Economic Data Watch and Market Outlook

Much of the economic data was overshadowed this past week by the invasion of Ukraine by Russia. As of the writing of this note, Ukraine has agreed to talks with Russia, but Putin has placed nuclear deterrent forces on alert.

Nations have rallied to support Ukraine though arms shipments, sanctions on the banking system, and targeting Russian billionaires. Even Elon Musk contributed by providing SpaceX’s Starlink Internet Service after the Ukraine vice prime minister Mykhailo Fedorov requested his help on Twitter. Reports have stated that it costs Russia roughly $20 billion per day to continue to engage and the invasion is proving to be not as easy as expected. A side consequence is NATO seems to have gained strength. One such example is Germany pledging to raise its defense spending above 2% of its GDP.

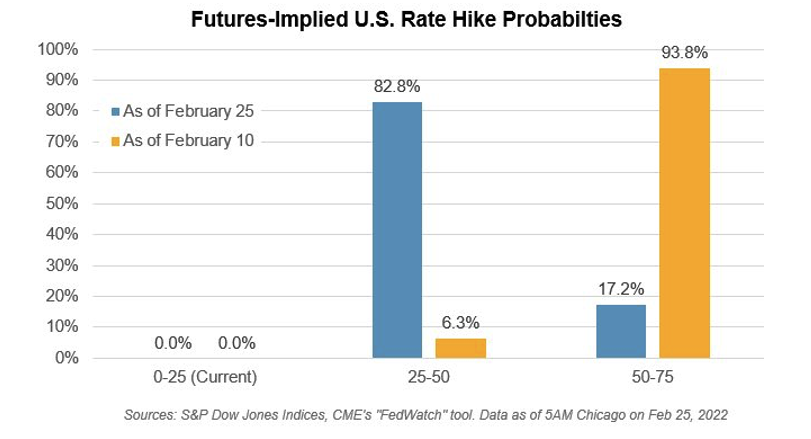

Geopolitical instability in Europe has created even more uncertainty and has put a magnifying glass on the financial system and energy. One such case is the Fed’s expected rate increase in March. While it’s still expected, views have shifted dramatically from a 50-75 bps rise to a 25-50 bps rise. Rising energy prices could slow the economy as oil is hovering around $100 and gas prices are averaging $3.60 per gallon according to AAA. Does the rise in oil prices soften the West to work with previous bad actors such as Iran? We continue to watch these developments but believe that oil will go higher until the conflict is settled.

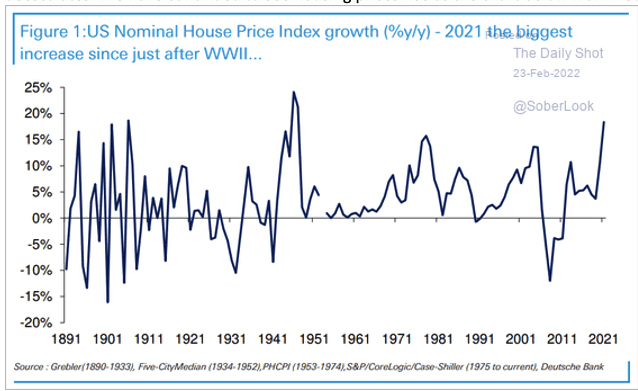

Much of the economic picture in the US and abroad will depend on how quickly the Ukraine/Russia War deescalates. We have continued to see housing prices rise as the chart below from Deutsche Bank shows.

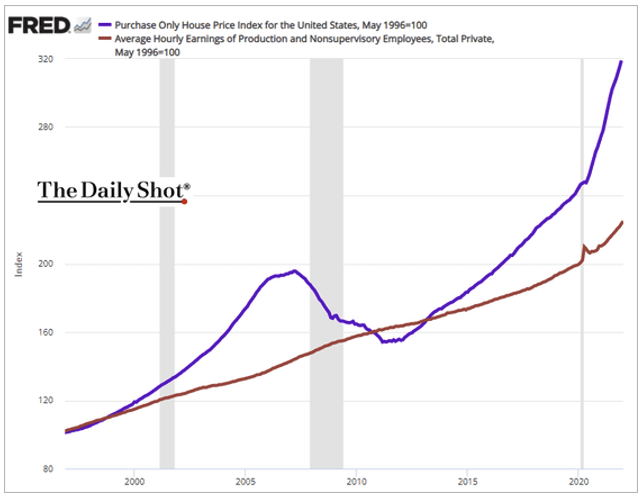

What is interesting is that the rise in housing prices has outpaced the rise in wages.

Most eyes will be on the Russian conflict but expect more data this week as mortgage data and industrial production results are released.

Equities

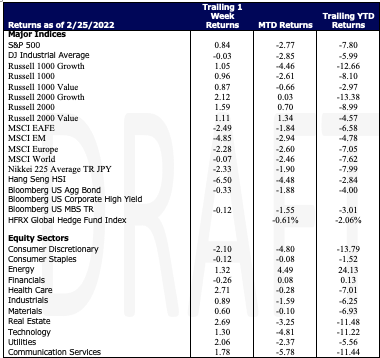

The market rebounded for the second consecutive day on Friday from the sharp sell-off leading up to Russia’s invasion of Ukraine. Overall, the markets were turbulent this week hitting correction territory. The S&P 500 ended the week in the green returning 84 bps helped by Healthcare (2.71%), Real Estate (2.69%) and Utilities (2.06%) sectors. For the week, the Dow was down 0.03% and the tech-heavy Nasdaq was up 1.1%. Year-to-Date, Energy is still the biggest winner amongst the 11 sectors returning 24.13% so far. Small-cap stocks continued their run with the Russell 2000 indices all ending the week positive. Globally, stocks ended the week in the negative extending losses on the year. EM stocks ended the week down 4.85% while Europe was down 2.28%. The MSCI World was down 7 bps.

Fixed Income

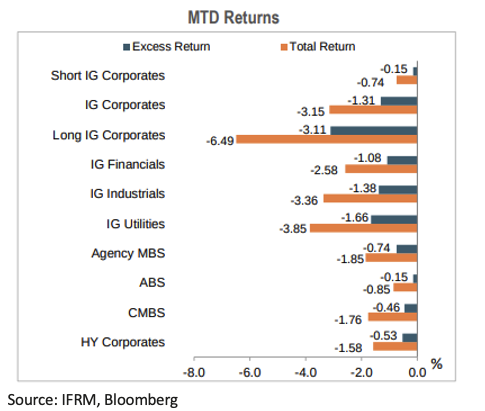

Treasury yields initially fell Thursday following the Russian invasion of Ukraine but rallied on Friday with the 10-year Treasury Note reaching 2% mid-day after initially falling to 1.85% on Thursday. The 2-year Treasury Note jumped 10 basis points on the week while the 30-year Treasury Bond rose 3 basis points to 2.77%. Corporate bond spreads tightened following the drop in Treasuries mid-week. Bloomberg US Agg Total Return Index was down .33% on the week while the Bloomberg US Corporate High Yield Index rose .72% on Friday to erase any losses during the week ending in a .37% gain. The Bloomberg US MBS Index continued to slide this week and is down 3% on the year. The probability of a March 50-basis point rate hike by the Fed fell from 80% to 20% due to the current geopolitical issues. Fed futures are still expecting 6 rate hikes during the year to keep inflation at bay. Market volatility is expected for the near term due to the combination of inflation, global monetary policy tightening, and geopolitical conflicts currently impacting the market.

Hedge Funds

While hedge funds posted losses for the week, in all regions, they only bore a portion of index-level downside (hedge fund reported returns do not include the large index gains on Friday the 25th). YTD global hedge funds are down about 3.7% while the MSCI World is down over 9%. Hedge funds are now outperforming their respective indices in all regions. In the US, crowded longs and shorts both had a good week as longs were up 70 bps and shorts were down 140 bps for a 210 bps spread. Single-name and macro products (ETFs and indices) were both net bought. The largest hedge fund buying for the week was in Europe driven by long additions across all sectors but utilities. Following three consecutive weeks of buying, hedge funds sold Asia ex-Japan through a mix of short additions and long buying. China (H shares) and Taiwan led the selling. Japan was also sold for the week 1/3 short additions and 2/3 long selling. Net leverage sits at 12-month lows in all regions.

Private Equity

Led by Apollo Global Management and KKR, the largest funds are acquiring and launching new credit origination platforms at a breakneck pace in Q1 of 2022. These platforms give funds the ability to expand expert teams while increasing their ability to create credit deals for private debt strategies or originate loans. As mega funds continue to expand their assets under management to unprecedented levels, funds will need the ability to deploy that capital and will seek to take advantage of the favorable regulatory treatment new credit deals receive in insurer portfolios.

The flood of investor money into private funds has certainly been a driving factor in creating a clear path into the origination business for large funds. With an inflow of large amounts of capital, funds must continue to feed the beast with the ability to originate loans in a proprietary way to align with the flow of capital. In addition to controlling the capital flow, fund managers also have an increased ability to control risk based on changing market conditions and will save time conducting due diligence of third-party lending deals.

Although managers will need to adjust to the operational and compliance aspects origination requires, analysts suspect other funds such as Carlyle, Blackstone and Ares to follow suit in the coming year.

Data Source: Bloomberg, CDC, CNBC, the Daily Shot HFR (returns have a two-day lag), Financial Times, Fund Fire, Morningstar, Pitchbook, Standard & Poor’s, US Census Bureau, the Wall Street Journal, Morgan Stanley and Goldman Sachs Capital Introduction and IR+M

| This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes. |