Economic Data Watch and Market Outlook

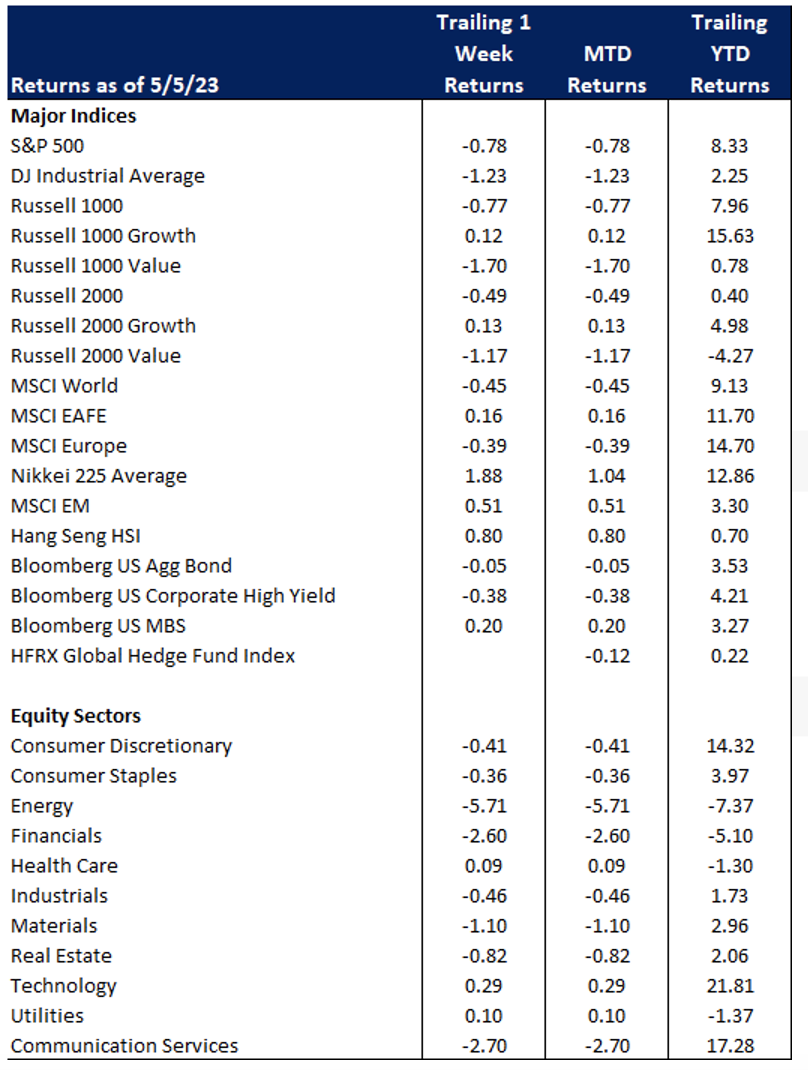

Global stocks fell slightly (MSCI World, -0.45%) with US stocks also pulling back (S&P 500, -0.78%). Ex US developed markets rose 0.16%. The US Aggregate Bond Index was flat, falling 5 basis points.

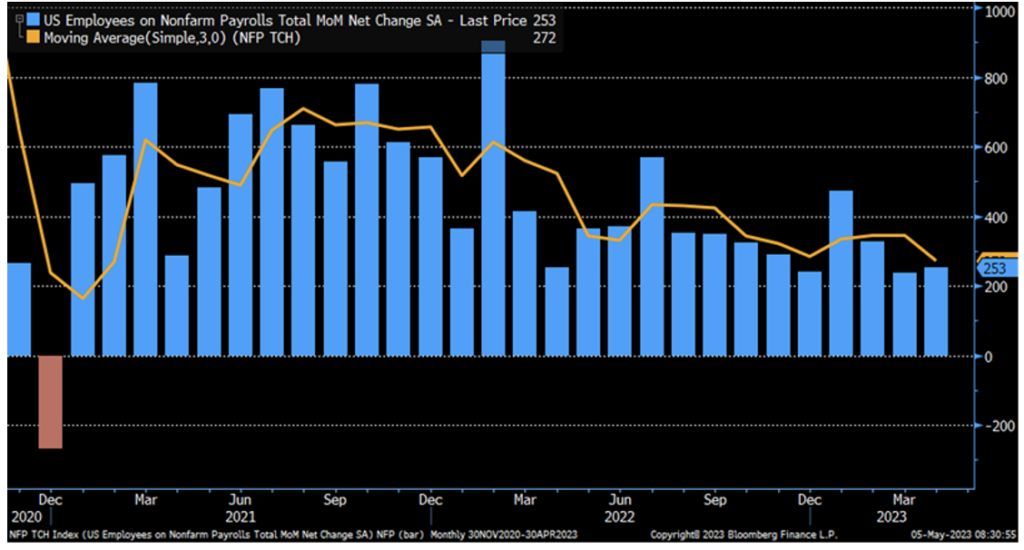

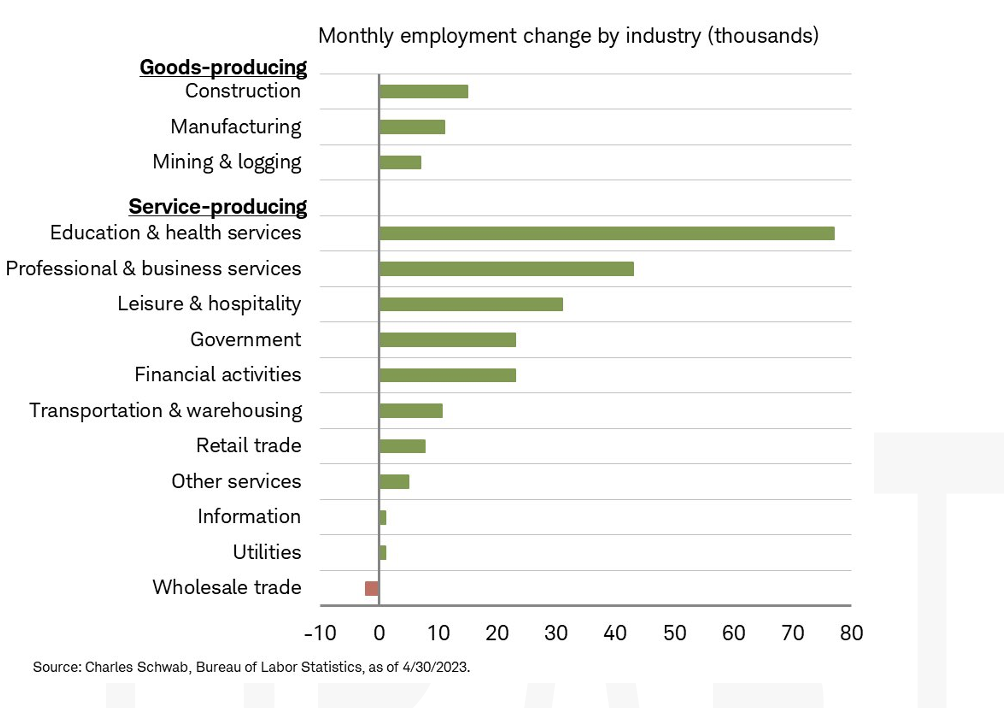

The US Jobs report beat expectations at 253 thousand. The labor force participation rate in April rose to the highest since 2008 at 83.3%.

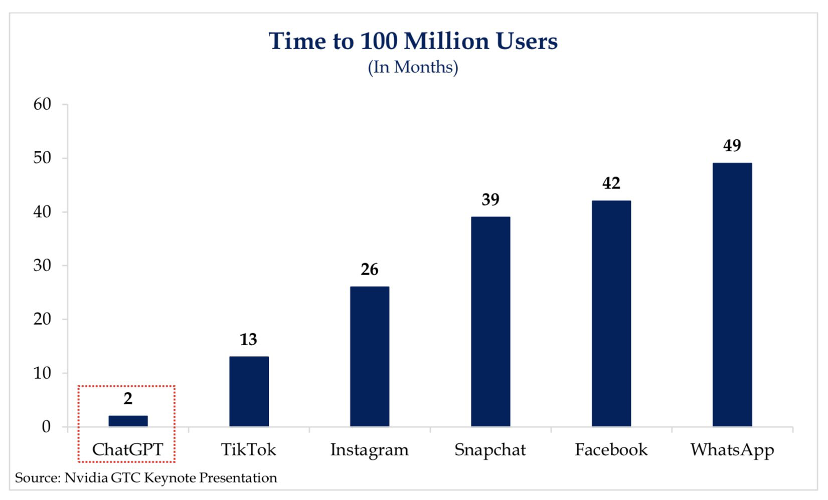

The speed at which artificial intelligence is taking hold has the potential to impact consumers and businesses dramatically. The chart below shows the amount of time it has taken for ChatGPT to reach 100 million users, a scant two months compared to Facebook’s 42 months as one example. Despite the largest growth in jobs in the education sector, it is already being blamed (warranted or not) for missed earnings by CHEGG, a direct to student learning company. The company reported a 61% decline and the stock dropped 47% after the announcement. IBM is slowing hiring to evaluate AI’s impact noting it is evaluating back office and human resource jobs as a source for the technology to replace humans. The rapid rise is also causing some to call for legislation. This may not hold as countries outside of the US are moving more quickly.

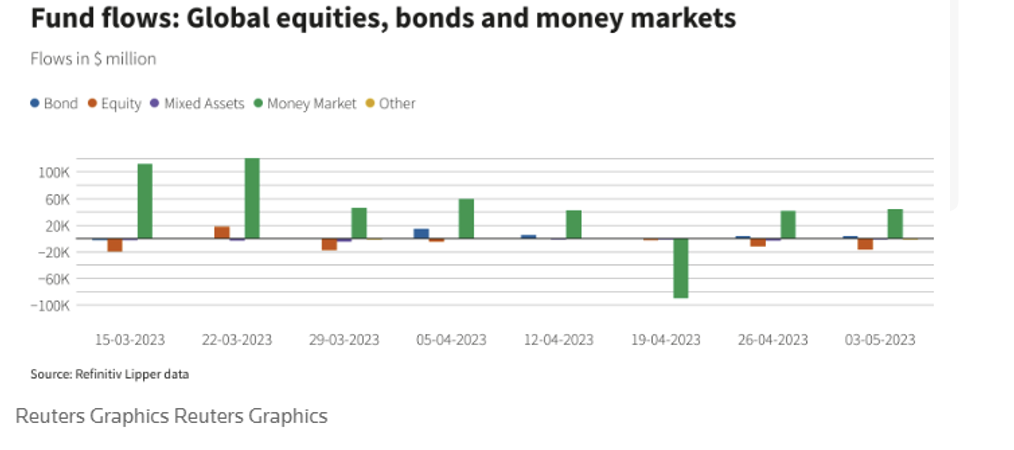

Global equity funds saw their largest set of outflows in the week up to May 3rd since March 29th, 2023 recording net outflows of $16.9B. The tech and financial sectors saw $563M and $358M of outflows while consumer staples saw inflows of $463M.

Consumer Price Index data is released on Wednesday, with core year-over-year expected to be 5.5%. Jobless claims are released on Thursday with the expectation of 245k initial claims. Core Producer Price Index data will also be released on Thursday with the Core PPI year-of-year expectation of 3.3%

Equities

Markets closed sharply higher Friday after a strong jobs report but mixed for the week (Dow: -1.23%; S&P: -0.79%; Nasdaq: +0.07%).

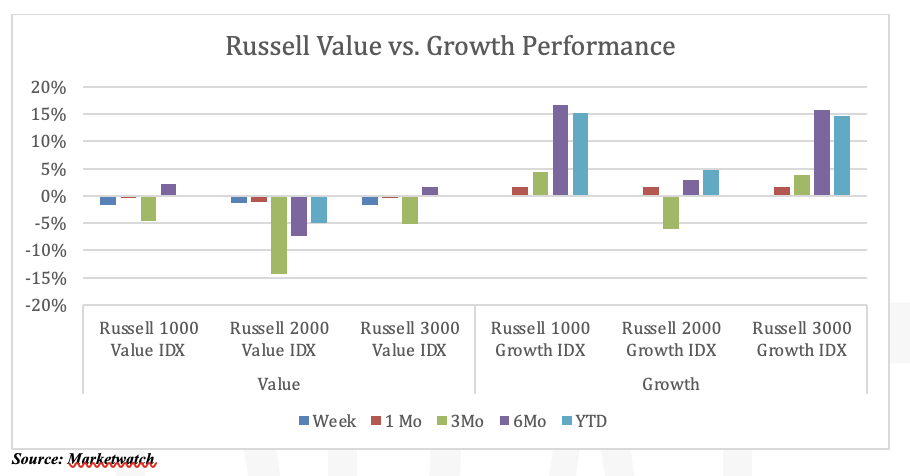

For the week, the Russell growth indices were flat (Russell 1000: +0.11%; Russell 2000: +0.12; Russell 3000: +0.11%) while the value indices (Russell 1000: -1.73%; Russell 2000: -1.22; Russell 3000: -1.71%) declined. Year-to-date, the Russell 1000 / 3000 Growth has outperformed the Russell 2000 Growth by 1054 bps and 988 bps respectively.

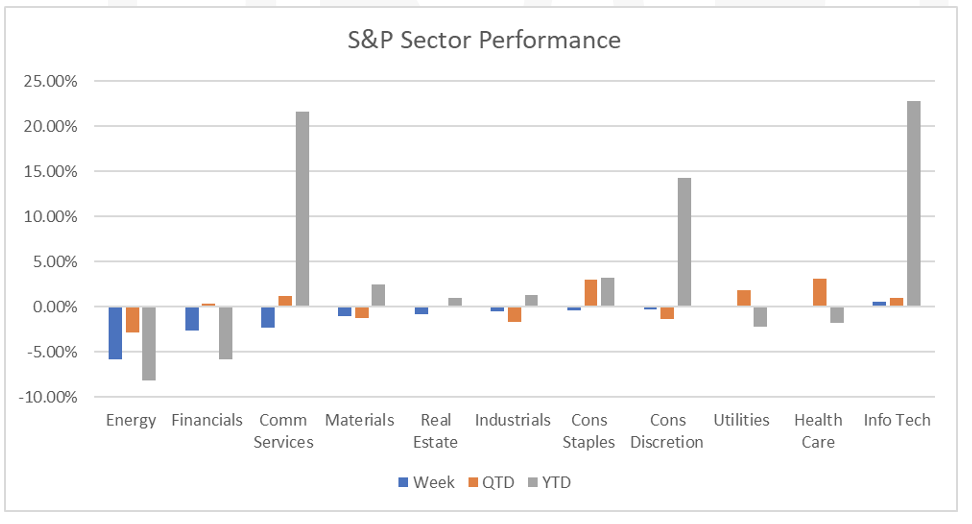

The worst performing sectors for the week were the energy (S&P Energy: -5.81%), financials (S&P Financials: -2.63%) and communication services sectors (S&P Communication Services: -2.29%). The S&P Energy sector declined by -5.81% as oil prices declined 2.4%.

Six companies raised their stock dividends this week Apple (+4% to $0.24), PepsiCo (+10% to $1.265), Simon Property Group (+3% to $1.85), AIG (+12% to $0.36), Microchip Technology (+7% to $0.383 cents) and Expeditors International of Washington (+3% to $0.69).

European equity markets were mixed for the week (FTSE 100: -0.65%; DAX: +0.99%; Euro STOXX 600: -0.28%). European savers are taking more of their money from banks and investing them in money market funds as data from Refinitiv Lipper showed more than €34B ($37.6B) of net flows into European money market funds in March, though still small compared to the €9.45T held in checking account as reported by Reuters.

Asian equity markets were mixed for the week (Hang Seng: -2.48%; Nikkei: +1.48%; Shanghai: +1.54%). Japanese markets were closed May 3 – 5 due to exchange holidays. India’s Blue Dart Express (BLDT.NS: -3.19%), logistics service provider, posted a drop of 49% drop in Q4 profits, with a 4% increase in revenue but with a 14% increase in total expenses due to higher fuel price costs and softening demand in the e-commerce segments. Meanwhile, China’s largest express delivery company SF Holding Co plans to raise ~$3B in one of the largest public offerings in Hong Kong later this year.

