Economic Data and Market Highlights

The US Federal Government entered its 38th day of closure as of Friday, November 7th, the longest in US history. The Senate remains in session, looking to find a solution as the FAA has started to cut the number of flights to reduce safety concerns. Unpaid, air traffic controllers continue to work with increasing numbers calling in sick. SNAP benefits also place pressure on Congress as lines at food banks continued to grow.

Elections were held across the country on Tuesday, with economic anxiety as a key issue. Gubernatorial elections in New Jersey and Virginia, Prop 50, California’s effort to redistrict, and the Mayor of New York City leaned heavily toward Democrats.

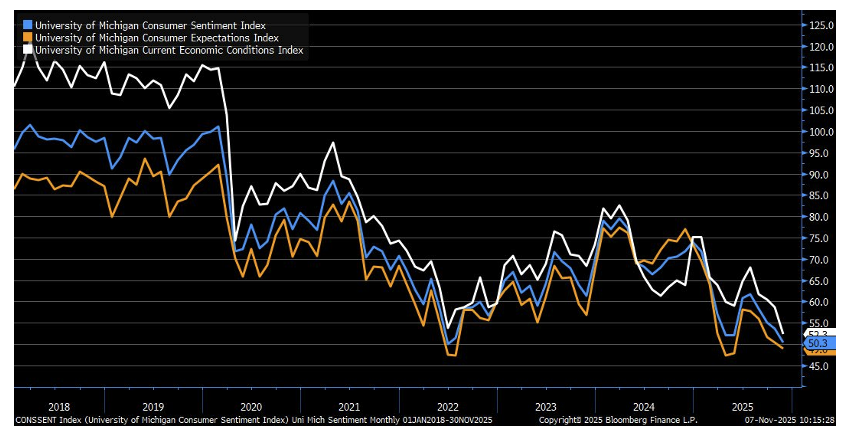

That economic anxiety played out in the University of Michigan Consumer Sentiment survey reported Friday, coming in at 50.3 versus the 53.0 estimate.

