ECONOMIC DATA WATCH and MARKET OUTLOOK

This past week was another example when sentiment overpowered macroeconomics. We will attempt to point out some of the many variables which continue to pressure equity/risk assets in the short term as well as the longer-term fundamental outlook.

Chairman Powell stated the tightening of policy, through various means, will start in March with potentially more rate hikes to follow (see more detail in Fixed Income Section). However, given our many years of experience, the most powerful tool is verbalizing plans, not necessarily acting on them, meaning the unknown of what may happen can be more powerful than the actual outcome at a later date. Secondly, 2021 GDP was announced at 5.7% (the largest annual increase since 1984) with a 6.9% increase in the fourth quarter, mainly driven by consumer spending. Even though supply chain issues are still impeding some economic growth, overall it is still very strong and appears to have longevity. Recent company reports support strong growth even in comparison to last year’s robust growth.

There is a double-edged sword with higher energy prices as it acts as a tax on lower income families but is a boost to risk assets as profits are plowed back into the markets. The trend toward private investing is strong, but large institutions have challenges balancing an appropriate amount of cash or liquidity. Although we see record amounts of capital raises for private investments, the investing period will extend as the supply of deals declines.

EQUITIES

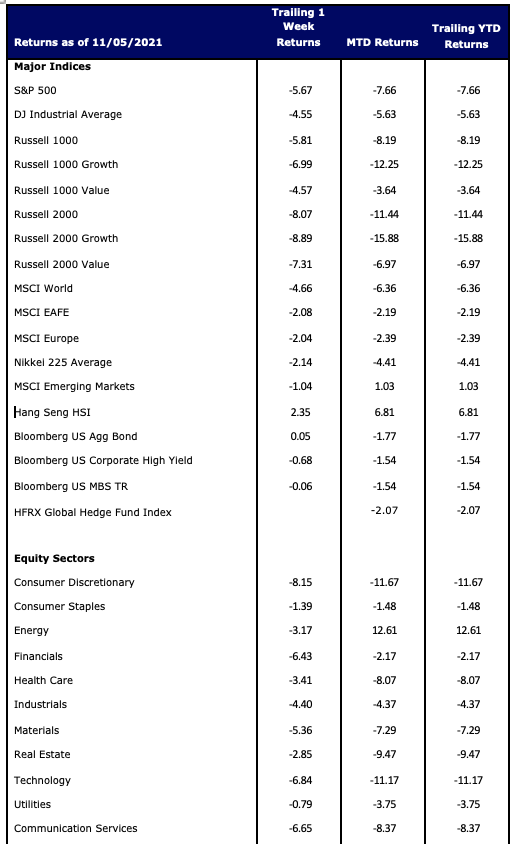

The US led the way for equities with the Russell 1000 returning 67 basis points last week and a -7.58% YTD. Growth outperformed value as mega TMT names started reporting their Q4 numbers helping to lead the Russell 1000 Growth to outperform the Russell 1000 Value 113 bps vs. 20 bps. YTD growth still significantly lags value with the Russell 1000 Growth -11.25% compared to -3.44% for its Value counterpart.

Sector returns varied for the week with energy leading the way (+5%) followed by technology (+2.32%), financials (+1.36%) and healthcare (+76 bps). The rest of the sectors were negative for the week, with industrials, consumer discretionary and utilities the largest laggards.

Globally, the MSCI World significantly outperformed other global indices as 69% is in the US and the top positions are the mega-cap US technology companies plus Tesla. Europe and Asia saw steep declines, all down 3%+ for the week. Not surprising, with the turmoil between Russia and Ukraine, the MSCI Emerging Markets Index was down over 4%.

FIXED INCOME

The Fed kept interest rates unchanged at its January meeting, but Chairman Powell reiterated his concerns on inflation and stated he believes full employment has been reached.

- Powell noted that there is “quite a bit of room” to raise rates without jeopardizing the labor market recovery

- A timetable for balance sheet reduction was not specified, but the Fed commented it would likely commence after raising rates; over the long-term the Fed intends to hold mostly Treasury securities

- Front-end Treasury yields jumped on the announcement, with the 2-year up 13 bps to 1.15%, the highest level since February 2020

Corporate spreads widened 3 bps from 97 to 100 bps, as the week’s light supply ($2.6B was priced) was offset by the weaker tone. The high yield primary market brushed off the equity volatility with demand remaining robust for higher-yielding debt. The Bloomberg High Yield Index rose as high as 4.99%, the most in over 14 months and spreads were up 20 bps to 315 bps. Issuers of asset-backed securities (ABS) flooded the market with over $21B of new supply month-to-date, well above last January’s total. Finally, the Bloomberg Municipal Bond Index had a month-to-date loss of 1.85% and is on track for its largest monthly loss since the start of the pandemic as investors await Fed rate hikes.

Source: IR+M

HEDGE FUNDS

Global hedge funds were down 90 basis points for the week through last Thursday (hedge fund data is reported Friday through the following Thursday) with the MSCI World down 2.5% in the same period, bringing month-to-date performance to -3.8% for global hedge funds vs. -7.9% for the MSCI World. Long/short equity funds lagged in all regions this past week with Asia the weakest following a very volatile week in the region. The buying of North American equities outweighed the selling seen across the other regions this week. Within North American equities, tech led the buying by sector, driven by an ~75/25 split between long buying and short covering. US TMT mega-caps were net bought following Q4 results. This was the 2nd largest week of North American tech buying since May 2020 (behind only the week ending Dec. 10, 2021). Following relatively consistent selling of the sector the past 3 weeks, HFs flipped to buying financials each session this week driven by banks, capital markets, and consumer finance. On a relative basis, this was the largest week of North American financials buying since December 2019. Healthcare (driven by biotech), materials (driven by chemicals) also contributed to the buying in the region. Despite being the top performing sector YTD, up ~19%, funds were sellers of North American energy for the 4th consecutive week with this week’s selling driven by short additions. In other regions, HFs sold into the underperformance in Asian equities. This was the largest week of selling in AxJ equities since Nov. 2020 with the selling spread across AxJ industrials, healthcare, comm. services and discretionary. At the country level, China accounted for the bulk of the selling (all share types) as the MSCI China Index fell ~7%. HFs also sold into the underperformance in Japan (NKY Index -4.9%), driven by the selling across Japanese real estate, discretionary, and industrials. Net flows to European equities were relatively paired off as the buying of EU staples and comm. services was offset by the selling of EU real estate, materials, financials and ETF products.

Source: Goldman Sachs and Morgan Stanley prime brokerage

PRIVATE EQUITY

After a COVID-19 induced slowdown in 2020, global M&A deal activity in 2021, supported by healthy returns from public markets and lofty multiples, rebounded and surpassed previous records.

The lead drivers of 2021 M&A activity were the financial services, healthcare and technology industries. At a global level, technology and ESG remain recurring themes. Although the tech sector accounts for a large proportion of global M&A, in light of changes imposed by COVID-19, companies across all sectors are being forced to adopt technologies that increase productivity, engage customers and streamline operations. Additionally, companies are feeling ESG related pressure to reduce carbon emissions, create better working conditions and increase diversity and inclusion in the workplace. Analysts predict a growing number of companies across sectors and geographies will use M&A to navigate these changes as well as ESG themes.

As unprecedented PE fundraising continues, analysts suspect the outlook for M&A in the first half of 2022 to be overwhelmingly positive. Although dealmakers will be keeping an eye on growing antitrust policies these factors are unlikely to significantly reduce deal activity in the short term. As for the second half of 2022, analysts predict a slowdown in M&A deals driven by the “buy-integrate-divest model” of many PE firms as the firms must now take time to integrate the many new acquisitions made throughout the last year. Additionally, contributing to a possible slow down, other forms of investment outside of PE may become more attractive such as treasury bonds due to increased interest rates which would decrease cash flow to the M&A industry.

Source: Pitchbook Global M&A Report 2021