Economic Data Watch and Market Outlook

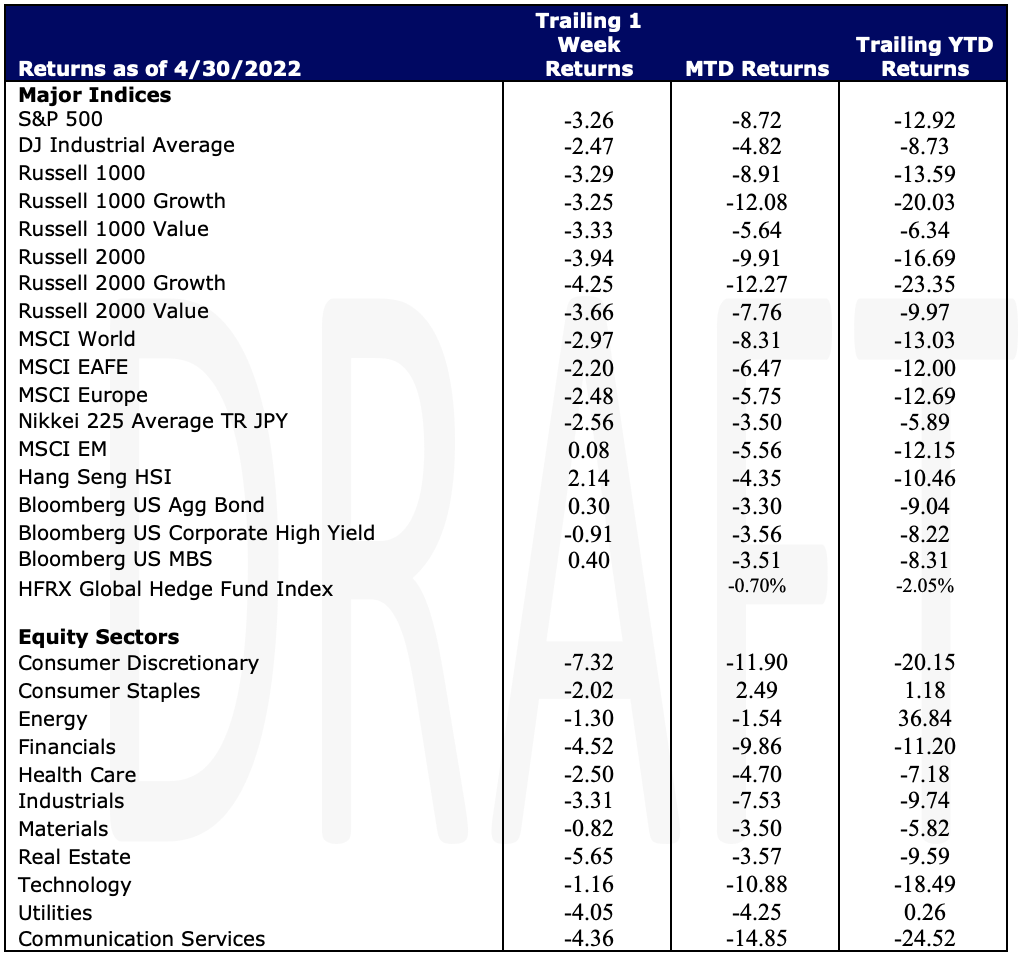

The fact that that equity markets have risen over 15% per year for the last three years, does not take away the pain of the last month. US markets were roiled on Friday as Amazon lost 14% of its value and dragged the broader market down with it. The S&P 500 fell 3.26% on the week and for the month fell 8.72%. The US Aggregate Bond index rose 30 basis points on the week and Emerging markets rose just 8 basis points in USD terms.

