Economic Data Watch and Market Outlook

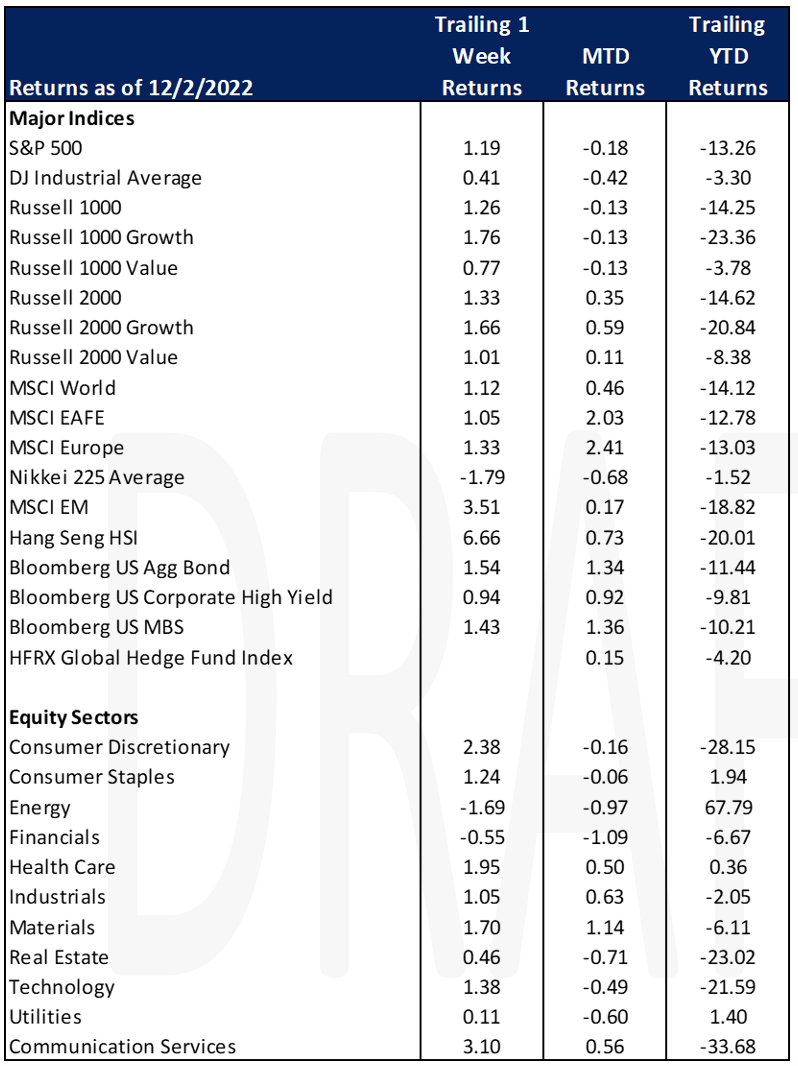

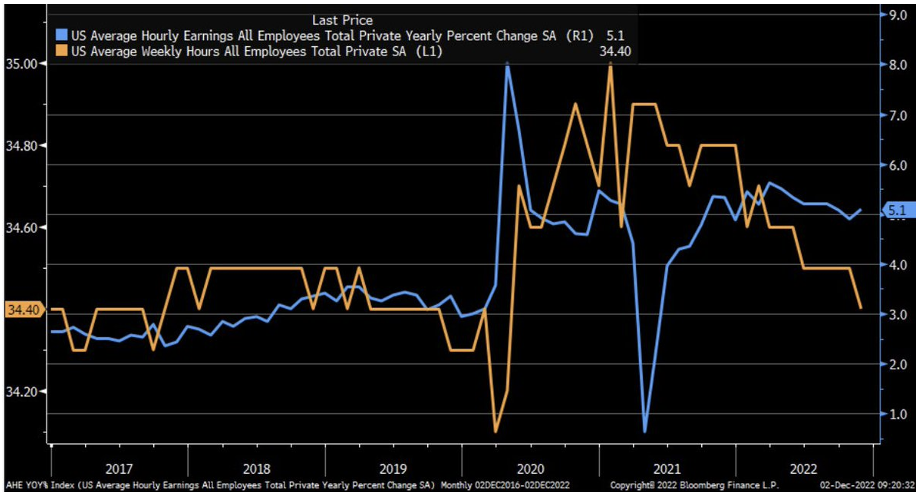

Global equity prices rose for the week with the MSCI World index rising 112 bps and the US Aggregate Bond index rising 154 bps. Markets ebbed and flowed during the week as Powell noted that the Fed may make smaller increases in rates which caused equities to advance mid-week, but those gains were pared as jobless claims were below estimates. There is evidence that employment is cooling as the graphic below demonstrates wage gains plateauing as well as weekly hours worked.

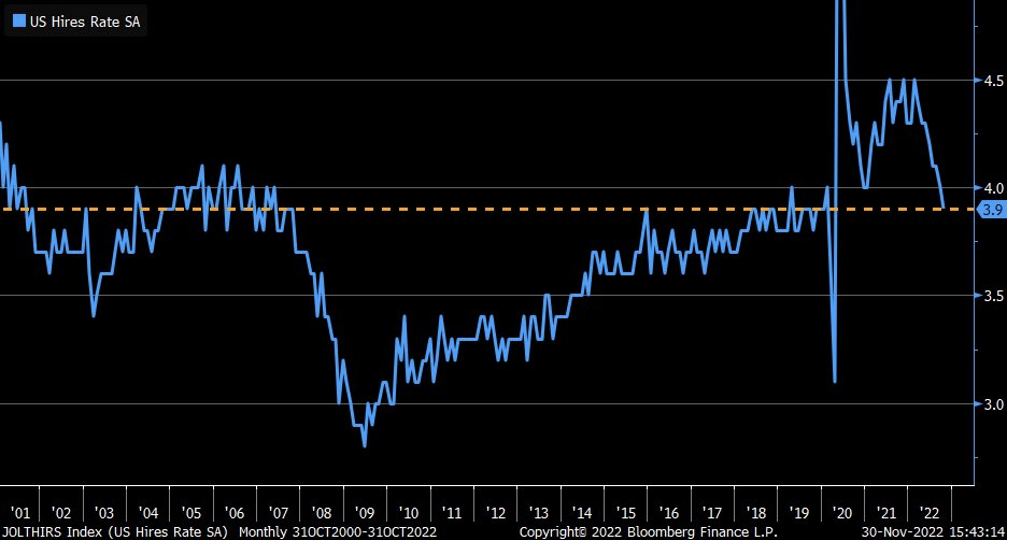

Hiring has also slowed:

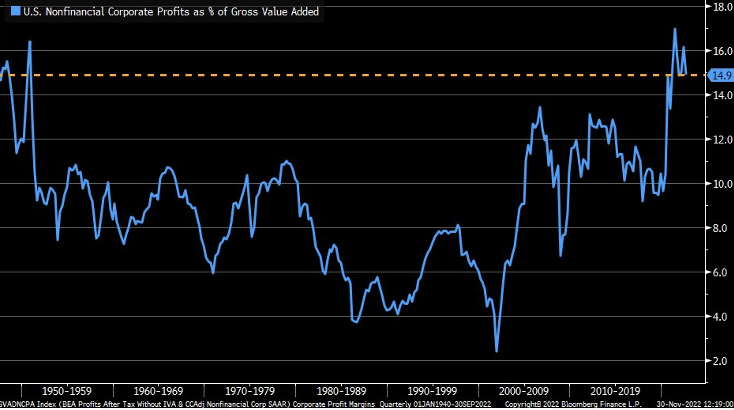

Additional evidence of the economy slowing is corporate profit margins easing slightly. Global profits have also slowed.

There is no doubt that higher rates have stalled the housing markets in the US with pending sales dropping approximately 37% year over year but as mortgage rates have declined as the chart below shows, the rate of applications have increased.

This upcoming week, we’ll learn about US production and trade balance data early in the week, European production data mid-week and US jobless claims on Thursday. Friday we’ll get the results of University of Michigan’s Confidence polls.

