Economic Data Watch and Market Outlook

Globally markets fluctuated Friday following Jerome Powell’s much anticipated speech signaling the fight over inflation is not over and the Fed will proceed “carefully” in its next move. Powell still maintains that inflation is too high and that there is a possibility that the Fed will raise rates again. US equities were slightly positive following the meeting, but global markets were relatively flat. On the week global equities were mixed with the MSCI World Index positing a 0.52% return while emerging market equities were slightly positive and developed markets were slightly negative. The US Aggregate Bond Index was up just 28 basis points for the week making its year-to-date return 0.41%.

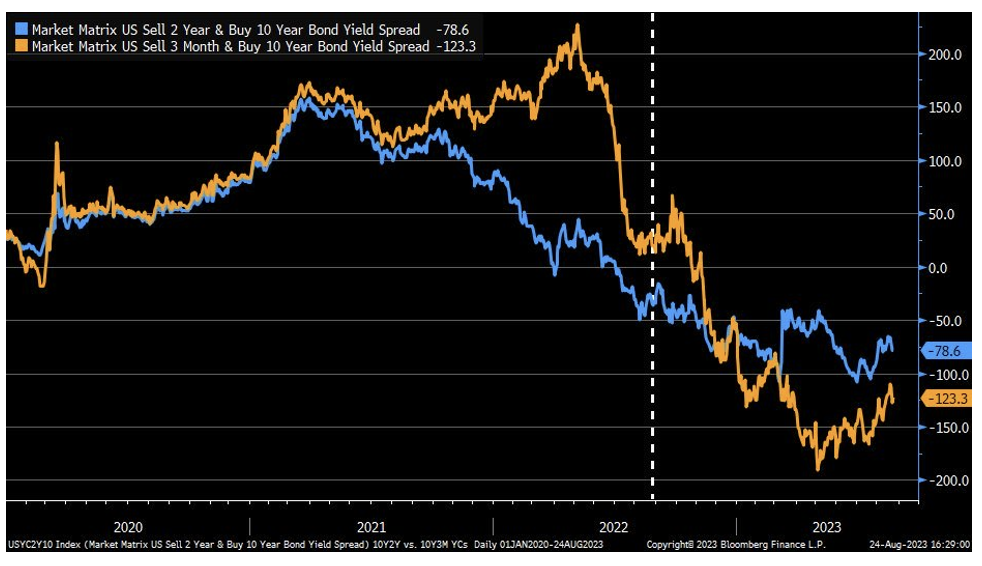

From an analysis published by Schwab, they noted that the spread between the two-year and ten-year was negative this year compared to Powell’s speech last in Jackson Hole.

There has been a fair amount of press recently about the US dollar’s dominance and, perhaps, that dominance is waning. This is largely due to Russian sanctions and their inability to use the SWIFT payment system. To accommodate, they have started accepting payments for their oil in yuan and rupees. India recently settled a transaction on August 14th that got a fair amount of publicity. However, despite their Foreign Minister stating that they would like everything to be transacted in the rupee, he still believes that the dollar being replaced is a long way off. The Bloomberg Dollar Spot Index advanced 0.2% for the week while all other G10 currencies besides the Australian dollar fell.

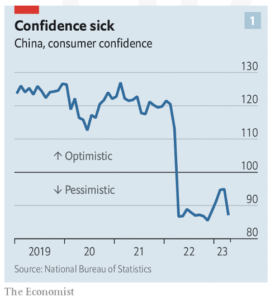

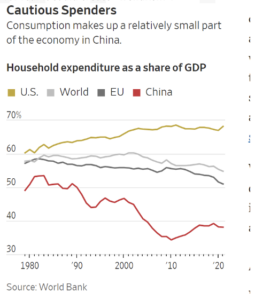

Weakness in China’s economy has been a highlight in recent weeks. Despite the success China has had increasing its per capital GDP from $2,000 in 1978 to today’s $20,000 (the world’s is $12,647), there are concerns globally that consumer debt within China is at dangerously high levels. There is evidence that the consumer is curtailing their spending and losing confidence of their ability to retain wealth. China’s President recognizes this issue but is hesitant to inject stimulus similar to the direction the US and other economies took during COVID for fear it could create “welfarism”.

Later in the upcoming week we’ll receive reports on jobless claims and July’s PCE Index as well as personal income and consumption numbers.

Equities

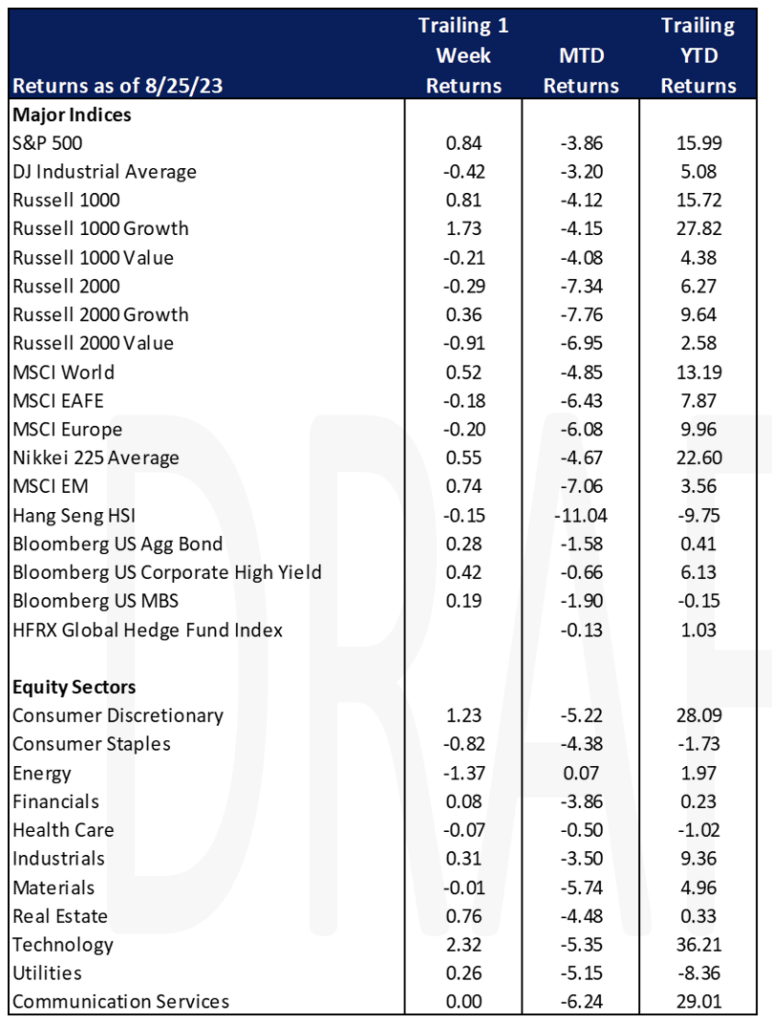

US equities were mixed this week with smaller cap stocks seeing bigger losses over large cap stocks. The Russell 2000 Index fell (-0.29%), the S&P 500 index posted a 0.84% return, and the Russell 1000 posted a 0.81% return. The S&P 500 and Nasdaq both snapped their 3-week losing streak while the Dow Jones Industrial Average fell for the second straight week as Boeing and Walt Disney impacted the index mid-week. Growth was the winner over value as the Russell 1000 Growth Index posted a 1.73% return while the Russell 1000 Value Index posted a (-0.21%) return and the Russell 2000 Growth Index posted a 0.36% return versus the Russell 2000 Value Index falling (-0.91%).

The Technology Select Sector SPDR ETF posted a 2.32% gain as tech stocks rallied leading into the blow out earnings from Nvidia. Nvidia’s reported stronger than expected earnings for the quarter announcing a 141% surge in data center sales along with record earnings and upward revised revenue guidance from $15.58 billion to $16.32 billion. Revenue more than doubled in Q2 to roughly $13.5 billion and net profit was $6.19 billion. Tuesday, Meta launched SeamlessM4T which is a translation model that works with 100 languages and also launched a coding tool, Code Llama, two days later. Earlier this year Zuckerberg announced the inclusion of AI into its products.

Energy saw the biggest losses for the week as the Energy Select Sector SPDR ETF fell (-1.39%), however, energy is the only sector that is positive for the month, up just 0.07%.

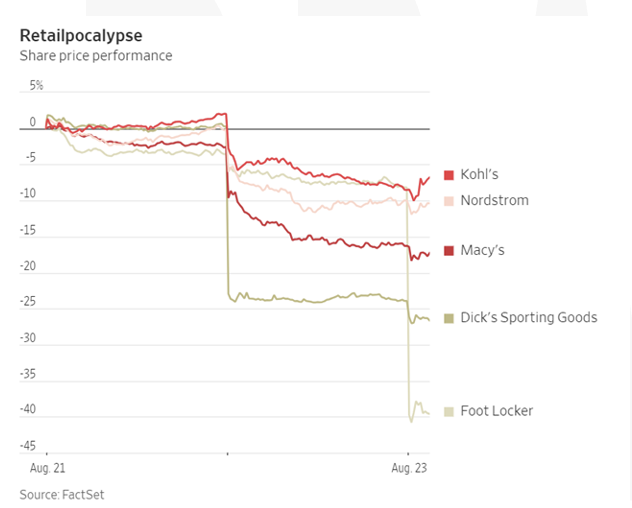

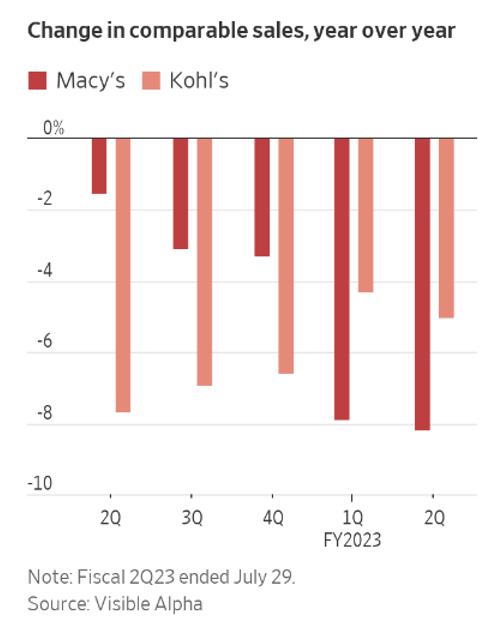

Shares of major retailers trended downward on the week as Macy’s reported that sales at its department stores fell by 8.2%, excluding licensed stores, in the quarter ending July 29 compared with a year earlier. CEO, Jeff Gennette said “The consumer continues to be under pressure as rising credit card balances on its own cards have been under pressure.” He also mentioned that people are starting to prepare for student loan payments come this fall. Kohl’s also reported a decline in sales of 5% over the same time span, worse than the 4.1% decline that retail sales data implied for this period. Macy’s stock fell 14% on Tuesday following the report and Kohl’s fell 10%. Outside of department stores, Dick’s Sporting Goods fell 24% Tuesday after missing expectations and reduced profit guidance for the year. Foot Locker fell 33% Wednesday morning following downwardly revised guidance. The underperformance of department stores can signal that the strength seen in 2021 and 2022 may have been due to pend up consumer savings.

Nike continued to see declines this week and has marked the longest daily decline since 1980. Inventories are building as consumers are shifting away from buying products.

Fixed Income

On Friday the Federal Reserve met for their highly anticipated annual conference in Jackson Hole, Wyoming. Fed Chair Jerome Powell acknowledged that the economic landscape has improved since this time last year, but that the US Central Bank is fully prepared to continue raising rates to combat inflation. The expectation for the Fed’s upcoming meeting on September 19-20 is a pause in rate increases, with the possibility of hikes later in the year. Powell went on to say that strong growth and increased strength in the labor market could require additional rate increases, but that rates are currently at a high enough level to where they are restricting growth and inflation. Treasuries fell throughout the speech but quickly rebounded. The 2-year Treasury yield ultimately ended the week higher, rising 11 bps, while the 10-year Treasury yield fell 1 bps, and the 30-year Treasury yield fell 8 bps. Major fixed income indices climbed throughout the week. The Bloomberg US Aggregate Bond Index rose +0.28%, the Bloomberg US Corporate High Yield Index rose +0.42%, and the Bloomberg US MBS Index rose 0.19%. Meanwhile, the US dollar rose for a sixth consecutive week, pushed higher as the markets weighed Jerome Powell’s hawkish comments.

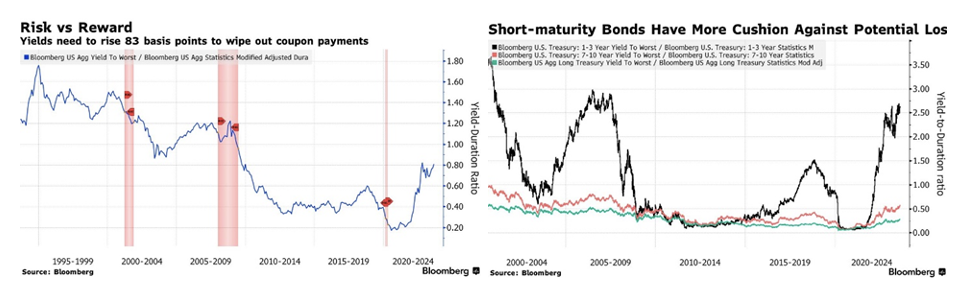

The bond market is starting to turn around, with the recent Bloomberg US Aggregate Bond Index yield-to-duration ratio, a measure of how much yields need to rise in order to erase the value of upcoming interest payments, reached its highest level in over a decade. The ratio is currently sitting at 83 basis points, which means yields would need to increase by that amount in order offset one year of interest payments. The current yield on the Bloomberg US Aggregate Bond Index is currently sitting at around 5.2% and would need to climb to over 6% in order to create issues. Short term yields have a larger buffer against losses, needing a 260 bps jump in yields to incur losses on 1–3-year debt, while longer term yields such as the 20 and 30 year would need only a 29 bps increase to offset interest income.