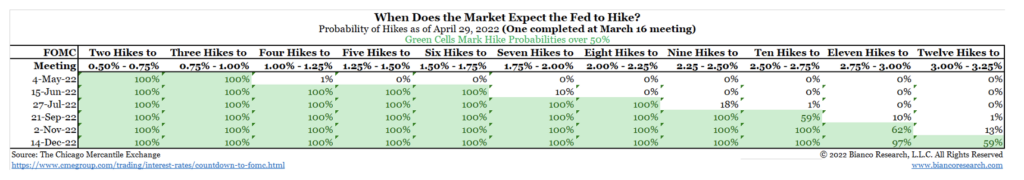

Real GDP contracted 1.4% on a quarter over quarter basis. As conversations regarding a recession becomes more common, the Fed is meeting this week to determine the next rate change. According a CME survey on 4/29, there is a 100% probability that the Fed will raise rates at least 50 bps at this upcoming week’s meeting. Note that the table below is for rate changes only and does not account for any quantitative tightening/easing.

Mortgage rates climbed to 5.37% during the week as the US House Price Index rose 2.1% for the month versus the 1.6% estimate. The S&P/CS Home Price Index rose 2.1% for the month compared to the 1.5% forecast. With housing prices and mortgage rates continuing to climb, mortgage applications declined 8.3% for the month as pending home sales declined 1.2%.

Personal Income was slightly better than expected at 0.5% versus 0.4% for the month and personal spending rose 1.1% versus an expected 0.7%.

Fidelity announced this past week that it would allow up to 20% of assets in client 401k plans later this year. The announcement was met with scrutiny almost immediately by the US Department of Labor.

The upcoming week will reveal how US Manufacturing is progressing as results are released early in the week. ISM will release multiple reports that will reveal clues about manufacturing employment, prices, spending, inventories, and backlogs. It could also provide clues as to how supply chain issues are being resolved (or not) as China continues to grapple with a COVID response. Payroll results will be reported on Friday with Non-Farm payrolls expected to be at 380,000.

Russia, Singapore, Hong Kong, Japan, and the UK will be closed on various days this week for specific holidays. China will be celebrating Labor for the first three days of the week.

Equities

Equity markets fell for the fourth consecutive week with the Nasdaq posting the biggest decline at more than 13%, its worst month since October 2008. The S&P was down nearly 9% for the month while the Dow Jones almost 5%. The S&P fell to the lowest close of 2022, moving further into correction territory on Friday, as Amazon investors grew worried over a huge earnings miss; the stock plunged 14% for its worst day since 2006.

Although roughly 80% of S&P 500 companies that have reported (half so far) have beat quarterly earnings, according to Factset, the broader concerns of the markets, such as inflation and the Fed, seem to be overshadowing the positive results. The markets are heading into a rocky week next week as the Fed is expected to raise interest rates and give more insight on its plans for tightening monetary policy to fight surging inflation. For the week, the S&P fell-3.26% while the Dow returned -2.47%. The tech-heavy Nasdaq’s large monthly decline, as previously mentioned, was due to broad weakness in technology stocks – down almost 11% on the month.

On a weekly basis, Consumer Discretionary -7.32% posted the largest loss out of the 11 S&P sectors while Real Estate -5.65%, Financials -4.52%, and Telecommunications -4.36% also contributed large negative returns on the week. All sectors returned negative results this week. Again, this week, large-cap stocks continue to outperform albeit both posting large negative returns on the week. Small-cap Growth stocks in the Russell 2000 returned -4.25% this week while Large-cap growth stocks returned -3.25%. From a Value standpoint, large-caps returned -3.33% and small-caps returned -3.66%. In general, small-caps are in bear market territory – down nearly 24% from their highs. Globally, stocks were in negative territory with the MSCI World -2.97% on the week and 13% year-to-date.

