Economic Data Watch and Market Outlook

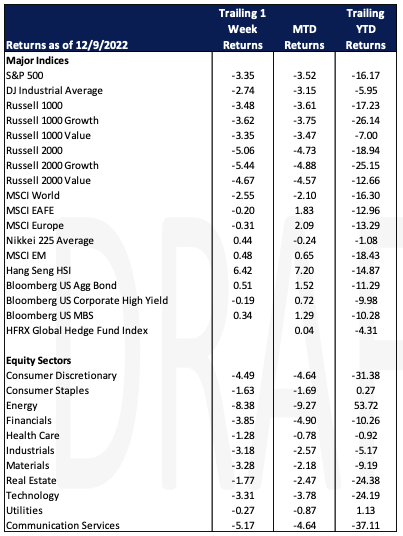

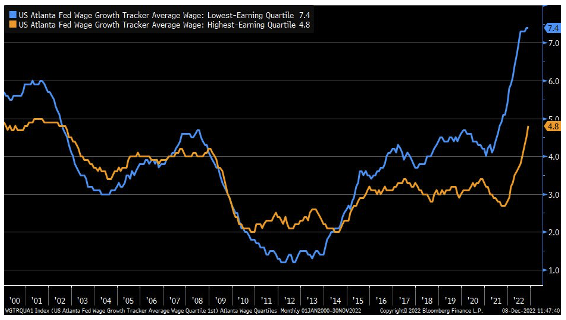

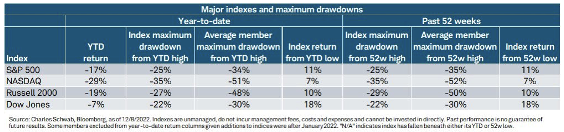

Volatility continued in the equity markets during the week as the MSCI World fell 2.55% largely due to US equities falling over 3% as the Russell 1000 fell 3.38% and the S&P 500 fell 3.35%. The US Agg rose 51 basis points and the economy continues to expand. PPI came in hotter than expected at 0.3% month-over-month versus the estimate of 0.2% and PPI inflation year-over-year came in at 7.4% versus the 7.2% estimate. Wage growth, while not expanding as the fast pace it once was, is still increasing, especially in the lowest quartile of earners according to the Atlanta Fed.

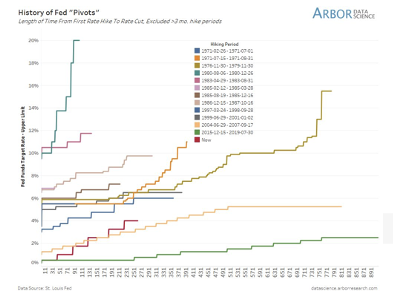

This past week’s inflation data continued to push expectation of a Fed ease out further. Historically, the Fed cycle has lasted 219 days before a pivot. At week’s end, the count was 260 days.

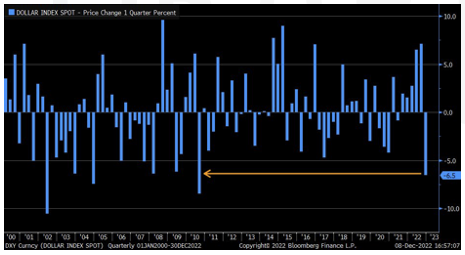

As we have discussed in past commentaries the strength of the US Dollar has put wind in the sails of many US companies and travelers vacationing in Italy this past summer. That trend has started to reverse, and we’ve seen the biggest quarterly decline since 2010.

Despite some fears that the economy is or soon will be in a recession, the University of Michigan Confidence increased more than expected at 59.1 versus and estimate of 57. Note that these results are still significantly lower than in the similar period of 2019 and 2020.

Equities

Volatility continues in the equity markets. US equities (the S&P 500) fell 3.35% eliminating gains from the previous week. The decline was broad based as growth and value fell roughly the same amount. Energy, Communication Services, Consumer Discretionary, and Financials were the economic sectors that lost the most, falling 8.38%, 5.17%, 4.49%, and 3.85% respectively.

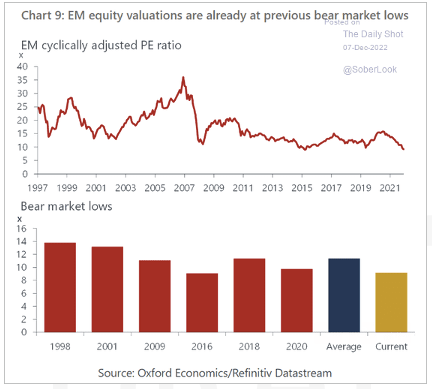

European, Japanese and emerging markets fared much better (-0.31%, 0.44%, 0.48%). International equity markets have also lead equity markets on a month-to-date basis, with the MSCI EAFE up 1.83% versus the S&P500’s decline of 3.52%. Emerging markets are slightly positive, up 65 basis points. Valuations in EM are lower than most previous bear market lows as the chart below from Oxford Economics shows:

Fixed Income

Treasury yields rose slightly on Friday after the PPI came in hotter than expected, up 0.3% for the month of November, and 7.4% from a year ago. Yields fell throughout the week but retraced towards Monday levels after the announcement, with investors worried about the impact this data point could have on the Fed’s decision next week. Yields finished the week down across the board. The 2-year Treasury yield ended the week down 8 bps to 4.33%, the 10-year Treasury yield ended the week down 3bps to 3.57%, and the 30-year Treasury yield ended the week down 6 bps to 3.56%.

Mortgage rates have dropped since the beginning of November, with the average 30-year fixed rate mortgage down from its high of just over 7%, settling into the range of 6.30% to 6.40% and its lowest level since September 2022. Rates have been relatively stable since September, acting as one would expect in relation to economic and housing data.

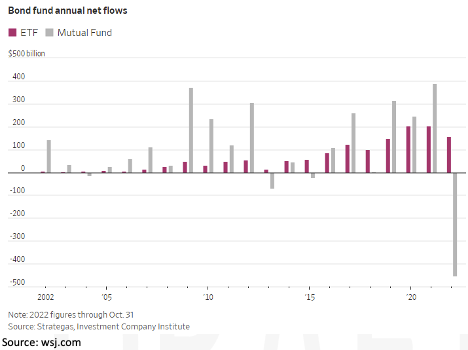

Investors are moving out of bond mutual funds and into ETF’s with $454B in outflows from mutual funds and $167B inflows into ETFs in 2022. It has been the worst year for Treasuries since 1975 with the Bloomberg US Aggregate Bond Index down 11.29%. Reasons for the shift include tax harvesting from mutual funds who held risker bonds, as well as lower fees that ETFs provide.

Hedge Funds

Following a strong end to November, hedge funds were able to limit losses this past week compared to their respective indices. The average global fund was down 70 bps compared to a negative 240 bps for the MSCI World. Long/short equity funds felt a bit more pain with the average global long/short equity fund down 90 bps and the average NA L/S fund -150 bps, capturing 55% of the S&P’s loss. Europe based funds fared better, only losing 30 bps compared to 190 bps for the Euro STOXX 600. Asia-based funds had the best week, gaining 70 bps despite the MSCI Asia Pacific declining 140 bps. Looking at crowded names, in the US, crowded longs underperformed the S&P by 100 bps but this was offset by crowded shorts underperforming by 250 bps, resulting in a positive spread of 150 bps. Crowded shorts worked well in Europe, while longs performed inline. In Asia, crowded longs outperformed by 2% while crowded shorts were flat, leading to a nice positive spread. Hedge funds were net sellers in North America (mostly index level), while net buyers in Europe and particularly in Asia ex-Japan where most of the buys were long buying in China. Net flows to Japan were flat.

Private Equity

Amid an overall volatile year for the venture capital market, healthtech has remained relatively hearty. Healthtech focused companies, specifically those in digital health, continue to attract investor interest at much higher levels than other venture verticals. Although healthtech deal making falls below last year’s record $34.5 billion, it has still shown a strong performance. Startups within the vertical have managed to raise more than $26 billion in venture investment across 1,413 deals through mid Q4. Valuations of healthtech companies have also remained strong with the median deal valuation of more than $45 million, nearly 33% higher than the 2021 median of $33.9 million. Large deals in this space include Somatus, a dialysis provider raising $325 million at a valuation of $2.56 billion and DispatchHealth, an in-home nursing care provider, which raised $330 million.

One challenge facing this vertical is the shortage of healthcare professionals, which has been exacerbated since the start of the COVID-19 pandemic. The shortage has made resourcing for healthtech start-ups difficult; however, analysts suspect that if the US enters a recession, startups could face an easier hiring market and relieve staffing challenges.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, Goldman Sachs, Morgan Stanley and the Wall Street Journal.