Economic Data and Market Highlights

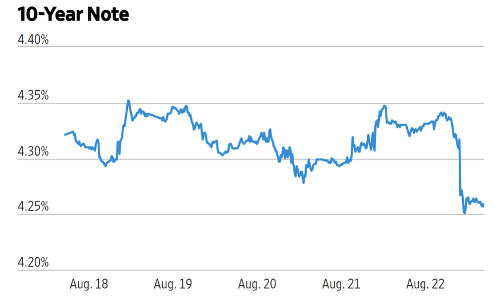

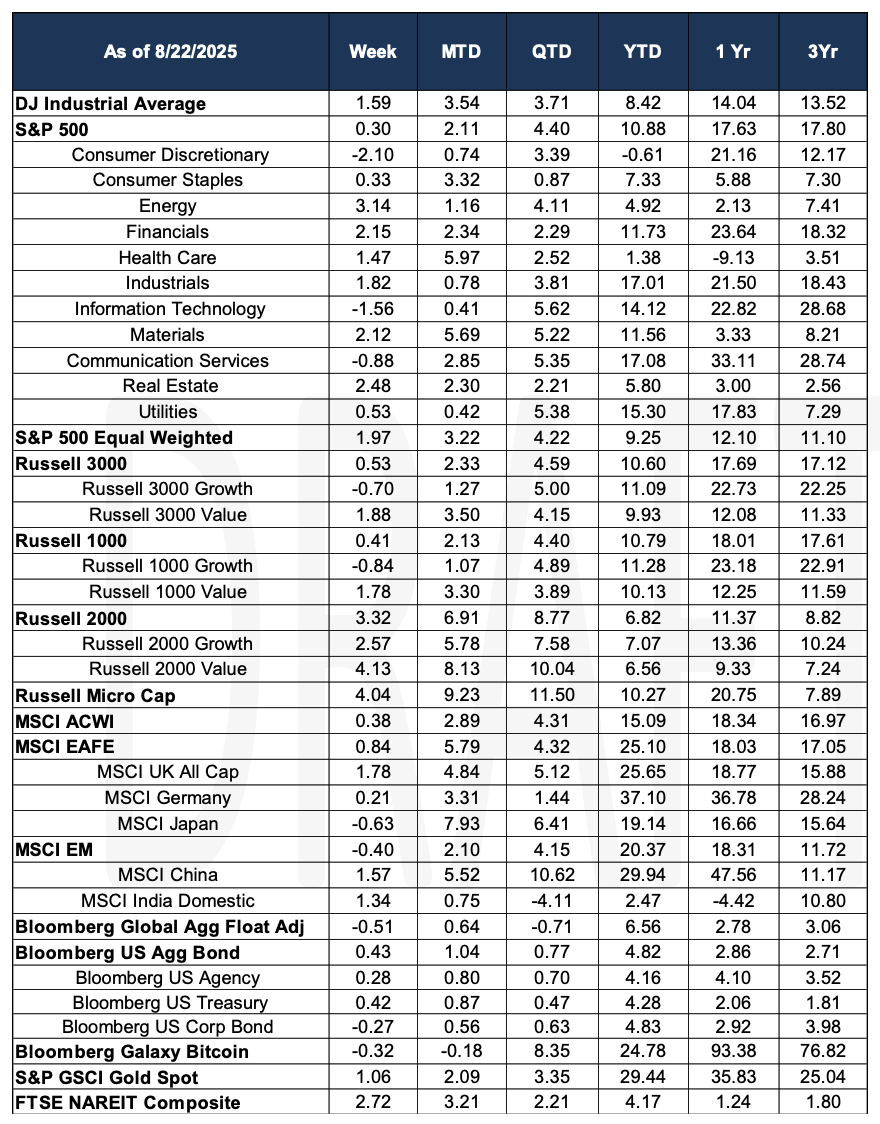

The S&P 500 advanced 1.41% on Friday, with 471 companies in the benchmark advancing. The consumer staples sector was the only sector that declined for the day. The exuberance was a result of Jerome Powell’s comments regarding adjusting policy related to shifting risks, noting that the dual mandate of the Fed, maximum employment and stable prices, and balancing the two. The rally helped the S&P finish in positive territory, up 0.30%. The MS ACWI rose 0.38% for the week. Small-cap names surged on the news with the Russell 2000, rising 3.32% for the week. The ten-year plummeted because of Powell’s speech.

Source: WSJ

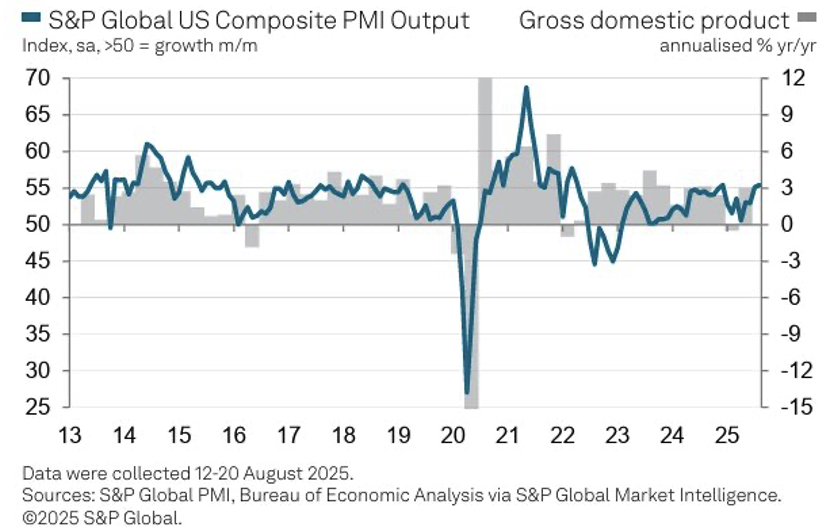

A rate cut would likely be due to economic weakness, but the US PMI data continues to show growth, with the largest gains coming from manufacturing. This, however, could potentially be due to further inventory building.

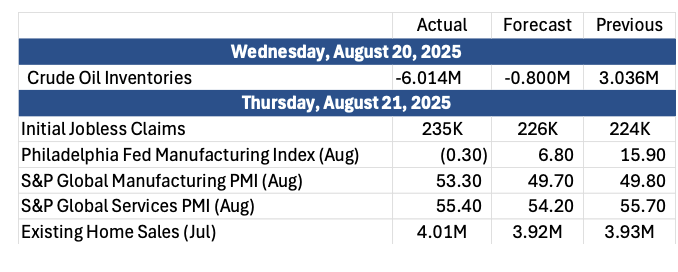

The Past Week’s Notable US data points (with revisions)

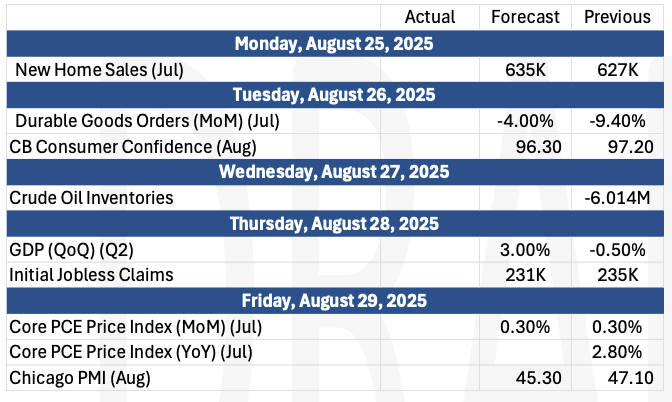

The Upcoming Week’s notable US data points

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara