Economic Data Watch and Market Outlook

Equity asset prices advanced globally for the week. US equities saw their biggest weekly gain since late-2020 as the Fed’s decision to raise rates, a 25-basis point increase, was finally announced. Fed Governors Bullard and Waller have suggested front-loading raising rates aggressively early on to get a handle on inflation, but Powell recently indicated he doesn’t want to push too hard and push the economy into recession.

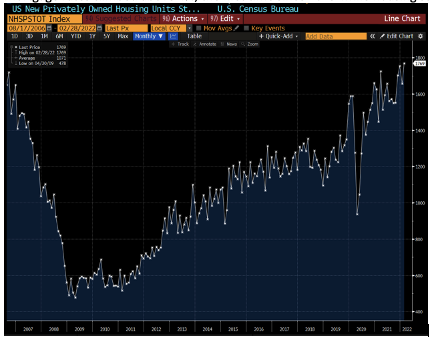

Mortgage rates climbed above 4%, the first time since 2019 while housing starts recorded their biggest jump since 2006.

Despite higher prices, jobless claims are the lowest since 1970. Consumers still continue to spend but the spending has sustained pressure on the supply chain. As warmer weather has hit and Covid restrictions have been rescinding across the US, consumers have regained the urge to travel. This increased demand which was underinvested during COVID, and current supply taken offline due to the Ukraine/Russia war have caused gas prices to dramatically increase. The present national average is $4.25 per gallon according to AAA.

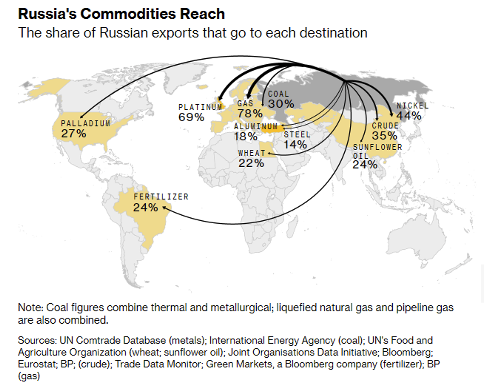

Russia continues to press on in its attack on Ukraine creating roughly 7% of its population to flee to Poland and other neighboring countries. The cost of the continued siege has taken a great economic toll on Russia exposing the gaps in its own economy which Putin believed to be self-sufficient. Factories are starting to shut down due to lack of aviation and auto parts to name a few. According to the Wall Street Journal, and a poll in 2020 by the Higher School of Economics in Moscow, Russia imports up to 75% of its nonfood consumer goods. Haver Economics and the Institute for International Finance estimate that current sanctions will cause an economic contraction that could set their economy back two decades. Despite that, Russia continues to be a significant supplier of global commodities. Below is a pre-sanction breakdown of Russian commodities and their main purchasers.

Equities

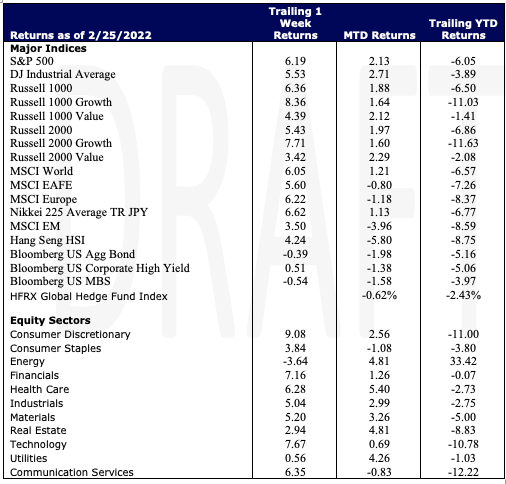

The S&P 500 and Dow Jones posted their best week since November 2020, returning 6.19% and 5.53% respectively, on the backdrop of China stating they did not support Russia’s invasion of Ukraine. Consumer Discretionary (9.08%), (+7.67%), and Financials (+7.16%), were the biggest gainers of the 11 S&P sectors – Tech was helped by strong returns in Apple rising 3.9% while NVIDIA climbed 6.8% and Meta Platforms (Facebook) gained 4.1%. Energy (-3.64%) and Utilities (0.56%) were among the biggest detractors this week. The Russell 1000 large and 2000 small-cap Growth indices stormed past their respective Value counterparts, returning 8.36% and 7.71%, respectively. YTD, Value still outperforms Growth.

Globally, the MSCI World posted a strong positive return of 6.05% while Europe returned 6.22% and Emerging Markets returned 3.50% on the week.

Fixed Income

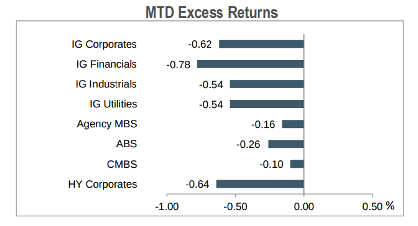

The Federal Reserve announced this week that they are raising the Federal Funds rate by 25 basis points. Following the announcement Treasuries rose with more drastic moves seen on the shorter side of the yield curve with the 2-year Treasury note jumping back to the 2% level briefly. The 10-year Treasury note ended the week at 2.15% and the 30-year bond ended the week seven basis points higher 2.47%. The rising bond yields impacted the municipal bond market which is set to sell 17% less of new issues this week compared to yearly average. The 30-year mortgage rate rose above 4%, the first time since 2019, which negatively impacted the performance of the mortgage-backed products. High yield issuance paused this week prior to the Fed meeting but saw some deals being priced post meeting. The Bloomberg US Agg Index was down 0.39% while the Bloomberg US Corporate High Yield index was up 0.51% on the week.

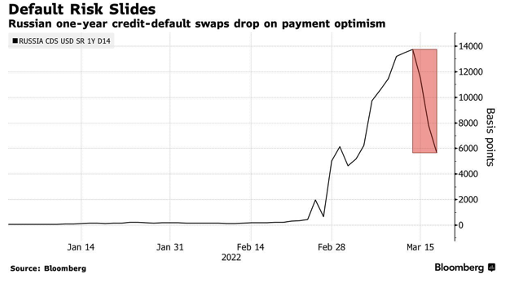

Russia paid off $117 million in interest on maturing Eurobonds this week avoiding a debt default which would be the first time the country defaulted on foreign debt since the Bolshevik Revolution in 1917. The move was a temporarily relief, but Bloomberg has reported that the country has roughly $88 million in interest payments coming due over the next 10 weeks. The news outlet suggested that managers are waiting for a default to claim Russian-owned NYC and London- based real estate.

Hedge Funds

Hedge fund returns were positive for the week which was not surprising given the index gains across the globe. Global funds were up 1.5% vs. 4.8% for the MSCI World, but YTD their loss is still only half of the index (-3.6% vs. -7.5%). Flows to global equities tilted towards net buying with shorts being covered in all regions and North America the most since June of last year. The buying in NA led to an increase in both gross and net leverage. On the sector level, the buying was spread across financials (banks), tech (hardware, software & semis) and ETFs. This past week was one of the strongest for North American crowded longs (Morgan Stanley prime book) as they posted a gain of 7.7%, one of the widest spreads in recent history to the S&P which was up 5%. Hedge funds were also net buyers in Europe and AxJ but the net buying was more short covering as they were also reducing longs, lowering gross exposure in both regions. In Europe, the de-grossing was mixed as quants drove the long selling (led by financials) and long/short drove the short covering led by EU discretionary and ETFs. In AxJ, most of the activity was driven by China and flows generally tracked the equity markets. Hedge funds were net sellers (long selling) on Monday and Tuesday then added back on the rebound Wednesday and Thursday (China).

Data Source: AGWEB Farm Journal, Bloomberg, CDC, CNBC, the Daily Shot HFR (returns have a two-day lag), Financial Times, Fund Fire, Morningstar, Pitchbook, Standard & Poor’s, US Census Bureau, the Wall Street Journal, Morgan Stanley and Goldman Sachs Capital Introduction and IR+M

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.