Economic Data Watch and Market Outlook

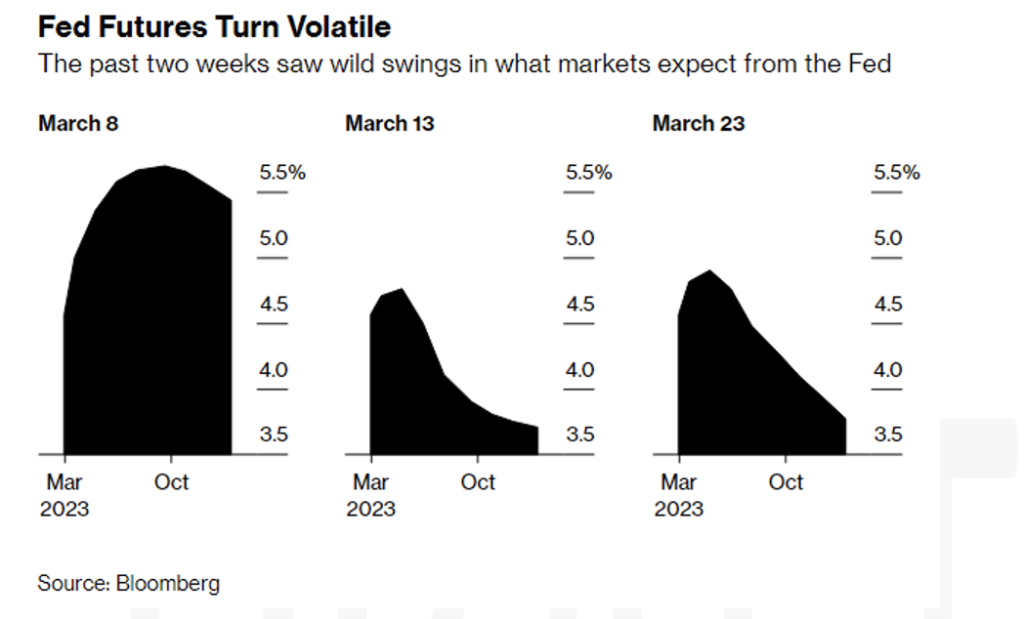

This past week, most eyes were on Wednesday’s rate decision by the US Federal Reserve. Consensus view had moderated significantly over the past few weeks as the US banking system appears to be under stress. If the Fed raises too much, potentially causing more stress on banks, they would either have to raise interest on demand deposits or address their reserve requirements as depositors left for higher yielding Treasuries. The first choice shrinks a bank’s earnings and the second choice could cause further stress by requiring banks to adjust reserves and sell longer dated Treasury securities. If the Fed, however, paused, it may also send signals that the US banking system was under significant stress, again causing depositors to flee for risk control reasons. Consensus was for an increase of 25 basis points which ended up being correct. It was noted in Powell’s press conference that they did consider pausing.