Equities

Equity markets were volatile and closed slightly higher (Dow: +0.41%; S&P: +1.19%; Nasdaq: +2.06%) for the week but on Friday the Dow (+0.10%) finished slightly higher while the S&P (-0.12%) and Nasdaq (-0.18%) finished slightly lower due to employment wage growth numbers coming in better than expected. US listed Chinese companies such as Alibaba (BABA: +4.79%) and JD.com (JD: +5.00%) rose on expectations that China has started taking steps on easing their zero COVID policy.

BlockFi, a cryptocurrency exchange, filed for Chapter 11 bankruptcy on Monday citing the recent collapse of cryptocurrency exchange FTX as well as a number of projects and businesses that failed earlier this year and the decline in price of digital assets. Since BlockFi filed for Chapter 11 bankruptcy it will still be able to operate while formulating a repayment strategy for its creditors.

Meanwhile Blackstone has limited withdrawals from its $69 billion unlisted REIT on Thursday after redemption requests hit pre-set limits due to investor concerns of valuations.

Apple has accelerated plans to move production out of China. Apple is reportedly telling suppliers to plan more actively for production in other areas of Asia. This could affect the 300,000 workers that are employed at Foxconn and responsible for 85% of iPhone Pro Production. Wait times have more than doubled for week 10 sales due to turmoil in the region.

European stock markets closed flat (FTSE 100: -0.03%; DAX: +0.27%; Euro STOXX 600: -0.15%) on Friday but also for the week (FTSE 100: +0.99%; DAX: -0.10%; European STOXX 600: +0.58%). Asian stock markets were up on Thursday after the Fed signaled slower rate hikes but mixed for the week (Hang Seng: +6.66%; Nikkei: -1.79%%; Shanghai +1.76%).

