Economic Data and Market Highlights

US equity markets sank this past week as the S&P 500 declined 2.58%, while the MSCI EAFE benchmark rose 1.34% as Japanese and UK equities both rising over 2%. The Bloomberg Aggregate Bond Index declined 45 basis points with the 10-year Treasury yield closing at 4.518% and the 30-year Treasury yield at 5.041%. The 30-year briefly touched 5.08%, the highest since October 2023, as it became more certain that the US would continue to run significant deficits with much higher interest costs after the House sent a new tax bill to the Senate for revisions and approval.

New home sales released on Friday were above expectations, but the March result was revised downward by approximately 50 units. Mortgage rates ticked up a bit week over week from 6.92% to 6.98%.

Consumer discretionary names declined by 3.09% for the week as Walmart announced the cutting of 1,500 corporate jobs to reduce costs and streamline decision-making, including areas such as their global tech, e-commerce support, and Walmart Connect efforts. The job cuts are minimal when considering the 2.1 million people it employs globally, but the stock was off 1.93% for the week as the retailer found itself at odds with the Trump administration after it noted that price hikes may occur due to the tariffs. The president targeted the company, saying that Walmart should absorb the tariffs. Target was off 4.35% after announcing that Q1 sales were down 3% year over year, and the average checkout dropped 1.4%. They revised their 2025 outlook down to a low-single-digit decline, potentially the third consecutive year of sales drop.

PMI came in higher than expected for May at 52.3. Forecasts for a 49.9 result. New orders were at their highest in 15 months, and inventories had their biggest increase since 2009. Is it a pick-up in the economy or frontrunning the tariffs?

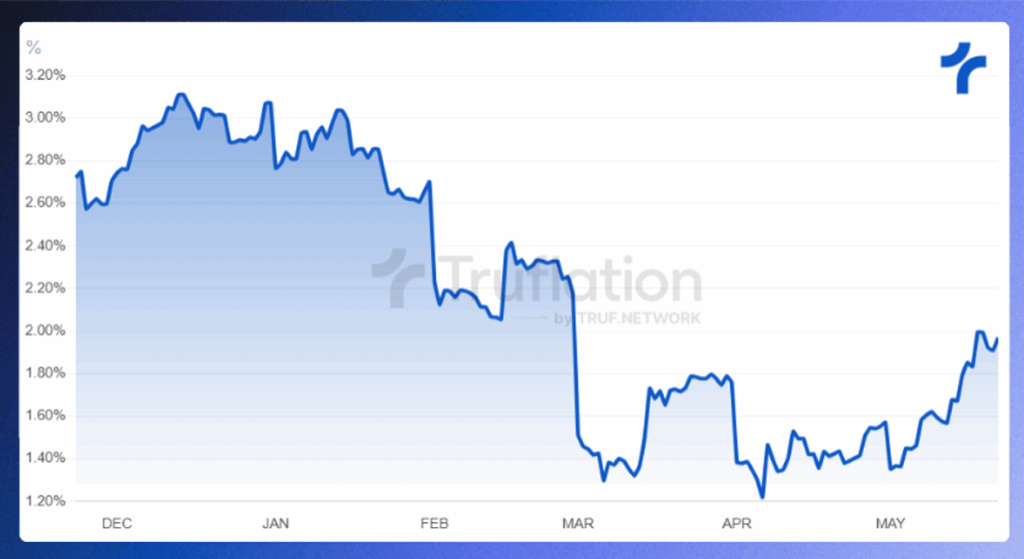

Source: Truflation

The Past Week’s Notable US data points (with revisions)

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Financial News London, Financial Times, Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire, Managing Director

Michael McNamara, Analyst