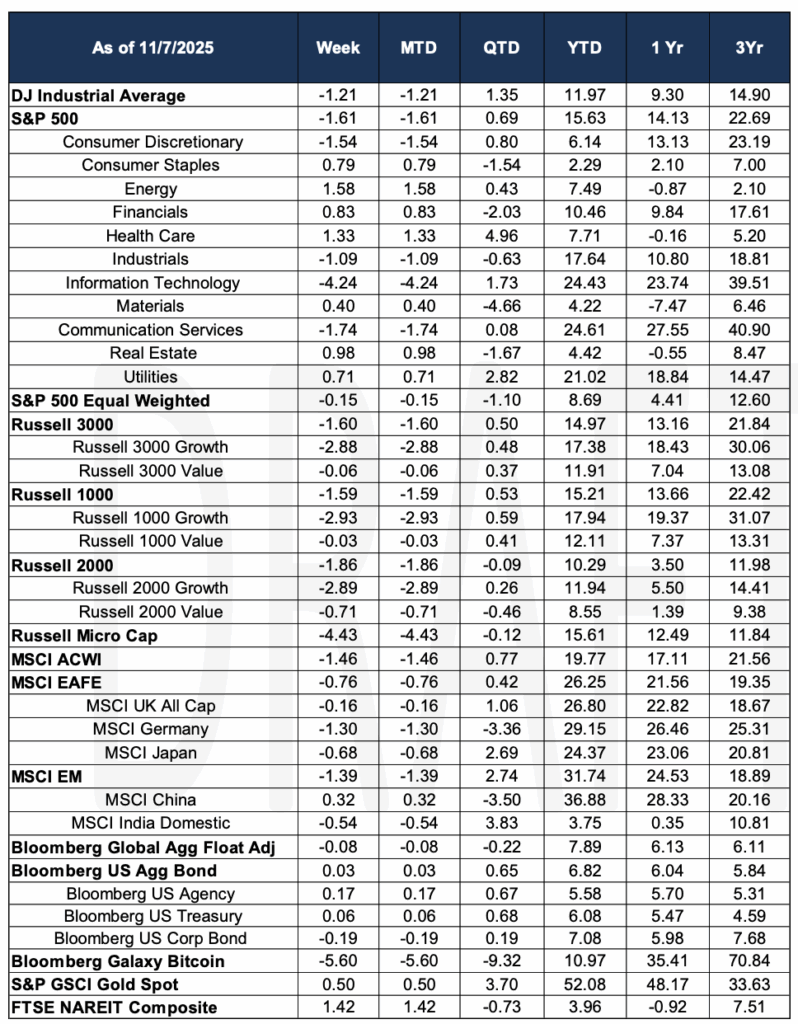

Equity markets turned negative for the week as larger AI names, those that are driving broad market indices, declined. The S&P 500 fell 1.61% with Tech names falling 4.24%. The equally weighted version, however, only fell 15 basis points. The US bond market rose slightly, up just three basis points. Gold advanced up 50 basis points, at least pausing the decline of the previous week. However, the precious metal is up almost 53% year to date. Bitcoin fell over 5% for the week.

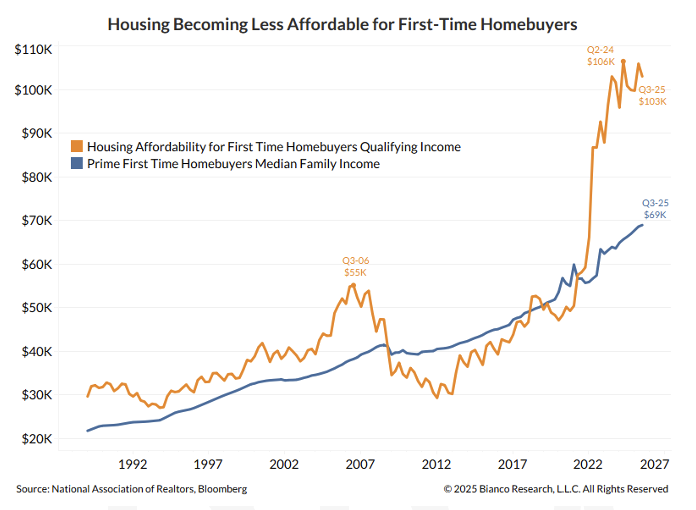

Thirty-year mortgages stood at 6.22% ending Friday, up five basis points from the previous week. First-time home buyers continue to have trouble finding a home and or having enough for the down payment. To address this, President Trump has proposed a 50-year mortgage.

The Past Week’s Notable US data points (with revisions)

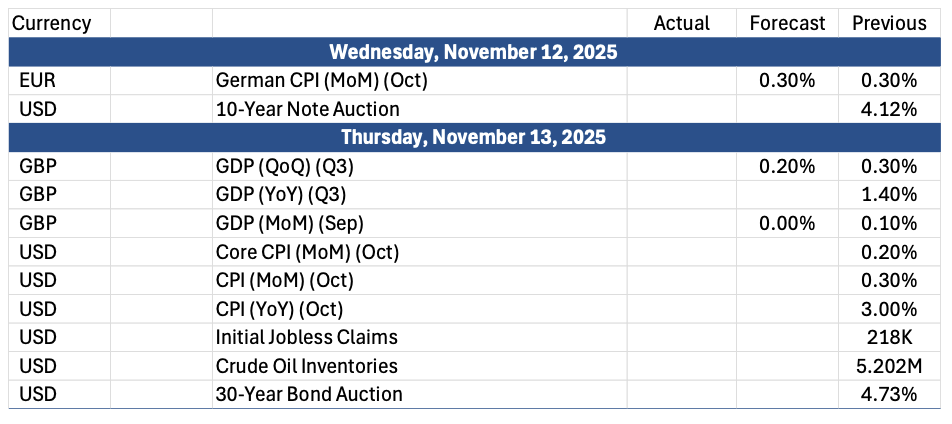

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara