Economic Data and Market Highlights

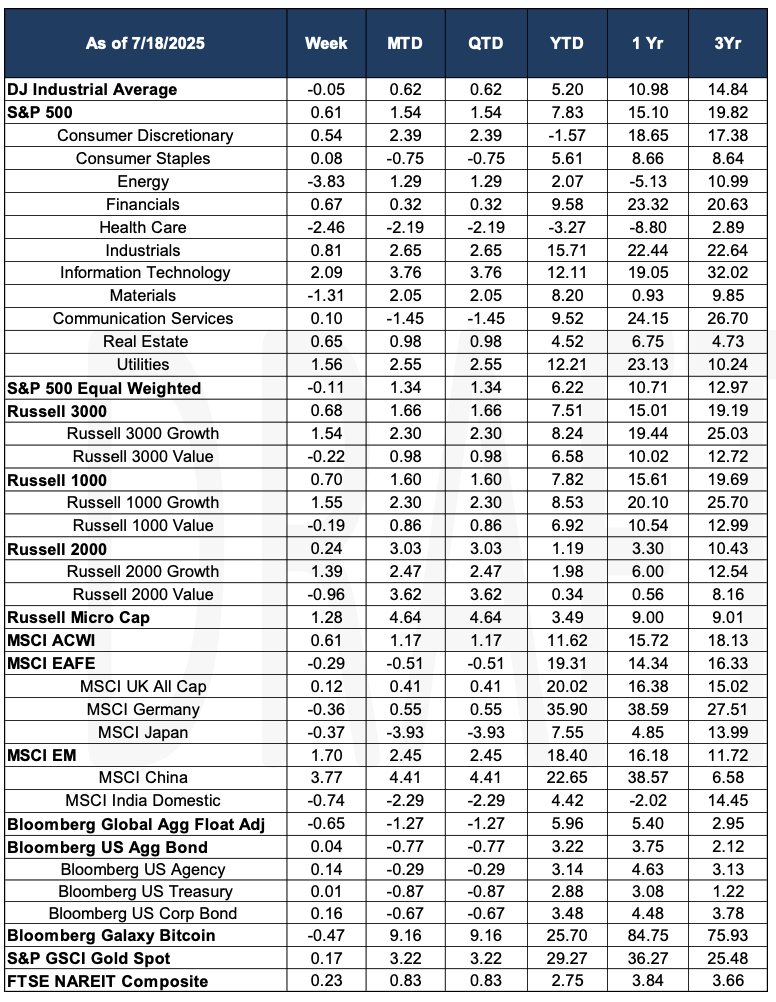

Over the past week, U.S. equities extended their rally: the S&P 500 climbed +0.6%, while the Nasdaq Composite led with +1.5%, powered by gains in AI‑related and tech stocks. Global markets echoed this strength, with MSCI ACWI up roughly +1.3%. Congress’s swift passage of stablecoin regulation provided an unexpected positive shock, supporting digital asset risk appetite. Meanwhile, markets remain buoyed by strong Q2 earnings—over 81% of S&P 500 companies beat estimates—and continued AI-chip momentum, especially from Nvidia and AMD. Still, lingering risks include renewed tariff talk (reports of potential EU levies dented sentiment mid‑week), and stretched valuations could spark volatility if earnings disappoint or macro surprises arise.

Bond markets softened this week: the Bloomberg U.S. Aggregate Bond Index likely edged into slightly negative territory as Treasury yields dipped—10‑year yields hovered around 4.42% amid growing rate‑cut expectations. However, pockets of credit weakness persist, with analysts pointing to compressed corporate bond spreads and structural liquidity concerns from reduced dealer activity and increased retail exposure.

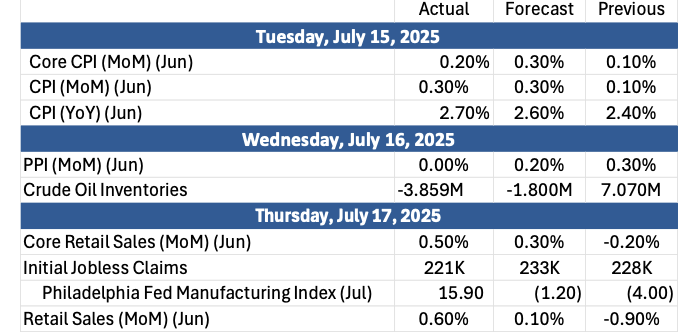

The Past Week’s Notable US data points (with revisions)

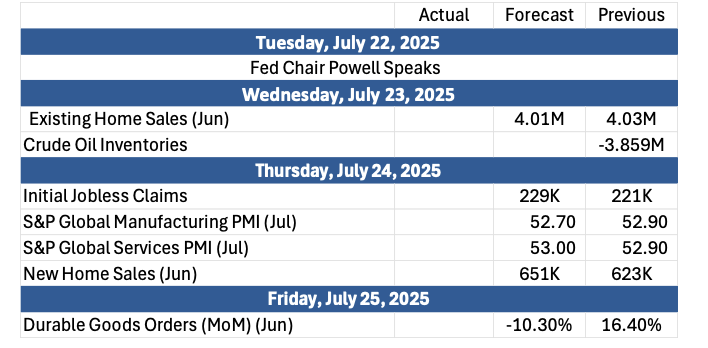

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Financial News London, Financial Times, Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara