Economic Data Watch and Market Outlook

Investors this week experienced their own version of March Madness as they saw incredible moves in the bond markets. Investors, regulators, and central banks scrambled to manage risk and contain any ripple effects of the collapse of Silicon Valley Bank, and Signature Bank with First Republic Bank under significant pressure. On March 1st the bank’s stock closed at $122.50 and sank to $17.53 a share this past Wednesday. The stock closed on the week at $23.03 recovering slightly only to drop after it was reported that the bank was cutting its dividend. Some of the US’s largest banks each agreed to contribute a total of $30 billion to shore up First Republic’s capital reserves.

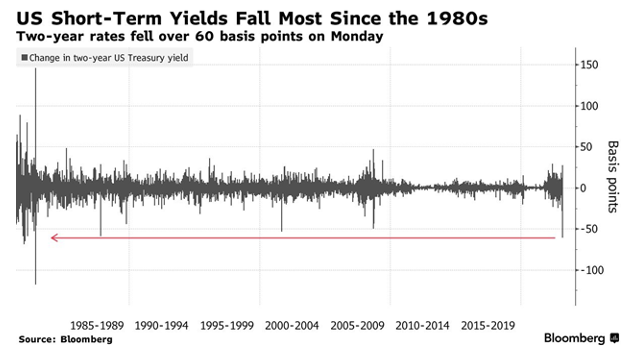

The instability, perceived or otherwise, created limited liquidity in Treasuries. The ICE BofA Move Index, is a measure of bond market volatility, and rose to its highest level since the bond market crash in March of 2020. The 10 year Treasury yield dropped from 3.72% to 3.43% on Friday and the two year from 4.49% to 3.83%.

As the weekend began, investors waited to see how Credit Suisse would fare as European regulators pushed for UBS to purchase the bank. Both banks had skepticism, but on Sunday afternoon it was announced, a deal was struck for UBS to purchase Credit Suisse for over $3B. It’s reported that Swiss Central Bank agreed to provide $100B in liquidity as part of the deal. Despite that, credit default swaps for UBS, the price of insuring UBS’s debt, soared over the weekend as the deal had been speculated to cost UBS $2B.

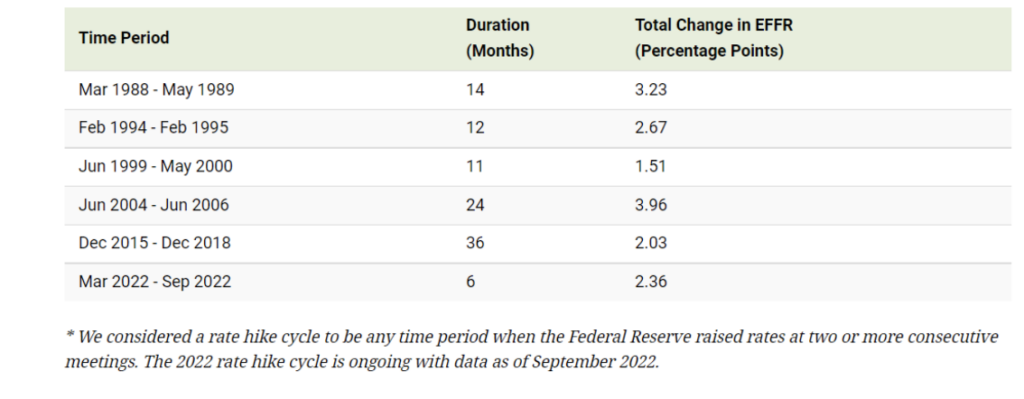

The velocity of Fed rate increases is the fastest since the 1988-1989 increases with similar increased occurred over a period of at least 11 months or longer as the World Economic Forum table below indicates.

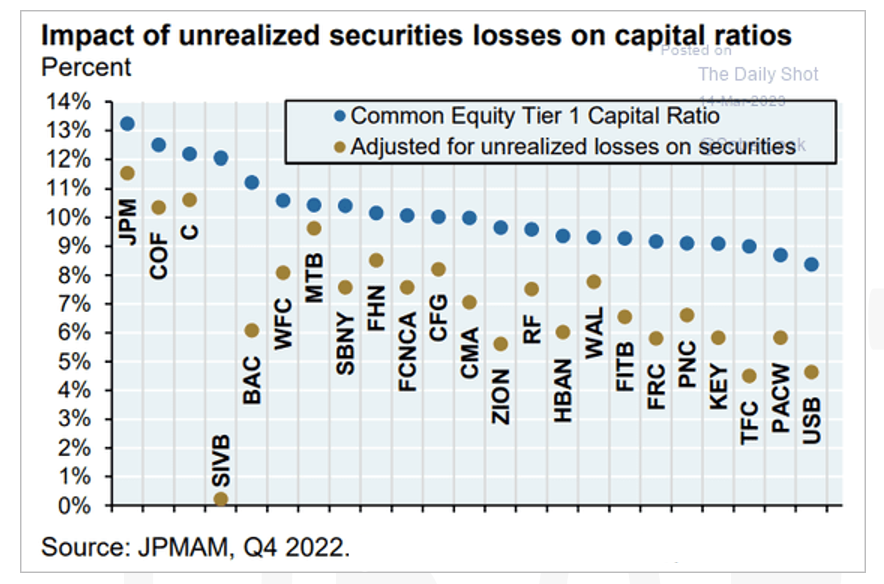

The rate and scope of change has caused the liquidity of some banks into question. Banks traditionally borrow short ( deposits) and lend long mortgages with reserves being invested in Treasuries. Even though banks tend to have duration mismatches, banks such as SIVB had limited risk management procedures. Investing in longer dated Treasuries to gain extra yield worked until it didn’t. As the Fed raised rates, the market value of those bonds were worth less. However, they are marked at par until a bank needs to sell them when, for example, when a large number of withdrawals are requested. When that happens, the bank needs to recognize the market value of the bonds, not the par value. The decrease in value requires them to adjust their reserve requirements. An inverted yield curve only serves to do more damage as investors choose to pull their money form deposit accounts and invest in short dated Treasuries adding fuel to the fire. JP Morgan looked at the balance sheets of several banks showing similar issues should significant amounts of capital be requested.

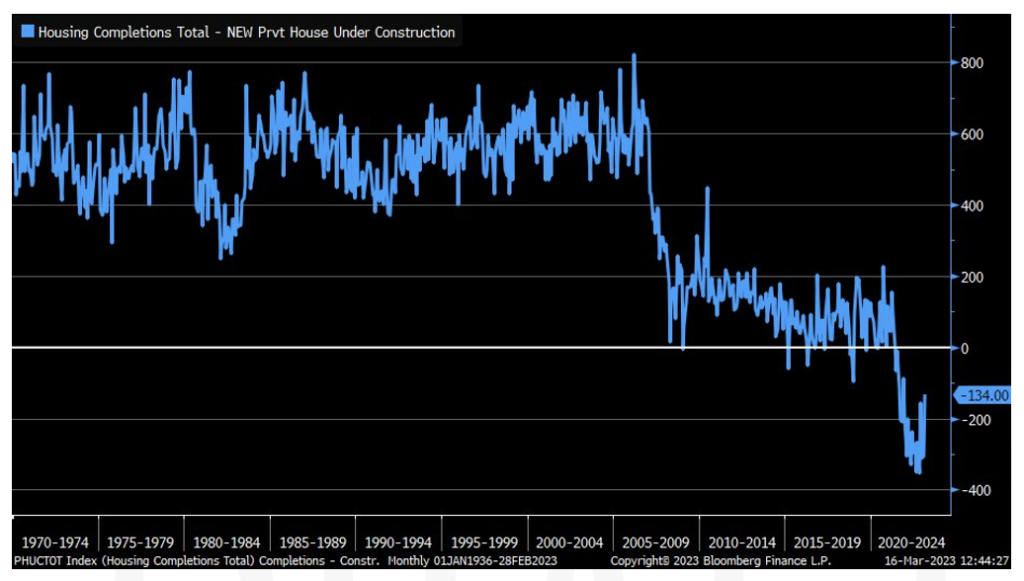

According to a new report from Redfin, median US Home sale prices fell 1.2% in February from a year ago. This is the first year over year decline in home prices since 2012. The number of homes sold is down 22.8% year over year. While still in negative territory, the number of units completed versus the number of units under construction has rebounded from over an 300K deficit to 134K deficit.

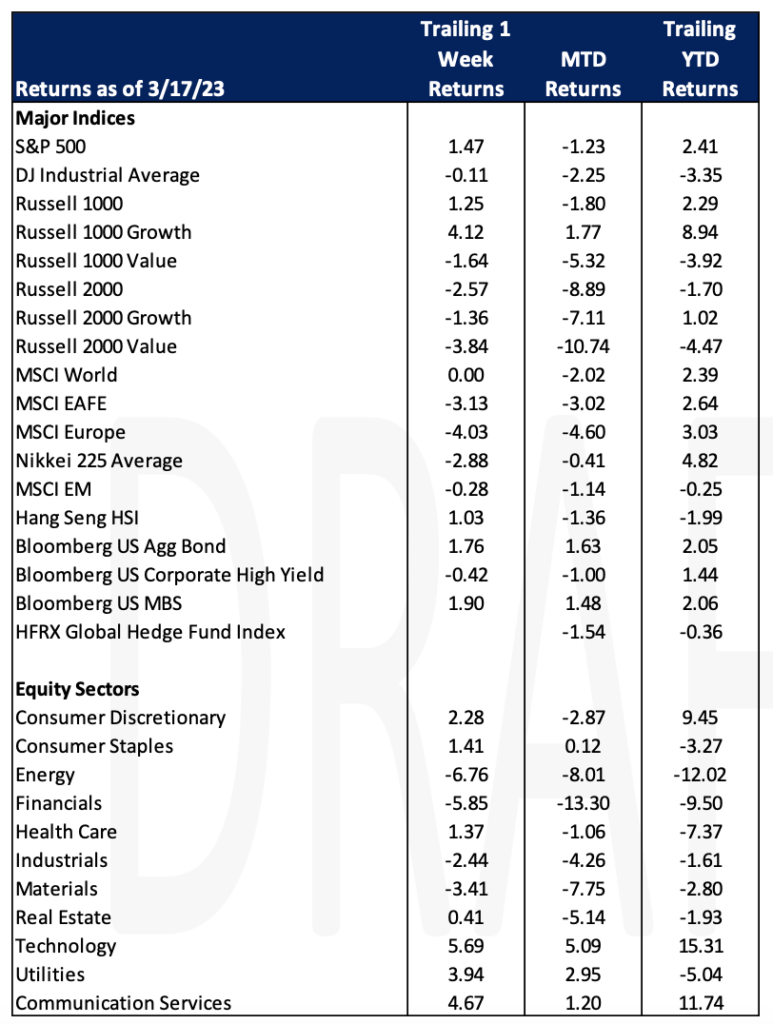

Equities

Equity markets were down Friday (Dow: -1.19%; S&P: -1.10%; Nasdaq: -0.74%; Russell 2000: -2.56%) but mixed for the week (Dow: -0.16%; S&P: +1.43%; Nasdaq: +4.41%; Russell 2000: -2.57%).

Technology stocks gained this week while the banking sector took a beating. Microsoft (MSFT: +12.40% / week) had their best week in nearly eight years while Apple (AAPL: +4.38% / week) is now up 25% in 2023. “With the uncertainty in the regional banking sector and a fairly good earning season for tech names, tech stocks have become the new safety trade with big tech names a major beneficiary” said Dan Ives, Wedbush analyst.

Unfortunately, banking stocks continue to worry investors Friday after First Republic (FRC: -32.80%) received a $30 billion dollar bank rescue plan from a consortium of banks including JPMorgan (JPM: -3.78%), Citigroup (C: -3.00% ), Bank of America (BAC: -3.97%) and Wells Fargo (WF: -1.69%). US Bancorp (USB: – 9.39%/day; -18.87%/week) had their worst week since 2009 while KeyCorp (KEY: -6.11%/day; -26.31%/week) had their largest weekly decline in over 3 years.

Performance of KBW Nasdaq Bank Index (BKX) and SPDR S&P Regional Banking ETF (KRE)

Annual reclassification of the GICS in the S&P Index happened at the close of trading Friday. Fourteen (14) companies’ GICS were reclassified which will change the composition of ~3% of the S&P 500 Index market cap. The biggest change is the reclassification of Visa, Mastercard and PayPal which increase the financial sector weighting while decreasing the information technology sector weighting. The change was announced in March of 2022 giving active fund managers ample time to consider rebalancing but passive strategies typically rebalance closer to the actual date, adding to the volatility in stocks this week. The SPY, State Street’s S&P 500 ETF, which is the world’s largest at $361B AUM, traded over 100 million shares on Friday. Its average volume is 89 million shares per day. Coincidentally, it saw inflows of $7.3B on Thursday as investors rushed back into risk assets. This was the highest daily inflow the ETF saw since 2020 when the Covid vaccine was announced in November 2020.

Noting above that Financials experienced the largest change, XLF, State Street’s Financial Sector ETF, declined 3.2% Friday after trading over 136 million shares. It’s average volume per day is slightly more than 49 million shares per day. The ETF saw inflows of $1.2B on Thursday and the SPDR S&P 500 Regional Banking ETF [KRE] saw inflows of $756M, the third largest day for the ETF, which saw record inflows of $1.1B on Tuesday.

European equity markets (FTSE 100: -1.01%; DAX: -1.33%; Euro STOXX 600: -1.21%) were down Friday and for the week (FTSE 100:

-5.35%; DAX: -4.29%; Euro STOXX 600: -3.84%). Regulators in Europe scrambled to stem fears of a banking contagions as Credit Suisse lost over a quarter its value over the last week (-25.94%).

Asian equity markets (Hang Seng: +1.64%; Nikkei: +1.20%; Shanghai -+0.73%) were up Friday but mixed for the week (Hang Seng: +1.18%; Nikkei: -2.88%; Shanghai -+0.63%). The number of stock market investors in China rose by more than 1.67 million in February as reported by China Securities Depository and Clearing Corporation Limited.

Fixed Income

Treasuries faced heavy volatility in the week following the Silicon Valley Bank crisis. Yields fell across the board for the week ending March 17th. Increased volume and thin liquidity led to the largest rally in US Treasuries since the 1980s with the 2-year Treasury yield falling 61 bps on Monday. The 2-year Treasury yield finished the week down 79 bps while the 10-year Treasury yield fell 31 bps, and the 30-year yield fell 1 bp. The Bloomberg US Aggregate Bond Index rose 1.76% week over week. While the Bloomberg US Corporate High Yield index fell -0.42%, and the Bloomberg US MBS index jumped 1.90%.

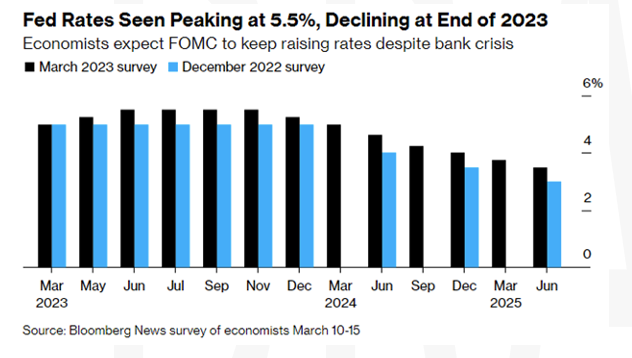

As noted above, the US Federal Reserve will announce a rate decision in the upcoming week. Consensus estimates were that the Fed could possibly raise rates 50 basis points less that two weeks ago. As concerns about banks’ stability came into question late last week, those estimates have changed. Bloomberg’s most recent survey indicates an increase of 25 basis points with some economists leaving open the possibility of a pause.

Hedge Funds As of Thursday March 16th

Hedge fund returns were mixed for the week with stocks recovering in the US but underperforming in Europe and Asia leading to a divergence in returns. Global funds underperformed the MSCI World returning -20 bps compared to +60 bps for the index. Americas-based long/short equity funds were up 20-30 bps, but the S&P 500 was up 260 bps in the same time frame. Digging deeper, funds benefitted from the rally in TMT stocks as TMT longs make up > 60% of the top crowded longs which were up 4.2% for the week. Exposure to energy on the long side and consumer on the short side mitigated the TMT gains. Outside NA, the average EU fund was down 50 bps (equity L/S -90 bps) but this was a decent sized out performance to the Euro STOXX 600 that was down 2.6% for the week. Funds in this region are running with a much lower gross and exposures to the region than historical numbers. Funds in the region also deviated from their US counterparts with exposure to the region in financials/banks as local funds had less net exposure where US-based funds were overweight to European financials. Asia-based hedge funds were flat on the week and China-only were up slightly even with the MSCI Asia -1.8%. Flows were mixed as North America buying was the highest in 12 months whereas the other regions were net sold. In NA, single-name buying was the highest since the last week of January 2021, of which 75% was from long additions (concentrated in financials and TMT) and the balance short covering. EU equities were the largest sold in about 9 months driven mostly by financials and energy. All cyclical sectors were net sold while defensive sectors were slightly net bought. In AxJ and Japan, funds were net sellers on both the long and short side.

Private Equity

After years of macroeconomic factors that led to increasingly higher valuations and revenue expansion, venture capital backed companies are faced with decreasing growth rates and falling valuations. According to PitchBook data sourced from Kruze Consulting, venture capital backed companies faced substantial revenue growth decline in 2022 as compared to 2021. Analysts also speculate that Q1 of 2023 will continue to show a steady decline in growth. This slowdown in revenue growth will likely mean VC backed companies will take even longer to achieve their pandemic-era sky high valuations and many of these companies may never reach these levels again if they are not top performers.

According to Kruze data, fintech startups saw the biggest reverse in revenue growth. The sector experienced 70% growth in 2022, however by the end of the year and into 2023 revenue shrank by 25% and continues to decrease. Additionally, the Ecommerce sector was also hit hard with revenue growth plummeting throughout 2022. Analysts attribute this decline as a likely result of consumer cost consciousness in the face of a looming recession and return to in-person shopping in a post COVID-19 world – a trend that will continue to impede growth in 2023. Alternatively, the healthcare sector, often seen as the most recession resilient sector, was not as severely affected and saw relatively stable growth throughout 2022 as compared to 2021.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Goldman Sachs, Market Watch, Morgan Stanley, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.