Economic Data Watch and Market Outlook

One of Clearbrook’s pillars for investing is sentiment. Unlike the more factual and algorithmic financial analysis, sentiment is measured in many ways. Technical analysis is often cited to be of value as well as put/call ratios, margin accounts, moving average convergence divergence levels and general surveys. In the end, sentiment usually describes market action when there is not a clear nor specific aspect to point to. Perhaps the most specific item this past week was the worst kept secret in months, that the Federal Reserve will commence tightening next year, probably in three twenty-five basis point increments. This now has its own acronym – the Powell Pivot.

One of the largest, market moving sentiment indicators was the highly telegraphed tax strategy by Elon Musk to sell some shares to pay for options. Why this caused greater selling is a mystery as it was so highly anticipated, but if affects sentiment. From a trading perspective, it was effectively a secondary offering given the size. People still do not like insider selling even if it is to pay taxes. The production delay by Rivian was also not a welcomed surprise.

One of the concerns about tightening is the question of who will buy US debt other than the Federal Reserve? That was partially answered in that European banks are now where US banks were pre-Covid. Rates are so low and credit so easy that lending isn’t as profitable – the net interest margin or “NIM.” European banks have been big sellers of the Euro and buyers of USD. This partially reflects the relative strength of the economy, rising rates to earn some amount of interest income and potentially just shoring up balance sheets. Many firms are bullish on Europe, but we wonder if that is just because it has lagged and thus by definition is cheaper or if there is a macro reason.

One of the more sentient articles this week was in the WSJ which made a very cogent argument that there is little incentive for many companies to expand production or distribution given the outlook to be at trend 2-2.5% GDP growth in 2023-24 and the high cost of building materials. As is often said, nothing reduces higher prices like higher prices. Values tend to gravitate to the mean where profits make expansion appropriate. Some building materials that have futures are receding while items like steel are still sticky.

Equities

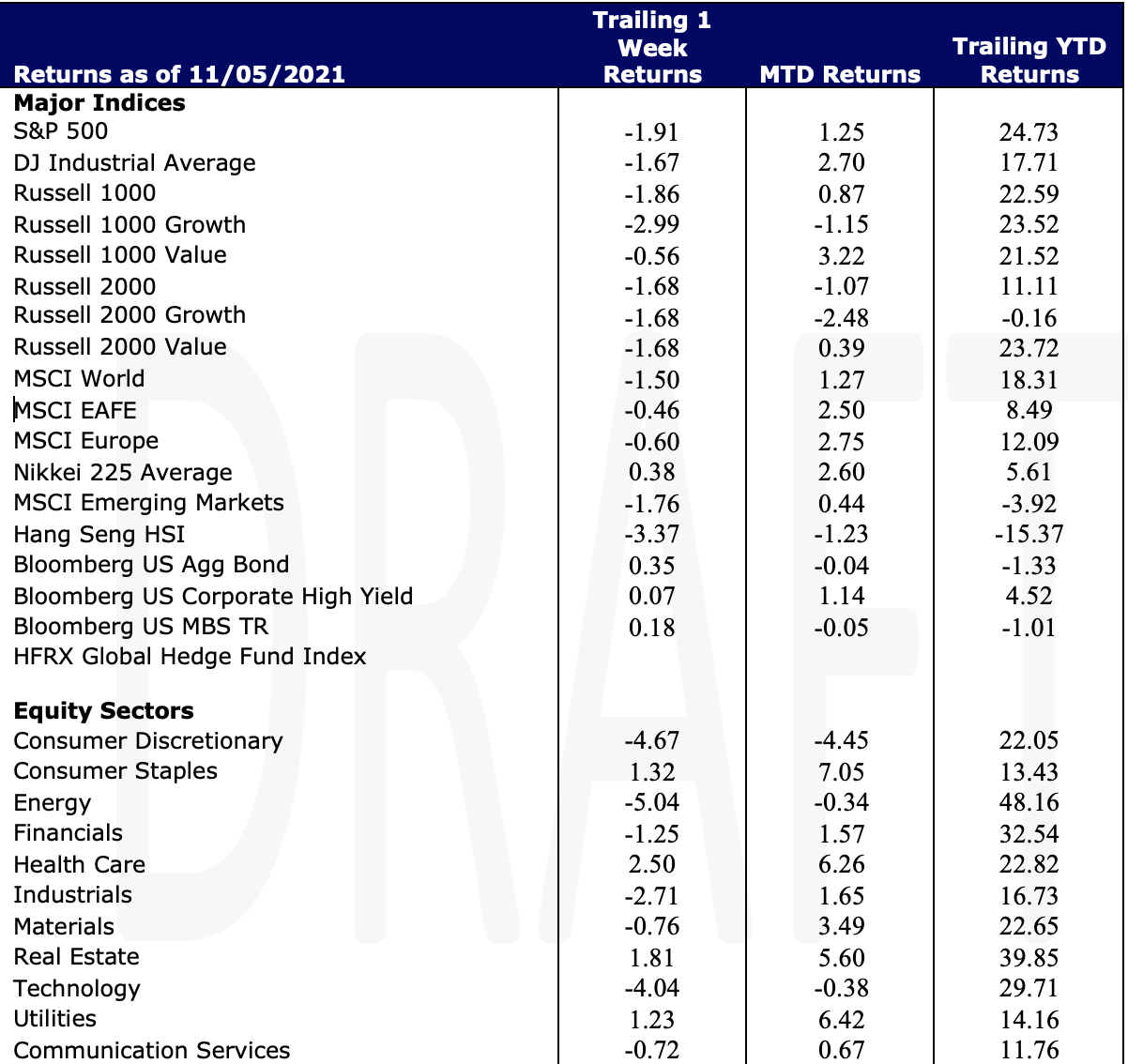

Growth Stocks dragged the broad US Equity markets down for the week (S&P 500, -1.91%). The Russell 1000 Growth fell 2.99% as the Consumer Discretionary sector fell 4.67% and Information Technology fell 4.04%. The Russell 1000 Value fell just 0.56% as investors became more defensive during the week. The Energy sector also plunged 5.04% but Consumer Staples, Real Estate, and Utilities advanced during the week, rising 1.32%, 1.81% and 1.23% respectively.

Small caps continued to pare gains. The Russell 2000 is up over 11% year to date but the R2000 Growth slid into negative territory (-0.16%), falling 1.68% for the week. The Russell 2000 Value fell the same amount for the week but small value stocks have surged YTD, up 23.72%.

Interesting dynamics have crept into the market surge over the last 18 months. Notably, we’ve seen a large amount of retail investors now investing/trading. One area has been Special Purpose Acquisition Companies (SPACs) that recently lost favor as they have suffered one of their worst drawdowns ever.

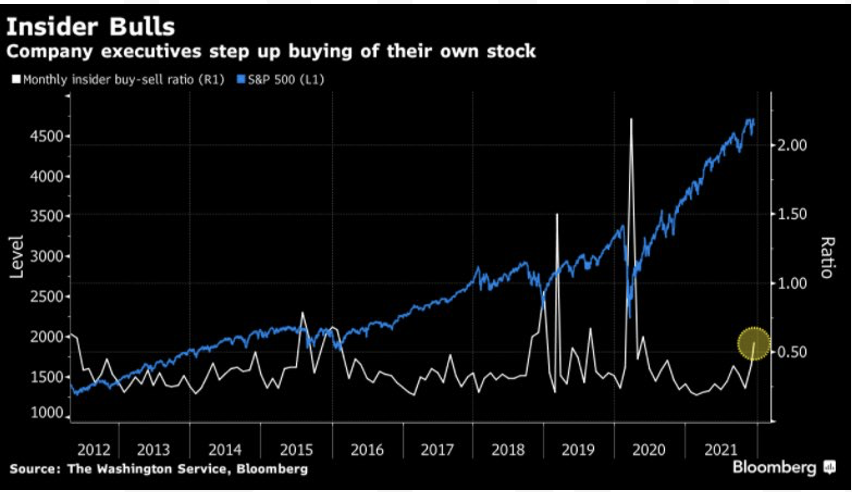

On the flip side, according to data aggregator Washington Service, more inside buying has taken place in the last 30 days since March 2020.

Fixed Income

The Bloomberg US Aggregate Bond index rose 35 bps for the week. The Fed announced Wednesday that they would double the pace of winding down its bond buying program. Initially markets were muted with the ten-year yield settling around 1.43% but yields have since come to the 1.37 range as ears about the OMICRON variant have started to cause concerns about shutdowns and a slow down in the economy.

Hedge Funds and Private Equity

Long/short alpha deteriorated again this past week (YTD worst in 10 years) but leverage still increased for the week, the largest weekly increase in eight months. The larger managers are underperforming their smaller brethren YTD as Goldman Sachs clients, on an asset weighted basis, are in negative territory whereas on a median basis up mid-single digits. Single-names saw net selling while macro products and ETFs net buying. Hedge funds rotated into defensive sectors (healthcare, financials, staples and utilities the most bought) while rotating out of info tech and consumer discretionary. Info tech vs. the S&P fell to its lowest level on Goldman’s record. The selling was more short selling than long selling. Nearly all regions were net sold except for Europe where short covers outpaced long sales.

Analysts are predicting a huge year ahead in 2022 for US private equity. Analysts forecast that mega-funds (funds larger than $5 billion) will raise over $250 billion in 2022, including the three largest-ever buyout funds. It is expected that the Carlyle Group, Apollo Global Management and Blackstone will lead majority of mega-fundraising activity in 2022, with over $80 billion anticipated between the three firms alone.

Additionally, driving anticipated growth in 2022, analysts forecast that the big five US public alternative managers’ AUM will eclipse $3 trillion while seeding firms will close at least six funds to back emerging managers. Furthermore, analysts predict that more private capital managers will go public in 2022 than in any previous year driven by favorable markets and lucrative valuations.

While companies continue to realize the need for increased digitization amidst the pandemic- related trends, middle-market software deals continue to be a driving force of PE growth. Analysts predict PE firms will close at least 400 middle-market software deals in 2022, surpassing the previous record of 317 deals for an aggregate of $45B through November of 2021. Included in the trend towards increased digitization, analysts predict at least ten US PE-backed healthcare provider platforms will go public, exceeding 2021’s record.

Data Source: Bloomberg, Bureau of Labor Statistics, CDC, CNBC, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook, Standard & Poor’s, US Census Bureau, and the Wall Street Journal

This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes.