Economic Data and Market Highlights

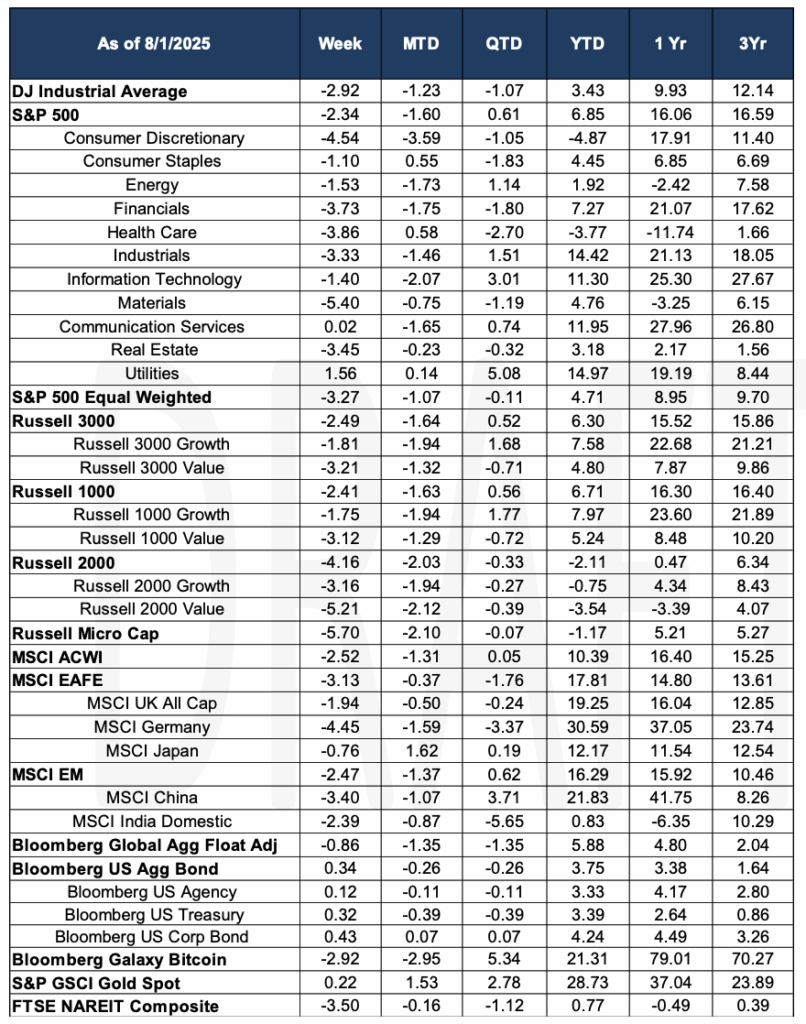

Global equity markets declined over 2% this week as the US administration announced its tariffs related to the August 1st deadline, the market absorbed earnings reports, and the US Fed held rates steady. The MS All Country World Index declined 2.52%. The S&P 500 declined 2.34% while the Russell 2000 declined 4.16%.

The Fed announced that it will keep rates unchanged at least until the September meeting despite intense pressure from the President to lower rates. While the markets largely expected rates to stay steady, two Board Governors dissented. Unanimous votes are typical with an occasional single dissent. A vote with two dissents has not happened since 1993. Further, Governor Kugler did not vote due to a personal matter, but later in the week, announced that she was resigning. Kugler’s term was set to expire in January, but this presents an immediate opportunity for Trump to attempt to replace Powell as Board Chair.

Non-farm payrolls rose less than expected (73k versus 106k est.) with those unemployed longer than 27 weeks rising to the highest since 2022 increasing 179,000 to 1.8 million. The long-term unemployed accounted for 24.9 percent of all unemployed people. The weak number caused the President to fire the Commissioner of the Bureau of Labor Statistics implying bias in the results. Dr. Erika McEntarfar was a Biden appointee.

It is important to consider that the Nonfarm Payrolls like much of the economic date we base decisions on relies on survey data. As cell communication has evolved potential survey participants tend to avoid calls from unknown numbers. This has caused a collapse in survey response data and as a result created larger error rates.

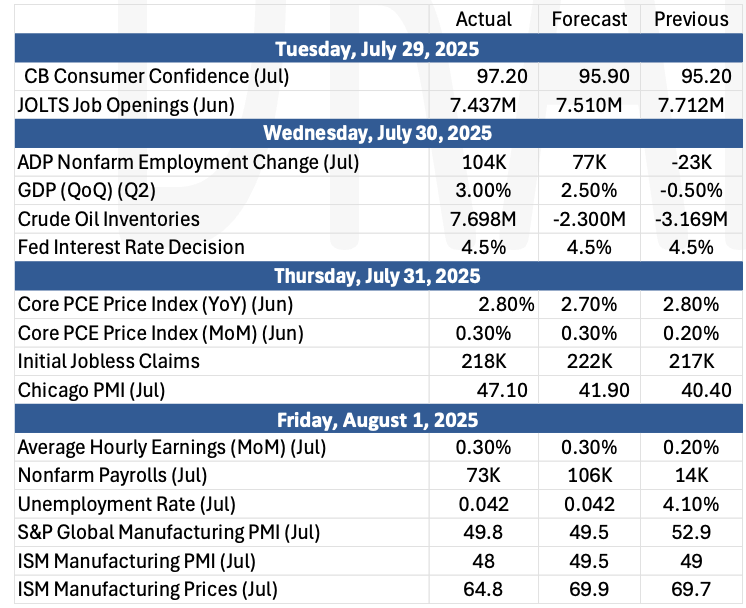

The Past Week’s Notable US data points (with revisions)

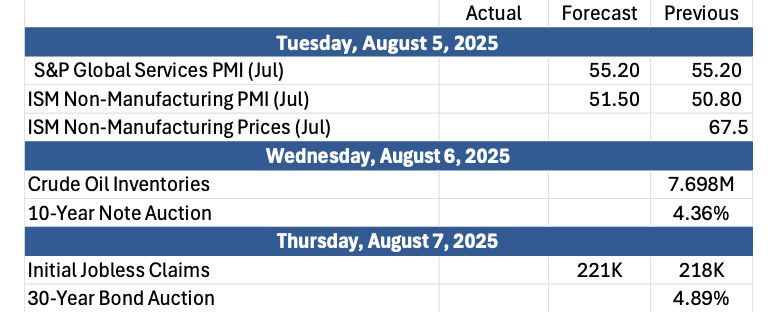

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara