Economic Data Watch and Market Outlook

This week seemed to be an example of losing a yard in a cloud of dust. Inflation is still a problem; consumer spending seems to be starting to subside or at least taking a breather with lessor support payments and investors are still unsure what a change in monetary policy could mean. In essence, how strong is the economy and when do we return to aggregate demand?

We often try to discuss investor sentiment, but in many instances, it can be difficult. Although most reports on the Omicron point to a much less deadly strain, the reaction by the government, major corporations and healthcare workers is very vigilant. The Supreme Court also appears to have a different opinion on action plans. Lastly, no two countries in the world seem to be holistically aligned. As far as we know, the Olympics are still on, but the Australian Open is waffling.

The point to which we feel is important to look at this week is simple. If interest rates are going to rise, and the economy is perceived to have more positives than negatives for at least the first half, why are banks being disproportionately sold? Over time, investors seem to be more immune to “big tech” volatility since stock prices have less connection to earnings, but the “yin to the yang” of big value should be to support banks. Going into the last 15 minutes of the close last Friday, there seemed to be a “black box” series of trades testing the resolve of investors. Not trying to be too specific, but NFLX bounced higher, JPM gapped lower and the ten-year fell further.

With supply chain issues still a problem, weather patterns play a big role. Arctic temperatures and pending bad weather may affect the east coast just as certain food shortages are being reported and many colleges are trying to restart classes on Monday after the winter break. Going into a long weekend it is usually hard to gauge risk asset price moves or use as a barometer of a trend given paring back leverage and long brokerage positions.

Last week just seemed to be somewhat of a rudderless market unsure about when and how hard the impeding policy tightening will push. Many managers we have been speaking to about 2021 summaries and positioning going into 2022 feel the FOMC may tighten too much with one saying it could happen any day. Given the effort of forecasting the move and Chairman Powell’s reappointment interview this week, we find it hard, but not impossible to think a move will happen any earlier than the March meeting. Investors abhor uncertainty.