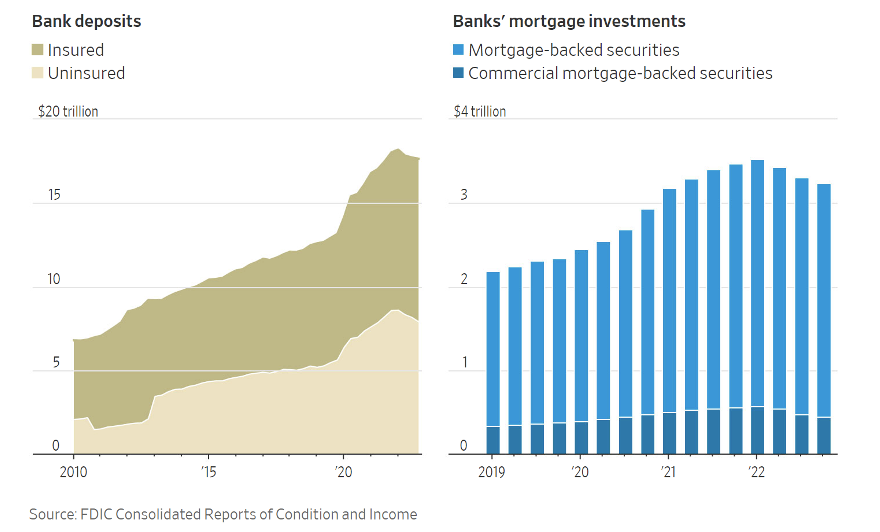

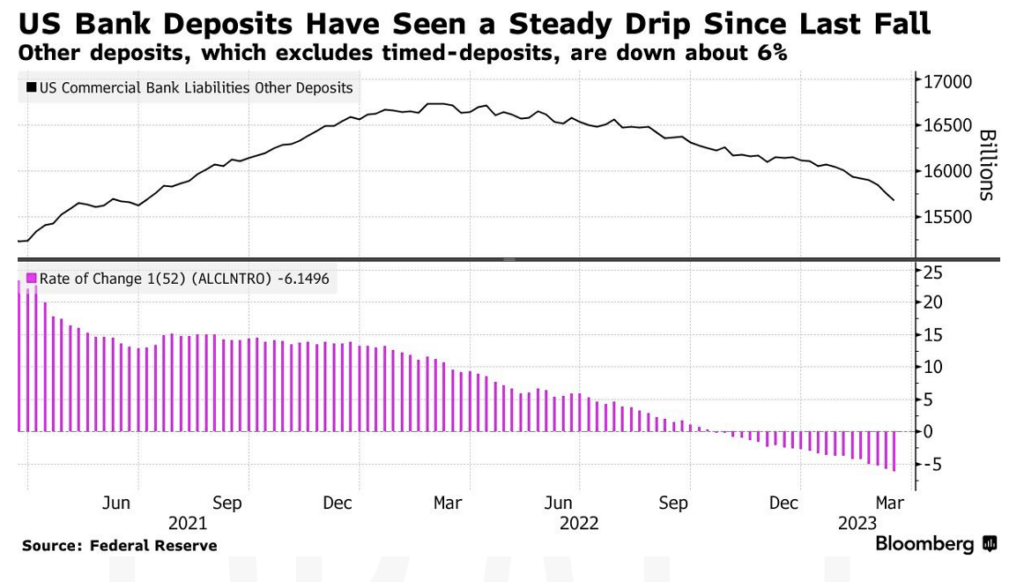

Some additional background on the ripple effects of choice number two: According to the Wall Street Journal, $2.3 trillion in excess savings were stashed in bank accounts during the pandemic. The WSJ also notes that $8 trillion of those deposits were uninsured at the end of 2022. Banks had to do something with that excess liquidity.

Previously, rates were at almost 0% and some banks chose to get as much return on those deposits as possible, investing in longer dated Treasuries and mortgage-backed securities. Now as rates have increased and investors can get 4.5% or more in a money market, and uncertainty grows about banks, investors are choosing those higher yielding securities. Note that under accounting rules a bank can keep the value of those securities at par until they sell them. Now that the securities’ values are realized, the reserve requirement of the bank is likely lower, causing it to sell more securities and the cycle continues.

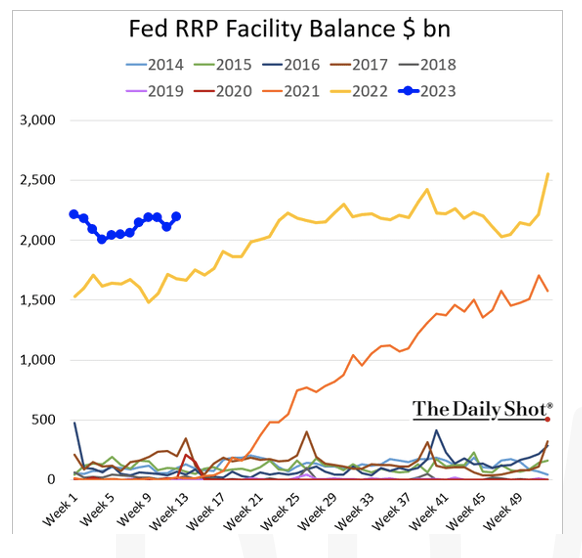

Why are money markets higher? A Federal Reserve program introduced a reverse-repo facility meant to create a floor on borrowing costs. Money funds acted as an intermediary loaning to banks in exchange for securities. Quantitative easing greatly affected the program and the reserve requirements of banks. As a result, some of the terms were relaxed during COVID and banks found themselves with excess therefore no longer borrowed from money funds. Money market funds then invested their cash directly with the Fed and as rates increased so did the returns of money funds. The graphic below shows the jump in money funds’ access to the reverse repo facility.

Despite the Fed’s move, the Treasury Secretary created uncertainty mid-week as she initially noted that all deposits above the $250,000 threshold would be covered then back tracked those comments. On Friday, President Biden hinted that federal deposit insurance could be used if more banks fail, stating that US banks are in “pretty” good shape. He then continued to say that if there is more instability to come, the government would be able to guarantee deposits above $250,000.

The much-publicized political football of Tik Tok played out this week as the company, owned by Chinese Company Byte Dance, is potentially being forced to divest or be banned from the US. Tik Tok’s CEO, Shou Zi Chew, appeared before the US House Energy and Commerce committee this week to discuss Project Texas, which would move all of US based data to the Oracle computing cloud in the US.

In China related news, the market is evaluating the impact of China’s reopening. Research firm Wood Mackenzie estimates that 40% of the global oil consumption will be related to the re-opening.

This week we will get data in the US on manufacturing, energy production, GDP and jobless claims.

Equities

Equity market returns for Friday (Dow: +0.41%%; S&P: +0.56%; Nasdaq: +0.31%) and the week (Dow: +1.18%; S&P: +1.41%; Nasdaq: +1.99%) were higher after a volatile week due to continued worries about banks globally and interest rates.

Deutsche Bank (DB) fell -3.11% in US markets and -11.1% in Frankfurt trading on Friday after a jump in their cost of insuring against the risk of default. The cost of DB credit default swaps spiked to a four year high on Thursday. US banking indices were essentially flat for the week as the Financial Stability Oversight Council said that “While some institutions have come under stress, the US banking system remains sounds and resilient.” Deutsche Bank came into focus this week with share prices losing almost a quarter of their value since the beginning of March. After UBS purchased Credit Suisse last week, investors have become fearful, looking for the next possible area of risk. Deutsche Bank recently underwent a multibillion Euro restructuring focused on reducing costs and increasing profitability. Deutsche Bank’s 2022 net income came in at $5.4B for 2022, a 159% increase from a year earlier. One of the main concerns of investors is the banks commercial real estate exposure and significant exposure to derivatives. Research firms have sited that this is an overreaction, pointing to the bank’s strong capital and liquidity positions.

Block Inc (SQ) fell 17.99% for the week as short sellers questioned the company’s user numbers based upon a Hindenburg Research report. Block said in a statement that Hindenburg’s report is “factually inaccurate and misleading” and that “Hindenburg is known for these types of attacks, which are designed solely to allow short sellers to profit from a declined stock price.”

European equity markets (FTSE 100: -1.01%; DAX: -1.33%; Euro STOXX 600: -1.21%) were down Friday and for the week (FTSE 100: -5.35%; DAX: -4.29%; Euro STOXX 600: -3.84%) as European banking indices suffered a steep selloff due to the intensified worries in the financial sector. Shares of UBS Group AG (UBS) and Credit Suisse AG (CS) also fell 6.3% and 6.7%, respectively, after Bloomberg News reported they are among the banks under scrutiny in a US Department of Justice (DOJ) probe into whether financial professionals helped Russian oligarchs evade sanctions. Austria’s Raiffeisen Bank International fell -5.7% as the ECB is pressing the bank to unwind its highly profitable business in Russia. German bank Commerzbank (CBK.Germany: – 5.9%) and France’s BNP Paribas (BNP.France: -5.8%) retreated as well. ECB and EU leaders have said that their “banking sector is resilient, with strong capital and liquidity position”.

Asian equity markets (Hang Seng: +1.64%; Nikkei: +1.20%; Shanghai -+0.73%) were up Friday but mixed for the week (Hang Seng: +2.04%; Nikkei: -2.88%; Shanghai -+0.63%). Analysts, according to Refinitiv IBES data, have cut Asian companies forward 12-month earnings’ estimates by 3.6% since February due to slowing global growth and trade data that has not shown a boost from China COVID reopening.

