Economic Data Watch and Market Outlook

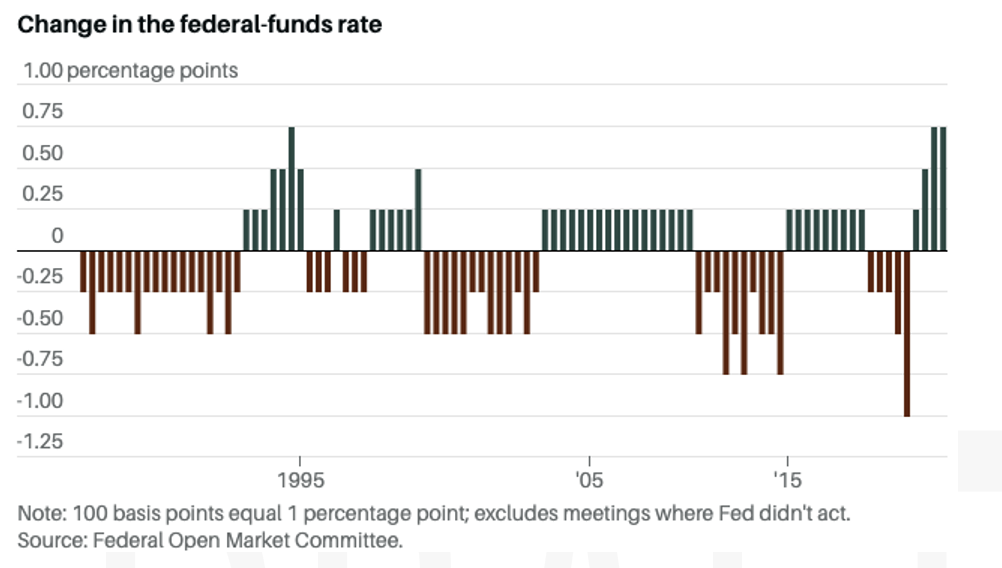

On Friday, Fed Chair Powell warned that the central bank’s mission to tame inflation will result in “some pain” for US households. He added that reducing inflation would not be quick or easy and, “requires using our tools forcefully to bring demand and supply into better balance”. Powell didn’t offer any indication as to whether the Fed will repeat another 75 bps rate hike. However, his remarks are suggestive that it is a strong possibility. After Powell said interest rates would stay high for some time, markets sank. The S&P 500 saw its worst day since mid-June tumbling 4.02% and erased its August gains. The Dow Jones dropped 4.20% in trading Friday afternoon. Powell said the Fed’s primary goal is to restore price stability and to do so will likely require maintaining a strict policy stance for some time. After the speech, the VIX, a measure of volatility and fear in equity markets jumped 17.36% to 25.56 but has more to go to reach its year-to-date high of 35.13 reached on March 9th.

China’s worst heatwave on record is closing factories and shutting of lights leading to water reservoirs dwindling in the hardest-hit areas. August is typically a wet season in China, but this month has been the opposite, the perfect storm of record high temperatures, and low rainfalls have forced factories in provinces such Sichuan and Chongqing to close. Toyota and Apple are among the companies impacted by power shortages. Residential power prices in July were up for 45% from the previous year.

Droughts globally have been reported on significantly as of late and as noted above has caused factories and power plants to close. Another industry heavily dependent on water usage is semiconductors. Intel is one of the most resourceful companies, striving to be net zero in terms of water usage across its 10 plants but has only managed it in three thus far: US, Costa Rica, and India. Of the 16 billion gallons of water they use per year, 13 billion flows back into local communities. For context, according to the EPA, the average American uses 82 gallons per day, the 3 billion lost in Intel’s production is the equivalent of 100,233 American’s water usage for one year.

The European energy crisis is continuing. France and Germany are hardest hit, with energy costs up 10x from the previous year reaching 900 euros per Mwh. France has seen six reactor outages since Wednesday. Power is eating into the margins of households and businesses alike and the unprecedented prices are seeing no abatement.

California is set to phase out the sale of ICE vehicles by 2035. California is the US’s largest auto market, and the legislation will be influential in further adoption of Electric and Hybrid Plugin vehicles. The bill sets targets on shorter term goals as well, shooting for 35% of new cars by 2026 to be emission free. This will not only effect vehicle production. California’s struggling power grid will need a revamping to keep up with the power needs of a state that registered 1.85M new vehicles in 2021.

