Economic Data Watch and Market Outlook

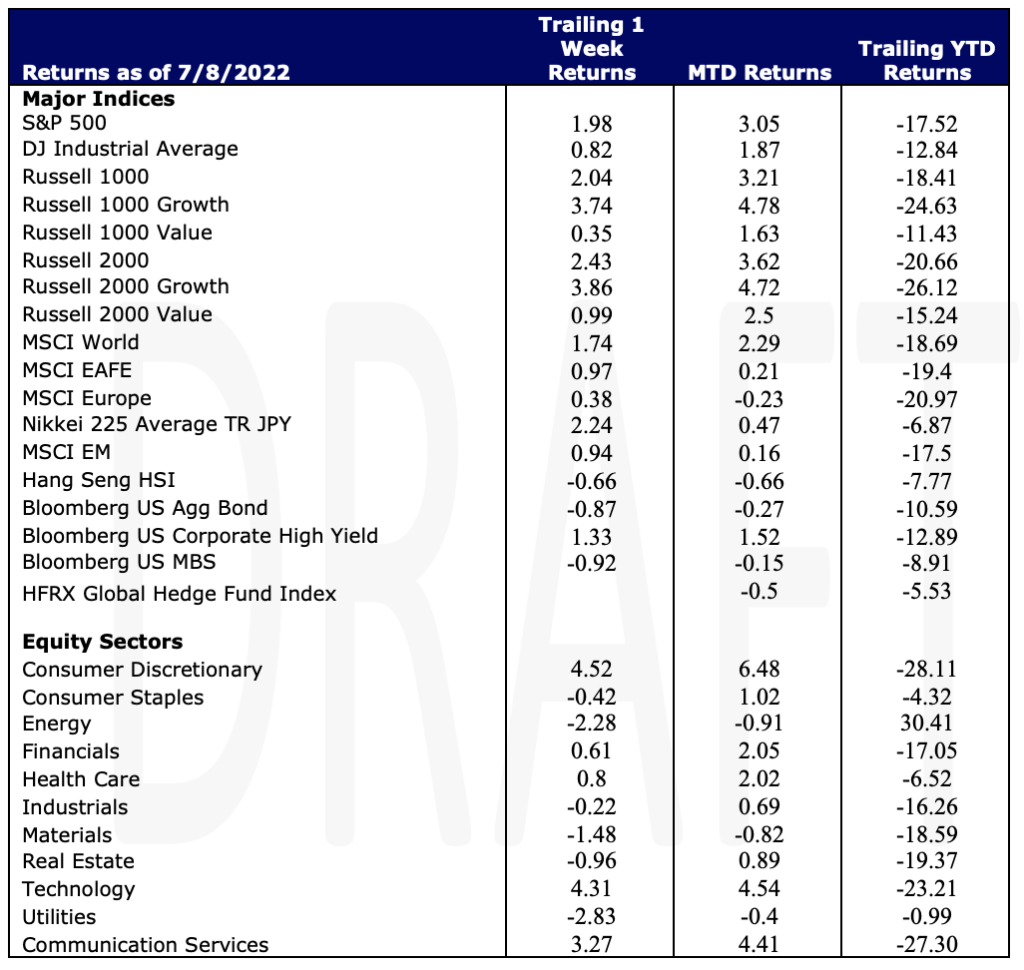

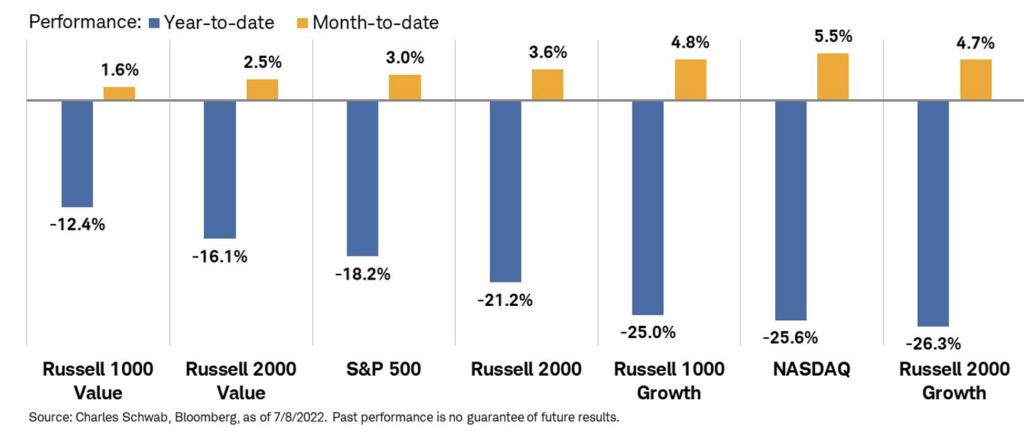

Equity asset prices rose globally as the MSCI World benchmark rose 1.74% on the week, US stocks as, measured by the S&P 500, rising 1.98% and the MSCI EAFE increasing 74 basis points. US Fixed income fell 87 basis points.

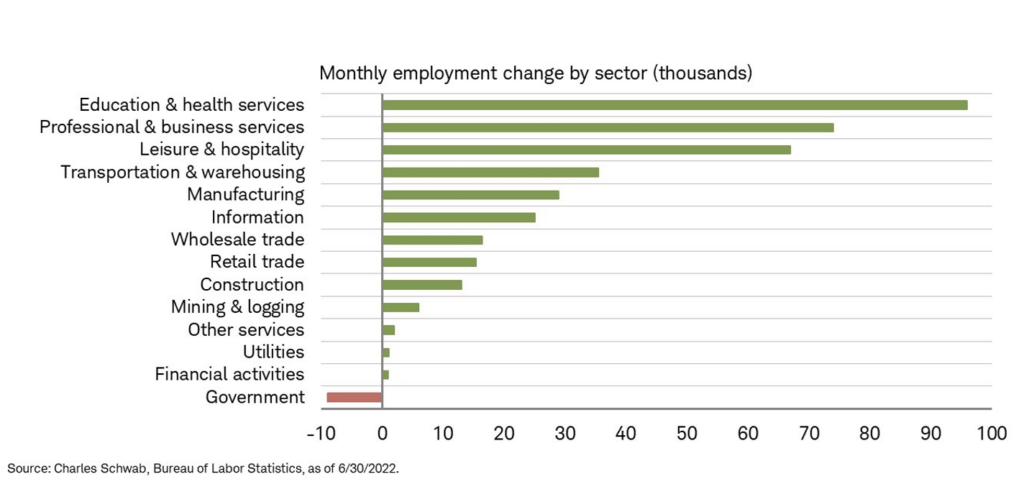

US jobs were reported on July 8th and came in hotter than expected, 372k vs the estimate of 268k with the government sector being the only sector to lose jobs. The unemployment rate was unchanged at 3.6%

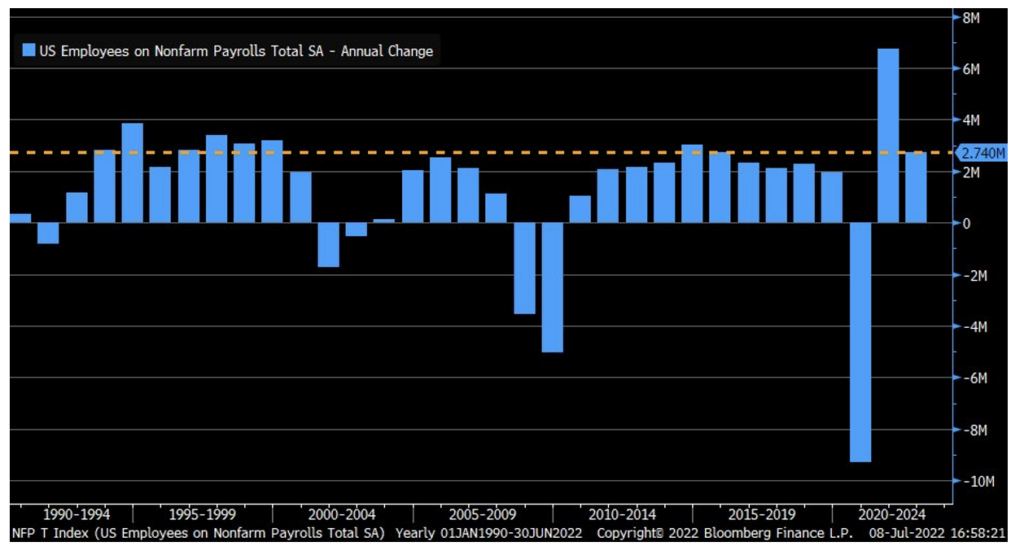

The strong US job growth in the first half of the year is the most significant job growth since 2014.

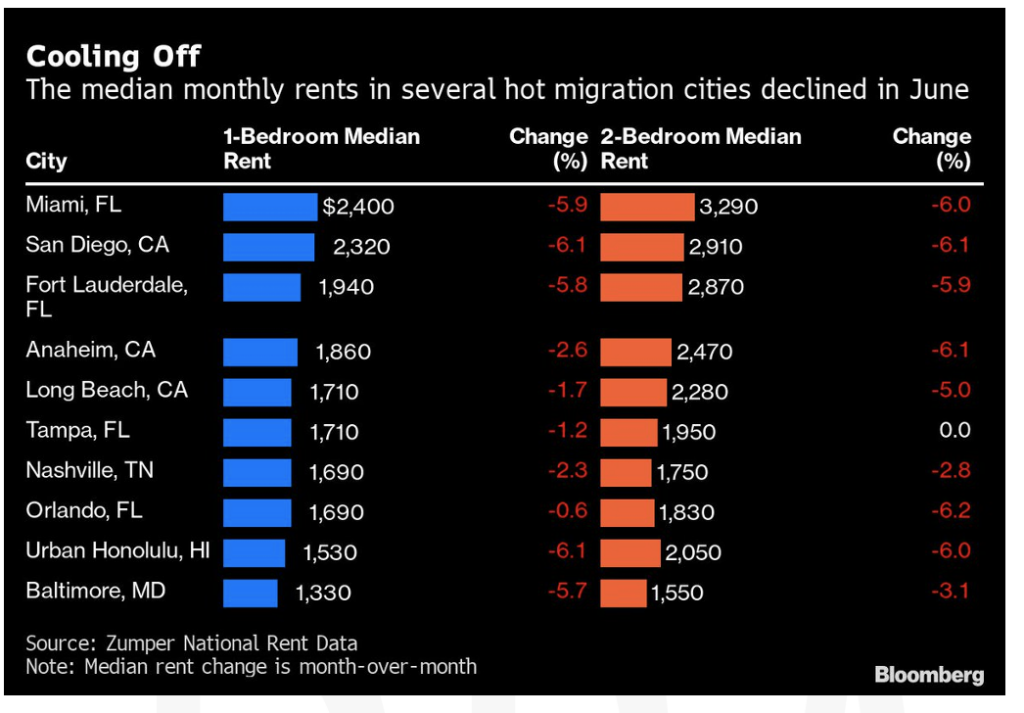

The Fed’s dual mandate of employment and prices are at odds but at this point curtailing inflation is the biggest priority. We have seen mortgage rates back off during the week, the largest drop since 2008 and rents are easing across the country.

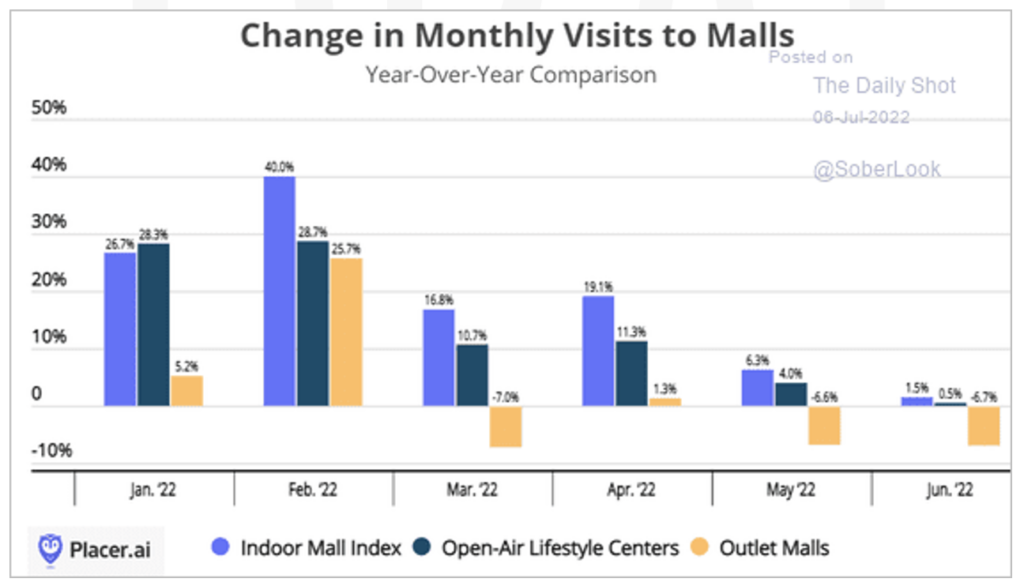

Further, consumer credit was much lower than expected coming in at $22.35 billion versus the estimate of $30.9 billion and mall traffic has declined on a year over year basis.

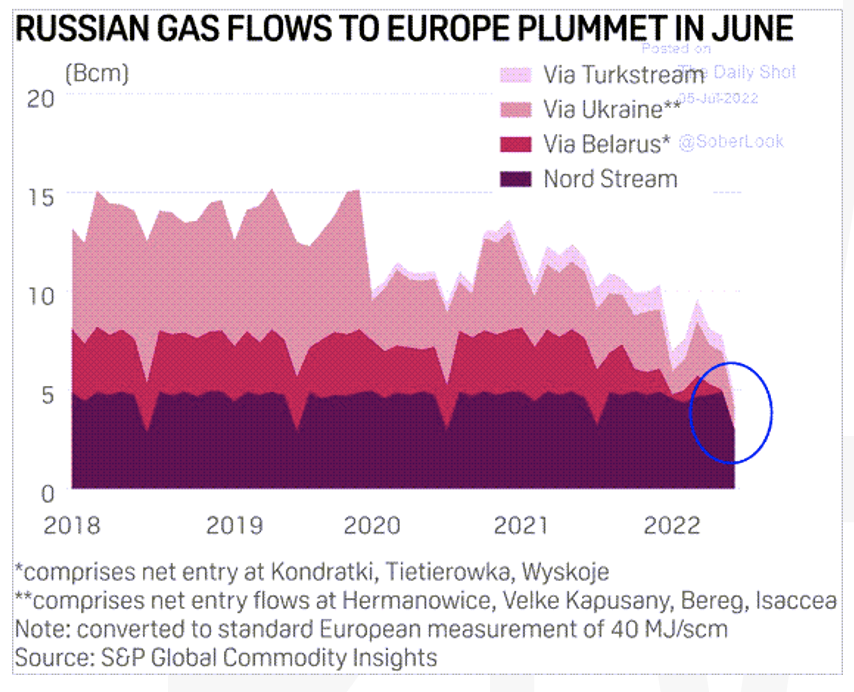

We continue to monitor our US vs European equity exposure in our discretionary accounts as the EU has more on its’ plate that trying to curtail prices, most of which is out of its control. Europe continues to struggle with high fuel prices as Russia has started to curtail their gas flows. The chart below is one such example as Germany’s forward power prices have hit new highs.

Equities

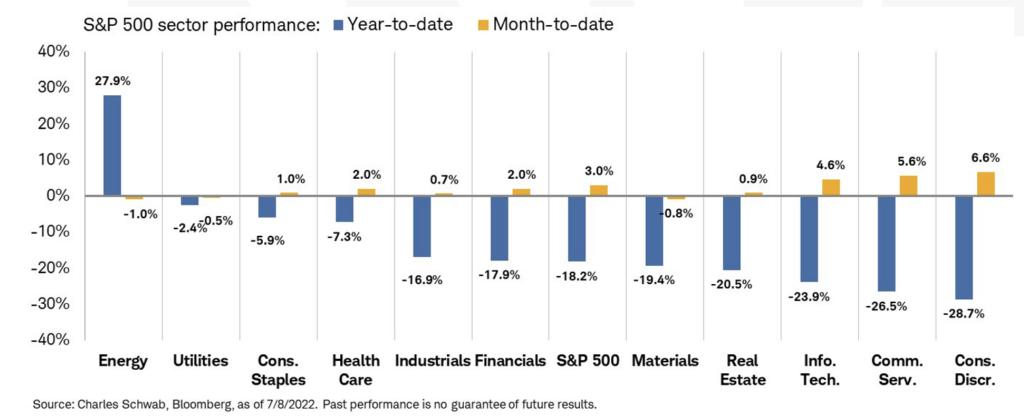

As noted above, equity prices rose for the week. Growth (Russell 1000 Growth) has continued its surge MTD rising 4.8% versus the Russell 1000 Value’s rise of 1.6%. Traditional Growth sectors such as Tech and Consumer Discretionary surged 4.31% and 4.52% respectively while Energy and Utilities fell 2.28% and 2.83% respectively.

Emerging Markets stocks advanced during the week rising 94 basis points. Smaller markets such as Sri Lanka have experienced unrest. Inflation will take a toll on those countries that have high corruption rates as debt financed in Dollar terms come due. As we’ll discuss in the Fixed section Russia has defaulted on its debt and some companies in China have also experienced issues. Each has its own reason but the inflationary pressure, sanctions etc. have given us pause in our discretionary accounts to allocate meaningfully to emerging market equities.

Fixed Income

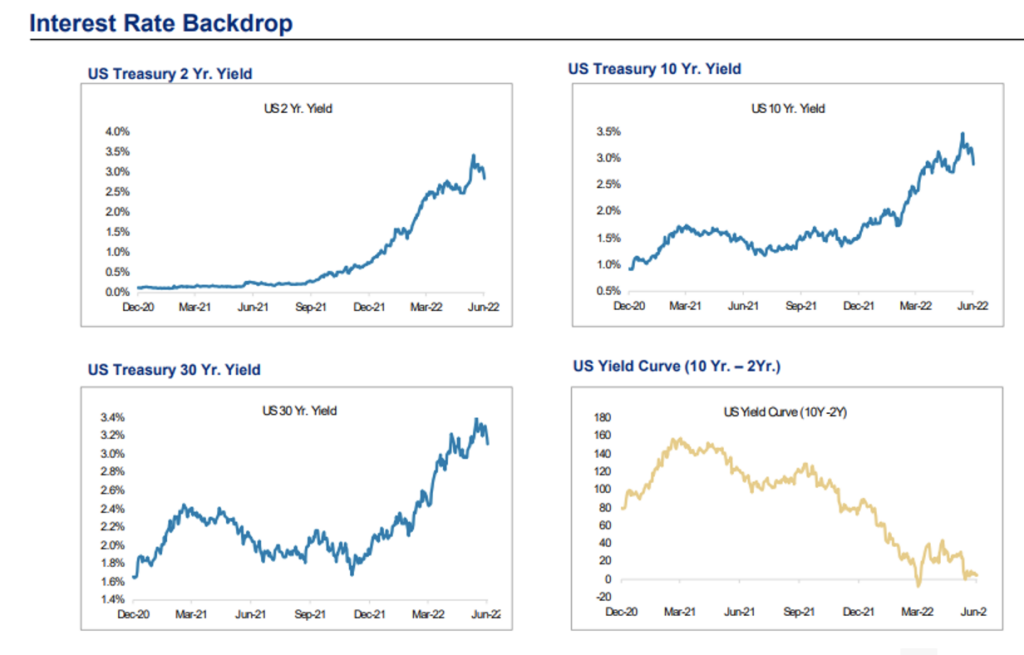

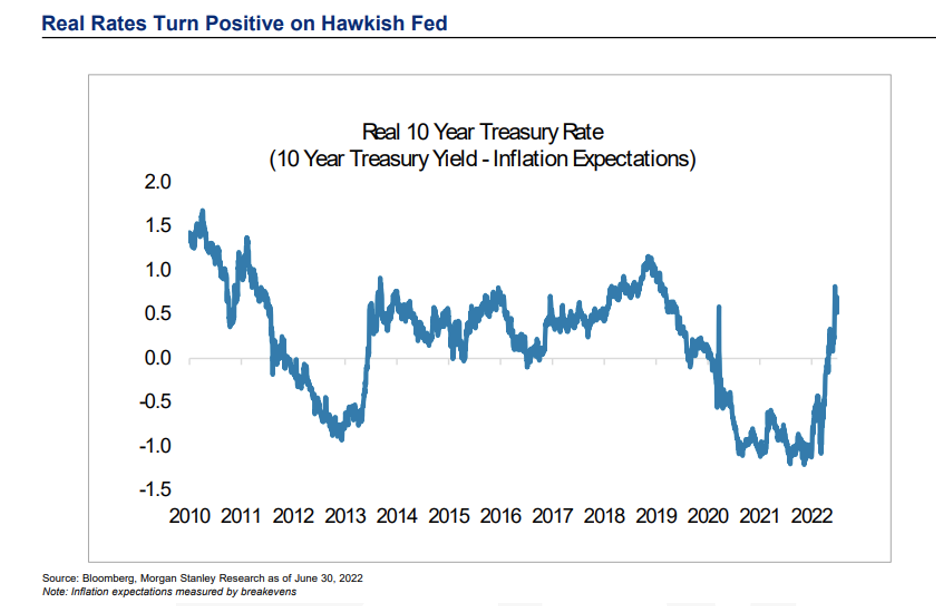

Treasury yields continued to climb this week with the 2/10-year Treasury curve inverting where both reached levels north of 3% following the recent release of Fed minutes midweek. With the inversion usually signaling a recession to follow, combined with a hawkish Fed, many investors have flocked to Treasuries for safety. The focus for the Fed looks to hit a benchmark funds rate of 3.5% by March 2023 before falling somewhere around 3% by the fall of 2023. The Fed’s dot plot is projecting approximately a median rate of 3.8% next year. Last week saw the largest inflow to the iShares 20+ Year Treasury Bond ETF since the end of May signaling investors are looking again for a safe place to put their money until things stabilize a bit.

Russian default on foreign debt for the first time since the 1918 has caused some concerns for any Russian bond holders who will have to settle privately if the US Treasury does not green-light an auction. This is now not allowed due to the Treasury’s Office of Foreign Assets banning any buying of Russian securities in the secondary market.

In China, Shimao Group Holdings Ltd just missed default days after missing a payment of $1billion Dollar note. Huarong Asset Management Co. perpetual Dollar bond is dropping to its lowest level since last year as its financial health posed a concern to investors. The 4.25% perpetual note fell 10 cents on the Dollar to 75 cents Wednesday. It is not alone in the steep drop as peer China Great Wall Asset Management Co. also saw a big drop last week as the company missed a June deadline to publish its 2021 annual report bringing to light some concerns over the health of nation’s state controlled bad debt managers. The dip has been thought to be amplified by the very weak market backdrop and poor trading liquidity in the market.

Hedge Funds

Global and Americas-based hedge funds started the month in positive territory which is not surprising as their respective indices rose this past week. Americas-based long/short equity funds were the top performers for the week, up approximately 1.7%, capturing most of the S&P 500’s gains of 1.98% while running with 40% net exposure. Crowded longs outperformed the S&P by a significant margin but unfortunately shorts were up even more leading to negative spread. Both Europe and Asia funds were down slightly for the week (roughly -20 bps and -40 bps respectively) but both regions are outperforming global and Americas funds YTD. Hedge funds were net buyers of equities globally, mostly from short covering with the largest buying in North America (ETF and single-name short covering). Energy was the most net bought sector in North America, despite underperforming. This followed a week of the most net selling in the sector seen all year. Financials were the next most bought, both from long additions and short covers, led by capital markets. Healthcare was another sector with notable buying across all sub-sectors except biotech, where hedge funds trimmed long exposure. At the factor level, hedge funds were buyers of volatility and growth and sellers of quality. Funds were net buyers of both Europe (mostly multi-strategy/macro funds) and AxJ, both adding to longs and covering shorts. Japan was the only region net sold for the week.

Private Equity

The recent and notable consolidation of the wealth management industry is attracting private equity firms as they see this consolidation as a chance to build up their portfolios with proven businesses. These businesses offer steady cash flows via the industry’s attractive recurring asset-based fee revenue structure, high client retention rates and the ability to grow quickly through acquisitions.

A recent report from Cerulli Associates estimates that “more than one third of advisors managing roughly 40% of the total industry assets are expected to retire within 10- years, yet one in four of them do not have a succession plan” helping to further drive private equity firms’ increasing presence in wealth management.

In Q1 and Q2 of 2022, private equity firms and their portfolio companies backed 48 asset management deals across the globe worth $6.7 billion, the highest deal count and deal value in the last 12 years. In 2022, the sector is on pace to exceed last year’s record of 82 management deals involving private equity investors. Additionally, M&A activity in this industry has gone up drastically in recent years. Of the 307 mergers and acquisitions announced in this sector last year, private equity was directly or indirectly involved with 60% of them.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M