Fixed Income

Next week the Fed is expected to hike rates another 50 basis points, with a few others expected to follow, leading to a goal of 2.5% by year end. This should get the Fed to their 2% inflation target. To reach a soft landing without causing serious market implications will be a tricky one for Fed Chairman Jerome Powell. As rates continue to rise and stocks plummet investors are starting to rethink their fixed income allocations. One vehicle that has sparked some interest with rising inflation are Series I Bonds which earn a fixed interest rate and a variable inflation rate which is adjusted semiannually, in May and November. Due to the 6-month window for compounding interest, you can lock in the coupon during the window. It will be adjusted for inflation next window pricing so inherently a safe investment for the current inflation risks the market faces. As of November, 7.1% was the current interest rate for a Series I Bond from November to end of April but starting next week the current yield will be 9.6%, which as a comparison to other investments, is a very attractive option for bond allocations.

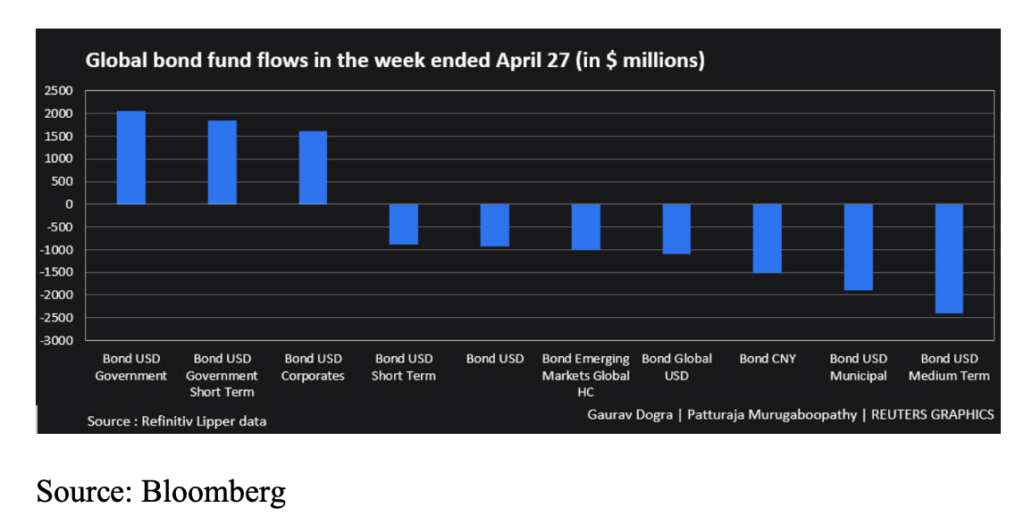

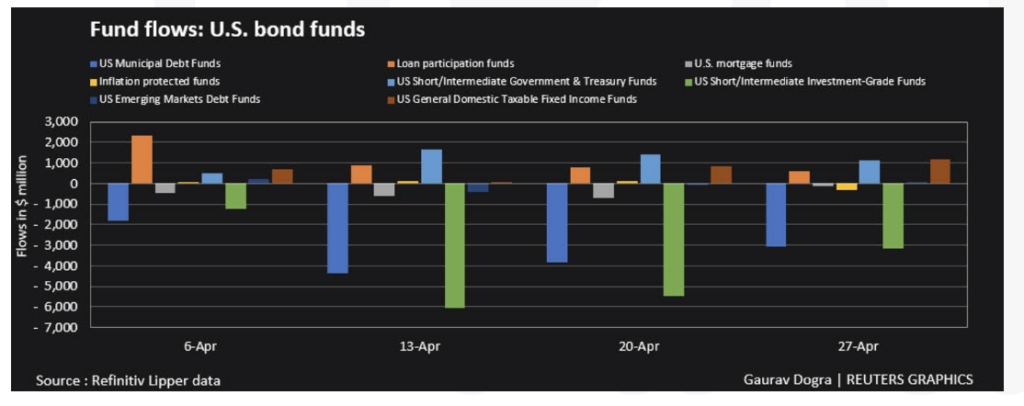

Global bond funds saw a fourth consecutive week of outflows totaling roughly $9.72 billion with investors seeking security in government securities. US Bond outflows seems to be easing a bit showing a 3-week low of $4.53 billion leaving the space this week. Inflation protected securities saw its first weekly outflow in 9 weeks while US short term/intermediate IG bond funds saw their 16th consecutive week of outflows. Investors seem to be taking a lot of risks off the table by just moving money out of equities and bonds and into money market funds, which saw its biggest weekly inflow since March 2nd. Inflows into US Bond funds came in 3 different sectors of the bond market: Loan Participation Funds, Short/Intermediate Term US Government/Treasury Funds, and General Domestic Taxable Fixed Income Funds. Loan Participation Funds and General Domestic Taxable Fixed Income Funds both saw inflows of $0.59 billion and $1.15 billion respectively.

On Friday, Russian Finance Ministry said it made a payment of $564.8 million on a 2022 Eurobond and a $84.4 million payment on a 2042 Eurobond in dollars. The funds went through Citi Bank and need to clear before May 4th which would be over their 30-day grace period before entering default. Russia originally made payment in Rubles which was not in the bond contract upon purchase. Russia has been adamant on paying in Rubles but entering default would cause a whole new sort of pain for the country. Russian government bonds rose late Friday following the news, but it still seems like only a matter of time before default becomes a reality. The payment came from Russian domestic reserves, but half of Russian foreign reserves have been frozen due to sanctions put on them by the EU and the US. If the payment in dollars is not received by May 4th it will mark the first Russian default on foreign debt since 1917 during the Bolshevik Revolution. Russian Finance Minister Anton Siluanov said they will take legal action if payments are impeded by foreign sanctions.

Hedge Funds

Hedge fund performance held in relatively well this week (ending April 28th) with the average global hedge fund down ~ 10 bps compared to -80 bps for the MSCI World Index. YTD, the average fund is down 4.3% compared to -11.2% for the MSCI World Index. Americas based long/short funds captured 30% of the S&P’s loss but only 25% of Thursday’s upside. Europe and Asia based funds were down ~ 80 bps and 20 bps respectively and for Asia funds, this represented only about 10% of the MSCI Asia’s -2.2% loss for the week. Crowded names in North America worked well this week with the top 50 crowded longs +1.7% and crowded shorts -1.1%. This 2.8% spread is in line with the best week of 2022 (January 28th) and 3rd best over the trailing 12 months. This week was one of the largest weeks of long buying of North America equities in the past 3 years. Amidst the focus of big tech earnings releases, the bulk of the buying was in North American TMT with ETFs and healthcare also contributing to the buying. Shifting to other regions, buying in Europe paralleled North America with a large portion of the buying in TMT. On the flip side, funds were net sellers of EU energy. In AxJ, funds were net sellers by adding to shorts. By country, China accounted for most of the selling followed by Taiwan and Korea.

Private Equity

The number of PE mega-funds, or funds containing at least $5 billion, has drastically increased over the last two years. The combined funding amount targeted by these mega-funds is at least $225 billion, more than two-thirds of the total amount US PE firms raised in 2021. The surge in mega-funds is limiting the capital available to General Partners (GPs) and could disrupt the lucrative status quo that PE firms have become accustomed to.

Before 2022, just seven US-based private equity funds closed funds that were $20 billion or larger. As of Q1 2022, there are at least nine funds that have already closed fund of $20 billion or larger. GPs are battling for limited resources as many managers are raising capital at levels that are overwhelming traditional Limited Partners (LPs) funding ability.

Analysts suspect there will be several consequences to restricted LP capital. First, it could drastically slow down the fast and smooth fundraising process GPs have been enjoying over the course of the last two years. Second, this could place a temporary ceiling on PE fundraising activity and could force GPs to turn to other sources of capital such as insurance companies.

Data Source: Bloomberg, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Fund Fire, Jim Bianco Research, Morningstar, National Mortgage News, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M