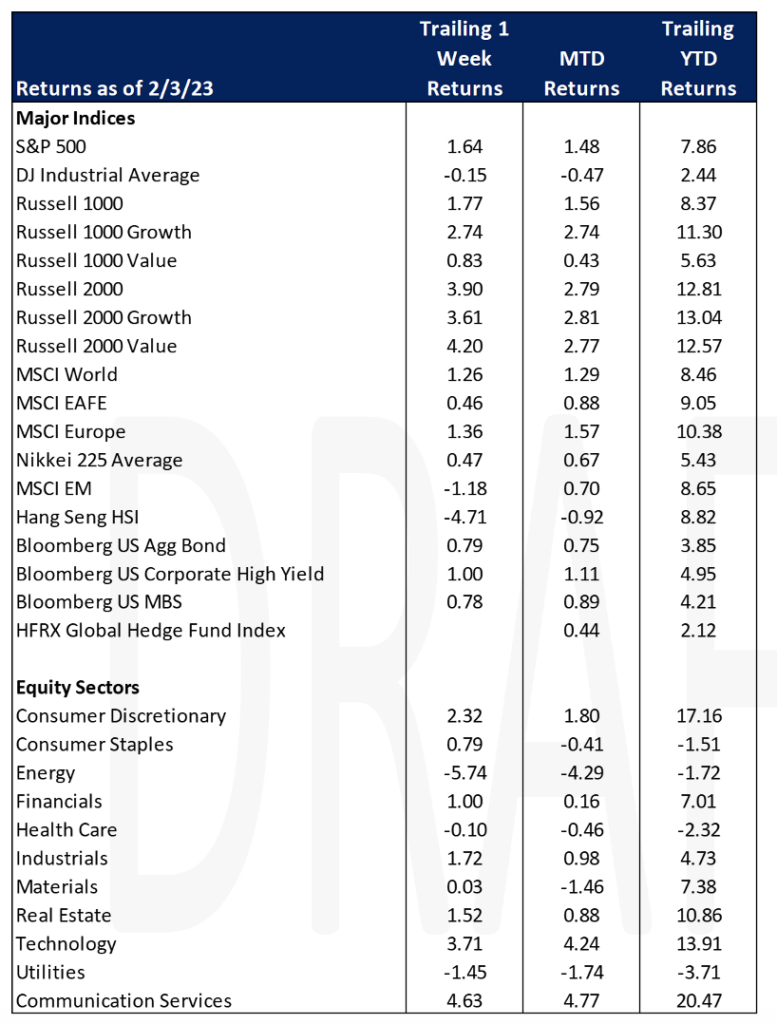

Global equity markets rose as the MSCI World advanced 1.64% on the week. The US Aggregate Bond index rose 79 basis points. The week’s news was dominated by the Fed raising rates by 25 basis points and Friday’s blowout jobs number which significantly exceeded consensus.

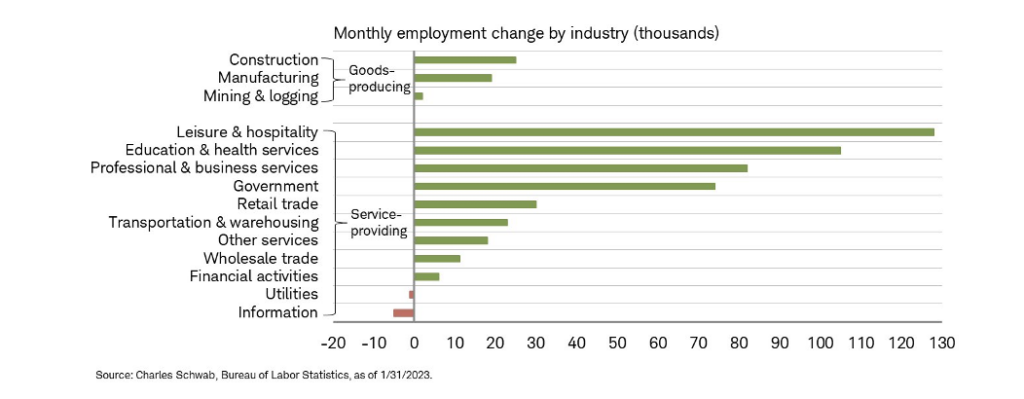

US payrolls exceeded expectations in January, with the jobless rate hitting a 53-year low. Employers added 517,000 jobs in January exceeding all estimates and almost doubling December’s number of 260,000. Unemployment dropped to 3.4%, the lowest point since May 1969. Average hourly earnings rose 0.3% from December, and 4.04% from a year earlier.

Data shows that consumer revolving credit has significantly increased in recent months along with data reported last week about pressure in auto loans and the size of payments. This counters one of the most interesting segments of the jobs number, the leisure and hospitality sector. This sector has consistently increased in recent months with the expectation that it would wane after the holidays as the sector added 128,000 jobs. The consensus for all industries combined was an estimate of 188,000.

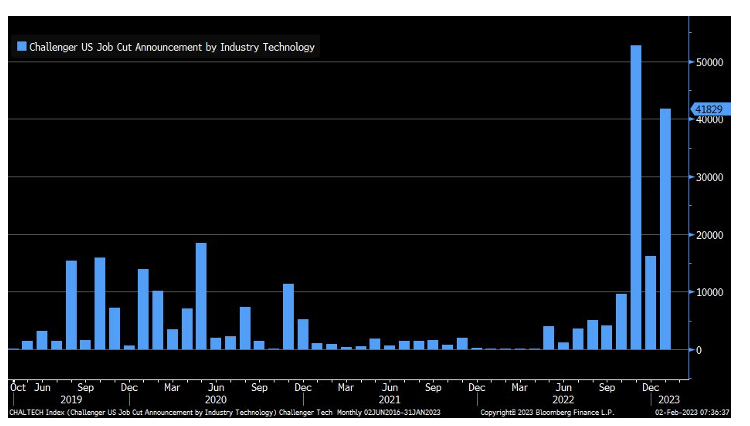

Tech layoffs have made significant headlines, but these workers seem to be finding new employment opportunities. While announced layoffs have surged as the chart below indicates, the actual loss in the last month has only been 5,000 workers as the above indicates. We’ll continue to watch this sector to determine if it there was over-hiring or if their cutback continues to be a realignment across the sector.

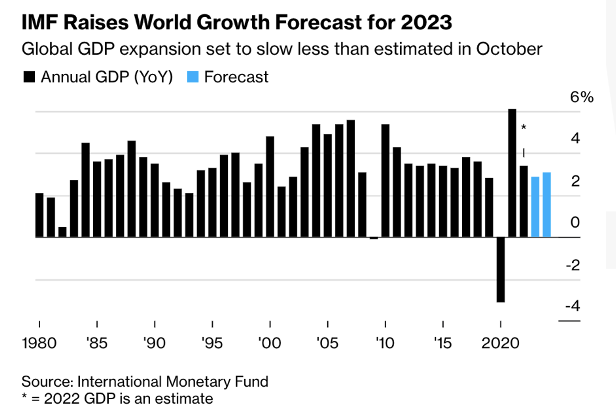

The IMF raised growth forecasts for 2023, with global GDP expansion slowing less than estimated in October 2022. The forecast was boosted by resilient US demand and China reopening. Global GDP is projected to grow by 2.9% in 2023, and 3.1% in 2024. The IMF expects consumer price increases slowing to 6.6% this year, down from 8.8% in 2022.

Equities

Expectations of slower increase in rates by the Fed fueled the market at the beginning of the week. By Wednesday afternoon the market was digesting the 25 bps raise and “easing inflation” comments made by the Fed Chair Powell and technology stocks rallied. Friday, the monthly job report beat expectations which stoked fears that interest rates would increase for longer than expected. Equity markets finished Friday lower (Dow: -0.38%; S&P: -1.04%; Nasdaq: -1.59%) but the S&P and Nasdaq ended higher for the week +1.64% and +3.36%, respectively, while the Dow was slightly lower at -0.15%.

Apple (AAPL: +2.44%) rose on Friday after reporting earnings and sales numbers that missed Wall Street estimates. Sales in their wearables segment came up short of expectations as well as sales in iPhones and Macs. This was their first quarterly revenue decline miss in nearly four years.

Meta surged 23% on Thursday despite reporting a 4% decline in year over year fourth quarter revenue with a 22% increase in expenses, a decline in earnings per share of 52% and free cash flow of 58%. Mark Zuckerberg also announced that 2023 would be “Year of Efficiency”. The stock closed -1.20% on Friday.

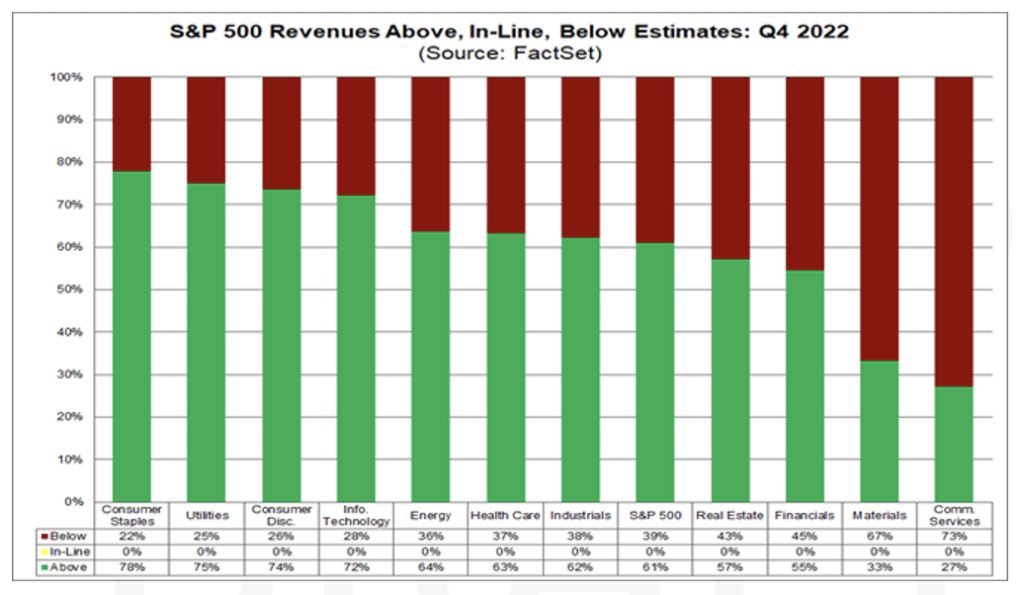

As per Factset, we are now at the midpoint of Q4 earnings season as 50% of the companies in the S&P have now reported Q4 2022 earnings. For EPS: 70% have reported actual EPS above estimates which is below the five-year average of 77%- and 10-year average of 73%. For revenues: 61% of companies have reported actual revenues above estimates led by companies in Consumer Discretionary, Energy and Healthcare sectors.

Also, US stock bulls feel that market signals point to an upbeat year for Wall Street even as there continues to be worries regarding the Fed’s monetary policy and corporate earning that have pointed to the economy slowing because January equities performance produced a “golden cross” chart pattern. There are more stocks making new highs rather than new lows. The market has risen 83% of the time after a rise in January, with an average 11 month gain of over 11% as per CFRA Research.

German based Thyssenkrupp AG (TKA1: -1.30% on Friday) is considering a standalone solution for Thyssenkrupp Marine Systems, which is their warship and submarine business. Deka Investments, Thyssenkrupp AG 12th largest shareholder and Ingo Speich, head of sustainability and corporate governance called for this disposal and cited reputational and compliance risk.

Overall European equity (FTSE 100: +1.03%; DAX: +2.07%; European STOXX 600: +1.23%) was positive for the week

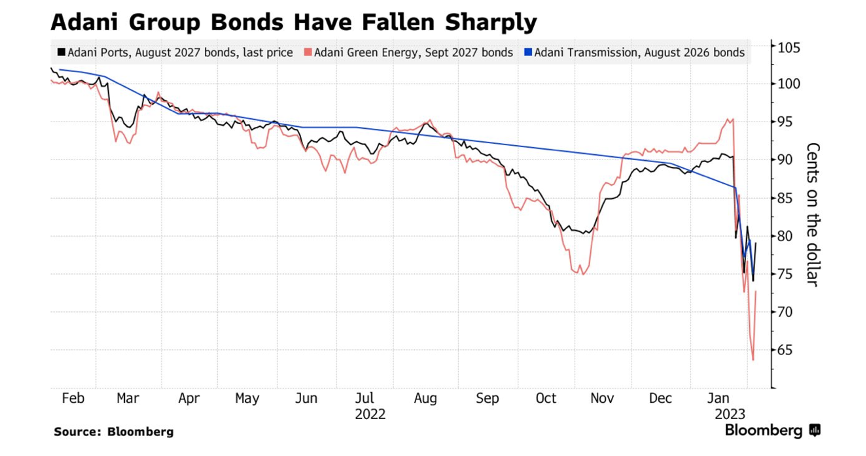

The Indian conglomerate Adani Group Companies lost $100 billion in market value as of Friday, as US short seller Hindenburg Research published a report on January 24th alleging the company’s improper use of offshore tax havens and stock manipulation. This week the company scrapped a $2.5 billion share sale. Reuters has reported that the Indian markets regulator is investigating this matter, including the crash in the company’s shares, a shelved share sale this week and any possible price manipulations. Adani Group is in coal and power trading businesses and operates through the following segments: Integrated Coal Management, Mining and Services, Solar Manufacturing, Shipping, and others.

As reported in Kyodo News, Japan will now begin restricting exports of advanced semiconductor manufacturing equipment produced by companies like Nikon Corp. to China in spring after it amended a foreign exchange law to allow the change, though the new law will not mention China specifically.

Asian markets for the week was mixed (Hang Seng: -4.71%; Nikkei: +0.47%; Shanghai -0.04%).

Fixed Income

As expected, the Fed raised interest rates by 25 bps on February 1st, with the benchmark rate now sitting in the target range of 4.50% to 4.75%, the highest level since October 2007. Rates climbed from where they started the week with the two-year Treasury yield rising 11 bps on higher-than-expected jobs growth, the ten-year Treasury yield rising 1 bp, and the 30-year Treasury yield falling 1 bp. The Bloomberg US Aggregate Bond Index rose 0.79%.

