Economic Data Watch and Market Outlook

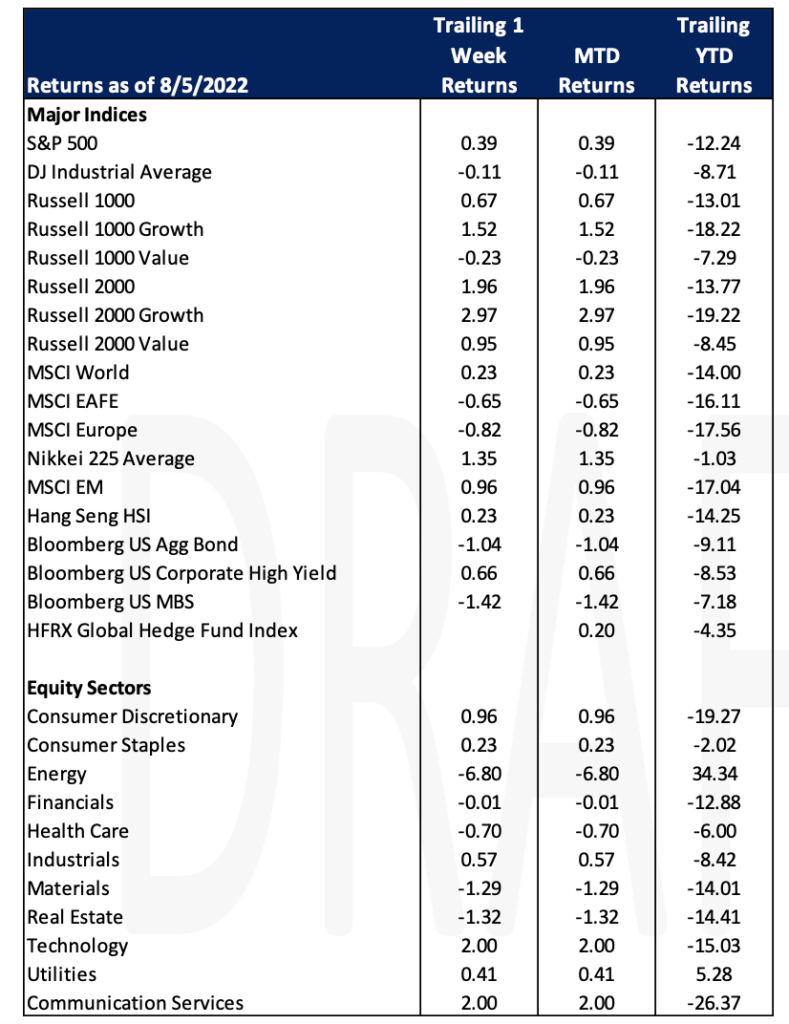

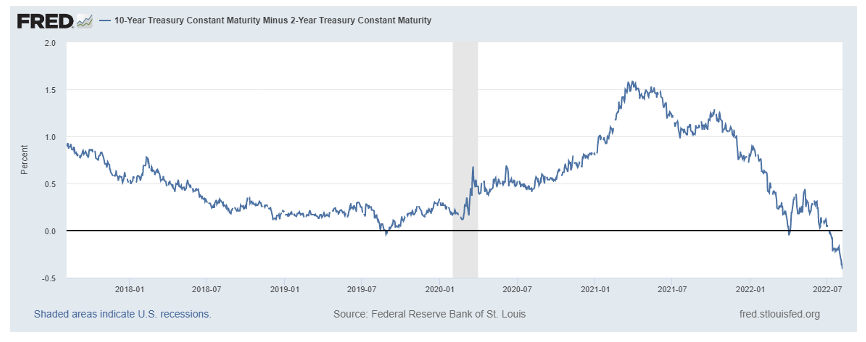

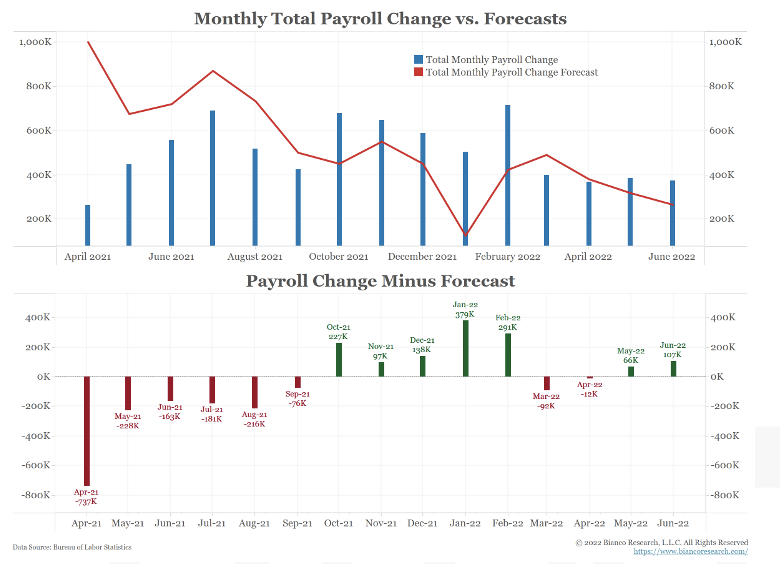

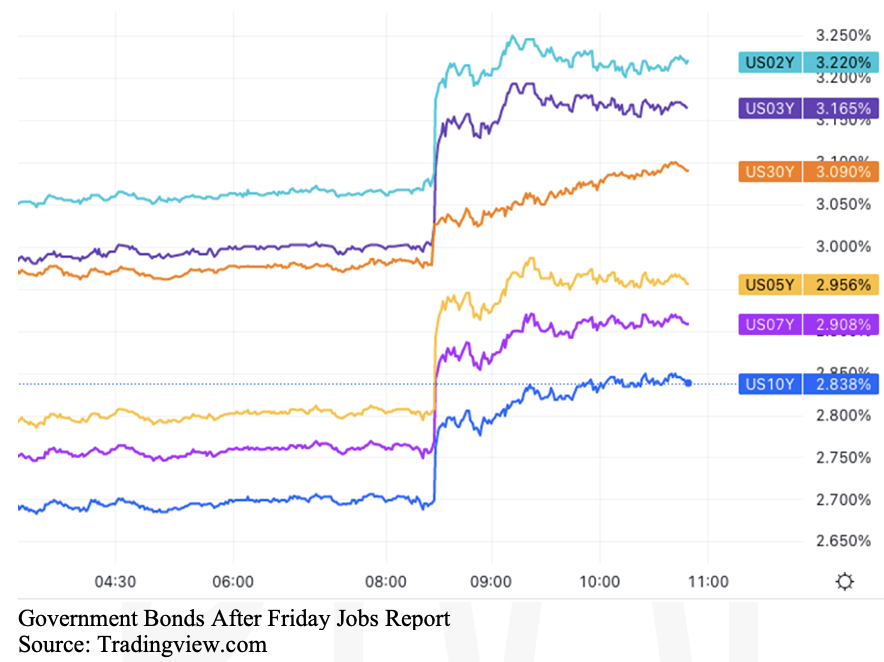

Asset prices ended roughly flat for the week with the MSCI World up approximately 23 basis points. Bonds fell 1.04% largely due to the latest non-farm payrolls report coming in at 528K new jobs. The unemployment rate was 3.5% – back at its pre-pandemic level. Wage growth also increased – average hourly earnings increased by 0.5% for the month and 5.2% from a year ago. In wake of the news, the bond yield curve inversion increased, with 2-year notes rising 21 basis points to 3.24%, and the 10-year rising 16 basis points to 2.84%.

Consensus estimates (69 in total) for non-farm payrolls stood at 250k with the highest being 325k. Wall Street has not had a good record with recent job growth estimates as shown in to the chart below from Bianco Research. Seven of the last nine releases, Wall Street’s estimated too low. The point is the Fed most likely has some work to do with respect to raising rates and any thoughts of easing remains seem unlikely in the near term.

Nancy Pelosi visited Taiwan this week to bolster support for the sovereign island located 100 miles off the coast of mainland China. Upon arrival, China initiated a 4-day simulation of a strikes on the self-governed island, in an effort to send a message to the US and Taiwan. The SSE Index, a composite of all stocks that are traded on the Shanghai Stock Exchange, dropped almost 100 points upon Pelosi’s arrival. The Biden Administration has to scramble to get back on message with China to maintain the status quo. Xi is up for re-election to his third term at the 20th National Congress of the Chinese Communist Party in November which has placed additional pressure on Xi to show strength.

The upcoming week is important for economic data as we hear about energy supplies and mortgage data but the big data points come on Wednesday and Thursday when we learn more about inflation as CPI and PPI are released.

Equities

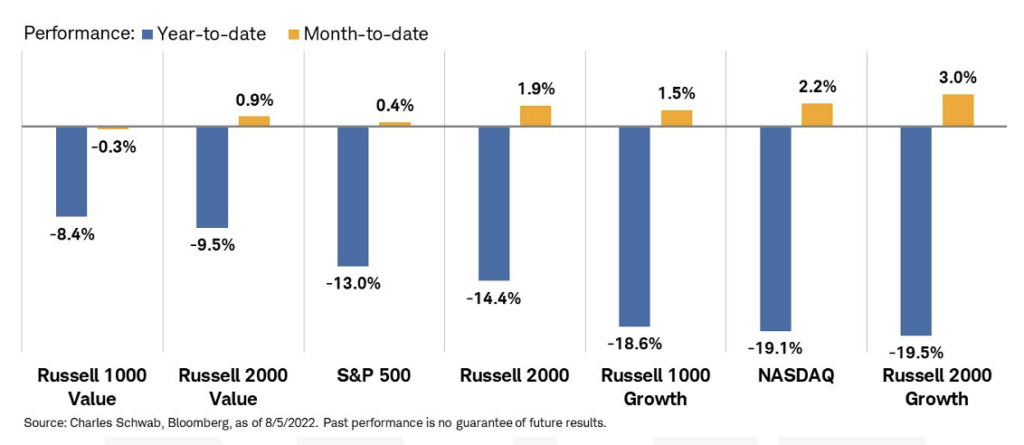

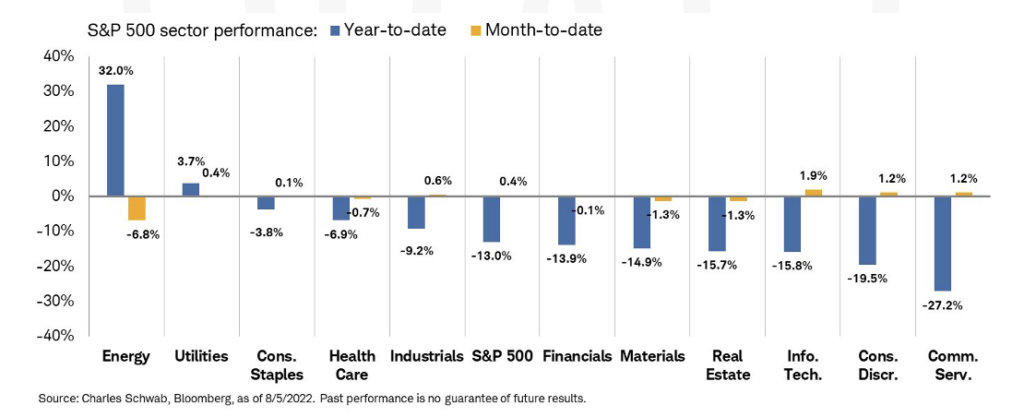

Stocks closed out the week in mixed fashion as the Dow was down slightly, -0.11% while the S&P 500 rose slightly, 0.39% largely a result of mixed economic data and shifting expectations.

Communication Services, Tech, and Consumer Discretionary stocks were the dominate positive reporting sectors rising 2.00%, 2.00% and 0.96% respectively. Expedia reported Q2 earnings that beat expectations citing record high lodging bookings and that travel has remained strong.

The major Asian market indices closed out the week with gains. Drops in markets Dow Asia and Shanghai Index at the beginning of this week was attributed to the visit House Speaker Nancy Pelosi made to Taiwan.

Fixed Income

Wrapping up the first week of August, the Treasury yield curve continues to widen with no signs of stopping. After rates peaked in mid-June, we saw a decline into the start of August. Since August 1st, rates have risen dramatically. On Friday, the July jobs report was released with the US economy adding 528,000 jobs in July; immediately after the release we saw a large jump in rates across the board. The 10-year rose nearly more than 10 basis points and the 2-year leapt even higher. The 10- and 30-year rates saw a steady incline into mid-morning on Friday while shorter term rates spiked into more volatile patterns. With the Fed’s focus on lowering inflation to 2%, further rate hikes may be necessary, but it is difficult to determine with the elevated volatility we have seen over the past several months. As stated previously, the Fed is willing to risk putting the economy into a recession to quell the record inflation rates we have been seeing in 2022. The raising of short-term interest rates above long-term interest rates has historically preceded every major US recession. On Thursday, the Bank of England raised rates from 1.25% to 1.75%, the largest rate hike since 1995, signaling a lengthy recession in the UK. This is the 6th consecutive rate hike since the beginning of 2022. The BoE said in a statement on August 4th that they expect the United Kingdom to enter a recession in the fourth quarter of 2022, and that post-tax income is projected to fall sharply in the next year while consumption growth turns negative. On Friday, the UK 10-year rose more than 20 bps to above 2%. The conflicting views on aggression towards inflation and recession from the US and UK’s central banks is something to monitor going forward.

Hedge Funds

Hedge funds have had a good start to the month with most strategies either outperforming or performing in-line with their respective indices. The average global fund is up ~ 50 bps, in-line with the MSCI World. Americas-based long/short equity funds are leading the pack in both absolute and relative terms with the average fund in this cohort up 150 bps compared to S&P up 50 bps. Even with good performance, the spread between crowded longs and shorts is negative on the month. EU and Asia funds are flattish on the month with both regions posting < 10 bps gains. YTD, funds in all regions are healthily outperforming their respective benchmarks. To note, Americas-based L/S equity funds are down 8% vs. 12% for the S&P. 5% came in January alone so since then, funds are only down 3%. Similar to July, so far in the first week of August (through Thursday), funds continued to globally cover shorts with the covering in NA on par with the largest levels of covering seen YTD. Tech and industrials were the most net covered for the week but there was also covering in specialty retail, hotels, restaurants and leisure, all of which short exposure was at peak levels. In addition to single-name shorts, funds covered broad-based index level hedges. On the long side, flows were more muted, but funds tilted towards buying tech and healthcare while selling defensive sectors such as utilities, consumer staples and real estate. Outside of NA, there was more short covering than short adds. In AxJ, the covering was spread across countries with China the most net bought country (both ADRs and H-shares). Lastly in Japan, hedge funds de-grossed both sides of the book.

Private Equity

As falling valuations in both public and private markets have placed increased pressure on the pace of private equity exits, PE firms are opting to hold portfolio companies longer instead of selling these investments at lower, more unattractive prices. Analysts suspect that the IPO window being effectively closed and a fewer number of strategic exits being available in comparison to previous years, potentially followed by a decline in distributions, will act as catalysts to increase secondary volumes both on the LP and GP side. Many PE-firms will pursue GP-led secondary deals while limited partners may also look to the secondary market to unload older assets in order to free up capital for new investments.

Historically, secondary transactions have been priced at higher discounts to net asset value when public markets are down given that secondary buyers use public market comps when pricing secondary fund interests. Analysts anticipate that that a lot of general partners did not write their portfolios down in Q1 and Q2 will do so in Q3 of 2022. Additionally, analysts are hopeful it will be a busy Q4 with pricing stabilizing.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M