Fixed Income

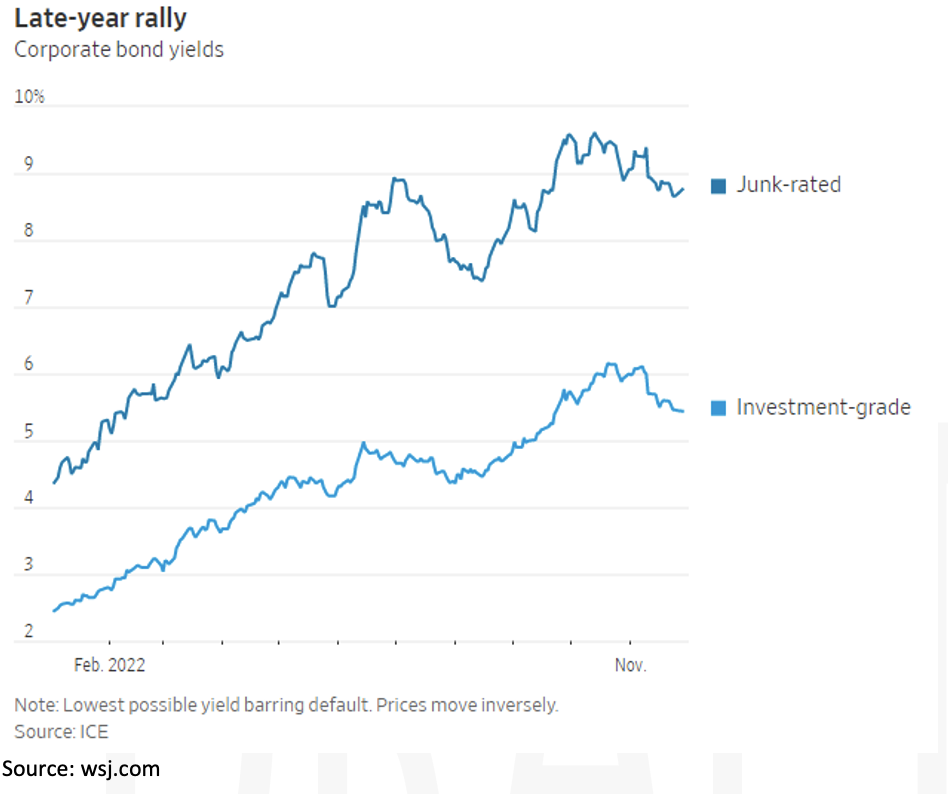

Treasury Yields continued their decline into the first days of December. Although a strong jobs report caused a spike on Friday morning, yields retraced to their Thursday levels by the end of trading hours. The 2-Year Treasury yield fell 18bps to 4.28%, the 10-Year Treasury yield fell 18bps to 3.41% and the 30-Year Treasury yield fell 18bps to 3.56%. A 50bps increase is expected at the Fed’s December 14th meeting, ending the unprecedented trail of 75bps hikes over the past year. Junk bonds rallied into the end of November, with yields of below-investment-grade bonds falling to 8.8% from their October 13th high of 9.61%.

Eurozone government bonds also rose Friday in response to the strong US Jobs report. The German 10-year bund yield climbed to 5bps 1.87% Friday, while the Italian 10-year bond yield rose 8 bps to 3.76%. European inflation data showed signs of cooling with the data showing an inflation rate of 10.0% for November, down from October’s rate of 10.6%. Although prices are still rising, the acceleration is no longer exponential.

Hedge Funds

With this week’s continued rally in the equity markets, hedge funds posted positive returns for November, albeit significantly trailing the indices. The average returns for funds vs. their respective indices were as follows:

– Global long/short +2.8% vs. MSCI World +7.8%

– Americas-based L/S +2.4% vs. S&P 500 +5.6%

– EU-based L/S +3.8% vs. Euro STOXX 600 +6.9%

– Asia-based L/S +4.2% vs. MSCI Asia +15%

Crowded longs worked well this week and it was the 3rd consecutive week NA crowded longs vs. shorts had a positive spread (70 bps) although crowded shorts generated negative alpha (the long was large enough to maintain a positive spread vs. the S&P). This followed multiple months of negative long alpha. YTD, crowded shorts have generated significant alpha, but crowded longs have been extremely challenging, down almost 3x the S&P.

Regarding flows, the de-grossing activity from previous weeks subsided, although funds did add to shorts in small amounts. By geography, NA saw the short additions mainly came from ETFs, tech and financials. HF also sold longs in more defensive sectors such as healthcare, utilities, RE and consumer staples. On the other side, funds were buyers of industrials through long purchasing and machinery short covering. Outside of NA, AxJ saw the most directional flows as funds were buyers of the region through both long additions and short covers (predominantly China through ADRs and H-shares). Flows to Europe and Japan were more muted.

Private Equity

The carbon & emissions tech vertical, which includes technologies that capture, store and utilize emitted carbon, reduce emissions, monitor physical assets containing stored carbon and carbon accounting software, saw a strong performance in Q3 of 2022. The quarter is the third-strongest quarter in history for this vertical in terms of deal value at $4.8 billion. Deal count for Q3 was the highest on record with a total of 231 deals. Median pre-money valuations in the carbon & emissions tech vertical have continued to climb, specifically in early-stage deals. Since 2017 the median pre-money valuation in early-stage carbon & tech emissions skyrocketed 254% from $9.9 million in 2017 to $35 million in 2022.

The largest deals in this space during Q3 include lithium battery producer and recycler Northvolt raising $1.1 billion in late-stage funding to build Europe’s largest battery recycling plant. Xpansiv, the environmental commodity trading platform, also raised $400 million early in Q3.

The passing of the Inflation Reduction Act (IRA) in the United States in August, has substantially accelerated the pace of investment in this vertical as the Act committed approximately $370 billion to combat climate change. Additionally, outside of the US, European policy makers continue to decrease Europe’s cap for carbon emissions by increasing the price that emitters must pay to emit carbon, therefore reducing emissions. Analysts suspect this vertical will finish at a comparable level to the record levels observed in 2021 and will continue to grow considerably year over year in both deal count and deal value.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Morgan Stanley, Goldman Sachs and the Wall Street Journal.