Hedge Funds

Performance was stronger this week as global hedge funds (HFs) managed to capture a meaningful portion of the upside in their respective benchmarks. The average global HF ended the week up +25 bps, while the average US-based long/short (L/S) equity fund outperformed gaining +55 bps compared to the MSCI World +48 bps and S&P 500 +16 bps. The average European-based L/S equity fund, however, only gained 4 bps against the Euro STOXX 600 +73 bps, while the average Asia-based L/S +90 bps vs. the MSCI Asia +1.72%. Longs performed decently across most regions as the top 50 crowded longs gained 47 bps in North America (NA), 34 bps in Europe, and 1.94% in Asia, though performance on the short side was particularly challenging in Asia given the top 50 crowded short names rallied 2.3% on the week, while crowded shorts in NA and Europe lost 96 bps and 40 bps respectively.

Global equities were sold for the week with the entirety of the selling driven by NA, though broadly, gross flows were far quieter this week vs. last. Breaking out the flows in NA, the bulk of what was sold was driven by the short side as HFs were sellers in a 90/10 split between short vs long adds, respectively. Much of what was added on the short side came in ETFs as HFs added to broad-based index level hedges, while HFs were also net sellers of industrials and energy via short adds. On the long side, HFs were net buyers of tech, communications services and consumer discretionary primarily via covering shorts in semis, autos, IT services, while adding longs in hotels, restaurants and leisure. From a thematic perspective, HFs trimmed long exposure in mega-cap TMT with limited activity on the short side, though positioning here continues to be elevated and still makes up 20-30% of overall directional net exposure in NA. In Europe, volumes were significantly quieter, and flows were muted as the capital put to work this week came in nearly equivalent amounts on both sides of the book, though HFs were net buyers of consumer staples, financials and utilities, while sellers of tech, energy and industrials. HFs were smaller buyers of AxJ as they also added to gross exposure, which was largely driven by Australia and South Korea, while HFs tilted as sellers of Taiwan, India and China (China the largest selling since August 2021). At the sector level, HFs were net buyers of AxJ financials and communications services by a fairly wide margin, while sellers of industrials/materials and energy. HFs were buyers on both sides of the book in Japan, and were buyers of most single-name sectors, led by consumer staples and tech.

Private Equity

The SEC’s recent decision is poised to reshape the dynamics between private investment fund managers and limited partners (LPs). In an open meeting held on Wednesday, the SEC approved a series of new regulations and amendments to the Investment Advisers Act of 1940. These changes, more flexible than an initial proposal from February 2022, target private fund managers by imposing constraints on preferential terms, a tactic commonly employed in manager-investor negotiations. The amendments further mandate quarterly financial statements for private funds and necessitate a fairness or valuation opinion for GP-led secondary transactions.

Notably, the SEC eliminated a contentious liability rule that would have held fund managers legally accountable for negligence. To safeguard investor interests, one of the new rules prohibits fund managers from entering into preferential treatment agreements with LPs if these terms adversely affect other investors. This includes scenarios where early exits or privileged information could compromise the interests of remaining investors. The SEC’s focus on transparency is exemplified by the prohibition of preferential information dissemination to certain LPs, unless these terms are offered uniformly to all LPs.

Despite exceptions to the new rules, the balance of power between LPs and fund managers is anticipated to shift due to increased transparency regarding side-letter provisions. The influx of information about past negotiations among LPs will influence the negotiation landscape. While these rules are expected to enhance investor protection, experts anticipate challenges in their interpretation and application.

Furthermore, the regulations require registered private fund managers to distribute quarterly statements detailing costs and performance, along with an annual audit for each private fund under their oversight. The new rules also address conflicts of interest in secondary transactions by mandating fairness or valuation opinions.

Ultimately, the SEC’s decision seeks to provide greater clarity and accountability in private fund management negotiations, fostering an environment where LPs’ interests are safeguarded, and transactions are conducted with greater transparency.

Authors:

Jon Chesshire, Managing Director, Head of Research

Elisa Mailman, Managing Director, Head of Alternatives

Katie Fox, Managing Director

Michael McNamara, Analyst

Sam Morris, Analyst

Data Source: Apollo, Barron’s, Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, J.P. Morgan, Market Watch, Morningstar, Morgan Stanley. Pitchbook, Standard & Poor’s and the Wall Street Journal.