Economic Data Watch and Market Outlook

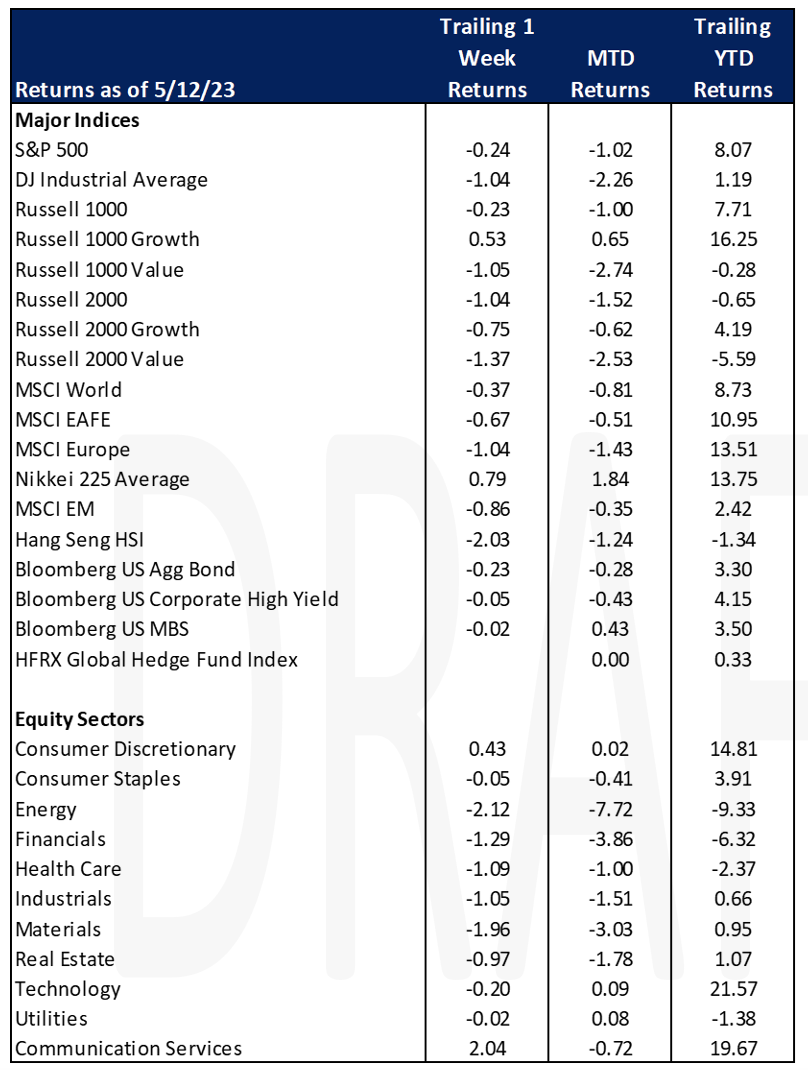

Global stocks fell slightly (MSCI World, -0.37%) as did US stocks with the S&P 500 dropping -0.24%). The US Aggregate Bond Index fell 23 basis points.

Negotiations began between President Biden and House leader McCarthy on May 9th to resolve the debt ceiling limits and equity and fixed income markets have had minimal reaction thus far. The VIX, a measure of the volatility of the S&P 500, closed at 17.03, close to its 52-week low of 15.53. For additional context, its 52-week high is 35.05. Digging deeper, we’re seeing the $30+ trillion Credit Default Swap market is pricing short-term insurance on US Treasuries. Spreads widened earlier in the week to an all-time high on Tuesday at 172 basis points before closing at 163 basis points. Five-year spreads stood at 72 basis points, the highest since 2009. Solutions outside of negotiations remain such as enacting the 14th Amendment giving the President the authority to pay the US’s debts.

Generally, its widely believed that a solution will occur, but the path may be rocky. Beyond the obvious payments to government employees being withheld and senior citizens not occurring, the pricing of Treasuries may re-ignite the banking crisis because of the impact on the price of Treasuries.

Both GM and Tesla are facing large recalls. GM stated that it will recall nearly 1 million cars in the US due to a defect in driver’s side airbags. Meanwhile Tesla has been ordered by Chinese regulators to recall more than 1.1 million cars in the region due to potential safety risks. The recall is focused on cars produced between January 2019 and April 2023. This is nearly equivalent to all of Tesla’s sales in China during the 4-year period.

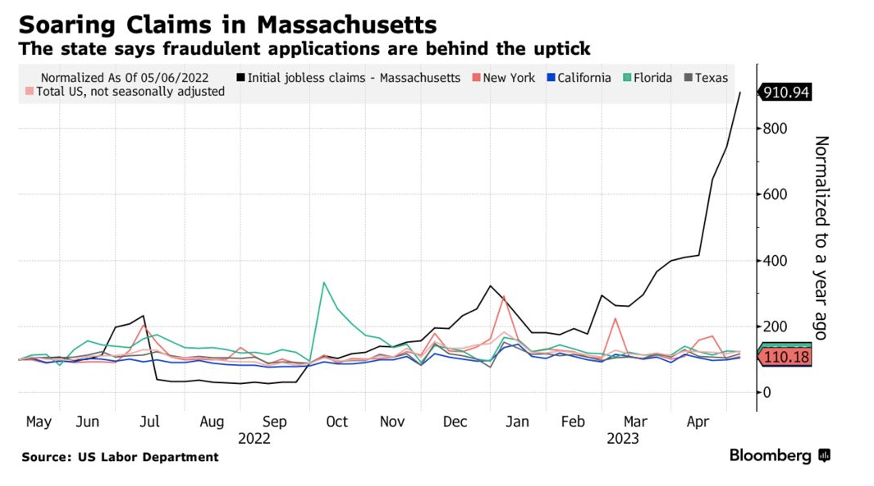

On Friday, Bloomberg reported the soaring surge in jobless claims are a result of fraud, impacting the national number released Thursday. It’s estimated that the Massachusetts claims accounted for nearly half of the national number. It was reported that the nationwide claims number was the highest since October 2021, but that number will ultimately be revised.

Equities

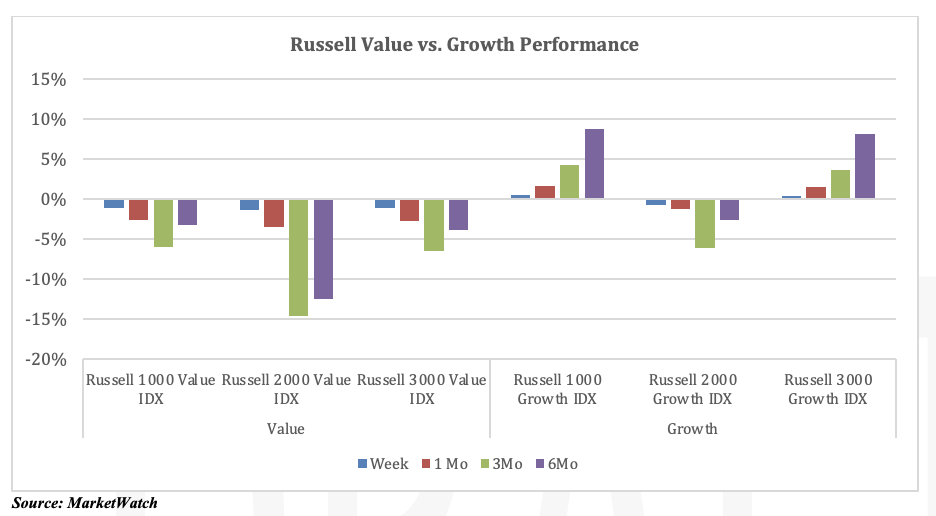

Equity indices were mixed after a volatile week (Dow: -1.11%; S&P: -0.24%; Nasdaq: +0.40%) with the market worried about the debt ceiling. For the week, the Russell 1000 / 3000 Growth (Russell 1000: +0.48%; Russell 3000: +0.41%) continue to outperform the Russell Value indices (Russell 1000: -1.11%; Russell 2000: -1.43%; Russell 3000: -1.13%) and Russell 2000 Growth (Russell 2000: -0.77%) indices. The Russell 1000 and 3000 Growth indices are outperforming the Russell 2000 by 1143 bps and 1072 bps, respectively, over the six-month period.

