Economic Data Watch and Market Outlook

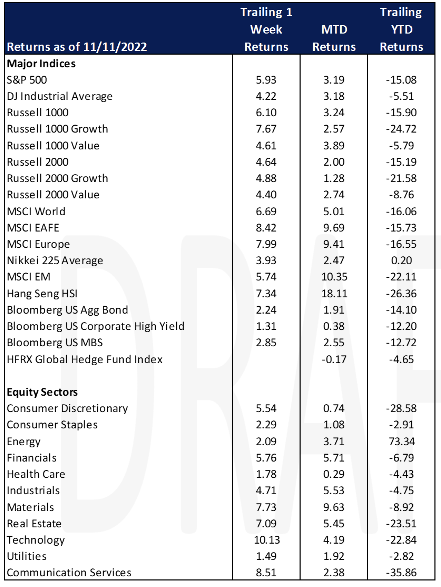

Global equity prices surged for the week with the MSCI World index rising 6.69% and the US Aggregate Bond index rose 2.24%. October’s Consumer Price Index rose just 0.4% for the month and 7.7% from a year ago – the lowest annual increase since January and a slowdown from the 8.2% annual pace in the prior month. Economists were expecting increases of 0.6% and 7.9%, according to Dow Jones. Excluding volatile food and energy costs, core CPI increased 0.3% for the month and 6.3% on an annual basis, also less than expected.

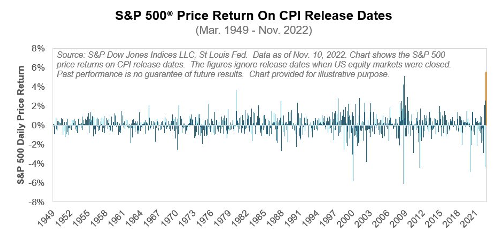

The better-than-expected release caused equity markets to surge. The S&P 500 jumped 5.55% on Thursday after the reading of consumer prices raised investors’ hopes that inflation may have peaked. Further, it was the biggest jump in the S&P 500 after a CPI release since the BLS started compiling the data in 1949.

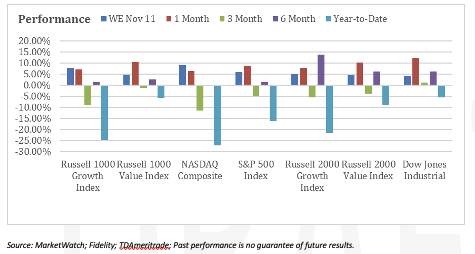

Stocks rallied across the board with growth stocks gaining 7.04%. The NASDAQ Index rose 7.4%, one of the largest one-day gains in its history (14th) according to data compiled by Schwab and Bloomberg. As the table below infers, substantial rallies often occur in bear markets and investors should tread carefully before making the determination that equites will continue to rise.

The CPI dominated the headlines on Thursday, but its release was not the only big news this week as midterm elections took place in the United States with a very different result than what was initially projected. The Republican party was expected to dominate most races in the House and Senate. As of the writing of this commentary some votes are still being counted in key house races, and a runoff was announced in Georgia, but the Democrats have maintained control in the Senate. House control is likely to switch but that result may not be certain for several more weeks as absentee ballots are still being counted.

Events in crypto dominated financial press later in the week as FTX, one of the largest global crypto exchanges collapsed. At present it is not expected to create any systemic effect on traditional markets. Larger institutions had exposure to FTX through venture investments. The firm held $16B in investor assets but lent $10B of that to a trading subsidiary. For context, the market cap of Coca Cola is just over $265B. The story is continuing to unfold but firms such as Sequoia have written their exposure to the exchange down to $0, and investors such as Ontario Teachers’ pension estimate the loss at $95M. As an aside, the loss to Ontario Teachers is less than 0.05% of their portfolio. There have been, and will continue to be, significant ripple effects across the developing crypto ecosystem. In our view, this has set back institutional adoption significantly. Of lesser importance, the Miami Heat are going to have to rename their arena.

Equities

The exuberance of the market Thursday following midterms and soft inflation data provided the biggest gain since 2020 for all stock indices (Dow: +3.70%; S&P: +5.54% and NASDAQ: +7.35%). US equities extended their gains on Friday (Dow: +0.10%; S&P: +0.92% and NASDAQ: +1.88%). Year to date, value continues to outperform growth.

90% of the S&P 500 market capitalization have reported third quarter earnings and have beaten analysts’ expectations by about 3% as per Credit Suisse. That said, Wall Street estimates earnings to drop in the 4th quarter. Next week some consumer discretionary companies (i.e. Home Depot, TJ Maxx, Walmart) and technology companies (i.e.Palo Alto Networks, Cisco, Nvidia) will report earnings.

Disney (DIS: +5.05% WoW), Meta Platforms (META: +24.43% WoW) and Twitter announced plans for, or have laid off, workers this week.

Crypto stocks slid as FTX and its affiliate companies filed for bankruptcy November 11. The company’s founder, Sam Bankman Fried, resigned as CEO and was replaced by John J. Ray III, a lawyer who has worked on the bankruptcies of companies such as Enron and Nortel Networks.

European and Asian markets surged after lower than expected CPI numbers that is easing rate hike fears in the US. The Euro STOXX 600 had their best week (+3.66%) in nearly eight months with financial services, mining and retail stocks leading the gains. Asian indices (Hang Seng +7.17%; Nikkei +3.91%; Shanghai +0.54%) was also up for the week due to a moderation of China’s Zero COVID policy which buoyed sentiment.

On other news China regulators said on Friday they would support bond issuance by central state-owned enterprises to fund tech innovation. Meanwhile in Japan Sony, Toyota, Softbank and chipmakers Kioxia Holdings and Tokyo Electron have formed joint venture Rapidus, to design and produce next generation semiconductors that will hit markets later this decade.

Fixed Income

The October CPI report showed slight cooling of inflation, with core inflation rising 0.3% and total CPI coming in at 7.8%, falling short of the 7.9% forecast. In response yields fell dramatically on Thursday, with the 2-year Treasury yield falling 27 bps, the 10-year Treasury yield falling 30 bps, and the 30-year Treasury yield falling 28 bps. The Bloomberg US Agg rose 2.62% this week. The bond market was closed on Friday due to Veterans’ Day. 30-year fixed rate mortgages followed suit, falling below 7% for the first time since the beginning of October, and ending the week at 6.62%. The signs of cooling inflation have offered some respite to the bond market after last weeks Fed meeting where Jerome Powell solidified his hawkish stance on monetary policy which caused many to hypothesize on whether the Fed’s target rate would reach 6% in 2023. This week’s CPI report lowered expectations back into the 5% range. The Fed Funds futures market has priced in an 85% probability that the next rate hike will show signs of slowing down monetary policy, with 50 bps hike in December.

China’s offshore credit market rallied this week after regulators expanded a financing support program. Although this does provide some relief for this market, which faced one of the worst routs in its history last month, it has yet to completely recover. Offshore notes have taken a beating and two large developers have issued a bond payment warning. High yield dollar bonds lost 12% in October and investment grade notes fell 3%, the second worst performance for both indices since 2009.

Hedge Funds (through Thursday)

Following the CPI release on Thursday, as mentioned above, equities significantly rallied on the day. US-based long/short equity funds captured the largest percentage of the day’s rally compared to other regions at 44% of the S&P (global funds captured 25% of the MSCI World leading them to be almost at breakeven YTD at -120 bps). Funds in Europe and Asia also had a good week, especially Asia up 1.9% vs. 2.9% for the MSCI Asia. Crowded names in NA both outperformed the S&P by ~ 1% therefore no positive or negative alpha. Not surprising, hedge fund flows were fairly muted leading up to Thursday’s CPI print. In NA, hedge funds were small sellers of technology and consumer discretionary through short adds but week-over-week were net buyers in almost all sectors except energy where they were net sellers. The net buying was predominantly short covers as short exposure was in the 99th percentile prior to Thursday. ETFs are being utilized to manage day-to-day market swings, both on the long and short side. Outside of NA, hedge funds were net buyers in Europe, mostly in cyclical sectors except for energy that was net sold as well as selling more defensive sectors. In AxJ, flows were paired off as funds covered shorts and sold longs but any buying on the long side were more cyclical sectors compared to defensive selling. Japan saw de-grossing for the week and net leverage rose in all regions.

Private Equity

For the third consecutive quarter, global M&A activity declined falling nearly 30% in deal value from its peak seen in Q4 2021. Although global activity has been in decline for the majority of the year, it is still on pace to surpass the pace of deals set prior to the COVID-19 pandemic. Similarly, deal count is also on pace to surpass pre-pandemic levels with 10,118 global M&A deals estimated for Q3 which is nearly a third higher than the quarterly average for 2015-2019.

Rising interest rates and inflation in the US have increased expectations of lower economic growth. As a result, future earnings of companies are being discounted at higher rates making M&A activity increasingly challenging. In Europe, investors are facing soaring consumer prices that hit a double-digit record in September, an energy crisis and a disrupted supply chain caused by Russia’s invasion of Ukraine. As a result, the European Central bank has also increased interest rates by 75 basis points for the second consecutive time this year.

Despite increasing fears of a recession and strong headwinds in the macroeconomic environment, analysts still believe M&A activity will rebound and be healthy in the coming months as PE investors are well equipped with $1.2 trillion in dry powder. Additionally, large businesses with strong cash flows and balance sheets continued to pursue and close on strategic acquisitions. Analysts also suspect the financial services and energy sectors to continue to drive M&A value. Long-term trends in these sectors have continued to drive capital and recent strength in energy prices brought renewed attention to the sector. In summary, while PE deals may slow down further in the near term as investors become conservative in the current market conditions, M&A activity remains strong comparable to historic levels.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.