Economic Data Watch and Market Outlook

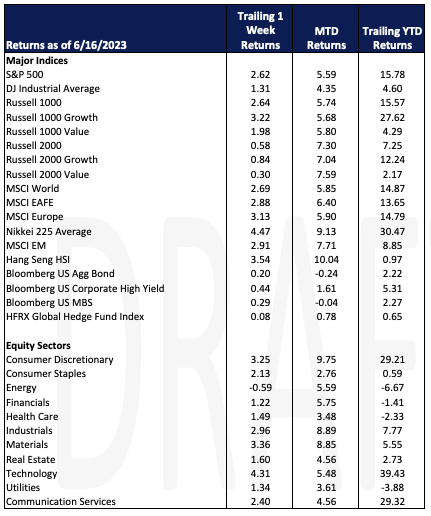

US Federal Reserve Chairman Powell noted on Wednesday that the Fed would “skip” a rate change at this past week’s June meeting to evaluate economic data. Markets had largely expected this as the Fed made several comments leading up to the meeting that it would likely pause. However, Powell surprised the markets by stating in his press conference that the Fed is likely to raise rates two more times this year. Expectations were that the Fed would cut this year which sent stocks down initially but equity markets for the week rose over 2.5% (MSCI World up 2.69% and S&P 500 up 2.62%) while bonds were up slightly (Bloomberg Agg up 0.20%)

The consumer remains very resilient thus far and remains optimistic. Preliminary data from the University of Michigan’s consumer survey revealed an impressive 8% surge in consumer sentiment, reaching its highest level in four months at 63.9. Economists had predicted a more modest improvement to 60, following a 7% decline to 59.2 in May. The increase in consumer sentiment can be attributed to a greater sense of optimism arising from the easing of inflation and the successful resolution of the debt ceiling crisis by policymakers.

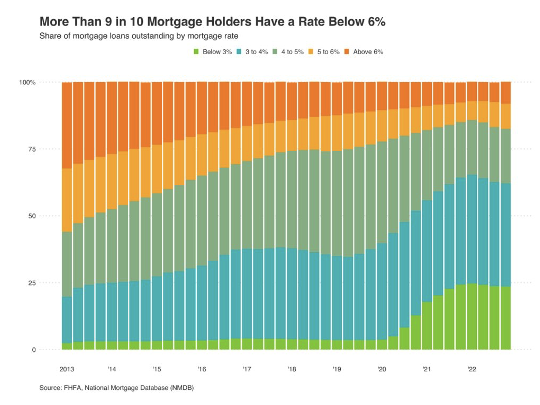

Data, points to some reason for optimism. Redfin reported that nine out of ten mortgage holders in the US have a rate below 5%. One in ten have a mortgage below 3%.

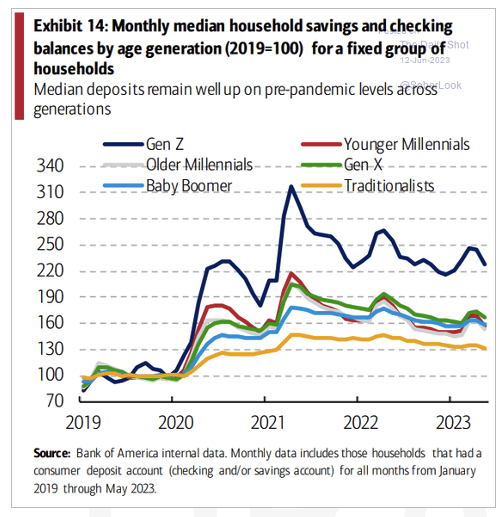

Further, a recent Bank of America survey notes that household savings rates across their accounts are still above pre-pandemic levels.

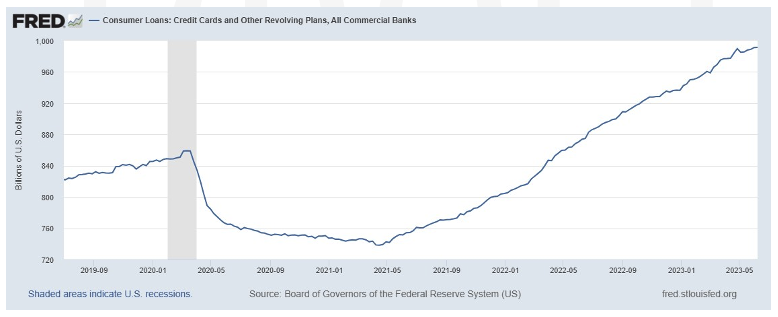

While bank balances may have increased, the NY Fed reported that household debt continued to rise to $17.05 trillion in the first quarter. While autos, housing, student loan balances increased at moderate levels, consumer revolving credit such as credit card also increased. While employment remains solid, hiring has slowed. We are closely watching consumer credit defaults and changes in bank loan loss reserves as employment rates change.

The upcoming trading week will be abbreviated as the US observed Juneteenth on Monday. Weekly housing data will be available on Wednesday and jobless claims on Thursday. We’ll get more insights on the Fed’s thinking as Powell testifies before Congress and multiple FOMC members and governors are set to speak at various events.

Equities

As noted above global markets surged during the week, despite the Fed noting that cuts will likely not occur this year or for the foreseeable future. The MSCI World advanced 2.69% as European markets surge 3.13%, the Nikkei rose 4.22%, and the S&P 500 rose 2.62%.

Within the US, large growth stocks led the way (Russell 1000 Growth up 3.22%) with big tech and artificial intelligence stocks leading the way. Consumer discretionary and technology stocks rose 3.25% and 4.31% respectively. Utilities (1.34%), financials (1.22%) and energy (-0.59%) stocks lagged the broader market. The Russell 1000 Value rose 1.98%

US stock returns continued to be biased toward larger cap names as the Russell 2000 advanced only 0.58% with no significant distinction between growth and value.

Expect some equity volatility this week as the Russell will reconstitute its benchmarks based on April 28th’s “Rank Day” which announces the recalibration of the benchmark based on market cap. Most traders and exchange traded funds have already positioned their portfolios, but index funds will reposition their portfolios as of Friday June 23rd.

Fixed Income

The two-year Treasury yield gained 12 bps through the week while the 10-year Treasury yield gained two bps and the

30-year Treasury fell three bps. Major bond indices had a good week as the Bloomberg US Agg Bond Index rose 0.20%, the Bloomberg US Corporate High Yield Index rose 0.44%, and the Bloomberg US MBS Index rose 0.29%.

The Federal Reserve paused rate hikes on Wednesday with Jerome Powell saying that nearly all of the Fed officials expect that it will be appropriate to raise interest rates more in 2023 to bring down inflation. He also made it clear that, “not a single person on the committee wrote down a rate cut this year, nor [does he] think it is at all likely to be appropriate.”

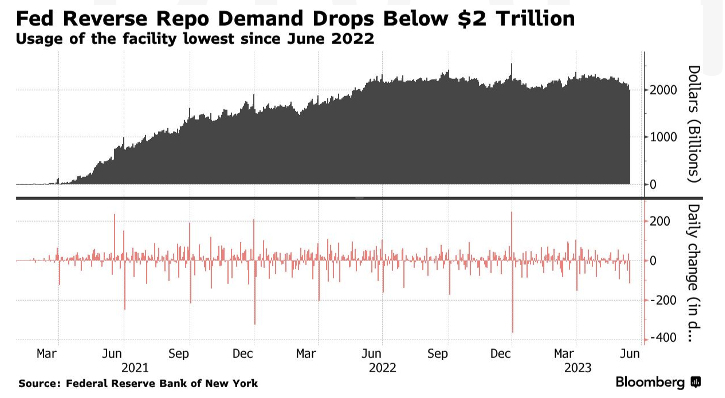

Investors are withdrawing money from a major Federal Reserve facility, causing the amount of money parked there to drop below $2 trillion for the first time in over a year. The facility, called the Overnight Reverse Repurchase Agreement Facility, allows counterparties such as money-market funds to place cash with the Central Bank. This decline indicates that investors are being attracted to other investments, particularly Treasury Bills. The usage of the facility has decreased by over half a trillion dollars since its peak in December 2022. Money-market funds are taking advantage of the growing issuance of Treasury Bills and the Federal Reserve’s pause in interest rate hikes. Previously, investors were hesitant to allocate their assets too far into the future due to concerns about government defaults and the ability to respond to rate hikes. The decline in usage of the facility reflects a decrease in concentration in ultra-short or overnight investments. Fed Chair Jerome Powell said that it is unlikely that reserves will become scarce in the near term due to the abundance of excess liquidity.

Hedge Funds

Hedge Funds (HFs) were once again able to post gains for the week ending June 15th with equities continuing to rally. US and Asia-based managers led all strategies in terms of performance. The average global fund was +80 bps which compares to the MSCI AC World Index +2.8%. Americas based long/short (L/S) equity funds were among the top performers as they posted gains of +1.3%, capturing slightly over 40% of the S&P’s ~3% gains WTD. While the returns this month have been positive, shorts have continued to weigh on L/S alpha, with the top 50 crowded shorts in NA +4.5% since the start of the week – they are also up close to 9% MTD vs. longs up 6.3%, making this one of the more challenging recent months for short alpha. In other regions, the average EU-based fund was up ~+25 bps for the week, leaving them up +1.1% and +3.9% on a MTD and YTD respectively (this compares to the Euro STOXX 600 Index +2.9% MTD and +12.0% YTD). As mentioned above, Asia-based HFs were among the stronger performers this past week, with L/S funds based in the region posting gains of +1.6% and China-focused L/S funds up even more at +2.1%. A driver of the strong performance for L/S funds in the region has been the crowded longs, which have rallied over 13% in the month of June (vs. shorts up +8.8%). The most notable trend this past week across global equities has been HFs continuing to cover shorts across all regions. In NA, in addition to covering short positions, HFs were also actively trimming long exposure, albeit in much smaller amounts, resulting in HFs being net buyers of NA equities. The covering was spread across several sectors/industries, though TMT-related industries ultimately ranked as the most covered. There was also saw small amounts of long selling, though most ended the week having been bought on a net basis. The long selling was more concentrated within cyclical pockets of the market with funds trimming long exposure within consumer discretionary, energy and materials. Healthcare and consumer staples were also slightly net sold, most of which was driven by HFs selling longs. In other regions, HFs added to longs in small amounts in Europe, Asia ex-Japan, and Japan, but the net buying of equities in all three regions was largely driven by HFs covering shorts with net exposure reaching its highest level in Japan since July 2021. Macro products were net bought, the most in three months.

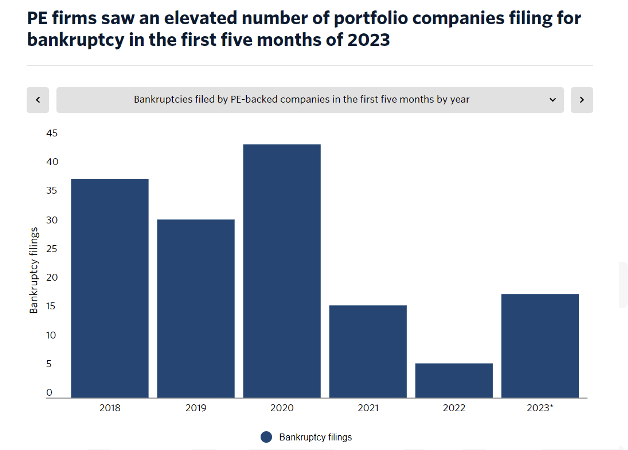

Private Equity

There has been an uptick in private equity-backed companies seeking bankruptcy protection which could be signaling a stress to these businesses. The credit cycle has put some stress on overextended borrowers which is the main reason this is seeing a rise. Per Pitchbook, through May of 2023, there has been at least 18 PE-backed companies that filed for bankruptcy in the US which marks the highest number since the start of the pandemic. Many of these borrowers filed for bankruptcy and they had more than $500 million in liabilities. 2023 has seen a handful of factors adding to these over levered companies that are now unable to pay off their debt. This can be attributed to the rate to borrow was near zero to start 2022 and rose in a year’s time to 5%-5.25% in May 2023 coupled with supply chain issues and inflation pressures. The collapse of Silicon Valley bank, Signature Bank, and First Republic has motivated banks to be a lot more stringent around borrowing standards leaving distressed firms especially out to seek alternative funding. Private equity and private credit firms should have a good amount of dry powder to support these stressed portfolio companies but as we have seen the market trend downwards firms are becoming more selective to which companies they are willing to give capital too.

Authors:

Jon Chesshire, Managing Director, Head of Research

Elisa Mailman, Managing Director, Head of Alternatives

Mike McNamara, Analyst

Sam Friedberg, Summer Associate

Data Source: Apollo, Barron’s, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.