Economic Data Watch and Market Outlook

Perhaps one of the greatest challenges for investors is determining how to calibrate and integrate economic decisions with possible non-economic changes. The past two weeks have focused on digesting the Omicron virus and its potential impact. However, as witnessed by the rise in vacation and leisure stocks and declines in some work from home stocks like Peloton, investors seem to be looking forward to an optimistic 2022. For the balance of the year, we expect the usual volatility as large investors and brokers square positions and make minor adjustments to their balance sheets. It is also always a wild card for charitable contributions and individual tax modifications given a murky tax outlook into 2022 and beyond. Short term performance is important, but investors hopefully are looking at how well the absolute return on broader averages has been the past three years.

This time of year, is also dedicated to condensing and prioritizing the postulates for strategic shifts and questions for 2022. Where should intellectual curiosity be focused? Fear and uncertainty are usually much worse in anticipation than reality. It is becoming abundantly clear that the monetary easing cycle will be reduced so the bias should be on higher rates, but will they rise to the historical averages when underlying fundamentals of the economy were materially different? Are some of the changes we are witnessing in the economy actually a benefit to the longevity of a growing country? Supply shortages have been a huge concern and fear for growth, but recent data supports that there are no real shortages but actually increased demand based on positive adjustments to real asset prices, stronger employment compensation and stimulus that appears to have been applied at the right time and had the desired effect.

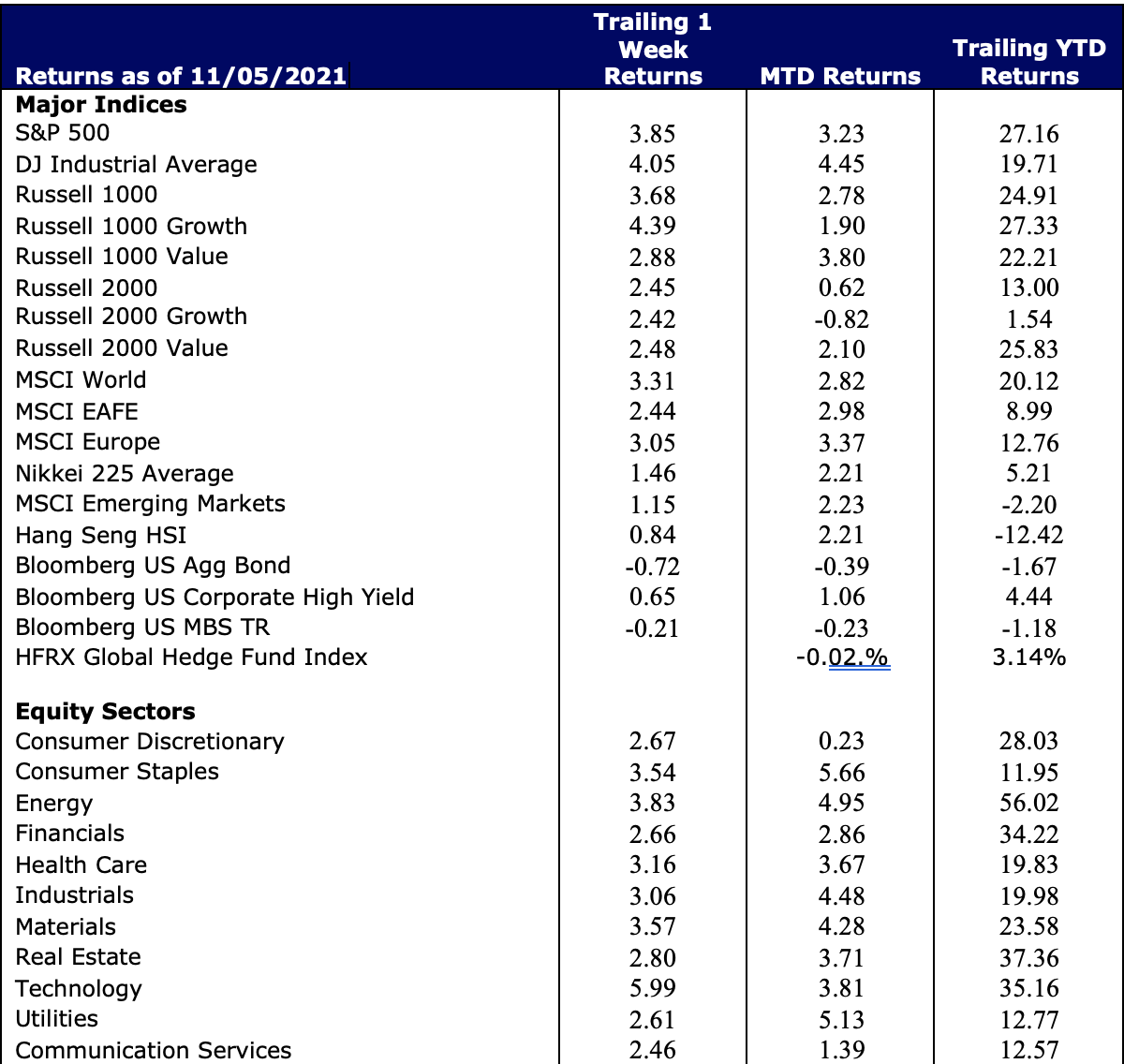

People in general dislike change but it opens new questions and opportunities. Recent economic data is clear and present- employment growth, wage inflation and strong orders, it’s time we take notice and get comfortable. At this juncture, risk assets seem to have a more of a tailwind than headwind. Equity prices jumped during the week as the MSCI World advanced 3.31% in USD terms. Bonds prices were mixed with High Yield index advancing 65 basis points while the Aggregate Bond index fell 72 basis points.

Equities

US equities were one of the better global equity markets in terms of return for the week. The S&P 500 finished up 3.85% while developed markets finished up 2.44% with European stocks jumping 3.05% and Japanese stocks rising 1.46%. In previous weeks we’ve watch as the VIX on the S&P 500 jumped to just above 30. However, markets settled this week and the risk trade was back on. Subsequently, concerns about downside risk waned and the measure dropped to under 19 by end the week.

The rise in stocks was broad, but large cap names fared better than smaller ones. The Russell 2000 advanced 2.45% with value stocks beating growth by only six basis points (R2000Val, +2.48% vs R 2000 Gro + 2.42%). The Growth Value split was the opposite in large cap stocks with Growth outpacing Value significantly (R1000 Gro, +4.39% versus the R1000 Val, +2.42%).

All the Economic sectors advanced. Communications Services sector rose 2.46% and was the lowest returning sector for the week. The best performing sector was Information Technology surging almost 6% on the week.

Emerging Markets rose only 1.15% as there are concerns that Brazil may be entering a recession, investors were losing confidence in Turkey’s government and central bank and a missed Evergrande debt payment.

Fixed Income

The Bloomberg US Aggregate Bond index rose 89 bps for the week. The yield on the 10-year fell to 1.342%. Yields on the 30-year fell 14 bps to 1.826%. As noted above, a weaker than expected jobs report (210,000 jobs added versus estimates of 573,000), the Omicron variant, and potentially tighter a Fed policy. The Fed is walking a thin line as it does not want to tighten and make it harder for borrowers perhaps stifling a fragile economy versus inflation rising faster than expected. Determining how serious the Omicron variant is will help shed light on Fed policy in the short and medium term and this data should be available in the coming weeks as we monitor the spread.

Hedge Funds and Private Equity

Following a challenging start to the month for hedge funds, most strategies were able to recover a good portion of their month-to-date losses this week, and most are now showing gains for the month of December. Different from past weeks, the most crowded North American longs outperformed the S&P helping to drive relative performance, while crowded shorts underperformed the benchmark driving alpha on both sides of the book. Hedge funds skewed towards buying across all regions this week. In North America, the buying was split between adding to longs and short covering with long/short and multi-strategy/macro the two main contributors. ETFs were net bought (short covering). All sectors were net bought with the exception of healthcare. Longs additions were the bulk of net buying in other regions, most notably Europe and Japan.

In Europe, the recent long additions were a notable reversal from the selling seen over the past ~2 months. In Asia ex-Japan, most of the buying was China (ADRs and H-shares) both adding to longs and covering shorts.

COVID continues to force abrupt shifts in buying patterns causing havoc on the world’s supply chain. This volatility has provided an exciting opportunity for both startups as well as venture capital as they seek to develop and fund solutions that bring order to the highly fragmented eco-system of supply chain tech. Emerging supply chain tech is enabling a shift towards connected networks that coordinate data related to supply, demand, inventory and capacity.

VC investment into supply chain tech was $7.8B in Q3 alone. Valuations for early and late-stage supply chain tech startups have increased significantly in each quarter of 2021. The median pre-money valuation for early-stage supply chain tech startups rose by 19.5% YoY to $35M while the median pre-money valuation for late-stage increased by 41.2% YoY to $120M. Maritime tech has seen an increased level of investment (7.4% of total VC investment in supply chain tech, up from 2.5% in 2020) as this industry races to fill its technology gap. Additionally, freight and delivery aggregator tech which provides booking platforms for shippers and carriers is also becoming one of the fastest growing sectors within supply chain tech.

The pandemic has highlighted many vulnerabilities within our global supply chain and will have a lasting effect on this industry including how it integrates new technologies. Current market conditions are providing a plethora of opportunities for new entrants seeking to address technology gaps in the status quo. Venture capital spend in this space is expected to see continued growth in coming quarters.

Data Source: Bloomberg, Bureau of Labor Statistics, CDC, CNBC, The Daily Shot, Deutsche Bank, Haver Economics, HFR (returns have a two-day lag), Morningstar, Pension and Investments, Pitchbook, Redfin, Standard & Poor’s, US Census Bureau, and the Wall Street Journal