Economic Data Watch and Market Outlook

Global equity markets (MSCI World +1.25%) had a strong week largely due to US Equities ( S&P 500 +1.71%) while the US Aggregate Bond Index fell 137 basis points. Markets ebbed and flowed as US Debt Ceiling negotiations continued. Bloomberg reported that a deal may be voted as early as this week with the potential for members of the Senate to be called back for a vote, but Friday reports circulated that negotiators for the House abruptly left the White House citing an impasse.

Markets have debated the US Federal Reserve’s next move. Some governors have maintained that the Fed may raise rates at its next meeting in mid-June but there seems to be some debate as Minneapolis Fed Governor and PIMCO alum, Neel Kashkari noted over the weekend that he would support a pause although noting that the Fed is not done in its efforts to tame inflation.

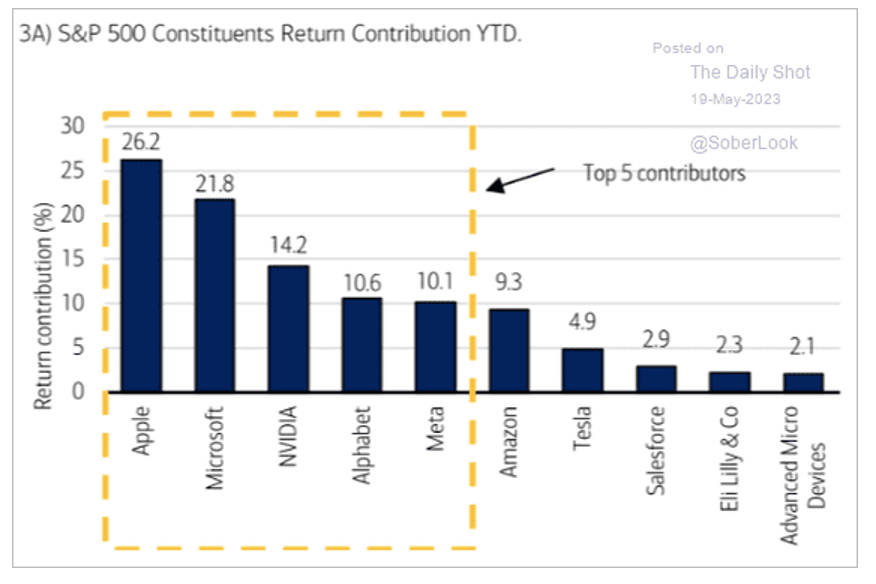

The S&P 500 has risen almost 10% on a year to date basis but has been dominated largely by a small number of names with the top 10 holdings representing about 27% of the benchmark. The benchmark is a capitalization weighted but looking at the benchmark on an equal weighted basis, the benchmark’s increase is just over 1.5%.

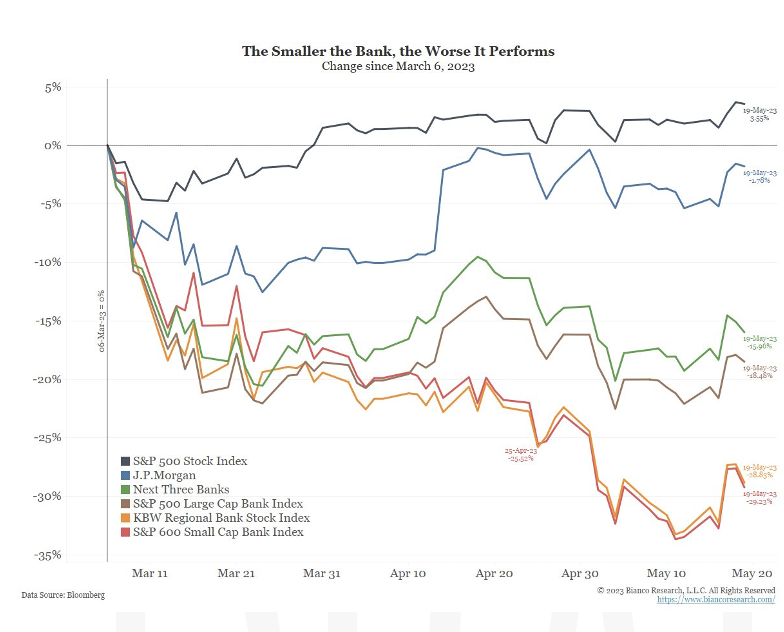

A default will put additional pressure on banks as a downgrade of US debt will further put pressure on those banks that have longer dates Treasuries on their books. Smaller banks have, in aggregate, experienced more significant stock declines than larger cap banks and the general market.

This week the US will release data on PMI and continuing jobless claims and learn more details about the Fed’s balance sheet. Of particular interest is the Tuesday release of M2 balances which indicate the velocity of money and an indication of how much credit is being extended and borrowed.

Equities

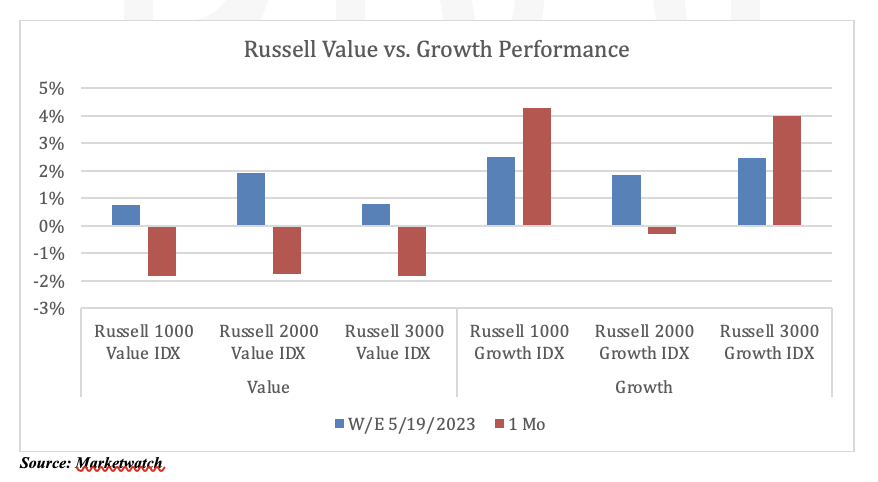

Equity indices gained this week (Dow: +0.38%; S&P: +1.71%; Nasdaq: +3.04%) but were down Friday as debt ceiling discussions stalled. Russell Value and Growth indices gained this week but only the Russell 1000 and 3000 Growth have gained for the month.

This week the Russell communicated preliminary lists of changes that will take effect after the market close on June 23rd. Goldman has forecasted 23 new stocks that will be added to the Russell 1000, moving up from the Russell 2000, eight of which will be healthcare stocks.

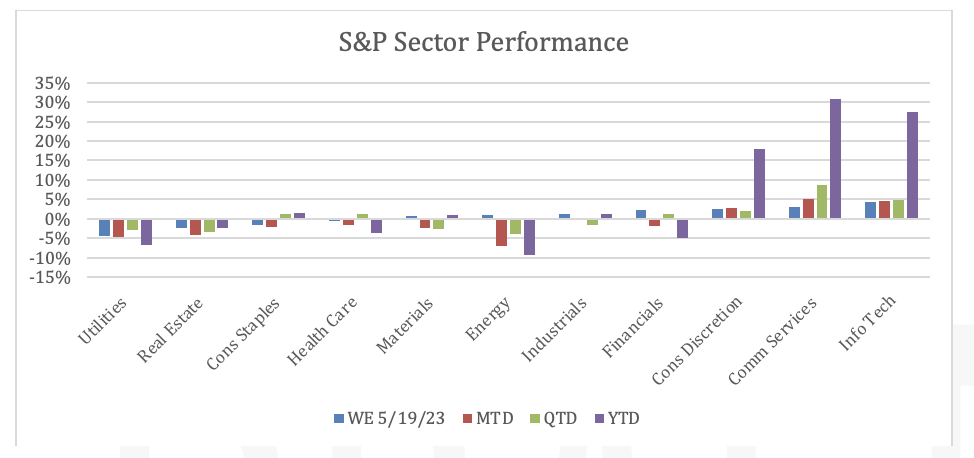

Healthcare, financial and energy sector equity funds faced net outflows of $698M, $677M, and $410M, respectively, but tech had a net $906M worth of inflows as per Refinitiv Lipper.

Some news in the market:

Wells Fargo (WFC: +6.78% / week) agreed to pay $1b to settle a shareholders lawsuit related to its 2016 fake accounts scandal as per Wall Street Journal.

Meta (META: +5.06% / week) is testing a text-based app that may debut in June which would compete with Twitter. A spokesman for Meta said “We are exploring a standalone decentralized social network for sharing text updates. We believe there’s an opportunity for a separate space where creators and public figures can share timely updates about their interests.”

Disney (DIS: -0.70% / week) is laying the groundwork to migrate all their ESPN channels as a direct-to-consumer streaming service. ESPN+ launched in 2018 and currently has 23.5M subscribers but only includes live golf, certain MLB and professional hockey programming along with a variety of scripted and unscripted programming. Disney+, which launched in 2019 has grown to 157.8M customers but in the most recent quarter lost 4M subscribers to competition. Transitions to streaming from cable is casting a large shadow for the revenue and profit for Disney.

European equity markets gained for the week (FTSE 100: +0.19%; DAX: +1.89%; Euro STOXX 600: +0.72%). The DAX hit a record high on Friday, while the STOXX hit a more than one year high with financial stocks leading gains. Foot Locker

(FL: -23.00% / week) cut growth projection after sales slowed in recent weeks, which affected European sports retailers such as JD Sports Fashion (JD: -7.94% / week), Adidas AG (ADS: -3.79% / week) and Puma (PUM: -9.74% / week).

Asian equity markets were mixed for the week (Hang Seng: -0.81%; Nikkei: +4.83%; Shanghai: +0.34%). Power Grid Corporation of India (PGRD: -3.27% / week), reported a 4% rise in 4th quarter profits while NTPC (NTPC: -0.94%) reported ~6% drop in 4th quarter profits as surging expenses offset higher demand. Both are state run companies.

Fixed Income

Treasury yields rose throughout the week with the 2-year Treasury yield rising 30 bps, the 10-year Treasury yield rising 24 bps, and the 30-year Treasury yield rising 17 bps. The 10-year Treasury yield reached its highest point since March 10th, 2023, while major bond indices fell. The Bloomberg US Aggregate Bond Index fell -1.37%, the Bloomberg US Corporate High Yield Index fell -0.42%, and the Bloomberg US MBS Index fell -1.32%. The chance of one more 25 bps hike is sitting at 82.6% according to the CME FedWatch tool. The weeklong selloff in Treasuries slowed on Friday after lawmakers in Washington announced they were pausing debt-limit talks. Yields ultimately ended the day higher – signaling optimism that policy makers will reach a deal.

According to a study by Zillow earlier this month, if the US government does default on its debt, mortgage rates could climb as high as 8.4%, the highest level in 23 years, adding $450 to the cost of monthly financing for a $400,000 home at current financing levels. In the event of a default, Zillow expects home prices to fall 1% from current levels. Such a minor decline in prices is due to the low supply of home listings as sellers are choosing to keep their low rate mortgages instead of sell. If there is an extended default, Moody’s anticipates a significant decline in home prices, as well as a much higher unemployment level.

Charles Schwab announced that it will raise $2.5 in bonds to secure financing after several months of wavering sentiment towards bank stocks. In a Thursday filing, Schwab stated that it would sell $1.2B of 5.64% fixed-to-floating rate senior notes due in 2029, and $1.3B of 5.85% fixed-to-floating rate senior notes due in 2034. Charles Schwab saw bank deposits fall by $40B in Q1 as would be depositors turned to higher yielding money market accounts.

Hedge Funds as of Thursday May 18th

For the week ending Thursday May 18th, HFs globally posted gains of ~40 bps. L/S equity funds globally captured a larger portion of the indices’ upside, with those based in the Americas capturing roughly 50% of the S&P’s gains on the week (US L/S +94 bps vs. S&P +1.9%). Month-to-Date (MTD), US-based L/S funds stand out as the clear outperformers as the average fund in this group is up +1.6% vs. the S&P up ~80bps. This could be due to crowded longs in NA outperforming the S&P by >2.5% MTD (crowded shorts are more in-line with index). Performance across other regions also held in well in relative terms, with EU-based funds capturing half of the gains in the Euro STOXX 600 index (EU-based funds +10 bps vs. index +20 bps). MTD, EU-based funds are up ~20 bps vs. index up ~50 bps. Asia-based funds posted gains of 20 bps vs. the index +60 bps. China-focused L/S funds slightly outperformed other strategies in the region as they were up +40 bps. Performance in May, however, remains more challenging for Asia funds with the average Asia-based fund/Asia-based L/S equity fund down 20 and 50 bps respectively vs. index +1%. This could be attributable to crowded longs in Asia underperforming their respective benchmark index by >3%. There appeared to be minimal appetite from HFs to buy single name equities in NA this past week considering the S&P rallied +1.9% through Thursday. While HFs ultimately tilted towards buying NA, the majority of the flow that took place was at the index level where HFs added longs and covered shorts to a lesser extent in broad-based index-related products (i.e. SPYs, QQQs, IWMs). As previously mentioned, flows across single name equites were quieter with healthcare, consumer discretionary and financials leading the net buying. The pace of TMT buying observed in late April/early May moderated this past week, with software being the lone industry to see any notable activity (HFs added longs across high quality names and covered shorts in smaller-cap/growthier names). Over the last several months HFs have not traded equities domiciled in Europe and AxJ in any meaningful directional amounts – this trend extended into this most recent week, where both regions were net sold in small amounts (both sold via short adds). In Europe, EU tech was the most net sold, with the bulk of the selling taking place in software and semiconductors. EU financials was the only sector in Europe to be net bought, with the buying largely concentrated within diversified banks and capital markets. As for Asia ex-Japan, the selling was particularly concentrated in China (mostly A-shares). On the other hand, Japanese equities were bought in small amounts (tech in particular).

Private Equity

PE managers are utilizing add-on strategies to meet capital distribution mandates until debt becomes more affordable. Last year 77% of PE deals in the US were add-ons which is an upward move of roughly 3%. The uptick is really an effect of the current market conditions. In Q4 of last year PE deal counts almost halved its volume of Q4 2021 levels with the averaged deal size also shrinking. When the IPO market came to a halt last year large firms lost the option to exit and by Q3 of 2022 the largest PE funds on average (over $1 billion AUM), struggled the most with a one year IRRs of 3.4% while funds under $250 million returned on average an IRR of 12.7%. When the Fed raised its interest rate again in May PE firms were seeing a diminishing supply of inexpensive debt. This is where add-ons started to become a tool for GPs because it flushed in more revenue and EBITDA to the current companies in the portfolio. In 2022 global PE add-on deals came in slightly below 2021’s historic year but outside of 2021 it marks the highest mark over the past 10 years. PE firms will acquire a company, fold it into an existing company in the portfolio, and thus expand the existing company’s multiple. On the contrary, when there is a market disruption like we have seen with the collapse of Silicon Valley Bank, add-ons usually diminish as they are seen as a strategy that is riskier than others.

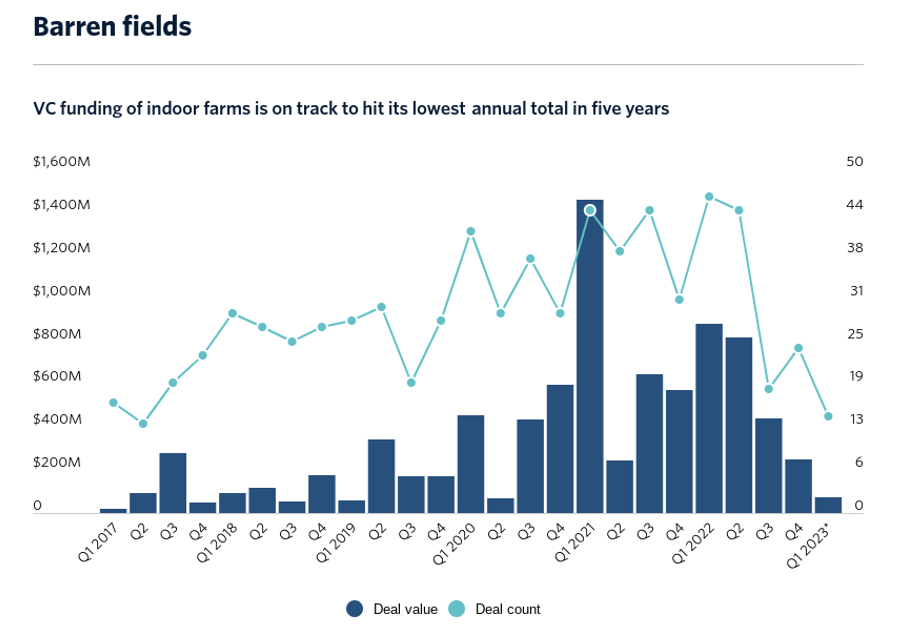

Indoor farming VC dollars struggled in Q1 with deal value dropping 70% from Q4 of 2022 and 91% down from Q1 2022. Rising energy costs due to the war in eastern Europe, coupled with rising interest rates, has impacted the space for startups’ cash balances. A few indoor farming companies have declared bankruptcy this year, Future Crops and Kalera, both using vertical farming as a way to grow produce. Late-stage companies are also feeling pressures similar to those seen at Infarm, a Berlin-based company that laid off 200 employees in November. In the beginning months of Covid we saw a rise in interests towards indoor farms due to their shorter supply chains and less personnel needed to run versus a traditional farm growing produce. A lot of that is starting to reverse now and the companies surviving are the ones doing so by cutting back.

Data Source: Apollo, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.