Economic Data Watch and Market Outlook

Periods of high price volatility usually focus on market sentiment more so than economic data and longer-term theorems, therefore we are speaking about sentiment far more than we thought or wanted to.

Perhaps you have heard that sometimes good news is bad, and bad news is good. It reminds us how teenagers use the phrase “that is dope” for something great. Economic data is factual, yet the interpretation is sentiment. Friday’s employment report for January was stronger than expected with higher wage pressures. Given where we are in this economic cycle, stronger growth means a greater probability of an FOMC rate increase.

This past week was the “Tale of Two Companies” which put pressure on tech stocks. Facebook’s earnings were below expectations while Amazon released very strong earnings that were not anticipated by investors . One of the best performing stocks on Friday was SNAP, a browser software company that posted its first positive earnings since going public in 2017.

Globally it was an interesting week. The trucker strike in Canada is rapidly becoming a major issue, the Russian troop buildup on the Ukraine boarder with the current deployment of more US soldiers, Omicron data is still vacillating, the Olympics started in China and much of the continent is dealing with snow, ice and sleet.

Equities

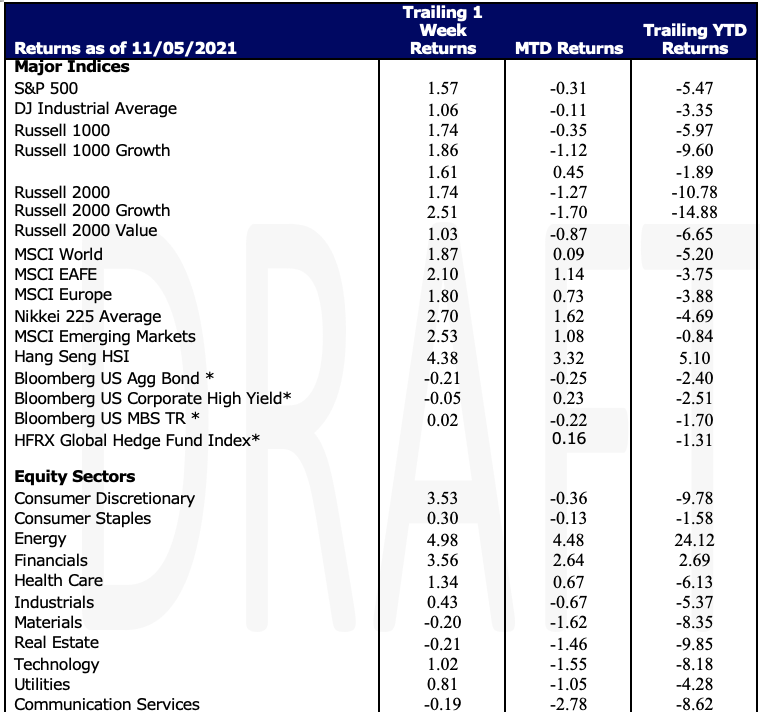

Equities markets remained volatile but recorded overall gains with the S&P, Nasdaq Composite and Russell 2000 all posting their best weeks’ performance since December. The US continued its momentum with the Russell 1000 returning 1.74% last week and a -5.97% YTD. Growth and Value performed similarly with the Russell 2000 Growth recording 251bps on the week and its Value counterpart returning 103bps whereas the Russell 1000 Growth and Value each posted 186bps and 161bps gains, respectively. YTD, both large and small-cap Growth significantly lags Value Sectors remained mixed last week; Energy (+4.98%), Financials (+3.56), and Consumer Discretionary (+3.53) the largest contributors while Real Estate, Materials, and Communication Services were the biggest laggards each recording roughly -20bps.

Globally, Hong Kong outpaced other major global indices returning 4.38% last week. Emerging markets ended on a good note last week gaining 253bps while the Japan Nikkei returned 2.70% after investors looked forward to a government policy on economic reopening this week.

Fixed Income

The Bank of England (BOE) raised its policy rate by 25 bps to 0.50%, the first back-to-back rate increase since 2004, while few policy members wanted a bigger hike to 0.75%. The BOE stated it would no longer reinvest income from maturing bonds as it grapples with inflation. The 10-year Treasury increased 1.84% following the news of the rate hike, after closing 1.78% prior. IG corporate supply reached $19B, largely dominated by financials, as Bank of America priced a $9B deal across 5 tranches. Corporate spreads tightened 1 bp to 105 bps amidst robust demand. HY corporate issuers took advantage of relatively calm markets to price about $2B of new supply. The Bloomberg HY Index declined 21 bps to 5.06%, and spreads tightened 16 bps to 326 bps as investors jumped back in the market looking for yield. After underperforming in January, municipal bonds recovered slightly, with the 10-year AAA muni yield falling 10 bps to 1.47%.

Hedge Funds and Private Equity

Hedge Fund flows were fairly muted amidst the market rally that began at the end of last week until the beginning of this week. Starting on Wednesday, net selling began, led by North America, mostly short selling both in ETFs and single-name. Both Goldman Sachs and Morgan Stanley’s prime books saw net selling in financials (mostly banks), but Morgan’s had net selling in TMT while Goldman’s saw net buying in TMT. This brought net leverage down from 54% to 50%, near 1.5-year lows. While hedge funds were net sellers in North America, they were net buyers in other regions. In Europe, net exposure rose, and funds added to longs (ETFs, utilities and healthcare the most net bought) and covered shorts. Hedge funds were net buyers in AxJ. Interestingly, that came from covering shorts and selling longs to a lesser extent. This was spread across a handful of countries. Japan was the most net bought region all from the long side. Regarding crowded longs/shorts in North America, positive alpha this week came from the short side, as longs underperformed the S&P (crowded longs are down 10% more than the S&P YTD). In Europe, YTD longs are outperforming while shorts have lagged, producing a positive spread. In Asia, crowded longs outperformed the MSCI Asia Pacific, but lag YTD.

Private Equity

SEC Chairman Gary Gensler’s new proposed fund-reporting rules are facing pushback from private equity firms and hedge funds alike. The proposed rule changes would significantly expand the amount of confidential information that large funds are required to share with regulators as well as the number of funds that would have to adhere to these requirements. Additionally, the proposed rules would also increase the speed at which these funds must share the information.

Under the new rules, large PE funds would be required to report “any secondary transaction initiated by the fund’s advisor, certain general or limited partner clawbacks, the removal of a GP, termination of a fund’s investment period or the termination of a fund. Hedge funds would have to report “a 20% drop in net asset value over 10 days, a 20% increase in margin requirements over 10 days, an inability to meet margin or collateral call, redemption calls that exceed 50% of a fund’s value and other significant events”.

As critics voice concerns that the proposed regulation will only burden firms with unnecessary paperwork and red tape, the SEC remains steadfast that the new rules are needed to “enhance regulators ability to detect systematic risk, regulate the private funds and protect investors.”

Data Source: Bloomberg, CDC, CNBC, the Daily Shot HFR (returns have a two-day lag), Financial Times, IR+M, Morgan Stanley and Goldman Sachs prime brokerage, Morningstar, Pitchbook, Standard & Poor’s, US Census Bureau, and the Wall Street Journal