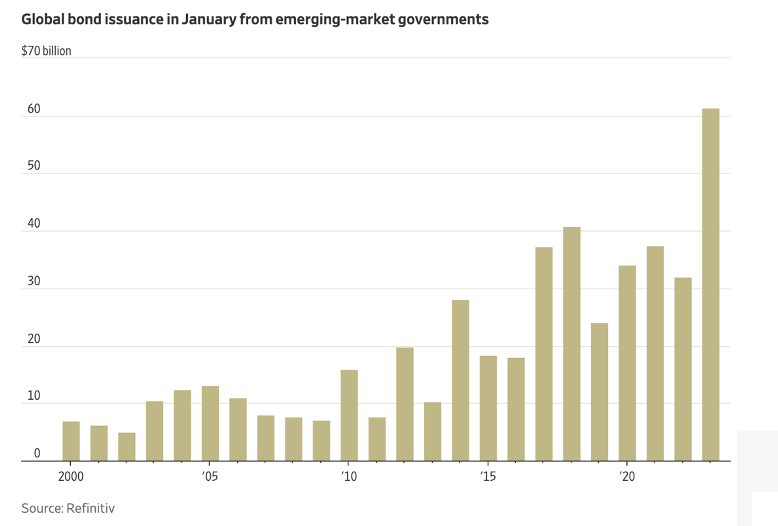

Emerging-market governments such as Mexico and Saudi Arabia issued $61B worth of bonds in January, exceeding the previous high for the month of January which was $41B, according to Refinitiv. After last year’s departure from emerging markets due to the Russia/Ukraine conflict, investors are diving back in to start 2023 and upping their risk tolerance after a poor year for fixed income. The movement comes from expectations that inflation is waning and that policy makers will slow or halt rate hikes in the coming months.

More than 200 financial institutions around the world are exposed to Adani Group’s $8B in bonds. A majority of the bonds have fallen to distressed levels after allegations of fraud by short seller Hindenburg Research came to the surface last week. Large asset managers such as BlackRock and Lord Abbett & Co. both have over $100M exposure to Adani bonds. Alongside Adani Group coming into question, the State Bank of India’s quarterly profit rose 69% from the previous year, exceeding analyst estimates. Net income was 142.1B rupees or $1.74B in Q4 2022. The BOI has offered as much as $2.6B in loans to Adani Group companies but sees no immediate challenge from the exposure stated Dinesh Khara, Chairman of the Bank.

Hedge Funds

Performance has seen a somewhat challenging start to the month given the outperformance of the shorts relative to equity benchmarks. With that said, absolute performance is still positive, with the average global fund up ~40bps in the first two days of February and the average Americas-based L/S fund up ~1.2% MTD. The crowded shorts in NA are up nearly ~5% more than the S&P, but given that 1) HFs aren’t running as high short exposure to these names vs. what they have in the past, and 2) crowded longs are up 2% more than the S&P, the impact of the negative short alpha hasn’t weighed on P&L as much as many might expect for the broader universe of L/S equity funds. Finishing out January, hedge funds had not done any material single-name short covering despite the negative short alpha in January, but that changed on Wednesday as funds shifted into short covering mode. This led to the first two days in February becoming two of the largest days of short covering seen in recent years (except March 2020 and January 2021 which were much larger) of which 80% of the flow was US equities and 20% EU equities (other regions were more muted). At the industry level, the covering was concentrated in TMT (lower quality software, IT services, tech hardware and internet retail), consumer related industries (specialty retail, restaurants and leisure, hotels and autos) and to a lesser extent financials (banks & capital markets). Energy saw the largest net selling in eight months, driven entirely by short sales. Regarding long selling, most was concentrated in North America. Chinese equities were net sold, the first time in seven weeks.

Private Equity

Given 2023’s uncertain global economic outlook, the private debt market may face its biggest test yet in the year to come. Private debt, which has seen nearly a decade of rapid growth, could see a decline as interest rates continue to rise threatening companies’ abilities to service their borrowing costs. Ultimately, this will force investors to carefully consider their private debt exposure. A looming global recession could also decrease prospective deals for alternative lenders, similar to what has happened to private equity firms. Alternatively, for companies that may find it more difficult to source capital from public markets at this time, alternatives such as private debt funds may be better positioned to negotiate more favorable terms with borrowers.

According to Pitchbook data, in 2021 private debt mangers had roughly $162 billion in dry powder, while that number was increased to roughly $169 billion in the first half of 2022. Pitchbook data also showed that global debt-focused fundraising has also started to slow down. Midway through 2022, 66 private debt funds had raised $82 billion in comparison to roughly $93 billion gathered by 130 funds during the first half of 2021.

Analysts suspect some areas of the debt market will be affected more than others while some strategies including distressed securities may be more favorable than others. According to Fitch Ratings, default rates in the high-yield and leveraged loan market are expected to rise globally. Institutional leveraged loans are estimated to see default rates as high as 3% and 4.5% in the United States and Europe compared to just .6% and 2% in 2021.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.