Economic Data Watch and Market Outlook

Global equity markets tumbled this week with the MSCI World dropping 2.11% while bonds in the US rose 80 basis points. While the Fed increased rates 50 basis points, a move that was largely expected by traders, the Fed did provide guidance around future increases, projecting to stop somewhere between 5.0% and 5.25%. The market had predicted 4.6%. There is some evidence that the hikes are working as November’s CPI rose year-over-year 7.7%, down from June’s 9.1% peak. While food and shelter costs are still showing price gains, used cars and electricity pricing have declined. The ECB also hiked rates and signaled a hawkish stance for future rate changes.

Recent reports from employment consultant Challenger, Gray, and Christmas suggested that we will begin to see layoffs in 2023. The Fed has also increased their assumptions regarding future employment. As firms begin to navigate a tougher economy ahead, some are starting to make announcements regarding their labor force. Notably this week, Goldman Sachs is set to lay off several thousand employees as well as cut/lower employee bonuses. Goldman Sachs grew dramatically in the last several years, going from 38,300 employees in Q4 2019, to 49,100 employees in Q3 2022.

US/China relations continue to remain tense as the US Government plans to blacklist yet another Chinese chip manufacturer in its efforts to bring manufacturing stateside. There are currently 36 Chinese companies that have been blacklisted, including Yangtze Memory Technologies Co. (YMTC). Further, this week Congress added to its defense bill, roughly $10 billion over five years, for aid grants to Taiwan to help them upgrade their military.

Equities

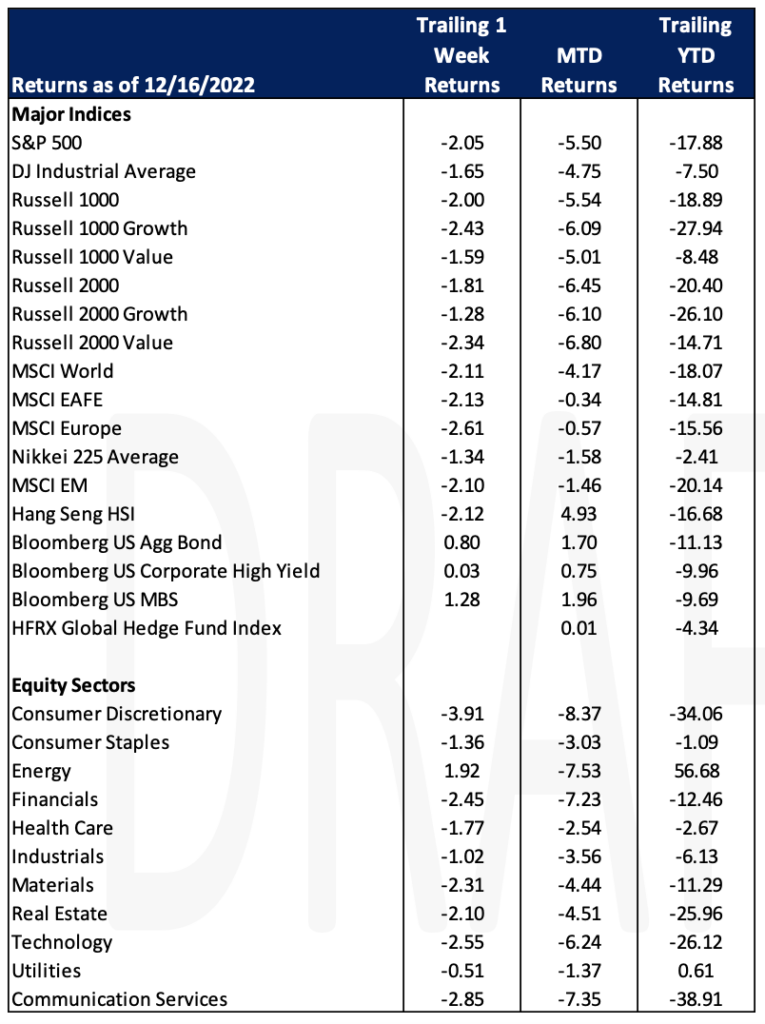

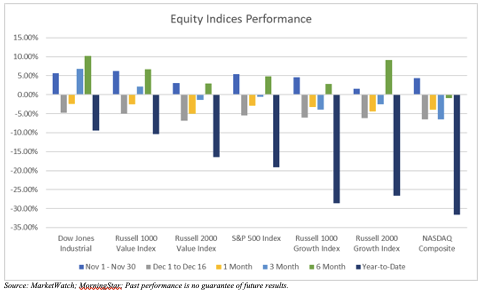

By end of day Friday, equities experienced the 3rd consecutive day of losses as stock sold off over interest rates and recession concerns closing down for the week (Dow: -1.65%; Nasdaq: -2.75%; S&P: -2.05%). Market declines since December 1 has eroded most of November gains for equity indices.

Meanwhile, the BofA Global Research report on Friday reported investors’ inflows totalling $18 billion for equities and $2.3 billion for bond funds for the week through Wednesday. US equity value funds recorded their largest inflows of $14.3 billion as investors purchased passive equities and sold active equities.

Tesla (TSLA: -4.72%) stock ended this week with a market cap of less than $500 billion for the first time since November 2020. Musk disclosed that he sold more than $3.5 billion in stock late Wednesday and cumulatively he has sold more than $39.3 billion worth of stock in the past 13 months. Meanwhile Tesla’s 3rd largest individual shareholder Leo Koguan (Forbes #112), tweeted that “Tesla needs and deserves to have working full time CEO”.

European indices were down for the day on Friday, as well as the week, as European banks (Bank of England, European Central Bank and Swiss National Bank) opted for 50 bps hikes as they try to rein in inflation. ECB also stressed that further rate rises were still to come. Asian markets also traded lower following the Fed rate hike and warning of still higher interest rates to come.

Fixed Income

A highly anticipated week for fixed income markets included the November CPI report as well as the December Fed meeting where a 50bps hike was announced. In response to Tuesdays CPI which showed a lower-than-expected inflation rate of 7.1% YoY, the S&P 500 rallied and then fell back to pre-CPI levels. Yields acted similarly on Wednesday and retraced to pre report levels. Yields ended the week lower, with the 2-year Treasury yield down 22 bps to 4.17%, the 10-year Treasury yield down 13 bps to 3.48%, and the 30-year Treasury yield down 4 bps to 3.53%.

Mortgage rates continued their decline throughout December, falling for the fifth straight week. According to Freddie Mac the average 15-Year Fixed Rate Mortgage averages 6.31% as of 12/15/22, down from 6.33% in the week prior. The Mortgage Bankers Association’s seasonally adjusted purchase index showed a 4% rise in applications for home loans versus the prior week.

Chinese property bonds have surged in the last month, with Asian high-yield bonds gaining 18% in the month of November. The Chinese zero-Covid policy has been largely to blame for struggles that fixed income markets have faced throughout 2022, but due to recent easing of restrictions some life is beginning to flow back into the region.

Hedge Funds

Hedge funds performed well this past week, mitigating losses compared to their respective indices. The average global fund was down ~ 10 bps compared a loss of just over 100 bps for the MSCI World. NA long/short equity funds managed to be slightly positive (< 10 bps) for the week compared to a loss of 1% for the S&P 500. These positive returns came from shorts as they declined more than the S&P. Crowded shorts in all regions underperformed their respective benchmarks and in NA, shorts were down 1.7% more than the S&P and 2% more than crowded longs. In Europe, funds protected well, falling < 10 bps compared to -2.1% for the Euro STOXX 600. Asia-based funds lagged their counterparts, capturing more of the downside, declining ~ 60 bps vs. -100 bps for the MSCI Asia. Regarding flows, hedge funds were buyers of global equities until Thursday when they flipped to being net sellers, resulting in muted overall flows for the week. In the first part of the week, the buying in NA was concentrated in TMT-related sectors with a little buying in consumer staples and utilities. Thursday ended up being the largest day of selling in approximately 2 months, driven by index-level products (mix of long sells and short adds). At the factor level, funds were net buyers of volatility, liquidity and growth and net sellers of dividend yield. Outside NA, hedge funds were net sellers in Europe at the largest level seen since late September, across a handful of sectors, led by tech, materials and communications services. In AxJ and Japan, flows were muted for the week, a change from the buying seen in China over the past few weeks.

Private Equity

One year after the bi-partisan Infrastructure Investment and Jobs Act was signed into place, private equity now manages roughly $45 billion of capital intended for infrastructure investments, up from less than $15 billion just one decade ago. Private equity has played a key part in financing, managing and ultimately accelerating these critical infrastructure projects including the repair of roads/bridges, expanding internet access for rural and underserved areas, building water and waste management systems and supporting renewable energy initiatives. In total, private equity is responsible for infusing nearly $180 billion into these projects across America in the past decade.

The Infrastructure Investment and Jobs Act will allocate more than $500 billion into infrastructure projects over the next 5 years. Analysts suspect this will heavily entice more private equity deal making in the near term as PE is a natural fit for public-private partnerships. Typically, public-private partnerships have helped state and municipal governments stay on schedule while also reducing the burden on taxpayers, a win-win for both municipal governments and private citizens alike. Additionally, today’s private equity investors are on the cutting edge of technology and innovation helping to bring hyperscale data centers, cloud infrastructure security, microgrids and other mission-critical facilities across the country.

Earning a spot as a top contributor within the US infrastructure system is clean energy technology or “clean tech.” Private equity has invested about $150 billion into more than 1,100 clean tech companies and projects over the past ten years. According to PitchBook, 2021 was a record setting year for capital invested in this space with $28 billion invested in roughly 130 deals. Analysts suspect that 2022 will be a comparable year to 2021 in terms of deal value and count.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Goldman Sachs, Morgan Stanley and the Wall Street Journal.