Economic Data Watch and Market Outlook

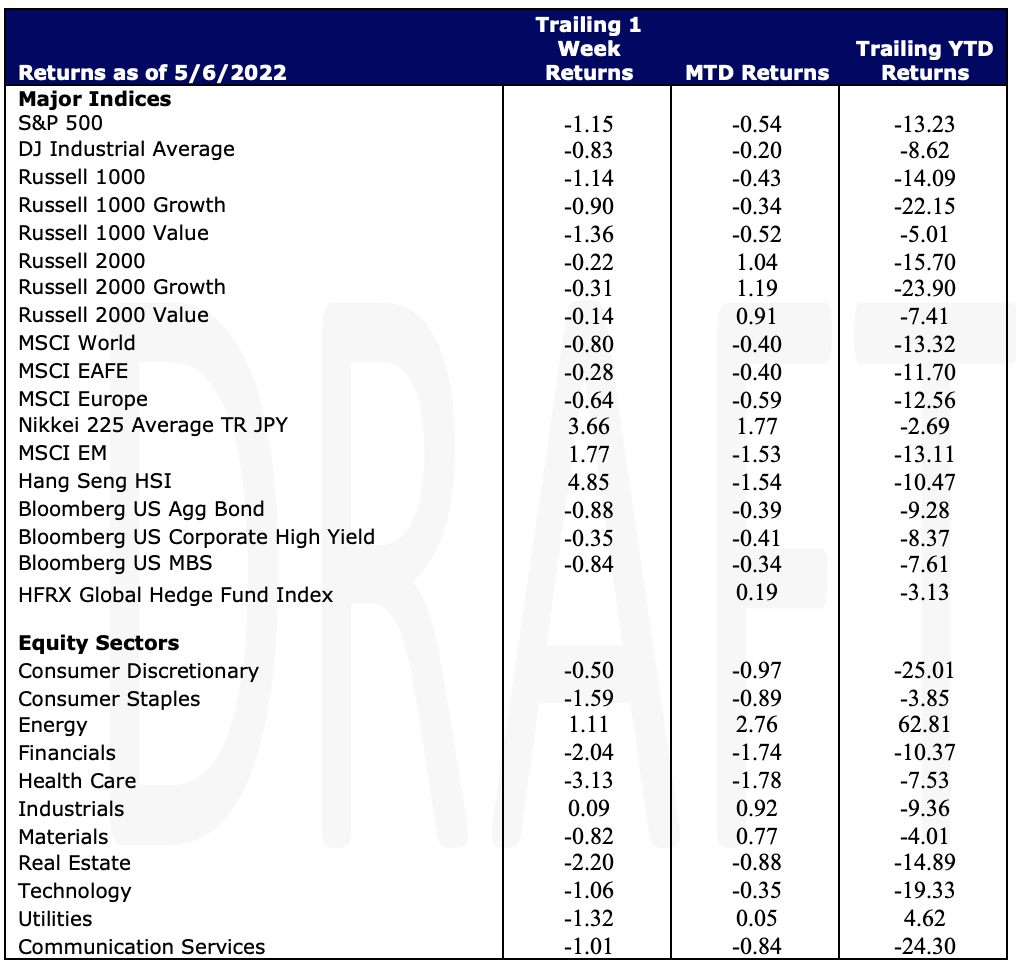

Global stocks were down during the week as the MSCI EAFE Index fell 29 basis points while the S&P 500, in the shortened trading week, fell 1.15%. The US Aggregate Bond index fell 88 basis points.

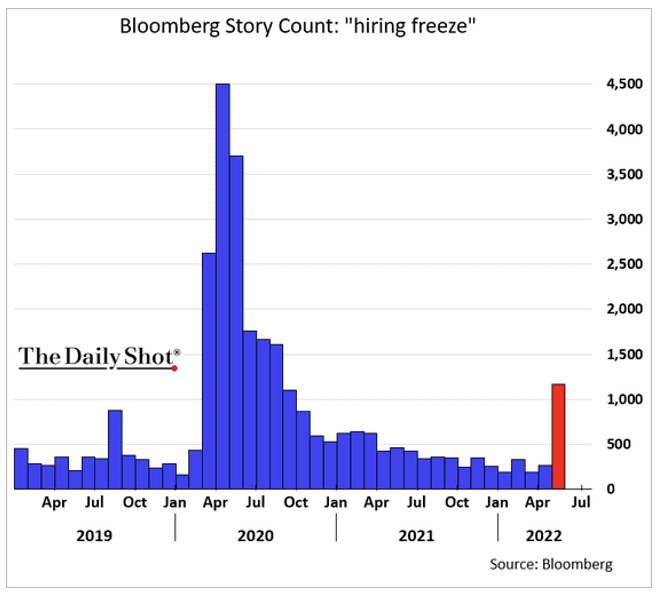

Payroll data released during the week came in at 390,000 versus an estimate of 320,000 with the biggest gains seen in Leisure and Hospitality, the Professional Services sector, and Construction. Losses were mostly in Retail. The labor participation rate also increased, albeit slightly. We are mindful that these numbers are through the rearview mirror and we are watching closely how employment data will play out in the coming months. Perhaps a media bias but the Bloomberg’s story count containing “hiring freeze” has increased.

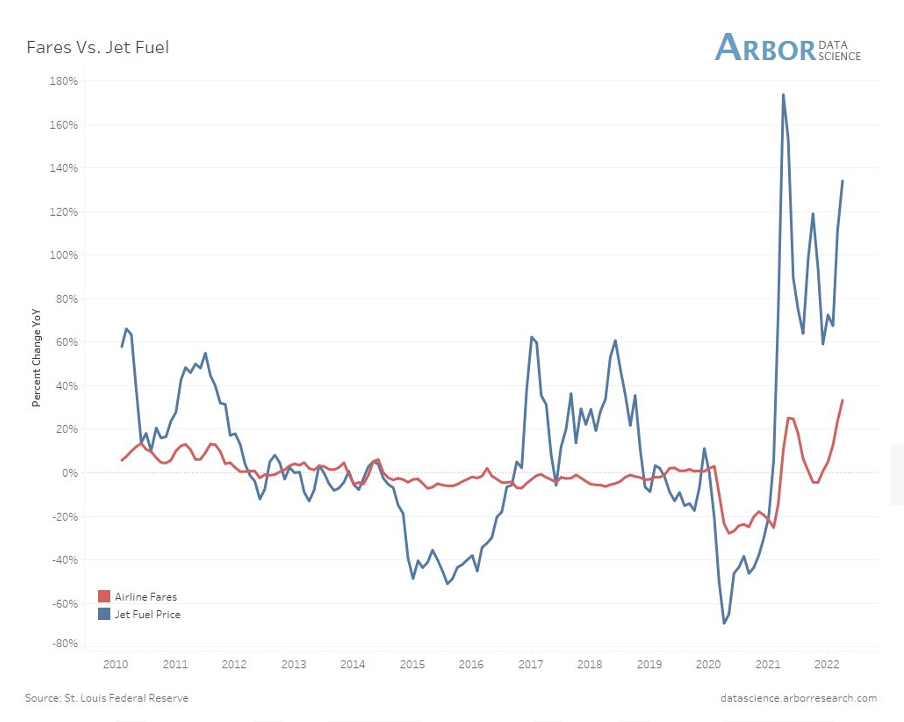

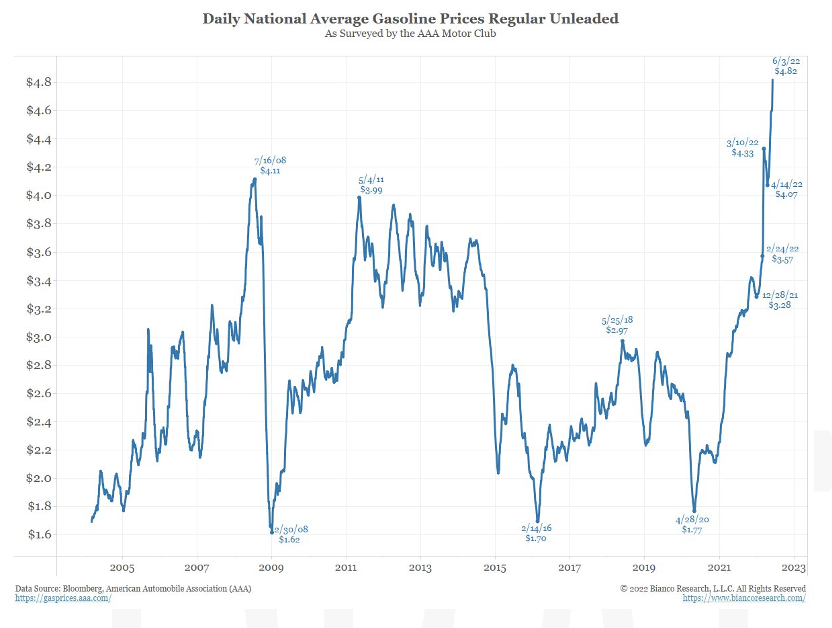

The consumer continues to spend as schools begin their summer breaks, families are embarking on vacations despite COVID lingering. Air travel remains strong and trending upward and gas prices continue to climb.

Notable events such as the Ukraine/Russia war and higher inflation have caused the rise in gas prices which, adjusted for inflation hit a 10-year high on Memorial Day and jumped higher during the week (currently as of the writing of this note the averages stand at $4.84 /gal as per AAA). Refineries switching to their summer blend from late April to June have also caused slight price increases. Chevron’s CEO noted during the week that there is no demand destruction and that their production is at full capacity so the consumer should not expect relief in the near future.

In the US this week, reports will shed light on Import/Export data, mortgages, fossil fuel inventories, and Michigan’s Consumer Sentiment Survey data but all eyes will be on CPI data released on Friday. Consensus has the year-over-year rate at 5.9%, ticking down from 6.2% the previous month.

Equities

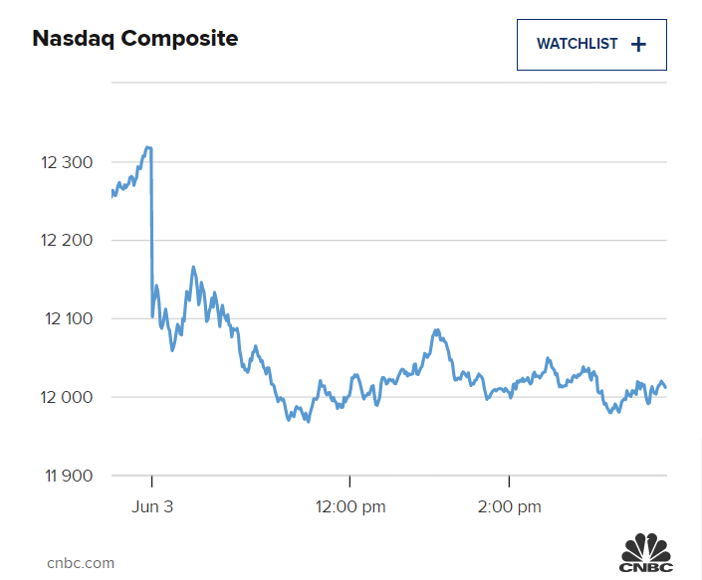

US equity markets ended the week with losses after investors worried over fears of inflation and higher interest rates could possibly tip the economy into a recession. The losses come a week after a strong rally in the markets, which came after several consecutive losing weeks. The S&P 500 ended the week down -1.15% while the Dow Jones logged -0.83% for the week and the tech-heavy Nasdaq lost a little over 1%. May’s stronger than expected labor report sent stocks down on Friday to close the week.

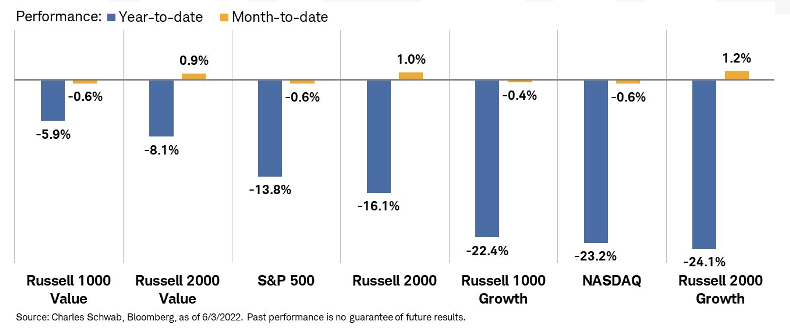

Investors fear that higher interest rates could slow the economy too much as well as higher yields hampering the value of future earnings making stocks in general look less attractive – growth and tech stocks in particular, especially the larger cap names. Note the performance of Growth versus Value on a year-to-date basis. All sectors are negative, but Growth has continued to lag.

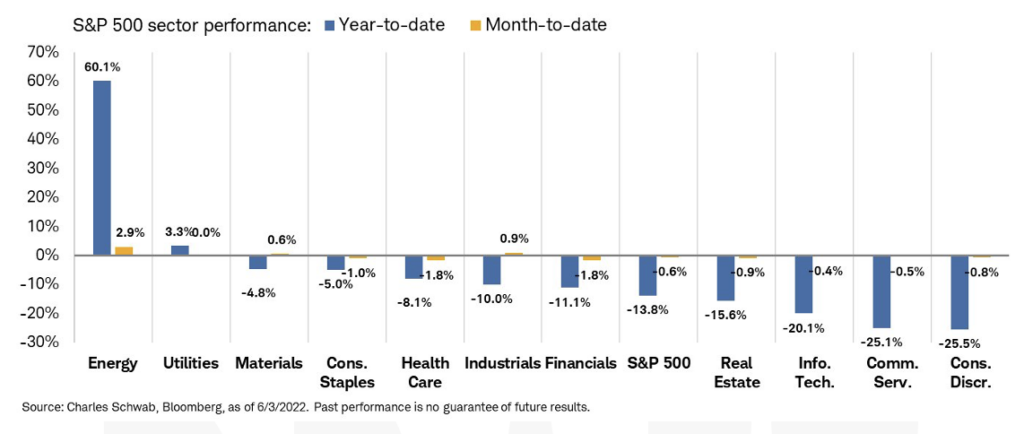

Tech shares retreated Friday as a result amid rising rates ending the week down -1.06%. In other tech headlines, Tesla also reported the company needs to pause hiring worldwide and cut its workforce by about 10%. However, Healthcare -3.13%, Financials -2.04%, and Real Estate -2.20% led the losses out of the 11 S&P 500 sectors.

Globally, stocks ended the week mixed – the MSCI World loss -0.80% on the week while Europe ended down -0.64%, Emerging Markets gained +1.77%, and Japan rallied 3.66%

Fixed Income

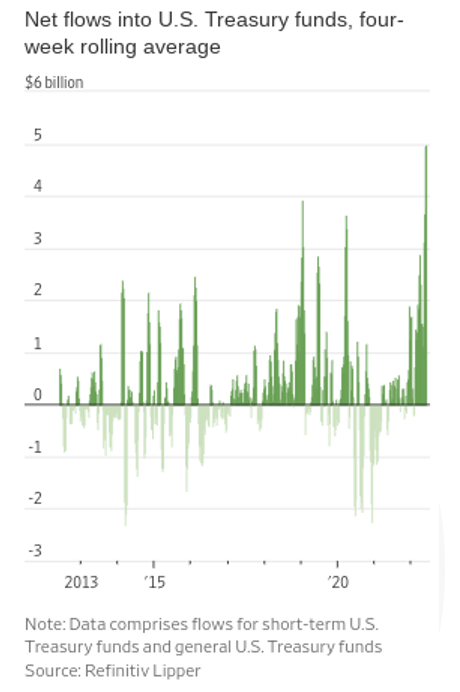

Treasury yields jumped this week after a two-week decline which has eased pain seen in the market to start the year. To end the week the 2-year Treasury note reached 2.68%, the 10-year Treasury note ended at 2.94%, and the 30-year Treasury bond ended the week at 3.10%. Due to the uncertainty in the equity market as of late, investors have bought a net $20 billion into mutual and exchange-traded funds that buy US Treasury’s over a 4-week period ending May 25th. This is the largest inflow over a four-week span in 29 years. Investors also bought $928 million of two-year notes at a recent government-debt auction, buying bonds themselves versus funds. Expectations around the Fed’s approach on aggressively raising rates have driven down prices of existing bonds, making this one of the worst starts of the year for the bond market. In turn, higher yields on new Treasuries have brought appeal to investors who think the prices will not decrease significantly from here. The increase in inflows to shorter term Treasuries does seem that a sizable number of investors view rates stabilizing a bit on the shorter end of the curve. It is hard to call a bottom, but it does seem a consensus from recent inflows to 2-year notes, which saw the largest interest in the most recent auction, in nearly 15 years.

Net inflows into Treasury bond funds have totaled $52 billion this year but outflows from core and core-plus have been $28 billion which is odd when you think about what makes up a portion of their book, Treasuries. Most agree that short-term rates will continue to rise as the Fed continues its current path but a big factor in this is if inflation has peaked. If so, we could see the Fed ease up towards the end of this year which would help relieve some of the pain the bond market has seen in 2022. On a positive note, US corporate bonds posted its first positive monthly return year-to-date which could be attributed to the stated easing inflation consensus. Total returns on the ICE BofA US Corporate Index, which tracks dollar-denominated investment-grade corporate debt, returned 0.55% in May which is the first positive number since November 2021. The total return for ICE BofA US High Yield Index returned 0.27% which is the first positive monthly return since December 2021. High Yield spreads have widened by roughly 30 bps but last week they dropped by over 70 bps from the peak of 494 bps which is the highest since November 2020. May seemed to be a bit of fresh air for the bond market as things began to slightly stabilize. If inflation eases, and the Fed does tone back the aggressive rate hikes that the market has already priced in, we can expect a rebound in both equities and the bond market in the latter half of this year.

Hedge Funds (data as of Thursday June 2)

Hedge funds were able to capture a majority of the upside to their relevant indices in all geographies. The only subset of that was European long/short equity funds which were down slightly for the week. The top 50 crowded longs were the main drivers of performance this week in all regions, especially Asia and North America where crowded longs outperformed their respective indices by 330 bps and 170 bps respectively. In North America, hedge funds re-engaged on the short side in all sectors but industrials. Energy was the most net sold sector with ~ 80/20 split between short additions and long sales. At the factor level, North American hedge funds were sellers of dividend yield, momentum and value and buyers of growth, size and quality. Outside of North America, hedge funds were net sellers of AxJ equities. There was buying in healthcare, tech and staples, but those buys did not outpace sales in other sectors. Turning to Europe, hedge funds were net buyers for the week, with the bulk coming from short covering. Lastly, Japan saw the largest week of buying since March 2020 led by consumer sectors.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.