Economic Data Watch and Market Outlook

Generally, asset prices continued to slide over the last trading week as fallout from the Ukraine/Russia War continued to impact markets. Over 2.5 million Ukrainians, mostly women and children continue to flee their country and sanctions continue to strangle the Russian economy and its citizens.

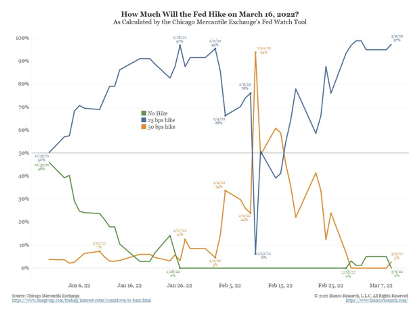

The US continues to evaluate the conflict in a more significant way. Congress passed its budget several days before the deadline while consumers have dipped into their savings ( the lowest since 2013 ) as inflationary pressures continue to mount. Those same pressures will play significantly into the Fed meeting this week. Expectations earlier this year suggested a 50 bps increase but given the geopolitical events, expectations have changed.

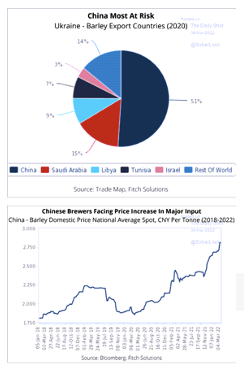

As we noted last week, we continue to see a rise in food prices as Russia and Ukraine are large suppliers of grain to the global economy. The Chart below shows the global share Ukraine has on barley production and its impact on Chinese brewers. China is one of the largest food importers.

As Major League Baseball’s lockout was resolved in recent days, expect the price of a beer to be higher at the ballpark this summer.

Equities

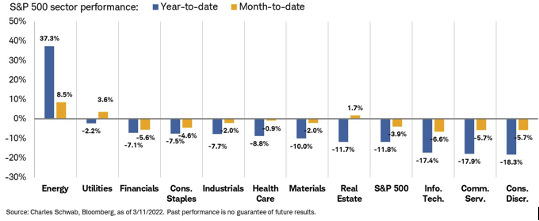

Equities were mixed last week as inflation fears, the Russia/Ukraine War, and oil prices continue to wreak havoc in the markets. The S&P 500 ended the week down -2.84% extending its year-to-date decline to -11.53%. The Dow closed down

-1.91% on the week – it’s fifth consecutive week of losses. Large-Cap growth stocks in the Russell 1000 Growth slid -3.59% while its Value counterpart ended the week down -2.22%. YTD, Large-Cap Growth is down -17.89%. Out of the 11 S&P 500 sectors, Consumer Staples (-5.90%), Technology (-3.79%), and Consumer Discretionary (-2.83%) were the largest losers of the week. The only sector posting a positive return was Energy posting a weekly return of 2.12%.

Globally, European stocks made a comeback and ended the week in positive territory posting a 2.71% return. EM equities were hit -5.08% and the MSCI World was down -1.90% on the week.

Fixed Income

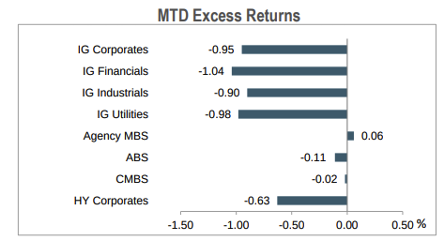

The combination of the US ban on Russian oil imports and the release of a new 40-year high consumer price index saw Treasury yields rise with the 10-year Treasury note climbing to 2% on Thursday. The 2-year note increased 26 basis points on the week to close at 1.75% and the 30-year bond rose to 2.36%. Municipal bond supply saw its highest level this week since December 2021 reaching $14 billion of new issuance. Investment grade bond issuance for the week was $18 billion higher than projected, reaching $68 billion. The high yield market was hesitant to roll out new bond issues, pricing only $2 billion on the week, and corporate spreads widened amid the current market volatility. The MBS market has been the winner thus far for March seeing the highest returns month to date across fixed income products. We continue to watch the ABS markets and positions across managers in aircraft leasing. Some planes helpd by Aeroflot are not being released as collateral. In a broader sense, concerns across emerging market bonds and their links to Russia have started to stoke fears of contagion.

The Bloomberg US Agg Total Return Index was down around 1.7% on the week while the Bloomberg US Credit Total Return Index was down roughly 2.4%. The Federal Open Market Committee will be meeting next week to discuss current market conditions, employment outlook, asset price stability, and monetary policy.

Hedge Funds

Hedge funds held in this past week amidst heightened volatility with the average global hedge fund down ~ 20 bps compared to -110 bps for the MSCI World. Americas based hedge funds were the relative leader, up 10 bps compared to a -160 bps for the S&P. Crowded shorts in North American equities were a positive driver this week, down -2.3% through Thursday. That said, crowded longs in Asian equities weighed on performance, down 5.5% in the same time period. Hedge funds were net sellers in all regions this week driven by long selling for the 2nd consecutive week. Looking back to 2020, the long selling in global equities the past 2 weeks has trailed only the final week of January 2021 and March 2020. The long selling was led by US tech, AxJ tech, industrials and consumer discretionary (both all regions). On the short side of the book in North America, this was the first week all year hedge funds covered shorts on a net basis and the largest since June 2021. Both gross and net leverage fell this past week. For fundamental long/short managers, growth exposure continues to decline and value exposure continues increase.

Private Equity

After reaching record highs in 2021, the flood of US capital into European startups is anticipated to accelerate yet again in 2022. For the first time in history, investment in European and Israeli startups surpassed the €100 billion mark.

Analysts attribute the increased presence of US investors participating in deals across the pond as one of the most significant drivers of growth. In 2021 US investors participated in 2,210 deals worth a total of €70.7 billion; a 50% increase in the number of deals and a 194% increase in the total worth of deals compared to 2020.

Historically, valuations in Europe have been lower than they are in more established ecosystems such as the United States. However, the increase in US investors has begun to increase both European deal sizes and valuations. The median European round with US participation nearly doubled in 2021 to €38 million compared to €19.4 million in 2020. On the contrary, deals with no US investors saw a median of only €6.3 million in 2021.

Analysts suspect given the rise and abundance of investable capital, US participation in European startups will continue to grow as VCs look for value and solid returns.

Data Source: AGWEB Farm Journal, Bloomberg, CDC, CNBC, the Daily Shot HFR (returns have a two-day lag), Financial Times, Fund Fire, Morningstar, Pitchbook, Standard & Poor’s, US Census Bureau, the Wall Street Journal, Morgan Stanley and Goldman Sachs Capital Introduction and IR+M

| This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes. |