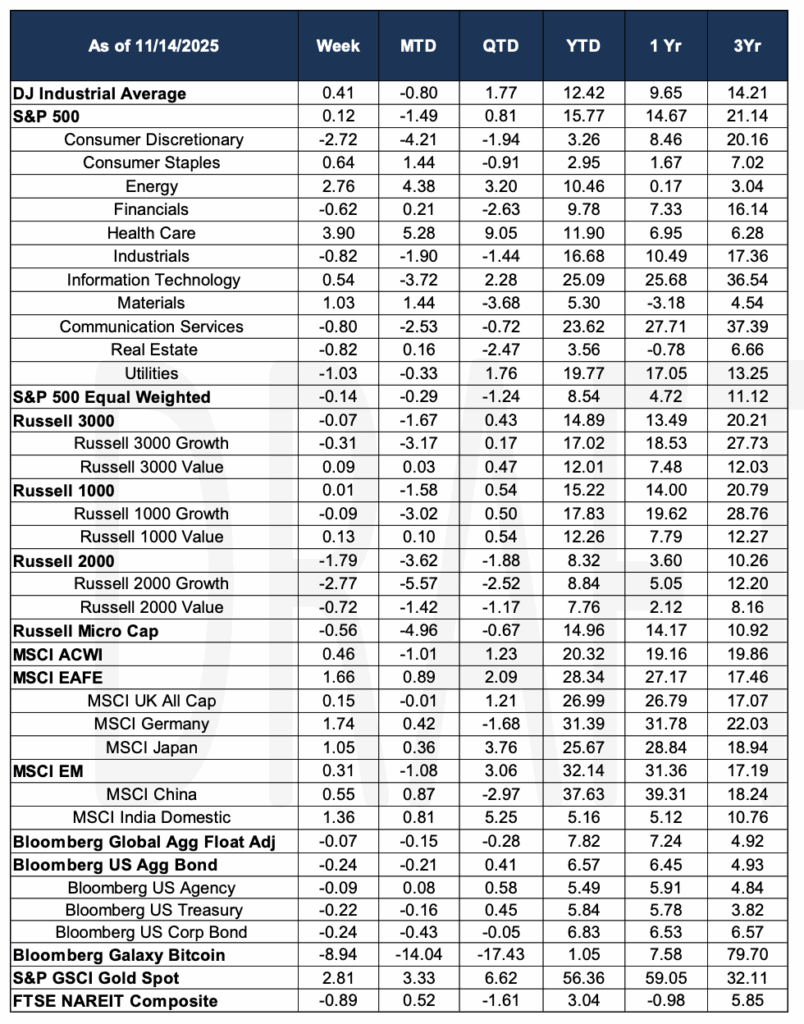

Markets ended roughly flat, but the weekly volatility remains. The S&P rose 1.14% from its opening on Monday to its high on Wednesday, only to close 2.9% lower from that high. The US government shutdown ended on Wednesday night with a deal that funds the government until the end of January in exchange for a vote on continuing to fund the Affordable Care Act. SNAP benefits and the Department of Veterans Affairs were extended until September 2026.

As companies focused on stockpiling bitcoin and other major cryptocurrencies have come under pressure amid market saturation and souring sentiment. New entrants are pushing into less popular tokens, sparking worries over increased volatility.

Bitcoin’s return on a year-to-date basis turned negative just as many companies are starting to use the digital asset as part of their company’s treasury holdings. At the time of this writing, BTC traded slightly above $94k.

Last week, we noted that the administration was considering a 50-year mortgage as a way to make housing more affordable. A 15-year auto loan was also floated. Both ideas received a cool reception on Wall Street, as they did not provide significant payment reductions. Later this week, the Administration addressed affordability again, suggesting that $2,000 checks be sent to U.S. citizens to address the issue. Tariffs on bananas and coffee were also reduced.

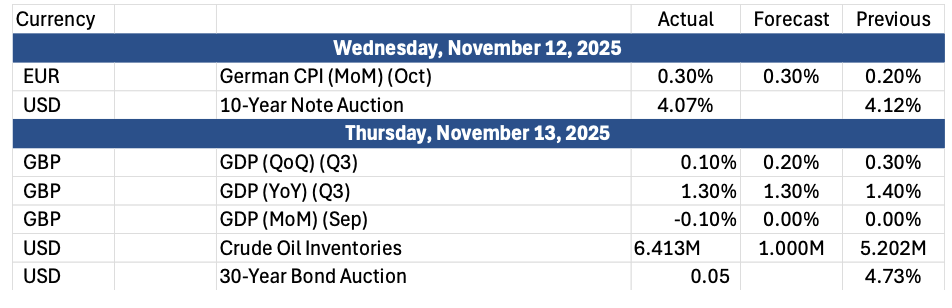

The Past Week’s Notable US data points (with revisions)

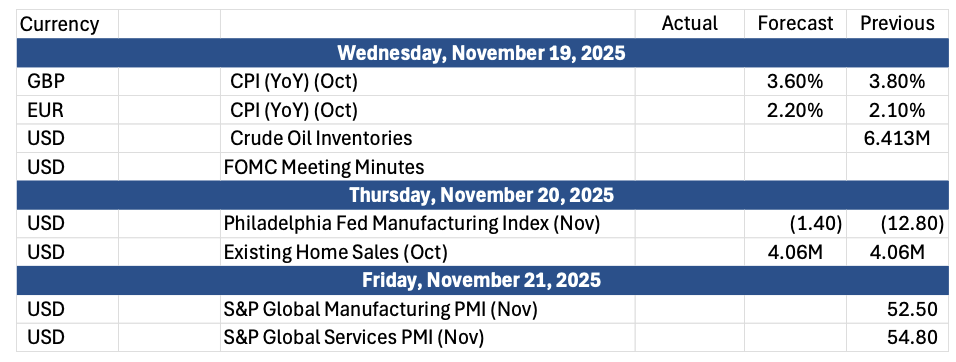

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara