Economic Data Watch and Market Outlook

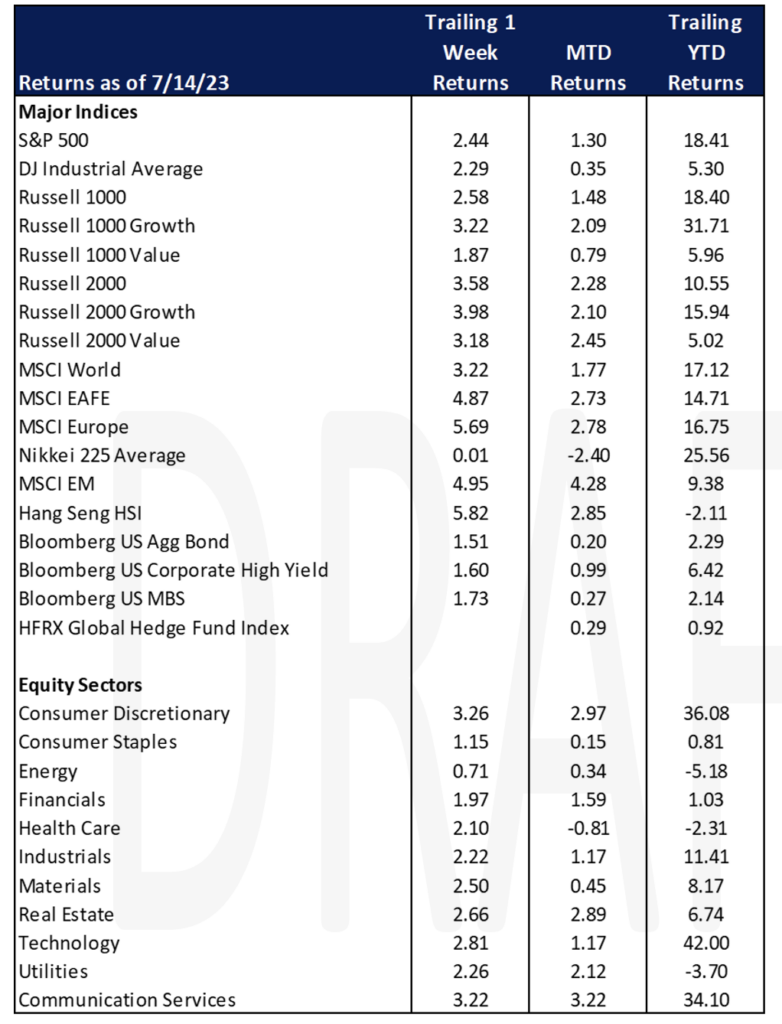

Equity markets continued to retrace their losses from 2022 as the MSCI World jumped 3.22% for the week advancing 17.12% year-to-date. The US Aggregate Bond index rose 1.51% for the week, up just 2.29% year-to-date. Falling 13% in 2022, it has a lot more to go to recover from its drawdown.

Equity markets rallied globally after the US Consumer Price Index came in lower than expected on a year-over-year basis at 3.0% whereas consensus was for 3.1%. This compared to the previous month’s 4.0% result. Investors are starting to believe that the economy may have a soft landing. As we will discuss later, some of the rally can be attributed to hedge funds covering short positions.

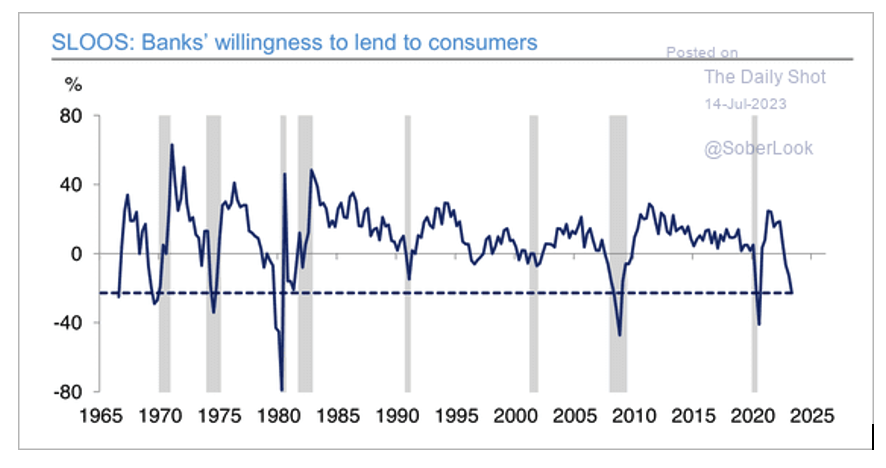

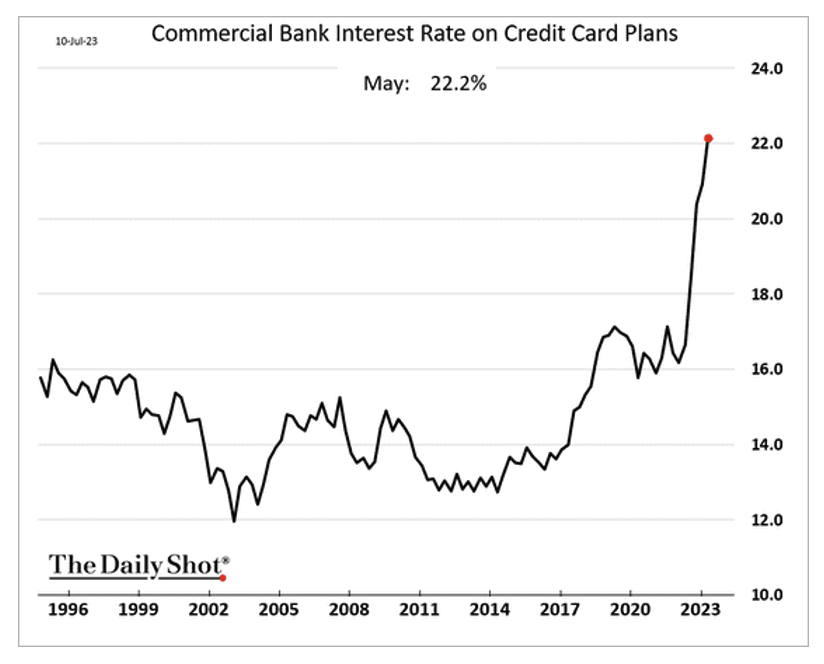

Deutsche Bank reported in a recent note that banks are continuing to curtail their lending to consumers. Further, credit card rates have climbed to an average new high according to data collected by the Daily Shot.

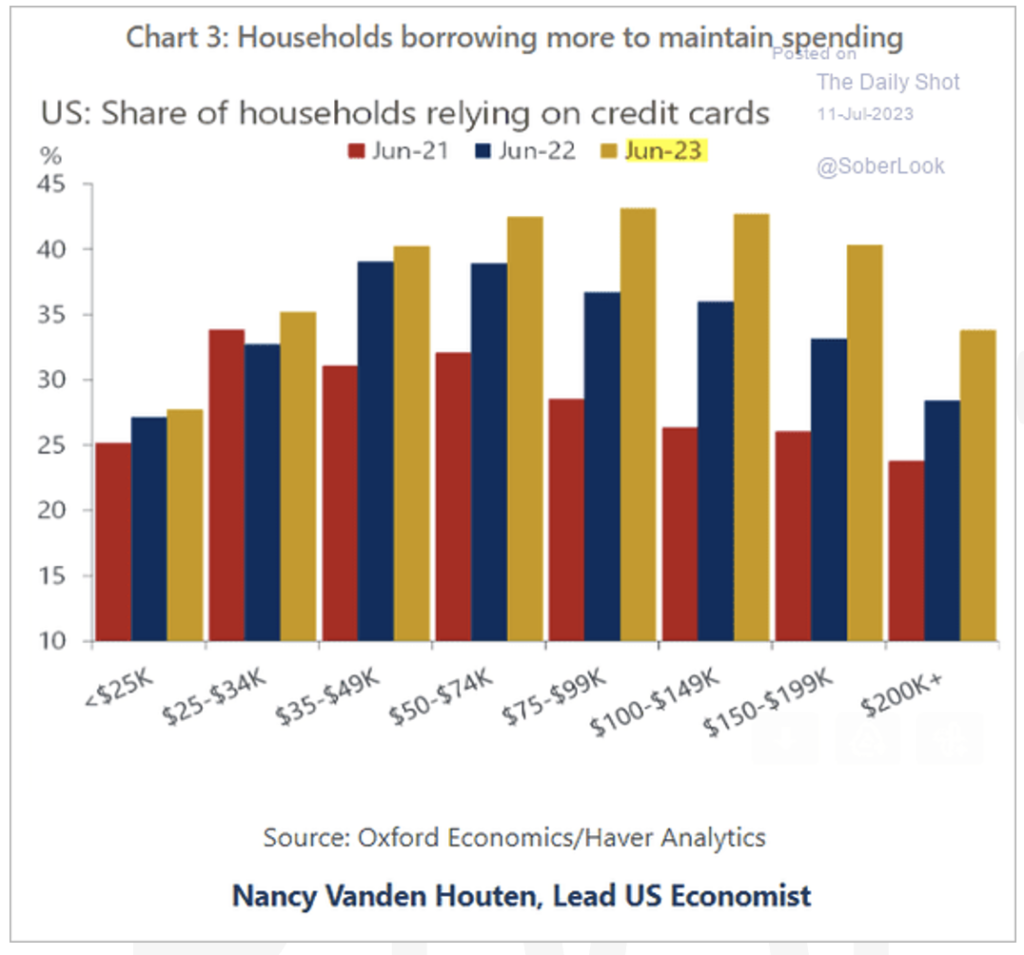

As we have discussed in previous notes, the level of credit card debt has increased significantly helping to explain the level of consumer spending that has kept the US economy resilient. Should the labor market be disrupted due to higher rates, this will be a data point to consider as investors think about short to medium term allocations. The chart below outlines the use of credit cards based on income levels. While the curve remains consistent, note the increased spend year to year.

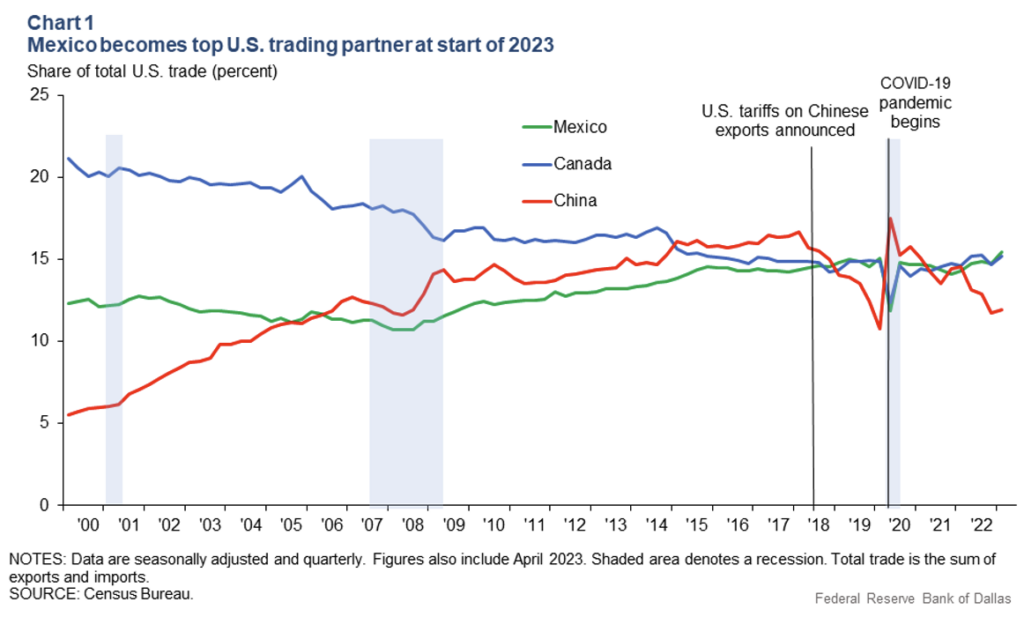

This week, the Federal Reserve Bank of Dallas reported that Mexico has surpassed China as the US’s largest trading partner. China had held that title since 2014 after surpassing Canada but in 2018, tariffs were put in place by the Trump Administration. Additionally, supply chain disruptions due to COVID and rising tensions between China and the US have caused manufacturers to rethink how they create, assemble, and distribute their products. China lost manufacturing capacity to Vietnam, India, and Mexico. Heightened tensions between the US and China have increased and “near-shoring”, accessing cheaper than US labor but within an ally’s border, will continue as will bringing manufacturing jobs back to the US.

The US Federal Trade Commission (FTC) has launched an investigation into OpenAI regarding potential risks to consumer data and reputations posed by its ChatGPT conversational AI bot. OpenAI, backed by Microsoft, has expressed willingness to cooperate with the FTC and emphasized the importance of technology safety while being pro-consumer. This marks the first official inquiry into a transformative technology like AI, with FTC Chair Lina Khan emphasizing the need for early vigilance. The investigation could have significant implications for OpenAI and the broader AI sector as regulators aim to ensure ethical and responsible operations.

This week, a decision in the three-year court battle between the Securities and Exchange Commission (SEC) and Ripple Labs was rendered by the US District Court. The SEC contended that Ripple’s token was sold to the general public as a security but the judge disagreed noting that it did not pass the Howey Test, a long standing benchmark for what is considered security ( https://www.investopedia.com/terms/h/howey-test.asp). In other blockchain news, the SEC accepted Blackrock’s application for a Bitcoin ETF after it was rejected two weeks ago. The acceptance is not final approval, only the next step that will allow greater scrutiny of the application.

In the upcoming week, we will learn about the health and productivity of the Chinese economy, and various releases related to inflation in Europe and the UK. In the US we will get jobless claims later in the week along with manufacturing data from the Philly Fed.

Equities

Following the positive inflation data, equities were positive during the week with the S&P 500 returning 2.44%, the Russell 2000 index returning 3.58%, NASDAQ 100 returning 3.52%, and MSCI World 3.22%. The S&P 500 and the NASDAQ both climbed to 52-week highs on the week. Investors flocked into big tech names such as Amazon which was up 2.7% following its Prime Day sale and NVIDIA jumped 4.7% on the day following the Producer Price Index (PPI) print.

Alphabet was among the best performers mid-week rising 4.7% Thursday post updating its Bard chatbot. Alphabet also announced that it is releasing the chatbot into Europe and Brazil which marks the largest expansion since February’s launch. Its launch occurred just as the Federal Trade Commission launched an investigation into OpenAI’s ChatGPT.

In other US equity news, this week Bob Iger’s contract was renewed for two more years as CEO of Disney. Delta Airlines posted a $1.8 billion dollar profit in the second quarter due to strong travel demand. KPMG and Microsoft have joined together to collaborate on general AI as well as cloud services.

Bank stocks were positive following strong Q2 quarterly earnings. BlackRock reported a net income of $1.4 billion which is up roughly 27% from the same period last year.

Microsoft got the green light this week after a US judge denied the Federal Trade Commission’s attempt to block the acquisition of Activision Blizzard. They have until July 18th to close the deal, but Microsoft still needs to work with the UK on regulations since the UK tried to veto the deal in April. The UK regulatory body said they were willing to evaluate the proposals. The deal will allow Microsoft to gain a bigger footprint in the mobile game space which is the fastest growing part of the gaming business.

Asia-Pacific markets also rose following the easing US inflation print. China trade data came in below expectations for June, but major indices bounced positively Thursday with the Shanghai Composite gaining 1.26%. Hong Kong’s Hang Seng Index was the best performing index following the positive US inflation data and recorded the biggest gains in healthcare and basic materials.

In Europe, the Euro STOXX 600 market had its longest run of daily gains in almost three months this week despite the Bank of England’s continuing battle to tackle inflation.

Fixed Income

Treasury yields on the short end of the curve rose slightly this week while yields on Treasuries over six months also rose. The two-year Treasury yield fell 20 bps to 4.74%, the 10-year Treasury yield fell 23 bps to 3.83%, and the 30-year Treasury yield fell 12 bps to 3.93%. Meanwhile major fixed income indices posted positive performance across the board. The Bloomberg US Aggregate Bond Index rose 1.51%, the Bloomberg US Corporate High Yield Index rose 1.60%, and the Bloomberg US MBS Index rose 1.73%.

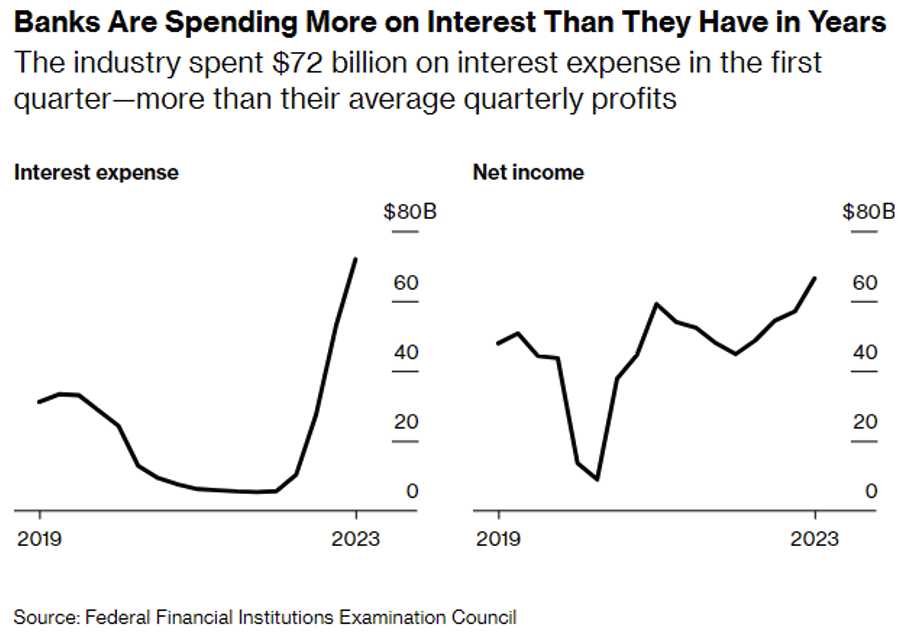

Earlier this year US banks faced sweeping withdrawals amidst the regional banking crisis that took place in mid-March. To shore up their books, banks are now turning to a medley of higher interest rate sources of capital. Regional banks have borrowed billions this year from the Federal Reserve and Federal Home Loan Bank, and higher interest rates are beginning to take a toll on earnings. In an analysis done by the Federal Financial Institutions Examination Council on 84 of the largest US banks, which control 80% of the industries assets – there has been a dramatic rise in interest expenses over the last year, with the industry as a whole spending $72B in Q1. Meanwhile Federal Home Loan Bank borrowings doubled $1.42T with brokered deposits making up $800B of those borrowings.

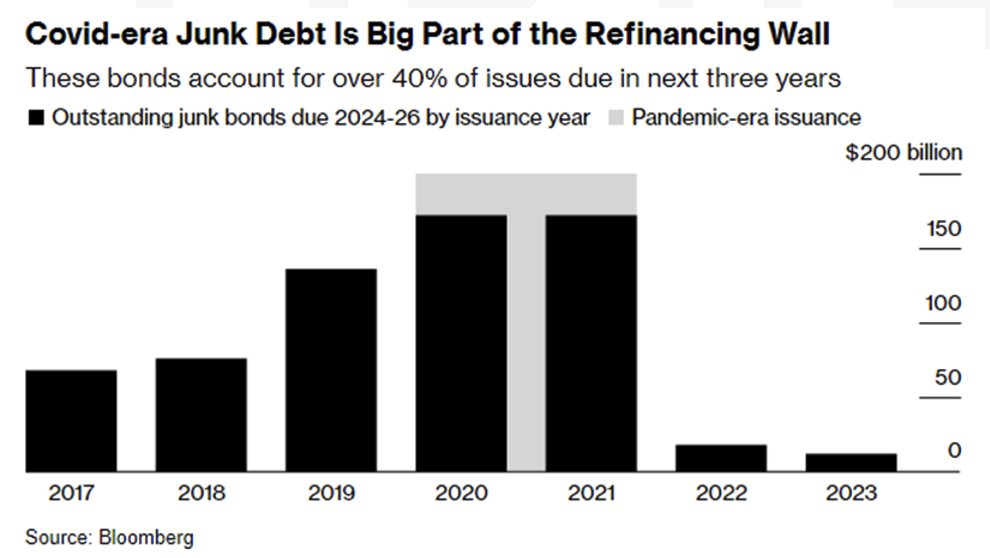

The $785B junk-bond maturity wall is nearing as risky borrowers are racing to refinance. Over 40% of these bonds were issued during the pandemic, with borrowers having an average of 4.7 years to refinance. Some of the borrowers under more stress are turning to asset disposals to pay back their debt. Strategists at Moody’s expect that the global high-yield default rate should peak around 5% by April 2024. The current high-yield default rate is sitting at 3.5% as of the end of May.

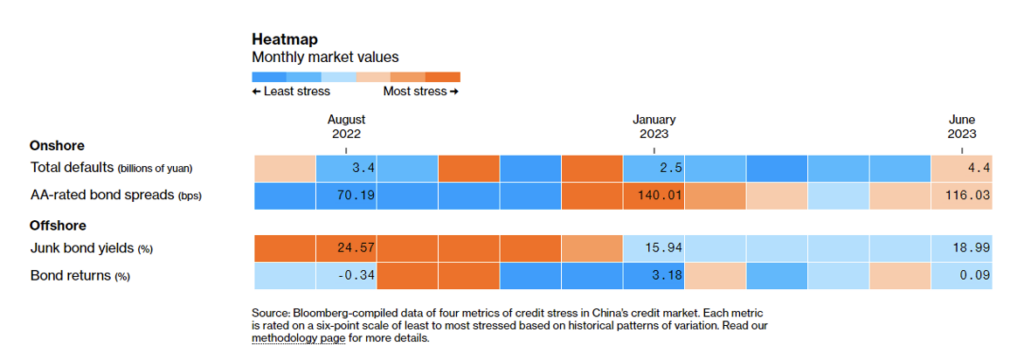

China is facing stress in their $12T onshore credit market. According to Bloomberg’s China Credit Tracker, stress in onshore credit rose to level four in June, up from level three in May, the highest level since February 2023. The scale goes from one to six. The primary driver of the issue was the failing of two major builders to pay a combined 4.4B yuan ($608M) bond payment. Other issues such as large domestic banks halting purchases of local notes sold in Shanghai could lead to local-government financing vehicles facing tighter liquidity conditions going forward, which could lead to alternate financing channels opening up.

Hedge Funds – Through Thursday, July 13th

For the week ending Thursday, July 13th, performance was particularly strong for hedge funds (HFs) despite the fact that crowded shorts continued to weigh on long/short (L/S) alpha (JP Morgan’s high short interest tracking basket is up 40% since hitting lows in May). Part of the reason performance has been improving in relative terms, despite shorts continuing to cause pain, has been due to HFs now running much lighter levels of overall short exposure including running less short exposure to those areas that were previously amongst the most crowded. This coupled with strong performance of long books led to better performance this past week vs. what has been observed in the past few months. Looking on a WTD view, the average global fund was up +1.4% and the average Americas-based L/S equity fund was up +2.1%, which puts them up +1.1% and +1.5% respectively for the month. HFs captured a slightly smaller portion of the upside in Europe where they were up +1.3% vs. the Euro STOXX 600 +3.1%. Asia-based funds were the top performers as the average fund ended +2.4% this week with China-focused L/S funds performing even better with the average fund up nearly 5%.

With global equities rallying this week HFs continued to position themselves directionally longer, however, this was achieved via funds covering short positions as opposed to adding longs. HFs actually sold longs in net terms this week, almost all of which was driven by equity L/S funds. This combination of selling longs / covering shorts led to this past week being one of the larger weeks YTD in terms of de-grossing. Most of the long selling was concentrated in North America (NA), where most of this flow was driven by L/S funds. The covering, however, outpaced what was sold on the long side leading to L/S funds ultimately being net buyers of NA equities. At the sector level the directional flow in net terms was relatively muted, though ETFs, consumer discretionary and communications services ended as the most net bought while industrials and technology were the most net sold. On the long side, the selling was largest in areas where HFs were already underweight, with financials, industrials and energy ending as the three most net sold sectors in notional terms. As for the short side, much of what was covered was seen in ETFs (accounted for ~45% of the overall covering), though HFs covered areas of the market where short exposure was higher, including autos, specialty retail, commercial real estate and banks. Outside NA, HFs were also net buyers of equities in all other regions, though the buying was a mix of long adds and short covers (i.e. no de-grossing). Flows were somewhat muted in both Asia ex-Japan and Japan (though HFs were buyers of China across both A- and H-shares), indicating a modest reversal of the strong YTD trend of buying Japan and selling China. In Europe, this week ranked as the 3rd largest in terms of covering, with the covering spread across almost all sectors + ETFs.

Private Equity

Early-stage venture debt deals have seen a significant decline following the collapse of Silicon Valley Bank (SVB), which was a major lender to startups. This decrease in loan volumes reflects higher lending standards and a lack of qualification for new loans among startups with uncertain financial prospects. According to the Q2 2023 PitchBook-NVCA Venture Monitor, the number of loans for angel-backed and seed-stage companies dropped by 44% and 45% year-over-year, respectively, compared to declines of 27% and 39% for late-stage and venture growth stage loans. Overall, startups closed $6.34 billion across 931 venture debt deals in the first half of 2023, a significant decrease from $20.07 billion across 1,513 deals during the same period last year.

The collapse of SVB, which primarily operated in the early-stage market, has left a void that other banks have not yet filled. Lenders are now placing greater emphasis on startups’ path to profitability and their ability to attract future investment. The demand for debt capital remains high, but it has become harder to secure amidst a decline in venture capital investment. Lenders are demanding more favorable covenant packages, warrant coverage, and higher interest rates, while becoming more selective and targeting higher-quality companies.

Authors:

Jon Chesshire, Managing Director, Head of Research

Elisa Mailman, Managing Director, Head of Alternatives

Katie Fox, Managing Director

Michael McNamara, Analyst

Sam Morris, Analyst

Josh Friedberg, Summer Associate

Data Source: Apollo, Barron’s, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, J.P. Morgan, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.