Economic Data Watch and Market Outlook

Global equity markets (MSCI World, -0.48%) declined for the week as European markets sank (MSCI Europe, -2.29% ) due to recessionary concerns. US debt limit talks also weighed on equity markets.

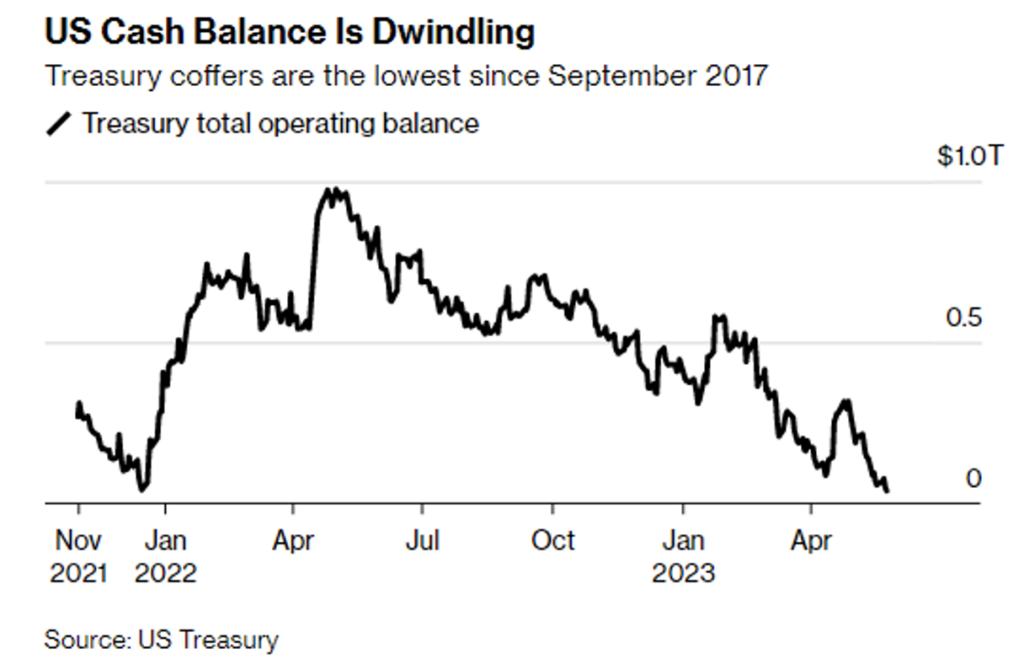

The US Treasuries cash balance hit its lowest level since 2017, falling to $38.8B on Thursday. That is down from $49.5B a day earlier and $140B as of May 12th. Concerns swirled earlier the previous week as Treasury Secretary Yellen weighed in on the debt negotiations that the Federal Government could run out of money by June 1st. She later walked back those comments revising the date to June 5th.

Debt negotiators worked into the Memorial Day weekend noting a possible agreement. The focus will now turn to Congress hoping for a smooth passage.