This week, we’ll hear comments from various Fed Governors as well as comments from the ECB. We’ll also see inflation data and industrial production from the EU and Germany. In the US, housing data will be reported mid-week and jobs data on Thursday and Friday

Equities

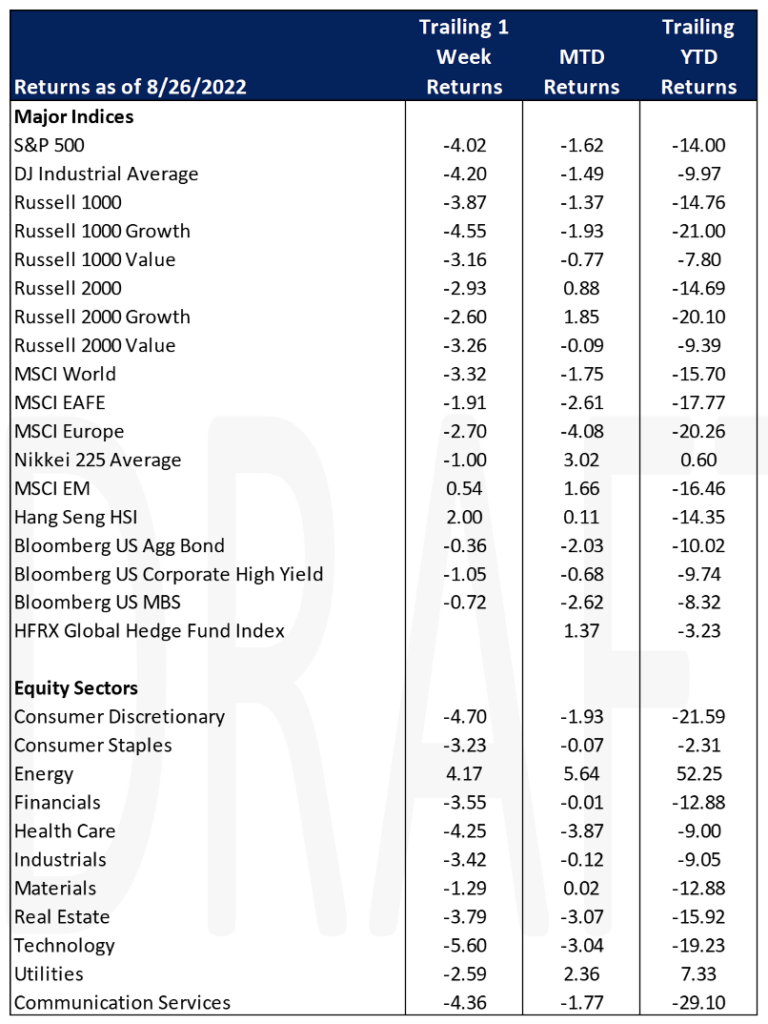

Equity market indices (Dow: -3.03%; S&P 500: -3.37%) were down Friday and lower for the week (Dow: -4.20%; S&P -4.02%) after Fed Chairman Powell’s speech affirmed that the Fed remains hawkish on rates. Powell stated the Fed would keep raising interest rates until inflation is on a clear path toward 2.00%.

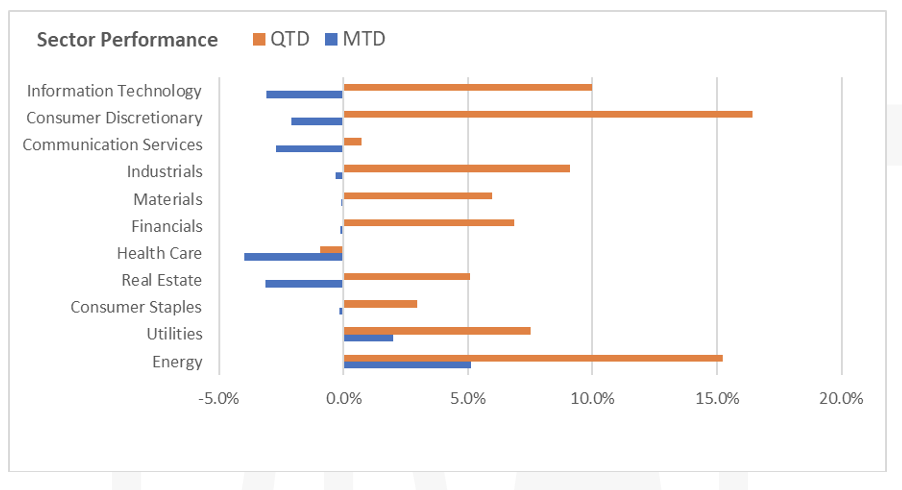

All S&P sectors declined led by information technology (-5.60%), consumer discretionary (-4.70%) and communication services (-4.36%). Technology shares was the hardest hit as the sector is particularly sensitive to higher rates. Shares of Affirm ($24.57), the buy now pay later lender technology company, dropped more than 20% (-$6.66) after the company issued weaker than expected guidance.

Performance for most sectors quarter to date was still up except for health care.

Source: S&P; Past performance is no guarantee of future results

The US and China reached an agreement on Chinese company audits, which may prevent Chinese companies from being delisted from American stock exchanges. The agreement allows Public Company Accounting Oversight Board inspectors to travel to Hong Kong or mainland China for inspections by mid-September and to complete their assessment of whether China is compliant with US law by end of the year.

Fixed Income

Yields remained flat throughout the week in anticipation of the Jackson Hole Fed meeting. After Powell’s speech on Friday morning Treasury yields rose, with the 10-year Treasury yield reaching above 3.00% and the 2-year Treasury yield reaching above 3.40%. The Fed has raised their benchmark interest rate 75 bps at their last two meetings, the only consecutive 75 bps increases on record reaching a range between 2.25% and 2.50%. Bond traders were expecting hawkish messaging and Jerome Powell delivered.

Source: Barrons.com

With their next meeting on September 20-21, a half point raise is the minimal expectation. Powell’s speech lasted only 10 minutes and his primary focus was discussing price stability. Notable quotes included “bringing some pain to households” and using the tools at the Fed’s disposal “forcefully”. The primary message coming from the Fed is that they will continue to raise rates until they are sure that the economy is beginning to stabilize. August’s employment report coming out next Friday will provide clarity for investors and provide more insight on what type of rate increase we could potentially expect in mid-September.

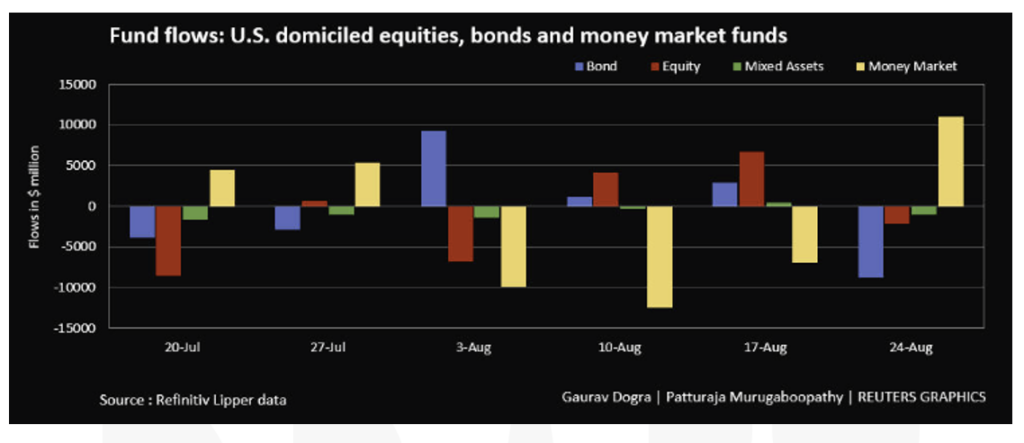

US bond funds saw the largest weekly outflow since June 22nd reaching net outflows of $8.81B. Conversely, money market funds saw their largest weekly inflow since July 6th of $11.07B. Junk Bonds reached a 4-week high on Wednesday at 8%.

Source: Refinitiv Lipper Data via Reuters

Investors are pricing in $130B losses on Chinese properties as the country’s housing market contracts. Defaults are expected through the end of 2022 primarily from developers with large amounts of offshore debt. Robin Xing, Morgan Stanley’s Chief China Economist said that a centralized bailout is most likely the necessary solution to the housing markets issues.

Source: Financial Times

Hedge Funds

Through Thursday August 25th, despite global indices tracking lower for the week, hedge funds were able to eke out gains in the same time period with the spread between longs and shorts positive in all regions. All regions had positive performance for the week except Europe with Asia funds performing the best. MTD, funds have been able to capture a large portion of index upside (these stats probably changed on Friday but HF data is Friday through Thursday). Regarding crowded longs and shorts, in all regions but Europe, longs outperformed shorts and their respective benchmarks. HF had been trimming gross exposure steadily since the beginning of Q3 but flipped to adding this past week, mostly by adding longs leading global equities to be net bought for the week. NA equities drove most of the buying coming from equity long/short, multi-strategy and global macro funds whereas flows were more muted for quant funds. TMT related industries were the most net bought followed by healthcare. To note, the buying was not in biotech but the sub-sector saw gross exposure reduction on both the long and short sides (a reversal from June/July). Trimming longs in energy and materials continued. Outside of NA, hedge funds were small net sellers in Europe as short adds outpaced long adds. In AxJ, most of the net buying was led by China (H-shares & ADRs) and Australia. In Japan, funds took up gross exposure adding to both long exposure and short exposure.

Private Equity

During uncertain financial markets in the first half of 2022, European venture capital pre-money valuations displayed resilience. European VC deal making has held strong throughout the first half of 2022, with valuations landing at higher-than-expected levels despite dire outlooks at the start of the year. While valuations across all financing stages paced above 2021 figures, down rounds compromised 15.4% in rounds closed in the first half of 2022 only up slightly from 14.8% in 2021.

Although the exit market has been considerably quieter than in 2021, in which companies rushed to exits to take advantage of high valuations and strong demand from investors, the aggregate value and number of unicorns in Europe has remained elevated during the first half of 2022. However, analysts suspect that the market has not yet fully corrected, and unicorns could still have their valuations slashed in the public markets in the coming months. In Q2 of 2022 unicorn deal value and volume declined significantly quarter-over-quarter. Additionally, analysts suggest early signs of valuation haircuts emerging for businesses that boomed during COVID-19.

Impressive returns coupled with the allure of diversification and exciting companies has enticed many non-traditional backers to move into the VC landscape. Over the past two years, investments from non-traditional backers have spiked substantially. Analysts suspect non-traditional backers to remain strong while exit activity will likely remain subdued over the next two quarters as founders and investors negotiate near term uncertainty.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M