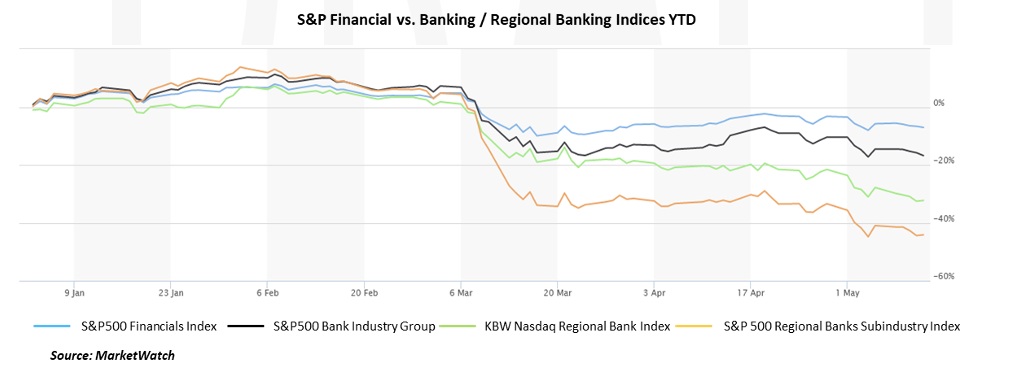

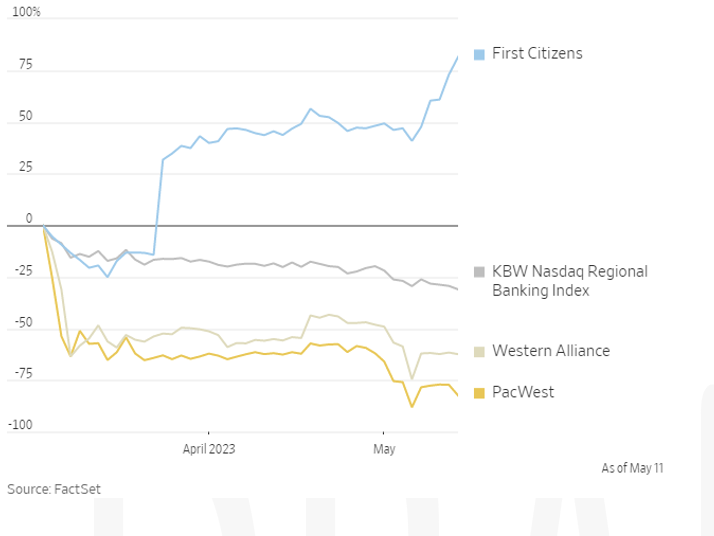

The regional banking turmoil continues with those banks remaining under pressure as investors worry that about banks’ underwater investment portfolios. Below is a year to date performance comparison of the S&P Financial Sector vs. Banking Industry / Regional Banking indices.

PayPal (PYPL) closed down Friday (-3.98%) and for the week (-17.72%) after reporting a disappointing outlook for its annual adjusted operating margin expansion of 100 bps vs. an earlier estimate of 125 bps. Affirm Holdings’, the buy-now pay-later company, beat expectations of their earnings loss by $0.16, gaining +12.79% for the week but declined -3.21% on Friday. Affirm’s rate of delinquency has declined from the end of September from 3.2% to 2.5% in March.

Elon Musk announced Twitter’s new CEO, Linda Yaccarrino, on Thursday. Tesla’s stock rose on Thursday (+1.86%), declined on Friday (-2.38%), closing the week down -1.21%.

European equity markets were mixed for the week (FTSE 100: +0.630%; DAX: -1.82%; Euro STOXX 600: -0.04%). UBS’s (CH:UBSG) Chief Executive, Ermotti, on Friday said that outflows from Credit Suisse seems to have stabilized. UBS gained +0.70% on Friday but declined for the week -0.80%.

Asian equity markets were mixed for the week (Hang Seng: -2.21%; Nikkei: +0.79%; Shanghai: -1.86%). Some news from the Asian markets: Sharp (JP:6753) closed down Friday (-8.69%) and for the week (-5.44%) as the maker of large LCD panels, used in television for Samsung Electronics and LG Electronics, and OLED displays reported a loss of $1.9B due to write-downs related to flat screen assets. Foxconn (TW:2317), Sharp’s top shareholder (34%), also closed down (-2.4%) on Friday and for the week (-2.38%) after reporting a loss of $564M in earnings due to investment in Sharp.

The Adani group, whose stock has been battered after the Hindenburg Group’s January allegations of stock manipulation, plans to raise up to $2.53B for two of their companies, Adani Enterprise ($1.53B) and Adani Transmission ($1B)

Fixed Income

US Treasuries rose throughout the week and fell into Friday, ending the week with a slightly positive increase in yields. The 2-year Treasury yield rose 6 bps throughout the week while the 10-year Treasury yield rose 2 bps, and the 30-year Treasury yield rose 2 bps. Major bond indices fell, with the Bloomberg US Aggregate Bond index decreasing by -0.23%, the Bloomberg US Corporate High Yield Index falling -0.5%, and the Bloomberg US MBS Index falling -0.02%.

Treasury Secretary Janet Yellen issued warnings regarding the debt ceiling. She mentioned that the Federal Government may have to renege on some of its obligations such as Treasuries or even payments to Social Security. The Congressional Budget Office (CBO) has also cautioned that the US Treasury could run out of cash by as early as the beginning of June. Bond yields climbed on the news.

As mentioned in the equity section, the regional banking crisis continued this week with PacWest coming into focus after cutting their dividend over the weekend and announcing a dramatic fall in deposits of 9.5% for the week ending May 5th. PacWest has stated that as of May 10th they have immediate available liquidity of $15B which still exceeds the $5.2B of uninsured deposits they currently hold. Conversely, Western Alliance saw deposits rise by $600M from May 2nd to May 9th. On Thursday, the FDIC announced that its plan to make up losses in the deposit insurance fund would charge banks on the level of uninsured deposits over $5B at the end of 2022. Furthermore, banks with assets between $10B and $100B have reported Q1 data showing that securities losses declined from $78B at the end of last year, to $67B at the end of the quarter. Industrywide deposits have been solid, with data showing that outside of the 25 largest banks, deposits rose by 0.4% from the prior week, while regional banks are falling further. The KBW Regional Banking Index fell 6% for the week and is now down 30% YTD.

Hedge Funds

Global indices declined this week but hedge funds in most regions were able to post positive performance. The average global fund and global long/short equity fund increased 14 bps and 31 bps respectively while the MSCI World declined 20 bps. In the US, the average long/short equity fund gained 60 bps despite the S&P falling slightly 10 bps. In Europe, the average fund gained 14 bps with the Euro STOXX 600 dropping 14 bps. Asia was the outlier. Funds in this region declined more than the MSCI Asia with the average Asia L/S fund losing 31 bps, the average China L/S fund -74 bps whereas the MSCI Asia Pacific declined only 8 bps. Crowded longs and crowded shorts worked well both in the US and Europe as the L/S spread for the week was +130 bps and +140 bps respectively. Not surprising, the crowded names in Asia did not work as well as the spread for the week was -210 bps (longs -135 bps and shorts +72 bps), the widest since March. HF were buyers of global equities on a net basis increasing gross exposure. A large bulk of the buying was in NA, in particular consumer discretionary and commodity driven cyclicals. HF also returned to buying of unprofitable/more expensive tech names which had been a depressed theme since the end of 2021. Macro products were buyers as well as single-name. In Europe financials, healthcare and RE drove the buying while in AxJ financials and RE sectors were bought and tech was sold. There was also selling in emerging Asia. Lastly, in Japan the buying was split 70/30 between long adds and short covers with technology, consumer discretionary and healthcare the largest sectors bought.

Private Equity

The SEC has completed rules enhancing reporting requirements for hedge funds and private equity giving them less time and providing more detailed information. Hedge Funds that meet at least 1.5 billion in assets under management will have to report events that the SEC believes may indicate financial stress. Of those events that will need to be reported are substantial investment losses, specific margin events, counterparty defaults, material changes in prime broker relationships, operation events, and certain events associated with redemptions. Private equity funds will need to report secondary market transactions 60 days after quarter end. Funds with more than $2 billion will have an additional set of reporting requirements that will need to be met annually which would include the strategy and use of leverage.

Chinese Firms continue to dominate the semiconductor VC space even though the US has been trying to catch up with legislation passing to encourage manufacturing domestically. Of the top 10 ranked VC investors in the space only two are based outside of China: Intel’s corporate VC arm Intel Capital and Walden International. In the US some of the bigger startups trying to innovate the space are Light Matter and SambaNova Systems. Light Matter produces light-photonics-based chips and SambaNova Systems has gained some focus from outside investors for their chips made specifically for machine learning and artificial intelligence.

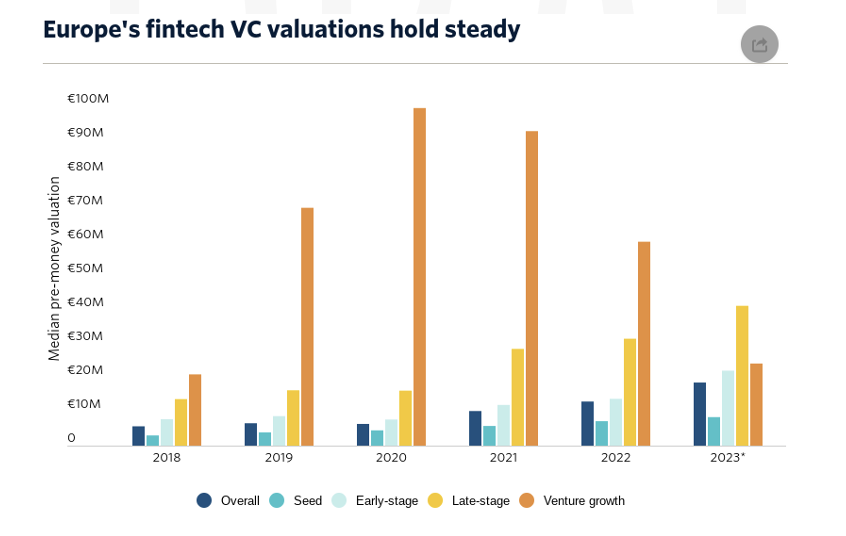

VC valuations have risen in 2023 for European fintech companies but there have been some recent markdowns which could signal a less positive outlook. Q1 2023 saw the median pre-money valuation for European Fintech startups at €18.6 million which is up from 2022’s €13 million. 2023 has seen an uptick across all stages except venture growth which was down roughly 60%.

Recent markdowns might signal companies in the space are overvalued with some names being devalued in April. The Euro Fintech space has been impacted by rising rates and decreased consumer spending. The tension in the banking sector is expected to impact the fintech space as well. Q1 of this year saw its lowest quarterly figure for Euro Fintech VC deals due to the increased probability of down rounds while others are avoiding fresh funding due to the current market uncertainty. If the market continues to face pressure, Fintech valuations should come down.

Recent markdowns might signal companies in the space are overvalued with some names being devalued in April. The Euro Fintech space has been impacted by rising rates and decreased consumer spending. The tension in the banking sector is expected to impact the fintech space as well. Q1 of this year saw its lowest quarterly figure for Euro Fintech VC deals due to the increased probability of down rounds while others are avoiding fresh funding due to the current market uncertainty. If the market continues to face pressure, Fintech valuations should come down.

Data Source: Apollo, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.