Economic Data Watch and Market Outlook

Global equities advanced slightly for the week (S&P 500 +0.41% and the MSCI World +0.45%). Bonds, represented by the Bloomberg Aggregate Bond Index fell slightly, 0.15%. Market strategists are considering the risks currently in the market with some strategists raising their return estimates for the S&P 500, presuming that return will come from a broader base.

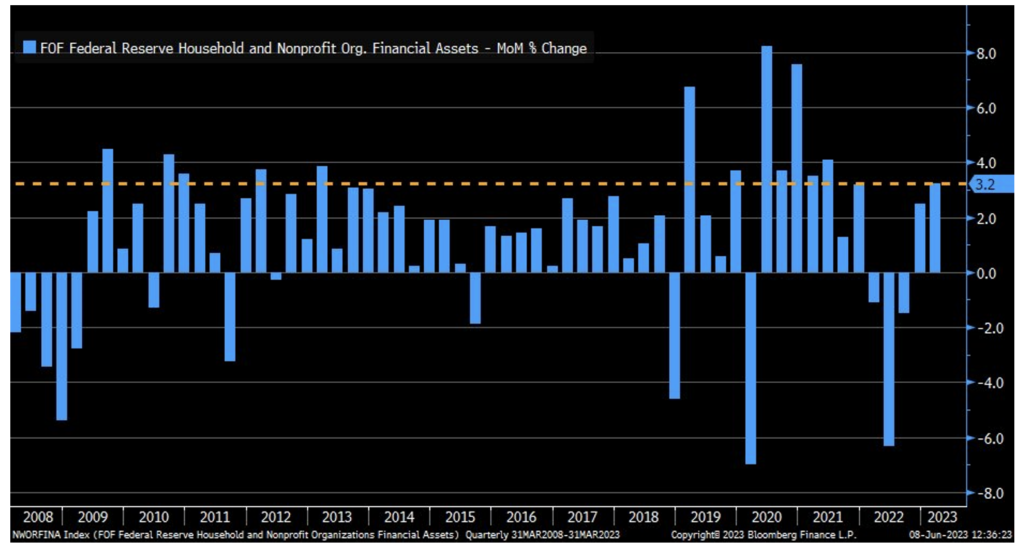

Part of the logic behind being more optimistic is due to the resilience of the economy. Employment continues to defy consensus, earnings have for the most part been solid, the consumer continues to spend, and residential housing continues to do well despite the rise in rates. Further, while consumer debt levels are high, as we have written about in previous notes, the Fed recently reported that the consumers’ financial assets have risen.

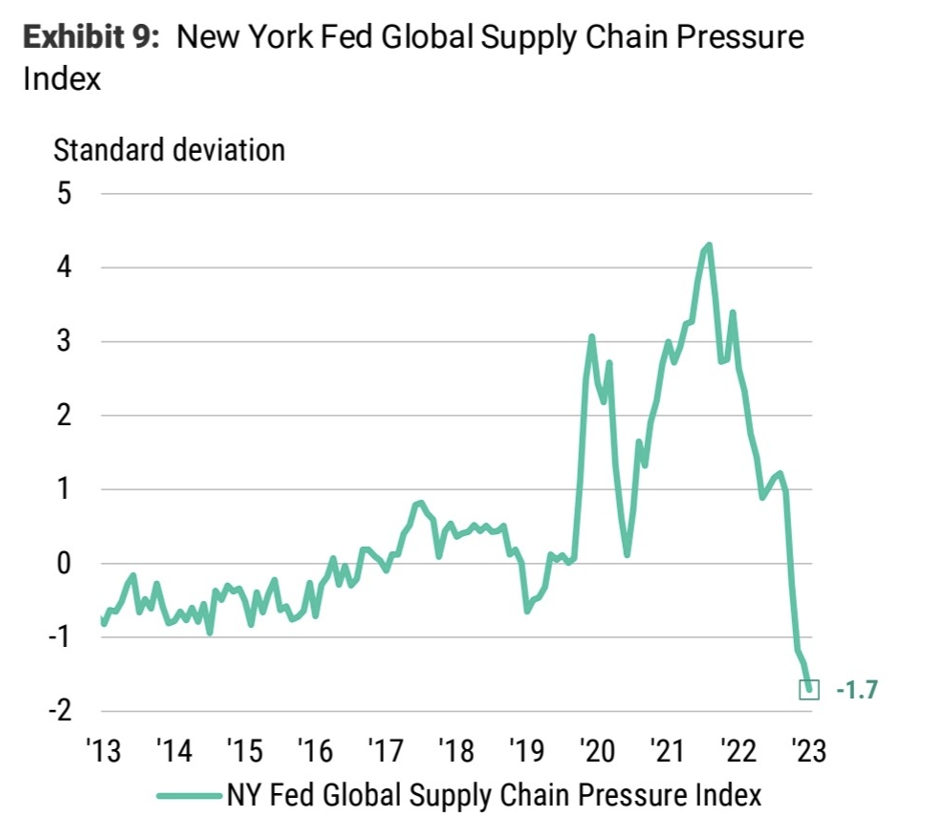

Some of the increased assets could be because inflation in some key areas seems to be waning. A recent note from Morgan Stanley highlighted how shipping costs have decreased to pre-Covid levels.

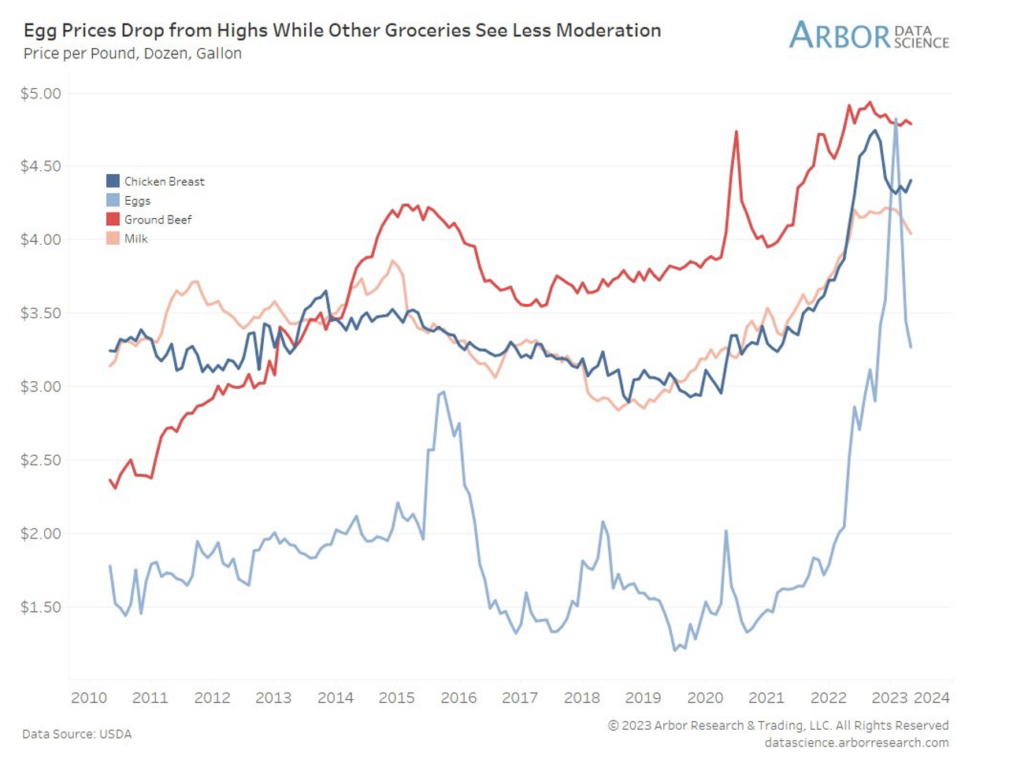

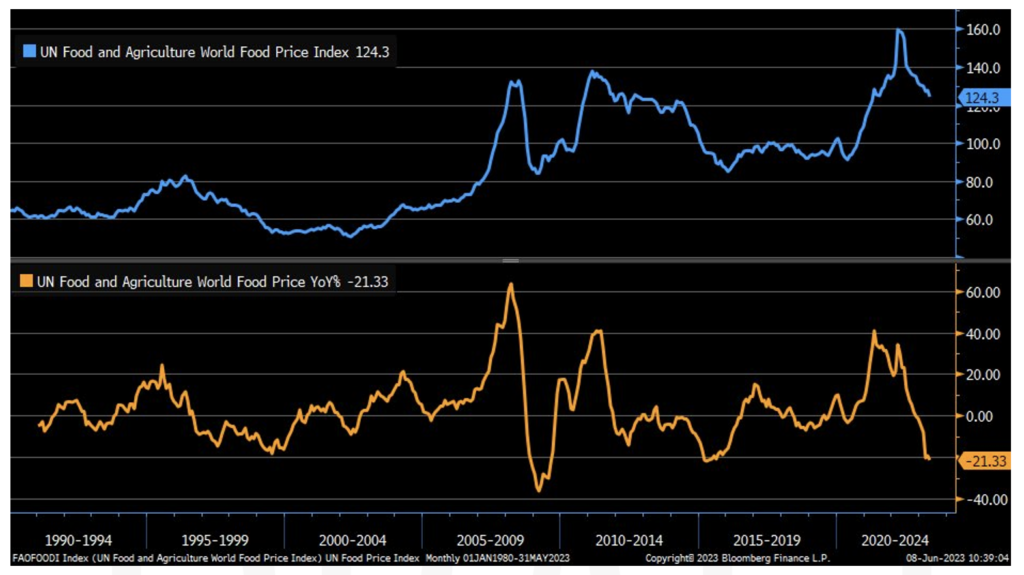

This has helped food prices on average decline globally with the exception of a few soft commodities. Coffee, chocolate, sugar, and orange juice have surged approximately 24%. Declines in protein prices have been somewhat muted but egg prices have dropped significantly as the effects of Avian flu have dissipated. As a whole, the broader agricultural index has fallen 3%, primarily weighed down by falling wheat and corn prices.

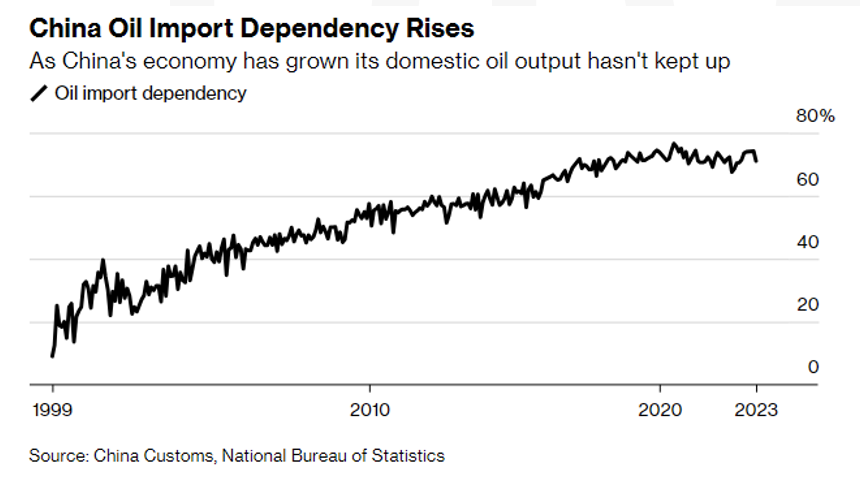

Early in the week Saudi Arabia announced that they would cut production by one million barrels per day as part of a broader agreement with OPEC members while quietly, China has been increasing its own drilling production. Approximately 60% of its new oil production is coming from its own offshore drilling rigs as onshore wells on its soil are becoming scarce. Currently China is the largest importer of oil in the world receiving 70% of its oil supplies from overseas. In 1999, this number was approximately 10%.

The upcoming week is a big week for data releases. On Tuesday, US Core CPI will be reported with consensus at 0.4% for May. PPI will be reported on Wednesday with estimates for the month being 0.2%. The Fed has entered its quiet period so we will likely see a fair amount of market speculation ahead of the June 14th meeting. Jobless Claims, New York and Philadelphia Manufacturing, and Retail Sales data will also be reported. Outside of the US, the UK will repot GDP results, the EU will report inflation data and Japan will announce an interest rate decision.

The highlight however comes on Wednesday at 2pm when the Fed will announce its decision on interest rates. Consensus is that the Committee will “skip” to analyze the data and resume on its path to taming inflation later in the summer.

Equities

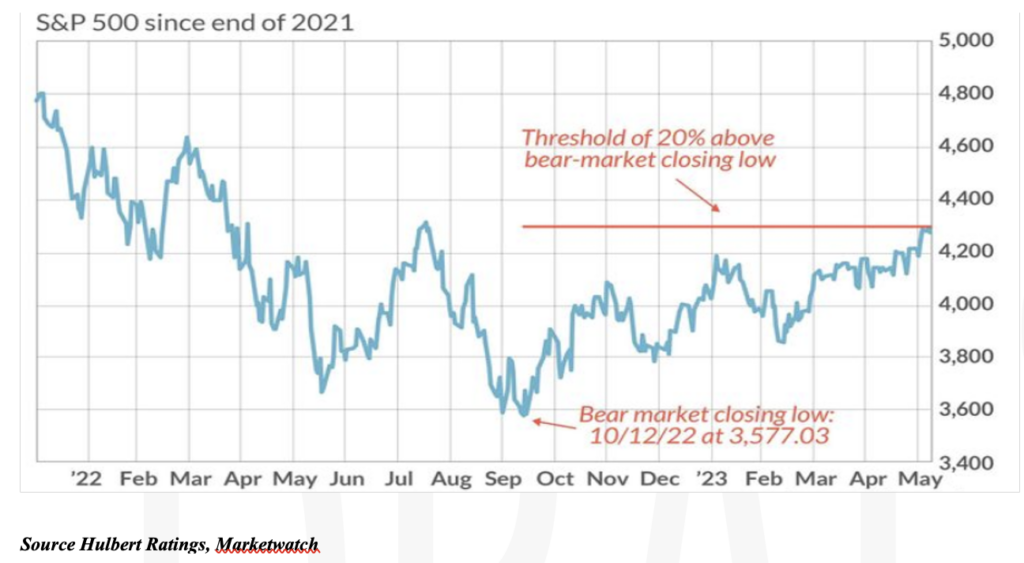

US equity markets gained slightly this week (Dow: +0.36%; S&P: +0.41%; Nasdaq: +0.14%). The S&P has had its fourth week of gains and closed more than 20% above its October lows, considered by many on Wall Street as potentially the beginnings of a bull market.

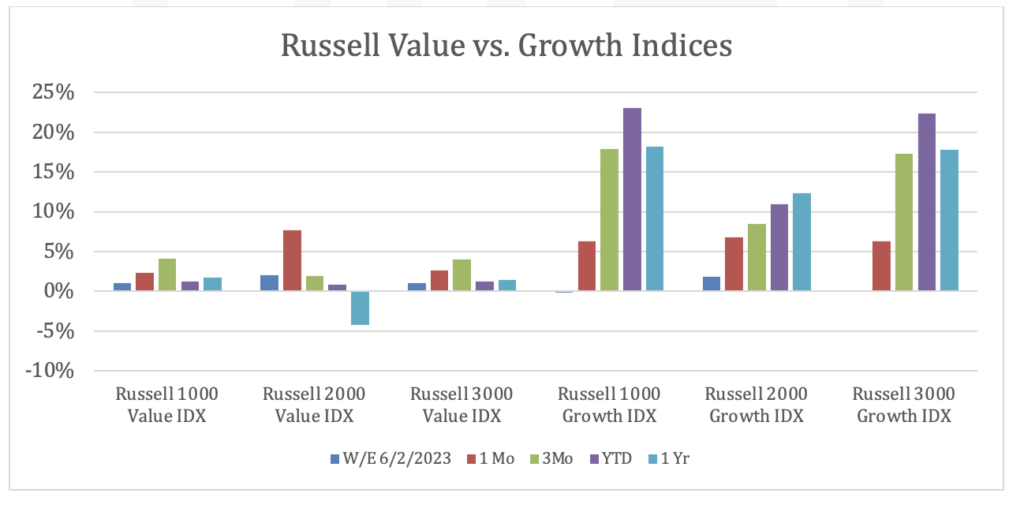

The Russell 2000 Growth and Value indices both gained this week, up 1.81% and 2.05% respectively, the Russell 1000 / 3000 Growth declined 0.12% and 0.02% respectively and the Russell 1000 Value rose 1.03% and the Russell 3000 jumped 1.05%.

Source: Marketwatch

In other news this week: S&P Dow Jones Indices announced this week that Palo Alto Networks (PANW) would be included in S&P 500 Index, replacing DISH Network. PANW gained modestly while DISH lost 10.55% during the week.

Boeing found an issue linked to a stabilizing bracket that could delay deliveries of its 787 Dreamliner. The US FAA agreed with Boeing’s safety assessment and would issue “no new airworthiness certificates for the 787 until the matter is addressed to its satisfaction.” The stock advanced 1.88 % on the week.

GM (GM: +5.73% / week) and Ford (F: +10.98% / week) agreed to adapt their electric vehicles to Tesla’s (TSLA: +14.21% / week) superchargers potentially making them the industry standard in the US.

European markets (FTSE 100: -0.62%; DAX: -0.64%; Euro STOXX 600: -0.46%) were slightly down this week. In France, food shoppers should pay less for their food in the next month as Finance Minister Bruno LeMaire secured a pledge from 75 food companies, such as Unilever (UNI: -1.75%), Nestle (NESN: -2.17%), Danone (DANO: – 4.57%), which make 80% of what the French eat, to cut prices on products. Note the chart in the above section that global food prices are off over 21% year over year.

Asian markets (Hang Seng: +2.36%; Nikkei: +2.35%; Shanghai: +0.04%) were up for the week.

Fixed Income

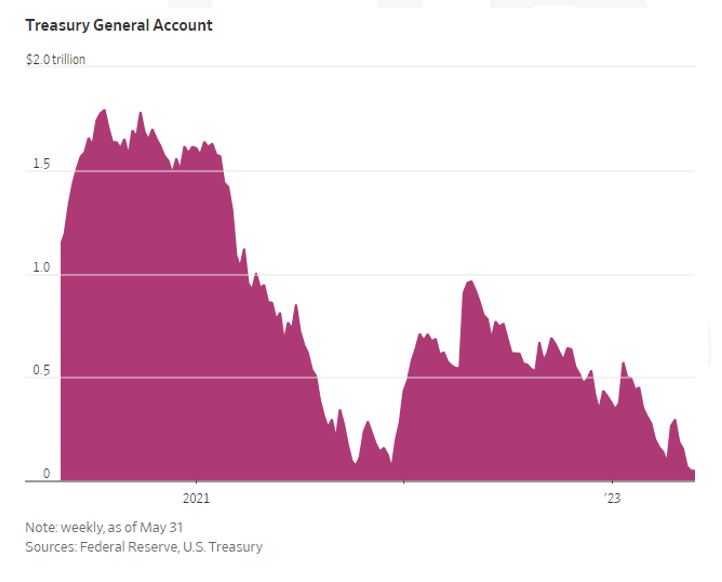

Treasuries on the shorter end of the curve fell this week while yields above 2 years rose. The 3-month Treasury yield fell 13 bps, while the 1-year Treasury yield fell 11 bps. Moving up the curve, the 2-year Treasury yield rose 9 bps, while the 10-year Treasury yield rose 6 bps, and the 30-year Treasury yield rose 1 bp. Major indices returns were mixed, the Bloomberg US Agg Bond Index fell -0.15%, the Bloomberg US corporate High Yield Index rose 0.31%, and the Bloomberg US MBS Index rose 0.04%. Before next week’s FOMC meeting, the US Treasury will sell $296B worth of debt, beginning with $123B of Treasury bills, and $72B of notes on Monday. Investors are preparing for a deluge of over $1T of Treasury bills in the weeks and months to come. In recent weeks, the Federal Reserve’s general account has dwindled to under $50B, with officials stating they have a target amount of $600B.

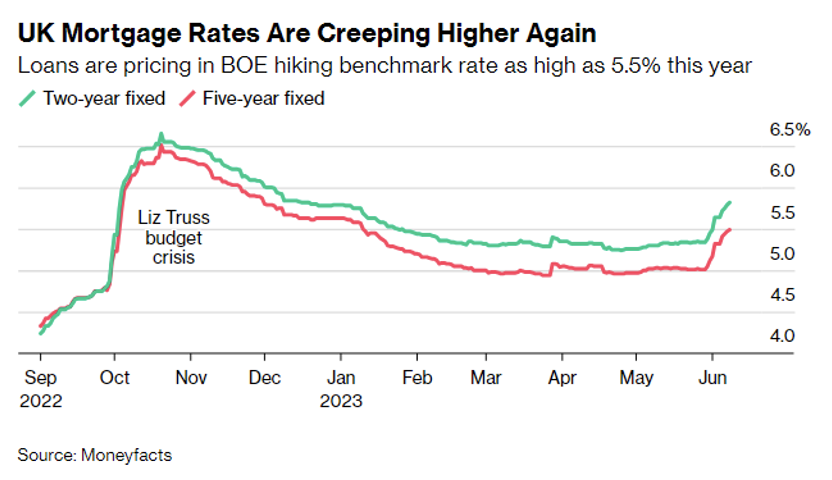

UK lenders are in the process of repricing homes. On Thursday, HSBC said that it was removing new business residential and buy-to-let products that it offers through broker services, and that the offerings should be back on the market at increased rates on Monday the 12th. On Friday, the number of home loan products available in the UK was 5,056, 4% lower than at the start of May. This move affects new home buyers as rates are set to increase more than they already have. Conversely, this could negatively impact home prices in the region. The average two-year fixed rate mortgage rose to 5.83% on Friday in reaction to a high inflation reading, pushing the two-year rate to the highest level since December 2022.

Japan’s Securities and Exchange Surveillance Commission is cracking down on two regional banks, seeking penalties for improperly selling structured bonds. The banks in question are Chiba Bank Ltd, and Musashino Bank Ltd. This is the first time in almost 20 years that the SESC has taken action in regard to structured bonds. The increased financial scrutiny comes hand in hand with Prime Minister Fumio Kishida’s initiative to spur growth through persuading households to invest.

Hedge Funds

Considering the outperformance of small-cap vs. large-caps, absolute performance was positive this week with global funds up ~20 bps and Americas-based long/short equity funds +30 bps tracking in line with the S&P 500 for the same period (hedge fund data is WoW Thursday to Thursday). Crowded names did not fare well in North America (NA) as shorts rose 200 bps and longs generally tracked the benchmark. That said, month-to-date the cohort is performing quite well, capturing ~58% of the S&P’s gains considering crowded shorts are outperforming crowded longs by ~250 bps for the month. Outside NA, EU-based funds and Asia-based funds were both relatively flat for the week while the Euro STOXX 600 was -26 bps and the MSCI Asia Pacific was +80 bps for the same time periods while crowded names performed in line with their respective indices. Hedge funds (HF) shifted to lowering gross exposure this past week trimming both long and short exposure, the largest amount since mid-February. De-grossing took place in all regions with NA accounting for 60% of the flow. In NA, the short covering was steady throughout the week with half of the flow taking place in index level products. Regarding single-names, the covering took place in most sectors led by consumer discretionary, financials and industrials. On the flip side, most of the long selling took place on Wednesday led by mega-cap TMT names (IWM outperformed QQQ by >3%), the largest this theme was sold since May 2022. Similar to NA, HFs reduced exposure on both sides of the book in European stocks with financials and energy accounting for over 80% of the flow. In Asia ex-Japan, longs were reduced across countries while most of the short covering was in Australia. In Japan, gross exposure was reduced mostly by trimming longs in technology and covering shorts in consumer discretionary.

Private Equity

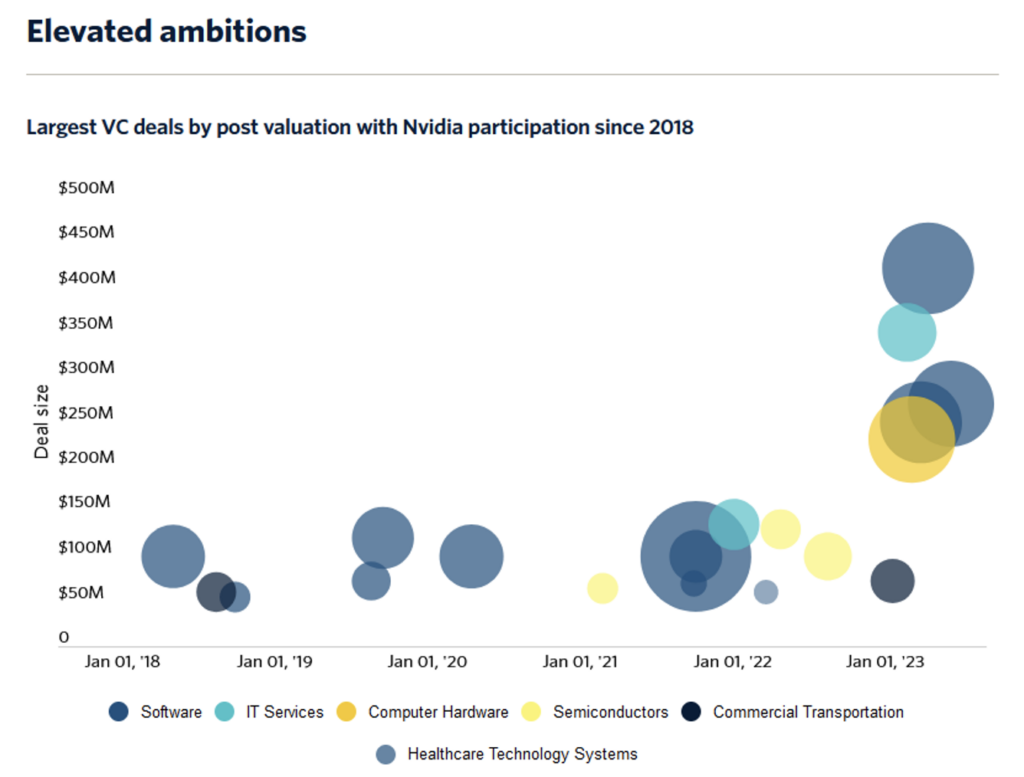

NVIDIA has benefited significantly from the surge in artificial intelligence and its stock has reflected that with its stock rising roughly 168%. The firm is also delving into startups in the space seen this week with the participation in a $270 million series C of Cohere which is a generative AI startup. This marks the second time NVIDIA has invested into the startup and has been in general has seen 5 of the largest VC deals since 2018 in 2023. NVIDIA, Microsoft, and Alphabet have all followed a trend of investing into AI, but NVIDIA is also expected to diversify a bit which they have done comparatively from other big tech names delving interests into healthcare and autonomous vehicles.

Blackrock announced this week that they will acquire Kreos which is a growth and venture debt firm focused on technology and healthcare. This only piggybacks on this year’s surge in interest in private credit with private transactions seeing a $42.5 billion inflow into the asset class in Q1 of 2023 per Pitchbook data. The asset class has become attractive for its income generation, stability, diversification, and much lower default rates versus public markets. The move is also beneficial to venture borrowers who are usually smaller in general size and are in search for capital. Silicon Valley Bank’s collapse earlier this year has only added to the inflow to venture debt. For context DSVB lent to early-stage startups and issued roughly $6.7 billion worth of venture debt in 2022. This amount of outstanding loans created opportunities for venture debt lenders outside of the traditional banking world.

Data Source: Apollo, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.