Fixed Income

Treasury yields remained relatively flat this week after heavy volatility in the week prior. The 2-year Treasury yield fell 5 bps throughout the week, while the 10-year Treasury yield fell 1 bp, and the 30-year Treasury yield rose 4 bps. The Bloomberg US Aggregate Bond Index rose 0.52%, the Bloomberg US Corporate High Yield Index rose 0.35%, and the Bloomberg US MBS Index rose 0.49%. Despite the banking crisis that has unfolded over the last several weeks, the Federal Reserve raised rates by 25 bps on Wednesday, signaling that high inflation continues to threaten the economy which is still facing a strong labor market and elevated prices. Fed officials expect that the banking issues that have unfolded should slow down the economy as well. With Jerome Powell saying that tighter financial conditions could be equivalent to a rate hike. Bets on future monetary policy have faced heavy volatility over the last several weeks, going from pricing in several more rate hikes, to imminent cuts following the SVB fallout.

Bank deposits fell by $98.4B to $17.5T in the week ending March 15th, the largest weekly decline in nearly a year. The decline was primarily driven by a drop in deposits at smaller banks. Deposits at small banks fell by $120B while the 25 largest banks saw deposits climb by $67B. Institutions have faced steady outflows of deposits for the last several months, with clients finding better rates in money market funds.

Hedge Funds

For the week, the average global fund was up 50 bps compared to 170 bps for the MSCI World. Long/short equity funds were able to capture a little more of the upside rising 84 bps for the week. Americas-based long/short equity funds performed in line with the S&P 500 for the week but lag a fair amount MTD. In Europe, EU funds significantly lagged the Euro STOXX 600, only rising 78 bps compared to 230 bps for the index. Asia-based funds reported +90 bps and China funds +130 bps. This compares to +180 bps for the MSCI Asia Pacific. Hedge funds were small net sellers of global equities, mostly from reducing long exposure. All strategies participated in the selling, but the bulk came from long/short equity funds. By region, the selling was the most extreme in the EU, with the selling from the previous week (the most in the past 9 months) continuing. The selling was across all single-name sectors with index level products more muted. Overall flows in NA were more muted but were more dispersed across sectors. HFs leaned towards selling technology and financials, particularly lending sensitive stocks (those that may have direct or tangential exposure to increased tightening in the lending market) and buying in small amounts across other sectors. To single out sectors, the buying was across REITs, chemicals and utilities with short covering in consumer discretionary. In Asia ex-Japan (AxJ), hedge funds reduced gross exposure but was more concentrated in Australia and Taiwan. Japan saw similar activity to AxJ, a trimming of gross exposure.

Private Equity

With the news of the failure of Silicon Valley Bank and the banking crisis in the United States analysts suspect private equity firms will face increased financing challenges as traditional lenders withdraw from the market and capital is in low supply. Additionally, with interest rates increasing again many General Partners that rely heavily on banks’ lending divisions will have to more carefully deploy capital and likely will move to the lower end of the market for deals.

Pitchbook analysts suggest that the main effect private equity firms will see will be increasingly conservative debt lending practices; a trend that private equity firms have actually been wrestling with since Q3 of 2022 as the bank-led leveraged loan market was brought to a virtual halt by the Fed’s rapid tightening cycle. Rather than financing leveraged buy outs (LBOs) which typically required multiple different bank loans, analysts suspect we will see larger firms pursuing deals that require less leverage and the purchase of assets that can be financed through majority equity transactions. According to Pitchbook data, private equity firms are already pursuing this strategy in full. As of Q4 2022 lower-middle-market and middle-market deals accounted for 76.5% of all private equity deals, the highest quarterly level in the past five years.

Despite financing challenges analysts suspect deal flow should remain steady throughout 2023 as private equity firms will be forced to deploy record amounts of dry powder that was raised throughout 2021. According to Pitchbook data, private equity firms amassed a record of $1.5 trillion in dry powder and will be under pressure from Limited Partners to deploy this capital consistently. Given the limited access to leverage as noted, PE firms will likely have to unload dry powder through alternate strategies such as take-privates particularly in the middle market.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), The Economist, Jim Bianco Research, Goldman Sachs, Market Watch, Morgan Stanley, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.