Equities

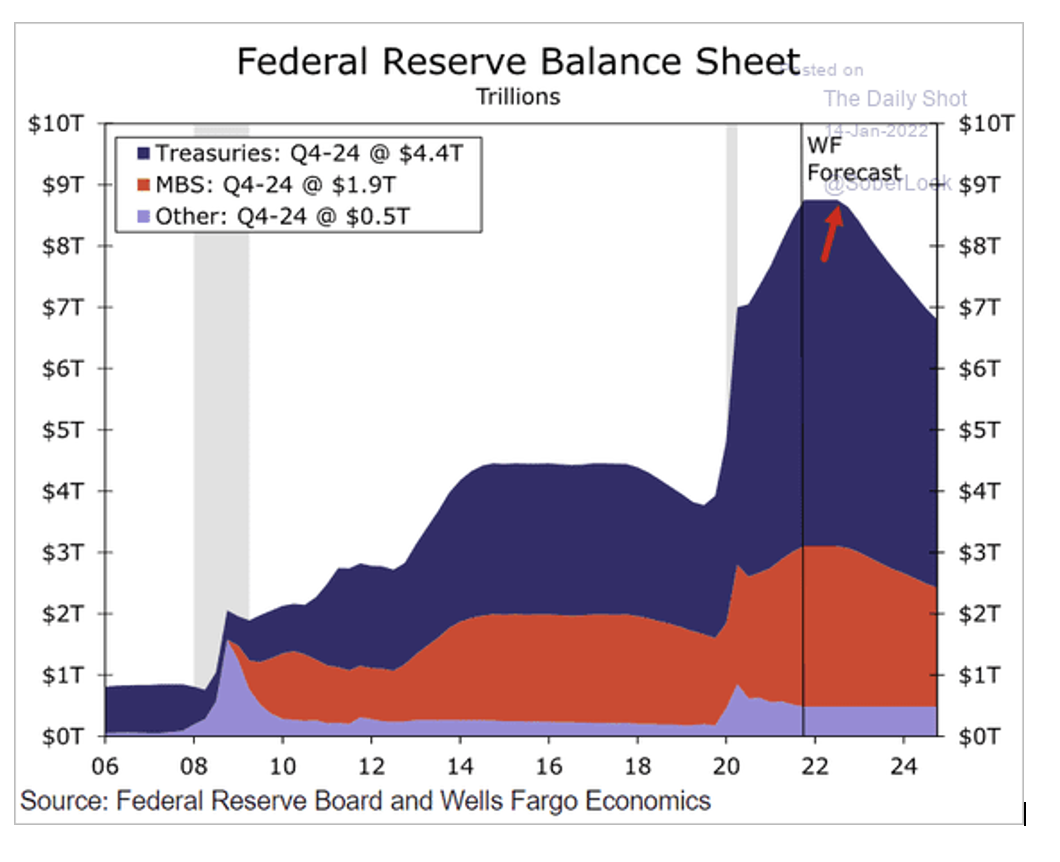

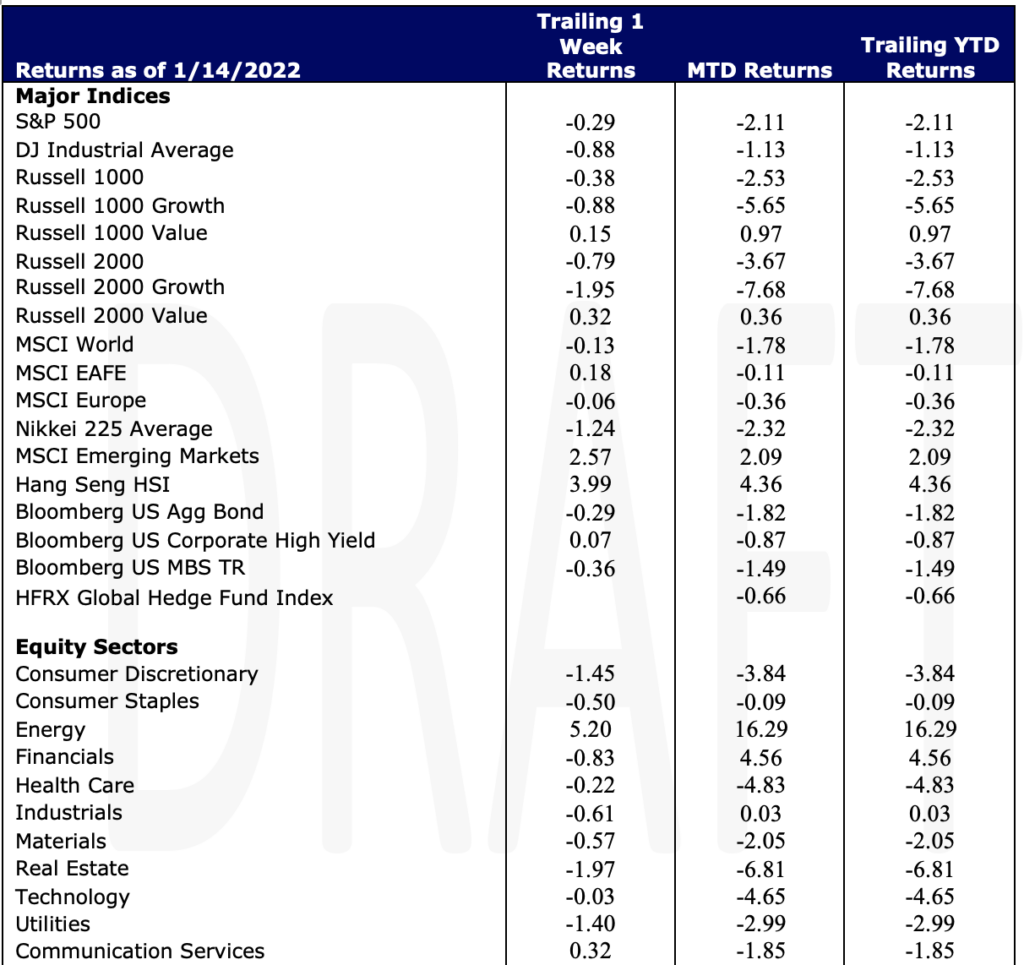

Year-to-date, US stocks are under pressure as speculation surrounds how many increases the Fed will implement in 2022 and beyond and how it intends to shrink its balance sheet (this is addressed in the Fixed Income Section). The Russell 1000 as of Friday fell 3.12% while the S&P 500 fell 2.11%. Growth stocks fell 88 basis point for the week, bringing the year-to-date decline to 5.65%. Value stocks advanced 15 basis points for the week and 97 basis points year-to-date. Real Estate ( -1.97%), Utilities ( -1.40%), and Consumer Discretionary (-1.45%) saw the steepest declines.

Small caps trended in similar fashion, with the Russell 2000 declining 79 basis points, the Russell 2000 Growth, falling 1.95% and the Russell 2000 Value rising 32 basis points.

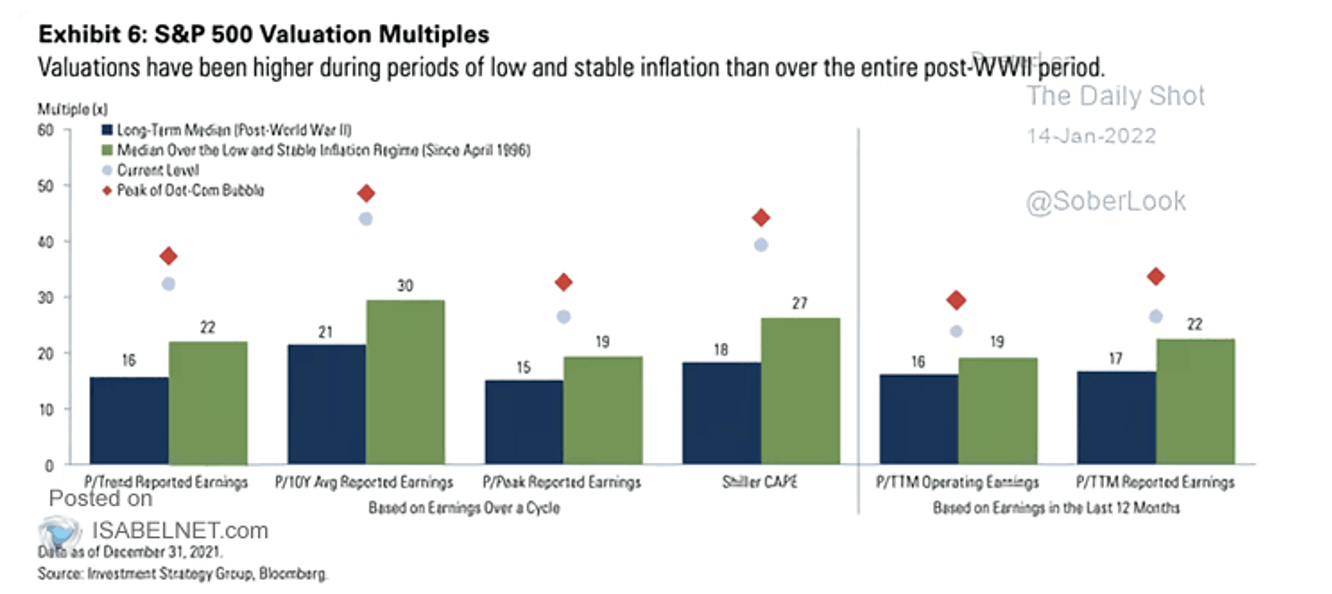

Concerns continue around valuations. Certainly, the chart below makes a compelling argument relative to historical norms. Stock prices will continue to see volatility but we do maintain that business in growth related industries, such as technology, will shine over the longer-term.

International stocks rose 18 basis points. Emerging market equities rose 2.57% for the week as the Hang Seng index rose 3.99%. Over the weekend, China’s full year GDP rose 8.1% slightly less than the 8.4% expected, but fourth quarter numbers were stronger than expected.

Fixed Income

The US Aggregate Bond Index fell 29 basis points for the week and 182 basis points year-to-date. We continue to watch the size of the Fed’s balance sheet and how they will manage to shrink it over time without drastically impacting the economy.

Hedge Funds and Private Equity

This week hedge funds were buyers of Asia ex-Japan and Japanese equities which outweighed the small selling of North American equities. The buying of Asia ex-Japan was long buying as the region outperformed for the week (MSCI Asia Pacific Index +2.4%). At the country level, the buying was China (H-shares), Taiwan, Hong Kong and Korea. Hedge funds were buyers of single-name sectors in Japanese equities most notably health care and industrials. Overall, hedge funds were once again sellers of North America, but sector flows were mixed. Energy was net sold despite the sector’s outperformance and investors continue to sell TMT while healthcare, materials and utilities were net bought. There has been a preference for European rate sensitive financials over North American and European banks had inflows while North American banks had outflows. US gross leverage rose week-over-week mostly from mark-to-market moves as opposed to active re-grossing. Net leverage rose slightly week-over-week. Gross and net leverage were basically unchanged in Europe and Asia.

Roughly one week into 2022, US venture capital firms have already raised $12.8B across fifteen funds. As 2021 recorded a total of $128.3B venture capital funding raised, the highest amount raised of any year within the last decade, 2022 is already on pace to far surpass that total.

The majority of this funding ($9B) comes from Andreessen Horowitz, also known as a16z. The firm has announced it will dedicate $2.5B to a venture capital vehicle, $5B to growth-stage funds and the remaining $1.5B to biotech funds. Each of these vehicles doubled in size as compared to their 2020 predecessors; indicating a16z’s fast-paced deal making is unlikely to subside.

Other notable firms that closed substantial funds in the first week of 2022 include Rabbit Capital which raised $1.15B for its seventh fund as well as $1.15B for an associated vehicle (Ribbit Bullfrog). Additionally, Khosla Ventures raised over $550M for its first opportunity fund and Smash Ventures raised $500M for its venture vehicle.

Data Source: Bloomberg, Bureau of Labor Statistics, CDC, CNBC, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

|

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes. |