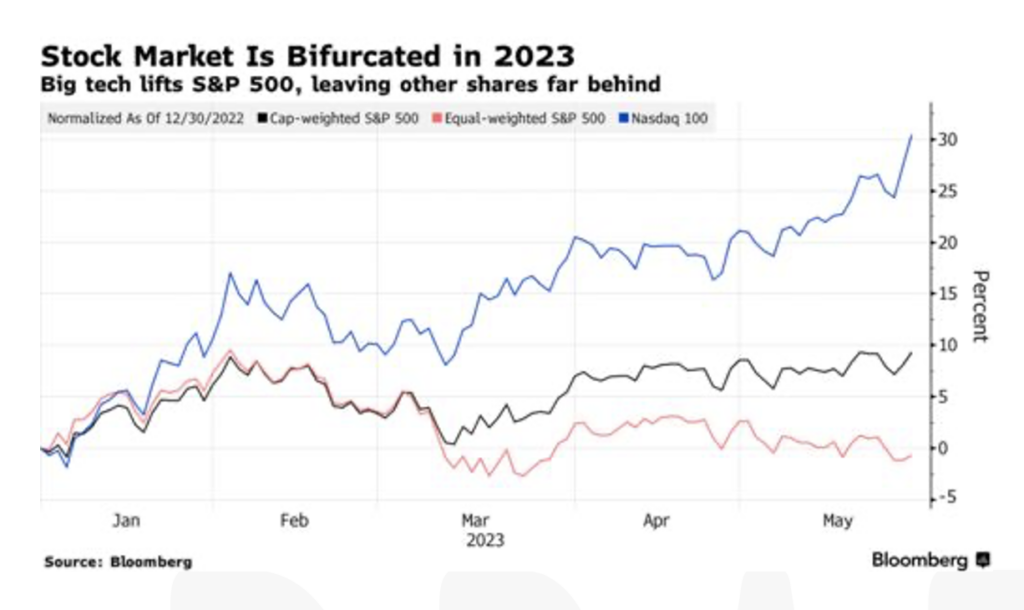

The S&P 500 Equal Weighted Index has been trailing its cap weighted counterpart by the largest margin since 1990. The “Big Seven” stocks, Alphabet, Apple, Meta, Nvidia, Amazon, Microsoft, and Tesla are up 43% since January. As of Friday, the cap weighted benchmark was up 10.29% versus the equal weighted version up 0.34%.

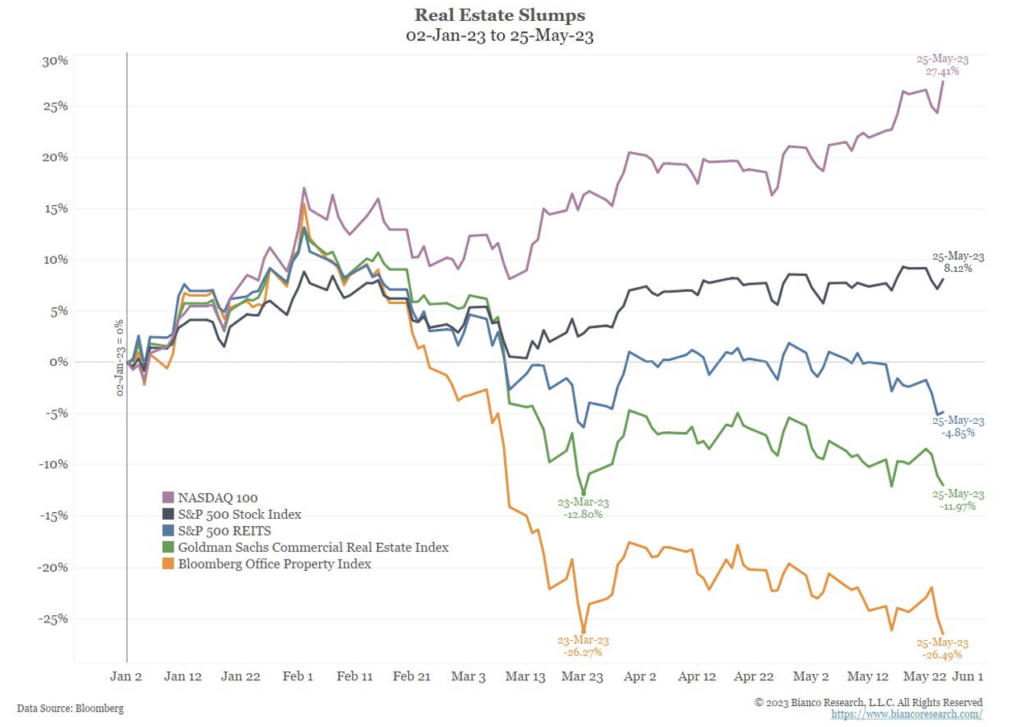

While a few tech stocks have driven performance, energy, financials, healthcare and real estate stocks have been the biggest detractors. Within real estate, office REITs have seen the biggest downturn.

US, UK, South Korean and Swiss markets have an abbreviated trading week, with the likely drama turning to the Debt Ceiling vote in Congress then the next Fed meeting. Despite that we’ll receive JOLTS job data on Wednesday and non-farm payroll results on Friday. In between we’ll get ISM data and various developed market industrial production results.

Data Source: Apollo, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.