Fixed Income

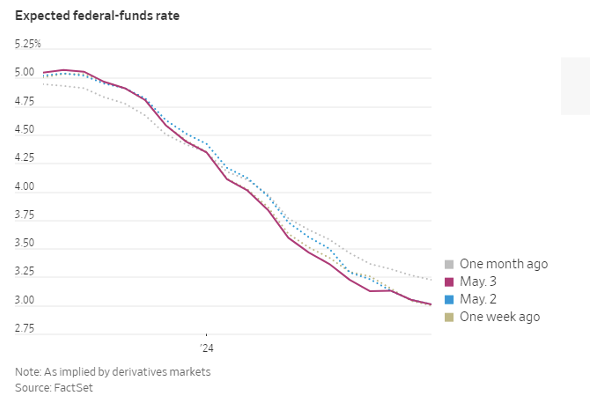

US government bond yields fell Wednesday in response to the Federal Reserve’s 25 bps rate hike, putting the benchmark Federal Funds rate between 5% and 5.25%. The 10-year Treasury yield fell to 3.35% after the close on Wednesday. On Friday, stronger than expected US employment data caused yields to jump, with the greatest changes being seen in short-maturity Treasuries. Nonfarm payrolls increased by 253,000 while the unemployment rate fell to 3.4%, and monthly wage gains rose 4.4% beating expectations of 4.2%. Treasuries closed out the week mixed, with the 2-year Treasury yield falling 12 basis points to 3.92%, the 10-year Treasury yield remaining flat at 3.44%, and the 30-year Treasury yield rising 9 bps to 3.76%. The Bloomberg US Aggregate Bond Index fell -0.05%, the Bloomberg US Corporate High Yield Index fell -0.38%, and the Bloomberg US MBS Index rose +0.20%.

Consumer Price Index data is released on Wednesday, with core year-over-year expected to be 5.5%. Jobless claims are released on Thursday with the expectation of 245k initial claims. Core Producer Price Index data will also be released on Thursday with the Core PPI year-of-year expectation of 3.3%

European Central Bank President Christine Lagarde stated on Thursday that there is more to come for rate hikes. Policy makers have rallied behind her, receiving almost unanimous support for the view that rates must be raised to the point that the ECB can be sure that price increases will slow to around 2%. The ECB raised rates on Thursday by 25 bps, with the deposit rate now sitting at 3.25%. Banks such as Goldman Sachs and Morgan Stanley have projected another two 25 bps increases which would put the terminal rate at 3.75%, while Danske Bank expects three more 25 bps hikes with a terminal rate of 4.0%. Core inflation is likely to remain sticky in Europe for the coming months and wage growth has continued to accelerate. UBS stated that the broader inflation environment will improve throughout the summer and that they expect the ECB will change their course of monetary policy by September 2023.

Hedge Funds

Equity markets declined across all regions this past week and funds were able to limit losses in all regions but Asia. Global funds declined 28 bps vs. -128 bps for the MSCI World, US-based equity long/short funds declined 46 bps but that is compared to -2.6% for the S&P 500, only capturing 18% of the downside. In Europe, the average EU fund lost 15 bps compared to 120 bps for the Euro STOXX 600. Asia was the most challenged where the average fund in that region declined 37 bps and the average L/S equity fund lost 52 bps despite the MSCI Asia Pacific rising 92 bps. One reason for this could be crowded longs in the region declined on average more than 200 bps relative to their benchmark whereas crowded longs in other regions generally performed in line with their respective indices. As markets continued their decline, HF added to both longs and shorts but added to shorts at a higher rate. Most of the gross exposure additions globally can be attributed to NA where HF were net short sellers mostly in index level products (the largest since February). Single-name net flows in NA were more even long and short with the bulk of the long additions coming in the tech sector (hardware and software) whereas similar to last week, most of the selling (short additions) were in industrials (professional services) and financials (diversified banks). US equities long/short ratio fell to the lowest in ten years and US banks long/short ratio dropped to the lowest in five years. In other regions, AxJ was net sold with a large portion coming from selling longs in Australia. HF tilted towards adding to shorts in EU financials equities (diversified banks and capital markets) and trimmed longs in electric utilities and consumer discretionary (luxury, gaming and autos). This week’s net notional selling of global financials was the largest in the past year and ranks in the 98th percentile vs. the past five years. In Japan, the markets were closed most days of the week.

Data Source: Apollo, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.